false

0001173420

0001173420

2025-01-23

2025-01-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): January 23, 2025

NOVAGOLD RESOURCES

INC.

(Exact

Name of Registrant as Specified in Its Charter)

| British Columbia |

001-31913 |

N/A |

| (State of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification) |

201 South Main Street, Suite 400, Salt Lake City,

Utah 84111

(Address of principal executive offices) (Zip

Code)

(801) 639-0511

(Registrant’s Telephone Number, Including

Area Code)

N/A

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

☐ Written communications pursuant to Rule 425

under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a -12)

☐ Pre-commencement communications pursuant to

Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

☐ Pre-commencement communications pursuant to

Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

|

Common Shares |

NG |

NYSE American

Toronto Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On January 23, 2025, NOVAGOLD Resources Inc. (“we”

or the “Company”) issued a press release announcing our financial results for the fiscal year ended November 30, 2024. A copy

of the press release is furnished as Exhibit 99.1 to this report and incorporated herein by reference.

In accordance with General Instruction B.2 of Form

8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liability

of that section, and shall not be incorporated by reference into any registration statement or other document filed under Securities Act

of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure

On January 23, 2025, we issued a press release announcing

our financial results for the fiscal year ended November 30, 2024, and providing updates on the Donlin Gold project. A copy of the press

release is furnished as Exhibit 99.1 to this report and incorporated herein by reference.

In accordance with General Instruction B.2 of Form

8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes

of Section 18 of the Exchange Act or otherwise subject to the liability of that section, and shall not be incorporated by reference into

any registration statement or other document filed under Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly

set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: January 23, 2025 |

NOVAGOLD RESOURCES INC. |

| |

|

|

| |

By: |

/s/ Peter Adamek |

| |

|

Peter Adamek |

| |

|

Vice President and Chief Financial Officer |

Exhibit 99.1

|

NEWS

RELEASE |

NOVAGOLD Files Year-End 2024 Report with Strong Treasury to Fund Key

Activities for Long-Term Value Creation

January 23, 2025 – Vancouver, British Columbia – NOVAGOLD RESOURCES INC. (“NOVAGOLD”

or “the Company”) (NYSE American, TSX: NG) today filed its 2024 fiscal year-end report and provided an update on its Tier

One1 gold development project, Donlin Gold, which NOVAGOLD owns equally with Barrick Gold Corporation (“Barrick”).

Details of the financial results for the year ended November 30, 2024, are presented in the

consolidated financial statements and annual report on Form 10-K filed on January 23, 2025 which is available on the Company’s website

at www.novagold.com, on SEDAR+ at www.sedarplus.ca, and on EDGAR at www.sec.gov. All amounts are in U.S. dollars unless otherwise stated.

As detailed in the above filings, NOVAGOLD held a strong treasury of approximately $101 million

in cash and term deposits as of November 30, 2024, and reported net annual cash expenditures of $24.5 million — including $12.4

million to fund NOVAGOLD’s share of the Donlin Gold project and $17.7 million in corporate general and administrative costs, below

its 2024 expenditure guidance of $31.2 million. As NOVAGOLD is a development-stage company with no production, the Company reported earnings

of ($45.6) million and earnings per share of ($0.14) for the 2024 fiscal year, reflecting expenditures in line with budget.

In 2024, the following milestones were achieved at NOVAGOLD and Donlin Gold:

|  | Donlin Gold undertook the following key activities in 2024 to advance technical work to position the

project for an updated cost estimate: |

|  | Substantially completed metallurgical test work at a pilot plant in Ontario, Canada to confirm proposed optimizations to the flowsheet;

advanced an updated resource model; and collected field and geochemical data for operational and closure planning; |

|  | Submitted the preliminary design packages for the Dam Safety Certification to the Alaska Department of Natural Resources (ADNR) in

the second half of 2024; |

|  | Collaborated with Donlin Gold, Calista Corporation (“Calista”), and The Kuskokwim Corporation (TKC) on substantial ecological,

educational and cultural awareness initiatives, including community outreach in the project’s region — hosted public open

houses in three locations, participated in two Subsistence Community Advisory Committee meetings, and established three additional Shared

Values Statements with local villages. |

|  | NOVAGOLD and Barrick held a Donlin Gold workshop in Alaska in September 2024 to review the important

work completed to date and to agree on the next steps for the Donlin Gold project and related 2025 activities. |

|  | Donlin Gold board approved a budget of $43 million (100% basis) for 2025, comprising the following key

areas: |

|  | Camp operations with grid drilling to refine mine planning assumptions; |

|  | Updated mine planning; |

|  | Geotechnical engineering and geosciences closure planning; |

______________________________________

1 NOVAGOLD defines a Tier One gold development project as one with a projected

production life of at least 10 years, annual projected production of at least 500,000 ounces of gold, and average projected cash costs

over the production life that are in the lower half of the industry cost curve.

|  | Project planning; |

|  | Advancement of Dam Safety Certificate applications; and |

|  | Community relations, government affairs, and maintaining permits in good standing. |

President’s Message

This last year was characterized by extensive efforts to increase Donlin Gold’s visibility

and advance activities for long-term sustainable value creation — strengthening the project’s position as a unique opportunity

to gain direct exposure to gold through one of the largest undeveloped gold assets globally2, located in a stable, tier one,

mining-friendly jurisdiction, Alaska3. With this strong foundation, we are nearing critical milestones that we believe will

allow us to unlock NOVAGOLD’s full potential.

Key activities in 2024 included the substantial completion of metallurgical test work at a pilot

plant in Ontario, Canada to confirm proposed optimizations to the flowsheet; field and geochemical data collection to continue updating

source characteristics for groundwater and surface water models for both operational and closure planning; as well as advancement of the

Donlin Gold resource model. Results derived from the considerable technical work performed over these past twelve months will serve as

inputs into updated feasibility work.

Partnering for Broader Reach into the Project’s Region and Meaningful Impact

We recognize the importance of ecological stewardship in the Yukon-Kuskokwim (Y-K) region. Since

mid-2023, Donlin Gold has intensified efforts to monitor, survey, and engage on the crucial subject of salmon fisheries in the Kuskokwim

and Yukon River watersheds. In 2024, Donlin Gold launched a salmon smolt monitoring program on the George River, a tributary of the Kuskokwim

River, in partnership with the Native Village of Napaimute to assess smolt health and migration patterns — an initiative that will

continue into 2025. Restoration of a portion of the historic Lyman placer site, which included significant stream and pond habitat creation,

including aquatic life access and use, was completed in 2024. Aquatic restoration work on a reach of Snow Gulch previously disturbed by

historic mining will start in 2025.

In 2024, Donlin Gold, Calista, and TKC held public open houses in Anchorage, Bethel, and Crooked

Creek — the closest community to the project. Two Subsistence Community Advisory Committee meetings were conducted, the first in

Aniak during the second quarter and the second in Anchorage in December. Donlin Gold also established three additional Shared Values Statements,

bringing the total to 18. Donlin Gold’s numerous partnerships in the Y-K region and statewide, aimed at supporting ecological projects,

education, summer youth employment programs, and cultural awareness efforts, continue to grow. Together these efforts underscore Donlin

Gold’s ongoing engagement with and commitment to local communities, reinforcing existing long-term relationships and addressing

specific community needs.

In 2024, the Donlin Gold project received continued support from U.S. Senators Lisa Murkowski

and Dan Sullivan, and then U.S. Representative Mary Peltola, including their submittal of a joint amicus brief in federal court referring

to Donlin Gold as one of the State’s “most important and necessary economic development projects” in “one of the

most impoverished regions in Alaska.”

______________________________________

2 Per S&P Global Market Intelligence, Donlin Gold is ranked 4th in Measured and

Indicated contained ounces among primary gold development projects.

3 Per the Mining Journal Intelligence – World Risk Report 2024, Alaska ranks

13th globally on the Investment Risk Index and received an AA rating, the highest rating category awarded.

Maintaining Permits in Good Standing

In 2024, Donlin Gold submitted the preliminary design packages for the Dam Safety Certification

to ADNR. Comments from ADNR on these presentations are anticipated in 2025, with potential issuance of the certification in 2026/2027.

Donlin Gold applied for and received an 18-month extension of the construction deadline on its

air quality permit through July 2026. The Alaska Pollutant Discharge Elimination System permit, which was originally set to expire in

2023, as well as the Waste Management Permit, which was set to expire in January 2024, are administratively extended by the Alaska Department

of Environmental Conservation until renewed. The Reclamation Plan, which was also set to expire in 2024, is administratively extended

until 2027.

In state litigation, we continued to support the agencies in defending Donlin Gold’s 401

Water Quality Certification, water rights permits and State pipeline Right-of-Way (ROW). These cases have been fully briefed and argued,

and decisions are anticipated in 2025.

In federal litigation, the Court issued a decision last fall on Donlin Gold’s Joint Record

of Decision, 404 permit, and ROW, upholding the federal agencies’ analysis on two of the three issues raised. The plaintiffs filed

a request for reconsideration on one of these issues, which the Court subsequently denied. Briefing on the appropriate remedy to address

the Court’s decision on the remaining item — namely, the evaluation of a theoretical large release from the project’s

tailing storage facility — is scheduled to be completed in early February 2025.

Gold Exposure Through One of the Largest Gold Assets Globally4

NOVAGOLD views the Donlin Gold project as an exceptionally rare investment opportunity —

particularly given the acute scarcity of high-quality assets located in secure, mining-friendly jurisdictions, coupled with the recent

surge in gold price, reaching an all-time high of $2,790 on October 30th, 2024. With over 39 million ounces of gold in Measured

and Indicated Resources and a grade of 2.24 grams per tonne5, representing twice the industry average, Donlin Gold stands

out as one of the largest gold assets globally, and is expected to be operationally cost-effective6 The project’s current

resource spans only 5% of its land package, offering remarkable further exploration potential. Projected to produce over one million

ounces in average annual output7 Donlin Gold’s success is anchored in its location in Alaska, among the safest mining

jurisdictions in the world8 with strong community and state support.

2025 Activities and Next Steps

NOVAGOLD and Barrick held a workshop in Alaska in September 2024 to review the important work

completed to date, as well as to discuss the next steps for the project and related activities in 2025. Subsequently, Donlin Gold’s

board approved a path forward with a 2025 budget of $43 million on a 100% basis. Camp operations will resume in the coming months to complete

grid drilling toward refining mine planning assumptions. Efforts will continue to advance key workstreams and preparation for a cost update.

Additional work will include project and mine planning, further advancement of the Dam Safety Certificate applications with work on the

Detailed Design Packages, steadfast support of pending litigation, and ongoing community relations and government affairs activities.

_____________________________________

4 Per S&P Global Market Intelligence, Donlin Gold is ranked 9th in Measured

and Indicated contained ounces among primary gold deposits.

5 Donlin Gold data as per the report titled “NI 43-101 Technical Report on

the Donlin Gold project, Alaska, USA” with an effective date of June 1, 2021 (the “2021 Technical Report”) and the

report titled “S-K 1300 Technical Report Summary on the Donlin Gold project, Alaska, USA” (the “S-K 1300 Technical

Report Summary”), dated November 30, 2021. Donlin Gold possesses Measured Resources of approximately 8 Mt grading 2.52 g/t and

Indicated Resources of approximately 534 Mt grading 2.24 g/t, each on a 100% basis and inclusive of Mineral Reserves, of which approximately

4 Mt of Measured Resources and approximately 267 Mt of Indicated Resources inclusive of Reserves is attributable to NOVAGOLD through

its 50% ownership interest in Donlin Gold LLC. Exclusive of Mineral Reserves, Donlin Gold possesses Measured Resources of approximately

1 Mt grading 2.23 g/t and Indicated Resources of approximately 69 Mt grading 2.44 g/t, of which approximately 0.5 Mt of Measured Resources

and approximately 35 Mt of Indicated Resources exclusive of Mineral Reserves is attributable to NOVAGOLD. Donlin Gold possesses Proven

Reserves of approximately 8 Mt grading 2.32 g/t and Probable Reserves of approximately 497 Mt grading 2.08 g/t, each on a 100% basis,

of which approximately 4 Mt of Proven Reserves and approximately 249 Mt of Probable Reserves is attributable to NOVAGOLD. Mineral Reserves

and Resources have been estimated in accordance with NI 43-101 and S-K 1300.

6 Donlin Gold data as per the 2021 Technical Report and the S-K 1300 Technical

Report Summary detailed in footnote 5 above, with anticipated life of mine operating cash cost of $635 per gold ounce. Peer data per

S&P Global Market Intelligence, Donlin Gold ranks in the lower half of the industry cost curve.

7 Donlin Gold data as per the 2021 Technical Report and the S-K 1300 Technical

Report Summary detailed in footnote 5 above, with anticipated average annual production of 1.1 million gold ounces over 27 years on a

100% basis.

8 Please see footnote 3 above.

With a strong treasury of over $100 million, NOVAGOLD is well positioned to fund our share of

activities for at least the next two years at current spending levels. The path ahead for Donlin Gold is clear, guided by the principles

of patience, partnership, and an unrelenting focus on long-term value creation. We firmly believe that with one of the industry’s

most attractive development gold assets, NOVAGOLD is optimally positioned to deliver exceptional returns.

We extend our heartfelt gratitude to our colleagues, partners, members of NOVAGOLD’s board

of directors, and shareholders for their unwavering support. As a new year begins, we remain deeply committed to fulfilling each and every

single one of the promises we have made and are excited to achieve new milestones together. To our valued shareholders, we express our

profound appreciation for the trust they have placed in our vision, which drives us to continually strive for excellence and deliver meaningful

results. At NOVAGOLD, we are not just advancing a mining project. We are building a legacy rooted in partnership, sustainability, and

value creation — for all stakeholders.

Sincerely,

Gregory A. Lang

President and CEO

Liquidity and Capital Resources

| |

|

|

At |

At |

|

|

|

|

November 30, 2024

$ |

November 30, 2023

$ |

| Cash and term deposits |

|

|

101,224 |

125,749 |

| Total assets |

|

|

109,753 |

133,290 |

In 2024, cash and cash equivalents decreased by $3.5 million, mainly to fund our share of Donlin

Gold, corporate administrative expenses, partially offset by a net reduction of term deposits held.

Spending on operating activities in 2024 increased by $4.9 million compared to the prior year,

primarily due to increased corporate general and administrative expenses, lower interest income on cash and term deposits, and higher

income tax withholding related to passive income taxable in Canada on a portion of interest income earned by U.S. subsidiaries. Cash provided

from investing activities in 2024 increased by $19.7 million compared to the prior year, primarily due to a net reduction of term deposits

held in 2024 and lower Donlin Gold funding requirements.

2025 Outlook

Our anticipated expenditure in fiscal year 2025 will be approximately $37.5 million, including

$21.5 million to fund our share of the Donlin Gold project and $16.0 million for corporate general and administrative costs.

NOVAGOLD’s main objectives include continuing to advance the Donlin Gold project towards

a construction decision; maintaining support for Donlin Gold among the project’s stakeholders; promoting a strong safety, sustainability,

and environmental culture; maintaining a favorable reputation of NOVAGOLD; and preserving a healthy balance sheet. Our operations primarily

relate to the delivery of project milestones, including the achievement of various technical, environmental, sustainable development,

economic and legal objectives, obtaining necessary permits, completion of feasibility studies, preparation of engineering designs, and

the financing to fund these objectives.

Conference Call & Webcast Details

NOVAGOLD’s conference call and webcast to discuss these results will take place today

at 8:00 am PT (11:00 am ET). The webcast and conference call-in details are provided below.

The video webcast and conference call-in details are provided below.

| Video Webcast: | |

www.novagold.com/investors/events/ |

| | |

|

| North American callers: | |

1-844-763-8274 |

| | |

|

| International callers: | |

1-647-484-8814 |

About NOVAGOLD

NOVAGOLD is a well-financed precious metals company, solely focused on the responsible and sustainable

development of its flagship Donlin Gold project in Alaska, one of the safest mining jurisdictions in the world9. The Donlin

Gold project, owned in equal partnership with Barrick, is positioned to be one of the world’s largest gold mines, with approximately

39 million ounces of gold in the Measured and Indicated Mineral Resource (541 million tonnes at an average grade of approximately 2.24

grams per tonne, on a 100% basis) categories, inclusive of Proven and Probable Mineral Reserves. According to the 2021 Technical Report

and the S-K 1300 Technical Report Summary10 Donlin Gold is expected to produce an average of approximately one million ounces

of gold over a 27-year mine life on a 100% basis. There’s substantial exploration potential beyond the designed footprint of the

Donlin Gold open pit, which currently covers three kilometers of an approximately eight-kilometer-long gold-bearing trend. Current activities

at the Donlin Gold project focus on state permitting, engineering studies, community and government engagement, and other environmental,

educational and cultural initiatives in preparation for the eventual construction and operation of this project. With a robust balance

sheet, NOVAGOLD is well positioned to finance its share of current activities.

NOVAGOLD Contacts:

Mélanie Hennessey

Vice President, Corporate Communications

604-669-6227 or 1-866-669-6227

_______________________________________

9 Please see footnote 3 above.

10 Donlin Gold data as per the 2021 Technical Report and the S-K 1300 Technical

Report Summary. Please see footnote 5 above.

Cautionary Note Regarding Forward-Looking Statements

This media release includes certain “forward-looking information” and “forward-looking

statements” (collectively “forward-looking statements”) within the meaning of applicable securities legislation, including

the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements include future-oriented financial information

or financial outlook within the meaning of securities laws, including information regarding NOVAGOLD’s anticipated expenditures.

Such information is intended to assist readers in understanding NOVAGOLD’s current expectations and plans relating to the future.

Such information may not be appropriate for other purposes. Forward-looking statements are frequently, but not always, identified by words

such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”,

“possible”, and similar expressions, or statements that events, conditions, or results “will”, “may”,

“could”, “would” or “should” occur or be achieved. Forward-looking statements are necessarily based

on several opinions, estimates and assumptions that management of NOVAGOLD considered appropriate and reasonable as of the date such statements

are made, are subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause the actual results, activity,

performance, or achievements to be materially different from those expressed or implied by such forward-looking statements. All statements,

other than statements of historical fact, included herein are forward-looking statements. These forward-looking statements include statements

regarding the anticipated timing of certain judicial and/or administrative decisions; the 2025 outlook; the timing and potential for commencing

a new feasibility study on the Donlin Gold project; the results of future feasibility studies; our goals and expenditures for 2025; ongoing

support provided to key stakeholders including Native Corporation partners; continuation of Donlin Gold’s salmon smolt monitoring

program; Donlin Gold’s continued support for the state and federal permitting process; sufficiency of working capital; the potential

development and construction of the Donlin Gold project; the timing and ability for the Donlin Gold project to hit critical milestones;

the ability for the Tier One gold development project to hit the anticipated projections; the sufficiency of funds to continue to advance

development of Donlin Gold, including to a construction decision; perceived merit of properties; mineral reserve and mineral resource

estimates; Donlin Gold’s ability to secure the permits needed to construct and operate the Donlin Gold project in a timely manner,

if at all; legal challenges to Donlin Gold’s existing permits and the timing of decisions in those challenges; whether the Donlin

Gold LLC board will continue to advance the Donlin Gold project safely, socially responsibly and to sustainably generate value for our

stakeholders; continued cooperation between the owners of Donlin Gold LLC to advance the project; the Company’s ability to deliver

on its strategy with the Donlin Gold project, increasing shareholder and stakeholder wealth; the success of the strategic mine plan for

the Donlin Gold project; the success of the Donlin Gold community relations plan; the outcome of exploration drilling at the Donlin Gold

project and the timing thereof; the completion of test work and modeling and the timing thereof. In addition, any statements that refer

to expectations, intentions, projections or other characterizations of future events or circumstances are forward-looking statements.

Forward-looking statements are not historical facts but instead represent the expectations of NOVAGOLD management’s estimates and

projections regarding future events or circumstances on the date the statements are made. Important factors that could cause actual results

to differ materially from expectations include the need to obtain additional permits and governmental approvals; the timing and likelihood

of obtaining and maintaining permits necessary to construct and operate; the need for additional financing to explore and develop properties

and availability of financing in the debt and capital markets; disease pandemics; uncertainties involved in the interpretation of drill

results and geological tests and the estimation of reserves and resources; changes in mineral production performance, exploitation and

exploration successes; changes in national and local government legislation, taxation, controls or regulations and/or changes in the administration

of laws, policies and practices, expropriation or nationalization of property and political or economic developments in the United States

or Canada; the need for continued cooperation between Barrick and NOVAGOLD for the continued exploration, development and eventual construction

of the Donlin Gold property; the need for additional capital if NOVAGOLD determined to proceed with an updated feasibility study on its

own; the need for cooperation of government agencies and Native groups in the development and operation of properties; risks of construction

and mining projects such as accidents, equipment breakdowns, bad weather, disease pandemics, non-compliance with environmental and permit

requirements, unanticipated variation in geological structures, ore grades or recovery rates; unexpected cost increases, which could include

significant increases in estimated capital and operating costs; fluctuations in metal prices and currency exchange rates; whether or when

a positive construction decision will be made regarding the Donlin Gold project; and other risks and uncertainties disclosed in NOVAGOLD’s

most recent reports on Forms 10-K and 10-Q, particularly the “Risk Factors” sections of those reports and other documents

filed by NOVAGOLD with applicable securities regulatory authorities from time to time. Copies of these filings may be obtained by visiting

NOVAGOLD’s website at www.novagold.com, or the SEC’s website at www.sec.gov, or on SEDAR+ at www.sedarplus.ca. The forward-looking

statements contained herein reflect the beliefs, opinions and projections of NOVAGOLD on the date the statements are made. NOVAGOLD assumes

no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except

as required by law.

Page 6 of 6

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

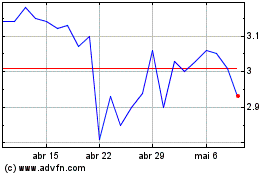

Novagold Resources (AMEX:NG)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Novagold Resources (AMEX:NG)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025