false000157233400015723342025-01-232025-01-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 23, 2025 |

VIRGINIA NATIONAL BANKSHARES CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Virginia |

001-40305 |

46-2331578 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

404 People Place |

|

Charlottesville, Virginia |

|

22911 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (434) 817-8621 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

VABK |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 23, 2025, Virginia National Bankshares Corporation (the “Company”) issued a press statement announcing the consolidated earnings for the quarter ended December 31, 2024.

A copy of the press statement is furnished as Exhibit 99.1 to this Form 8-K and incorporated herein by reference.

The information in this Form 8-K, and the exhibit hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No. Description of Exhibit

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

VIRGINIA NATIONAL BANKSHARES CORPORATION |

|

|

|

|

Date: |

January 23, 2025 |

By: |

/s/ Tara Y. Harrison |

|

|

|

Tara Y. Harrison

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

|

|

FOR IMMEDIATE RELEASE |

INVESTOR RELATIONS CONTACT: |

|

Tara Y. Harrison (434) 817-8587 |

VIRGINIA NATIONAL BANKSHARES CORPORATION

ANNOUNCES 2024 FOURTH QUARTER AND FULL YEAR EARNINGS

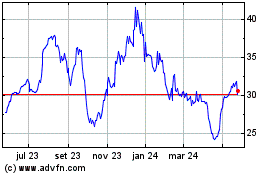

Charlottesville, VA – January 23, 2025 - Virginia National Bankshares Corporation (NASDAQ: VABK) (the “Company”) today reported quarterly net income of $4.6 million, or $0.85 per diluted share, for the quarter ended December 31, 2024, compared to $3.2 million, or $0.59 per diluted share, recognized for the quarter ended December 31, 2023. For the twelve months ended December 31, 2024, the Company recognized net income of $17.0 million, or $3.15 per diluted share, compared to $19.3 million, or $3.58 per diluted share, for the twelve months ended December 31, 2023.

The increase in net income from the fourth quarter of 2023 to the same quarter in 2024 was primarily the result of increased interest income from increased average balances of loans at higher rates than the prior period, combined with decreased interest expense, as we reduced our borrowing expense and overall cost of funds. The decline in full year 2024 net income compared to 2023 was primarily the result of increased cost of funds year-over-year.

President and Chief Executive Officer's comments: "During 2024, we focused on loan growth and reducing ongoing operating expenses," stated Glenn W. Rust, President and Chief Executive Officer. "I am proud to announce that we succeeded in both of these endeavors. We increased loan balances 13% over the prior year while decreasing our overhead costs. Our credit quality metrics continue to be strong, along with our capital and liquidity positions."

Key Performance Indicators

Fourth Quarter 2024 Compared to Fourth Quarter 2023

•Return on average assets increased to 1.12% from 0.79%

•Return on average equity increased to 10.98% from 9.03%

•Net interest margin (FTE)1 improved to 3.21% from 2.89%

•Loan-to-deposit ratio increased to 86.8% from 77.5%

•Efficiency ratio (FTE)1 improved to 60.2% from 64.0%

December 2024 Balance Sheet Highlights

•The Company continued to experience loan growth in the fourth quarter of 2024. Gross loans outstanding as of December 31, 2024 totaled $1.2 billion, an increase of $20.5 million, or 1.7%, compared to September 30, 2024, and an increase of $143.3 million, or 13.1% compared to December 31, 2023.

•Outstanding borrowing from the FHLB declined from the prior quarter by $32.5 million and declined from the prior year-end by $46.5 million, as management made a concerted effort to stabilize overall cost of funds. As of December 31, 2024, the Company had unused borrowing facilities in place of approximately $199.0 million and held no brokered deposits.

•Securities balances declined $17.3 million and $159.3 million from September 30, 2024 and December 31, 2023, respectively, to December 31, 2024; funds from the maturities of investments were repurposed to higher yielding assets in the form of loans.

_____________________________________________________________________

1 See "Reconciliation of Certain Quarterly Non-GAAP Financial Measures" at the end of this release.

•The Company utilizes a third-party to offer multi-million-dollar FDIC insurance to customers with balances in excess of single-bank limits through reciprocal Insured Cash Sweep® (ICS) plans. Deposit balances held in ICS plans amounted to $166.6 million as of December 31, 2024, $145.6 million as of September 30, 2024 and $151.5 million as of December 31, 2023.

•Total deposits increased $43.6 million, or 3.2% from September 30, 2024 to December 31, 2024 and increased $14.4 million, or 1.0% year-over year.

Loans and Asset Quality

•Credit performance remains strong with nonperforming assets as a percentage of total assets of 0.19% as of December 31, 2024, 0.33% as of September 30, 2024 and 0.17% as of December 31, 2023.

•Nonperforming assets amounted to $3.0 million as of December 31, 2024, compared to $5.3 million as of September 30, 2024 and $2.7 million as of December 31, 2023;

oTwelve loans to eleven borrowers are in non-accrual status, totaling $2.3 million, as of December 31, 2024, compared to $2.1 million as of September 30, 2024 and $1.9 million as of December 31, 2023.

oLoans 90 days or more past due and still accruing interest amounted to $754 thousand as of December 31, 2024, compared to $3.2 million as of September 30, 2024 and $880 thousand as of December 31, 2023. The past due balance as of December 31, 2024 is comprised of three loans totaling $705 thousand which are 100% government-guaranteed, and three student loans totaling $49 thousand.

oThe Company currently holds no other real estate owned.

•The period-end Allowance for Credit Losses (“ACL”) as a percentage of total loans was 0.68% as of December 31, 2024, 0.70% as of September 30, 2024 and 0.77% as of December 31, 2023. The proportionate increase in government-guaranteed loans over the respective periods is the driver of the decrease in the ACL as a percentage of total loans year-over-year. Balances in government-guaranteed loans have increased $108.6 million from December 31, 2023 to December 31, 2024. Such loans are 100% government-guaranteed and do not require an ACL.

•The fair value mark that was allocated to the acquired loans was $21.3 million as of April 1, 2021, with a remaining balance of $6.8 million as of December 31, 2024.

•For the three months ended December 31, 2024, the Company recorded a net recovery of provision for credit losses of $126 thousand, as the recovery of previously charged-off loans nearly offset the increase in provision required for new loan balances; this balance is net of an $82 thousand provision for unfunded reserves, as a result of an increase in unfunded construction commitments.

Net Interest Income - Quarterly Comparison

•Net interest income for the three months ended December 31, 2024 of $12.2 million increased $1.5 million, or 13.8%, compared to the three months ended December 31, 2023, as interest income earned on assets increased and interest expense on deposit accounts and borrowings declined.

•Net interest margin (FTE), (a non-GAAP financial measure)1, for the three months ended December 31, 2024 was 3.21%, compared to 2.89% for the three months ended December 31, 2023. The increase as compared to the fourth quarter of 2023 was the outcome of the increase in yield on loans and the decrease in cost of funds, both described below.

•Yield on loans was 5.63% for the three months ended December 31, 2024, compared to 5.47% for the prior year same period. The accretion of the credit mark related to purchased loans positively impacted interest income by 13 bps in the fourth quarter of 2024, compared to 15 bps in the fourth quarter of 2023.

•The overall cost of funds, including noninterest-bearing deposits, of 194 bps incurred in the three months ended December 31, 2024 decreased 7 bps from 201 bps in the same period in the prior year. Overall, the cost of interest-bearing deposits also decreased period over period by 7 bps, from a cost of 258 bps to 251 bps. Management believes that the Bank's cost of funds stabilized during the first half of 2024, and the cost of funds and cost of interest-bearing deposits have been declining in the second half of 2024. The cost of borrowings also declined from the fourth quarter of 2023 to the fourth quarter of 2024, from 5.35% to 4.33%.

__________________________________________________________________

1 See "Reconciliation of Certain Quarterly Non-GAAP Financial Measures" at the end of this release.

Noninterest Income - Quarterly Comparison

Noninterest income for the three months ended December 31, 2024 increased $132 thousand, or 6.2%, compared to the three months ended December 31, 2023, as the gain on early redemption of debt of $525 thousand partially offset the lower wealth management, deposit account, debit card, credit card and ATM fees.

Noninterest Expense - Quarterly Comparison

Noninterest expense for the three months ended December 31, 2024 increased $484 thousand, or 5.8%, compared to the three months ended December 31, 2023. This increase is primarily the result of increased compensation expense from lender incentives related to increased loan production, as well as increased professional services expense from increased cost of such services. These increases were partially offset by lower data processing costs, as a result of effective contract negotiations.

Income Taxes - Quarterly Comparison

The effective tax rates amounted to 22.0% and 16.6% for the three months ended December 31, 2024 and 2023, respectively. The increase in the effective tax rate in the current year period is higher than the statutory rate as a result of the adoption of the proportional amortization method for accounting for low-income housing tax credits, which increased tax expense. The prior year period effective tax rate is lower than the statutory rate, due to the recognition of low-income housing tax credits and the effect of tax-exempt income from municipal bonds and income from bank owned life insurance policies.

Book Value

Book value per share increased to $29.85 as of December 31, 2024, compared to $28.52 as of December 31, 2023, and tangible book value per share (a non-GAAP financial measure)1 was $27.70 as of December 31, 2024 compared to $26.12 as of December 31, 2023. These values increased as net retained income increased and unrealized losses in the investment portfolio remained relatively flat period over period.

Dividends

Cash dividends of $1.8 million, or $0.33 per share, were declared and paid during the fourth quarter of 2024.

Share Repurchase Plan

Year-to-date, the Company has repurchased 20,350 shares at an average price of $27.42 per share. No shares were repurchased during the second half of 2024.

_____________________________________________________________________

1 See "Reconciliation of Certain Quarterly Non-GAAP Financial Measures" at the end of this release.

About Virginia National Bankshares Corporation

Virginia National Bankshares Corporation, headquartered in Charlottesville, Virginia, is the bank holding company for Virginia National Bank. The Bank has eight banking offices throughout Fauquier and Prince William counties, three banking offices in Charlottesville and Albemarle County, and banking offices in Winchester and Richmond, Virginia. The Bank offers a full range of banking and related financial services to meet the needs of individuals, businesses and charitable organizations, including the fiduciary services of VNB Trust and Estate Services. The Company’s common stock trades on the Nasdaq Capital Market under the symbol “VABK.” Additional information on the Company is also available at www.vnbcorp.com.

Non-GAAP Financial Measures

The accounting and reporting policies of the Company conform to U.S. generally accepted accounting principles (“GAAP”) and prevailing practices in the banking industry. However, management uses certain non-GAAP measures to supplement the evaluation of the Company’s performance. Management believes presentations of these non-GAAP financial measures provide useful supplemental information that is essential to a proper understanding of the operating results of the Company’s core businesses. These non-GAAP disclosures should not be viewed as a substitute for, or more important than, operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Reconciliations of GAAP to non-GAAP measures are included at the end of this release.

Forward-Looking Statements; Other Information

Certain statements in this release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, statements with respect to the Company’s operations, performance, future strategy and goals, and are often characterized by use of qualified words such as “expect,” “believe,” “estimate,” “project,” “anticipate,” “intend,” “will,” “should,” or words of similar meaning or other statements concerning the opinions or judgement of the Company and its management about future events. While Company management believes such statements to be reasonable, future events and predictions are subject to circumstances that are not within the control of the Company and its management. Actual results may differ materially from those included in the forward-looking statements due to a number of factors, including, without limitation, the effects of and changes in: inflation, interest rates, market and monetary fluctuations; liquidity and capital requirements; market disruptions including pandemics or significant health hazards, severe weather conditions, natural disasters, terrorist activities, financial crises, political crises, war and other military conflicts or other major events, the governmental and societal responses thereto, or the prospect of these events; changes, particularly declines, in general economic and market conditions in the local economies in which the Company operates, including the effects of declines in real estate values; the effects of, and changes in, trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; the impact of changes in laws, regulations and guidance related to financial services including, but not limited to, taxes, banking, securities and insurance; changes in accounting principles, policies and guidelines; the financial condition of the Company’s borrowers; the Company's ability to attract, hire, train and retain qualified employees; an increase in unemployment levels; competitive pressures on loan and deposit pricing and demand; fluctuation in asset quality; assumptions that underlie the Company’s ACL; the value of securities held in the Company's investment portfolio; performance of assets under management; cybersecurity threats or attacks and the development and maintenance of reliable electronic systems; changes in technology and their impact on the marketing of new products and services and the acceptance of these products and services by new and existing customers; the willingness of customers to substitute competitors’ products and services for the Company’s products and services; the risks and uncertainties described from time to time in the Company’s press releases and filings with the SEC; and the Company’s performance in managing the risks involved in any of the foregoing. Many of these factors and additional risks and uncertainties are described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and other reports filed from time to time by the Company with the Securities and Exchange Commission. These statements speak only as of the date made, and the Company does not undertake to update any forward-looking statements to reflect changes or events that may occur after this release.

VIRGINIA NATIONAL BANKSHARES CORPORATION

CONSOLIDATED BALANCE SHEETS

(dollars in thousands, except per share data)

|

|

|

|

|

|

|

|

|

December 31, 2024 |

|

|

December 31, 2023* |

|

|

(Unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

Cash and due from banks |

$ |

5,311 |

|

|

$ |

18,074 |

|

Interest-bearing deposits in other banks |

|

11,792 |

|

|

|

10,316 |

|

Securities: |

|

|

|

|

|

Available for sale (AFS), at fair value |

|

263,537 |

|

|

|

420,595 |

|

Restricted securities, at cost |

|

6,193 |

|

|

|

8,385 |

|

Total securities |

|

269,730 |

|

|

|

428,980 |

|

Loans, net of deferred fees and costs |

|

1,235,969 |

|

|

|

1,092,665 |

|

Allowance for credit losses |

|

(8,455 |

) |

|

|

(8,395 |

) |

Loans, net |

|

1,227,514 |

|

|

|

1,084,270 |

|

Premises and equipment, net |

|

15,383 |

|

|

|

16,195 |

|

Bank owned life insurance |

|

40,059 |

|

|

|

38,904 |

|

Goodwill |

|

7,768 |

|

|

|

7,768 |

|

Core deposit intangible, net |

|

3,792 |

|

|

|

5,093 |

|

Right of use asset, net |

|

5,551 |

|

|

|

6,748 |

|

Deferred tax asset, net |

|

15,407 |

|

|

|

15,382 |

|

Accrued interest receivable and other assets |

|

14,519 |

|

|

|

14,287 |

|

Total assets |

$ |

1,616,826 |

|

|

$ |

1,646,017 |

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

Liabilities: |

|

|

|

|

|

Demand deposits: |

|

|

|

|

|

Noninterest-bearing |

$ |

374,079 |

|

|

$ |

372,857 |

|

Interest-bearing |

|

303,405 |

|

|

|

305,541 |

|

Money market and savings deposit accounts |

|

437,619 |

|

|

|

412,119 |

|

Certificates of deposit and other time deposits |

|

308,443 |

|

|

|

318,581 |

|

Total deposits |

|

1,423,546 |

|

|

|

1,409,098 |

|

Federal funds purchased |

|

236 |

|

|

|

3,462 |

|

Borrowings |

|

20,000 |

|

|

|

66,500 |

|

Junior subordinated debt, net |

|

3,506 |

|

|

|

3,459 |

|

Lease liability |

|

5,389 |

|

|

|

6,504 |

|

Accrued interest payable and other liabilities |

|

3,847 |

|

|

|

3,954 |

|

Total liabilities |

|

1,456,524 |

|

|

|

1,492,977 |

|

Commitments and contingent liabilities |

|

|

|

|

|

Shareholders' equity: |

|

|

|

|

|

Preferred stock, $2.50 par value |

|

- |

|

|

|

- |

|

Common stock, $2.50 par value |

|

13,263 |

|

|

|

13,258 |

|

Capital surplus |

|

106,394 |

|

|

|

106,045 |

|

Retained earnings |

|

82,507 |

|

|

|

73,781 |

|

Accumulated other comprehensive loss |

|

(41,862 |

) |

|

|

(40,044 |

) |

Total shareholders' equity |

|

160,302 |

|

|

|

153,040 |

|

Total liabilities and shareholders' equity |

$ |

1,616,826 |

|

|

$ |

1,646,017 |

|

|

|

|

|

|

|

Common shares outstanding |

|

5,370,912 |

|

|

|

5,365,982 |

|

Common shares authorized |

|

10,000,000 |

|

|

|

10,000,000 |

|

Preferred shares outstanding |

|

- |

|

|

|

- |

|

Preferred shares authorized |

|

2,000,000 |

|

|

|

2,000,000 |

|

* Derived from audited consolidated financial statements

VIRGINIA NATIONAL BANKSHARES CORPORATION

CONSOLIDATED STATEMENTS OF INCOME

(dollars in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

|

For the twelve months ended |

|

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

Interest and dividend income: |

|

|

|

|

|

|

|

|

|

|

|

|

Loans, including fees |

|

$ |

17,253 |

|

|

$ |

14,644 |

|

|

$ |

66,534 |

|

|

$ |

56,053 |

|

Federal funds sold |

|

|

230 |

|

|

|

64 |

|

|

|

765 |

|

|

|

207 |

|

Other interest-bearing deposits |

|

|

41 |

|

|

|

59 |

|

|

|

206 |

|

|

|

501 |

|

Investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

1,340 |

|

|

|

2,880 |

|

|

|

6,689 |

|

|

|

11,554 |

|

Tax exempt |

|

|

323 |

|

|

|

325 |

|

|

|

1,302 |

|

|

|

1,308 |

|

Dividends |

|

|

111 |

|

|

|

102 |

|

|

|

431 |

|

|

|

367 |

|

Total interest and dividend income |

|

|

19,298 |

|

|

|

18,074 |

|

|

|

75,927 |

|

|

|

69,990 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

Demand deposits |

|

|

67 |

|

|

|

73 |

|

|

|

272 |

|

|

|

346 |

|

Money market and savings deposits |

|

|

2,939 |

|

|

|

2,964 |

|

|

|

11,803 |

|

|

|

9,673 |

|

Certificates and other time deposits |

|

|

3,463 |

|

|

|

3,508 |

|

|

|

15,410 |

|

|

|

8,617 |

|

Borrowings |

|

|

504 |

|

|

|

663 |

|

|

|

1,691 |

|

|

|

1,934 |

|

Federal funds purchased |

|

|

4 |

|

|

|

26 |

|

|

|

29 |

|

|

|

138 |

|

Junior subordinated debt |

|

|

86 |

|

|

|

87 |

|

|

|

346 |

|

|

|

313 |

|

Total interest expense |

|

|

7,063 |

|

|

|

7,321 |

|

|

|

29,551 |

|

|

|

21,021 |

|

Net interest income |

|

|

12,235 |

|

|

|

10,753 |

|

|

|

46,376 |

|

|

|

48,969 |

|

Provision for (recovery of) credit losses |

|

|

(126 |

) |

|

|

794 |

|

|

|

(600 |

) |

|

|

734 |

|

Net interest income after provision for (recovery of) credit losses |

|

|

12,361 |

|

|

|

9,959 |

|

|

|

46,976 |

|

|

|

48,235 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

Wealth management fees |

|

|

247 |

|

|

|

756 |

|

|

|

1,152 |

|

|

|

1,976 |

|

Deposit account fees |

|

|

321 |

|

|

|

389 |

|

|

|

1,363 |

|

|

|

1,593 |

|

Debit/credit card and ATM fees |

|

|

429 |

|

|

|

535 |

|

|

|

1,914 |

|

|

|

2,277 |

|

Bank owned life insurance income |

|

|

297 |

|

|

|

270 |

|

|

|

1,155 |

|

|

|

1,764 |

|

Gains (losses) on sales of assets, net |

|

|

- |

|

|

|

(20 |

) |

|

|

36 |

|

|

|

112 |

|

Gain on early redemption of debt |

|

|

525 |

|

|

|

- |

|

|

|

904 |

|

|

|

- |

|

Gain on termination of interest rate swap |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

460 |

|

Losses on sales of AFS, net |

|

|

- |

|

|

|

- |

|

|

|

(4 |

) |

|

|

(206 |

) |

Other |

|

|

449 |

|

|

|

206 |

|

|

|

1,069 |

|

|

|

1,125 |

|

Total noninterest income |

|

|

2,268 |

|

|

|

2,136 |

|

|

|

7,589 |

|

|

|

9,101 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

|

4,162 |

|

|

|

3,851 |

|

|

|

15,933 |

|

|

|

15,900 |

|

Net occupancy |

|

|

906 |

|

|

|

918 |

|

|

|

3,662 |

|

|

|

4,017 |

|

Equipment |

|

|

206 |

|

|

|

173 |

|

|

|

720 |

|

|

|

762 |

|

Bank franchise tax |

|

|

401 |

|

|

|

291 |

|

|

|

1,452 |

|

|

|

1,220 |

|

Computer software |

|

|

214 |

|

|

|

188 |

|

|

|

917 |

|

|

|

778 |

|

Data processing |

|

|

622 |

|

|

|

799 |

|

|

|

2,647 |

|

|

|

2,970 |

|

FDIC deposit insurance assessment |

|

|

200 |

|

|

|

170 |

|

|

|

700 |

|

|

|

710 |

|

Marketing, advertising and promotion |

|

|

159 |

|

|

|

186 |

|

|

|

730 |

|

|

|

1,098 |

|

Professional fees |

|

|

303 |

|

|

|

82 |

|

|

|

934 |

|

|

|

674 |

|

Core deposit intangible amortization |

|

|

307 |

|

|

|

355 |

|

|

|

1,301 |

|

|

|

1,493 |

|

Other |

|

|

1,302 |

|

|

|

1,285 |

|

|

|

4,670 |

|

|

|

4,441 |

|

Total noninterest expense |

|

|

8,782 |

|

|

|

8,298 |

|

|

|

33,666 |

|

|

|

34,063 |

|

Income before income taxes |

|

|

5,847 |

|

|

|

3,797 |

|

|

|

20,899 |

|

|

|

23,273 |

|

Provision for income taxes |

|

|

1,286 |

|

|

|

629 |

|

|

|

3,933 |

|

|

|

4,010 |

|

Net income |

|

$ |

4,561 |

|

|

$ |

3,168 |

|

|

$ |

16,966 |

|

|

$ |

19,263 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share, basic |

|

$ |

0.85 |

|

|

$ |

0.59 |

|

|

$ |

3.16 |

|

|

$ |

3.60 |

|

Net income per common share, diluted |

|

$ |

0.85 |

|

|

$ |

0.59 |

|

|

$ |

3.15 |

|

|

$ |

3.58 |

|

Weighted average common shares outstanding, basic |

|

|

5,370,912 |

|

|

|

5,365,982 |

|

|

|

5,371,439 |

|

|

|

5,357,085 |

|

Weighted average common shares outstanding, diluted |

|

|

5,407,489 |

|

|

|

5,394,713 |

|

|

|

5,392,114 |

|

|

|

5,382,145 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VIRGINIA NATIONAL BANKSHARES CORPORATION

FINANCIAL HIGHLIGHTS

(dollars in thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At or For the Three Months Ended |

|

|

|

December 31, 2024 |

|

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

Common Share Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

4,561 |

|

|

$ |

4,600 |

|

|

$ |

4,159 |

|

|

$ |

3,646 |

|

|

$ |

3,168 |

|

Net income per weighted average share, basic |

|

$ |

0.85 |

|

|

$ |

0.86 |

|

|

$ |

0.77 |

|

|

$ |

0.68 |

|

|

$ |

0.59 |

|

Net income per weighted average share, diluted |

|

$ |

0.85 |

|

|

$ |

0.85 |

|

|

$ |

0.77 |

|

|

$ |

0.68 |

|

|

$ |

0.59 |

|

Weighted average shares outstanding, basic |

|

|

5,370,912 |

|

|

|

5,370,912 |

|

|

|

5,377,055 |

|

|

|

5,366,890 |

|

|

|

5,365,982 |

|

Weighted average shares outstanding, diluted |

|

|

5,407,489 |

|

|

|

5,396,936 |

|

|

|

5,385,770 |

|

|

|

5,380,081 |

|

|

|

5,394,713 |

|

Actual shares outstanding |

|

|

5,370,912 |

|

|

|

5,370,912 |

|

|

|

5,370,912 |

|

|

|

5,390,388 |

|

|

|

5,365,982 |

|

Tangible book value per share at period end (non-GAAP) 5 |

|

$ |

27.70 |

|

|

$ |

28.68 |

|

|

$ |

26.43 |

|

|

$ |

25.99 |

|

|

$ |

26.12 |

|

Key Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets 1 |

|

|

1.12 |

% |

|

|

1.15 |

% |

|

|

1.05 |

% |

|

|

0.91 |

% |

|

|

0.79 |

% |

Return on average equity 1 |

|

|

10.98 |

% |

|

|

11.44 |

% |

|

|

11.07 |

% |

|

|

9.57 |

% |

|

|

9.03 |

% |

Net interest margin (FTE) 2 |

|

|

3.21 |

% |

|

|

3.24 |

% |

|

|

3.04 |

% |

|

|

2.93 |

% |

|

|

2.89 |

% |

Efficiency ratio (FTE) 3 |

|

|

60.2 |

% |

|

|

58.6 |

% |

|

|

62.7 |

% |

|

|

66.8 |

% |

|

|

64.0 |

% |

Loan-to-deposit ratio |

|

|

86.8 |

% |

|

|

88.1 |

% |

|

|

84.3 |

% |

|

|

78.8 |

% |

|

|

77.5 |

% |

Net Interest Income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

$ |

12,235 |

|

|

$ |

12,024 |

|

|

$ |

11,181 |

|

|

$ |

10,936 |

|

|

$ |

10,753 |

|

Net interest income (FTE) 2 |

|

$ |

12,321 |

|

|

$ |

12,111 |

|

|

$ |

11,268 |

|

|

$ |

11,023 |

|

|

$ |

10,839 |

|

Company Capital Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tier 1 leverage ratio |

|

|

11.34 |

% |

|

|

11.81 |

% |

|

|

11.47 |

% |

|

|

11.24 |

% |

|

|

11.13 |

% |

Total risk-based capital ratio |

|

|

18.77 |

% |

|

|

18.88 |

% |

|

|

18.64 |

% |

|

|

18.49 |

% |

|

|

18.24 |

% |

Assets and Asset Quality: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average earning assets |

|

$ |

1,526,464 |

|

|

$ |

1,487,182 |

|

|

$ |

1,491,821 |

|

|

$ |

1,513,924 |

|

|

$ |

1,487,910 |

|

Average gross loans |

|

$ |

1,218,460 |

|

|

$ |

1,181,447 |

|

|

$ |

1,144,350 |

|

|

$ |

1,117,570 |

|

|

$ |

1,061,297 |

|

Fair value mark on acquired loans |

|

$ |

6,785 |

|

|

$ |

7,301 |

|

|

$ |

8,237 |

|

|

$ |

8,811 |

|

|

$ |

9,399 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for credit losses on loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning of period |

|

$ |

8,523 |

|

|

$ |

8,028 |

|

|

$ |

8,289 |

|

|

$ |

8,395 |

|

|

$ |

7,799 |

|

Provision for (recovery of) credit losses |

|

|

(208 |

) |

|

|

(3 |

) |

|

|

(518 |

) |

|

|

11 |

|

|

|

713 |

|

Charge-offs |

|

|

(127 |

) |

|

|

(272 |

) |

|

|

(208 |

) |

|

|

(184 |

) |

|

|

(207 |

) |

Recoveries |

|

|

267 |

|

|

|

770 |

|

|

|

465 |

|

|

|

67 |

|

|

|

90 |

|

Net recoveries (charge-offs) |

|

|

140 |

|

|

|

498 |

|

|

|

257 |

|

|

|

(117 |

) |

|

|

(117 |

) |

End of period |

|

$ |

8,455 |

|

|

$ |

8,523 |

|

|

$ |

8,028 |

|

|

$ |

8,289 |

|

|

$ |

8,395 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-accrual loans |

|

$ |

2,267 |

|

|

$ |

2,113 |

|

|

$ |

2,365 |

|

|

$ |

2,178 |

|

|

$ |

1,852 |

|

Loans 90 days or more past due and still accruing |

|

|

754 |

|

|

|

3,214 |

|

|

|

1,596 |

|

|

|

876 |

|

|

|

880 |

|

Total nonperforming assets (NPA) 4 |

|

$ |

3,021 |

|

|

$ |

5,327 |

|

|

$ |

3,961 |

|

|

$ |

3,054 |

|

|

$ |

2,732 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NPA as a % of total assets |

|

|

0.19 |

% |

|

|

0.33 |

% |

|

|

0.25 |

% |

|

|

0.19 |

% |

|

|

0.17 |

% |

NPA as a % of gross loans |

|

|

0.24 |

% |

|

|

0.44 |

% |

|

|

0.34 |

% |

|

|

0.27 |

% |

|

|

0.25 |

% |

ACL to gross loans |

|

|

0.68 |

% |

|

|

0.70 |

% |

|

|

0.69 |

% |

|

|

0.73 |

% |

|

|

0.77 |

% |

Non-accruing loans to gross loans |

|

|

0.18 |

% |

|

|

0.17 |

% |

|

|

0.20 |

% |

|

|

0.19 |

% |

|

|

0.17 |

% |

Net charge-offs (recoveries) to average loans 1 |

|

|

-0.05 |

% |

|

|

-0.17 |

% |

|

|

-0.09 |

% |

|

|

0.04 |

% |

|

|

0.04 |

% |

1 Ratio is computed on an annualized basis.

2 The net interest margin and net interest income are reported on a fully tax-equivalent basis (FTE) basis, using a Federal income tax rate of 21%. This is a non-GAAP financial measure. Refer to the Reconciliation of Certain Non-GAAP Financial (FTE) Measures at the end of this release.

3 The efficiency ratio (FTE) is computed as a percentage of noninterest expense divided by the sum of net interest income (FTE) and noninterest income. This is a non-GAAP financial measure that management believes provides investors with important information regarding operational efficiency. Management believes such financial information is meaningful to the reader in understanding operating performance, but cautions that such information should not be viewed as a substitute for GAAP. Comparison of our efficiency ratio with those of other companies may not be possible because other companies may calculate them differently. Refer to the Reconciliation of Certain Non-GAAP Financial (FTE) Measures at the end of this release.

4 The Bank held no other real estate owned during any of the periods presented.

5 This is a non-GAAP financial measure. Refer to the Reconciliation of Certain Non-GAAP Financial (FTE) Measures at the end of this release.

VIRGINIA NATIONAL BANKSHARES CORPORATION

AVERAGE BALANCES, INCOME AND EXPENSES, YIELDS AND RATES (TAXABLE EQUIVALENT BASIS)

(dollars in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

|

|

|

|

Interest |

|

|

|

|

|

|

|

|

Interest |

|

|

|

|

|

|

Average |

|

|

Income/ |

|

|

Average |

|

|

Average |

|

|

Income/ |

|

|

Average |

|

|

|

Balance |

|

|

Expense |

|

|

Yield/Cost |

|

|

Balance |

|

|

Expense |

|

|

Yield/Cost |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Earning Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable Securities and Dividends |

|

$ |

213,609 |

|

|

$ |

1,451 |

|

|

|

2.72 |

% |

|

$ |

346,248 |

|

|

$ |

2,982 |

|

|

|

3.44 |

% |

Tax Exempt Securities 1 |

|

|

66,211 |

|

|

|

409 |

|

|

|

2.47 |

% |

|

|

66,710 |

|

|

|

411 |

|

|

|

2.46 |

% |

Total Securities 1 |

|

|

279,820 |

|

|

|

1,860 |

|

|

|

2.66 |

% |

|

|

412,958 |

|

|

|

3,393 |

|

|

|

3.29 |

% |

Loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate |

|

|

921,967 |

|

|

|

13,159 |

|

|

|

5.68 |

% |

|

|

873,226 |

|

|

|

11,919 |

|

|

|

5.42 |

% |

Commercial |

|

|

261,544 |

|

|

|

3,507 |

|

|

|

5.33 |

% |

|

|

149,765 |

|

|

|

2,018 |

|

|

|

5.35 |

% |

Consumer |

|

|

34,949 |

|

|

|

587 |

|

|

|

6.68 |

% |

|

|

38,306 |

|

|

|

707 |

|

|

|

7.32 |

% |

Total Loans |

|

|

1,218,460 |

|

|

|

17,253 |

|

|

|

5.63 |

% |

|

|

1,061,297 |

|

|

|

14,644 |

|

|

|

5.47 |

% |

Fed Funds Sold |

|

|

19,313 |

|

|

|

230 |

|

|

|

4.74 |

% |

|

|

4,709 |

|

|

|

64 |

|

|

|

5.39 |

% |

Other interest-bearing deposits |

|

|

8,871 |

|

|

|

41 |

|

|

|

1.84 |

% |

|

|

8,946 |

|

|

|

59 |

|

|

|

2.62 |

% |

Total Earning Assets |

|

|

1,526,464 |

|

|

|

19,384 |

|

|

|

5.05 |

% |

|

|

1,487,910 |

|

|

|

18,160 |

|

|

|

4.84 |

% |

Less: Allowance for Credit Losses |

|

|

(8,555 |

) |

|

|

|

|

|

|

|

|

(7,833 |

) |

|

|

|

|

|

|

Total Non-Earning Assets |

|

|

109,030 |

|

|

|

|

|

|

|

|

|

115,114 |

|

|

|

|

|

|

|

Total Assets |

|

$ |

1,626,939 |

|

|

|

|

|

|

|

|

$ |

1,595,191 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Bearing Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Bearing Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Checking |

|

$ |

263,281 |

|

|

$ |

67 |

|

|

|

0.10 |

% |

|

$ |

287,228 |

|

|

$ |

73 |

|

|

|

0.10 |

% |

Money Market and Savings Deposits |

|

|

442,660 |

|

|

|

2,939 |

|

|

|

2.64 |

% |

|

|

413,771 |

|

|

|

2,964 |

|

|

|

2.84 |

% |

Time Deposits |

|

|

318,203 |

|

|

|

3,463 |

|

|

|

4.33 |

% |

|

|

304,053 |

|

|

|

3,508 |

|

|

|

4.58 |

% |

Total Interest-Bearing Deposits |

|

|

1,024,144 |

|

|

|

6,469 |

|

|

|

2.51 |

% |

|

|

1,005,052 |

|

|

|

6,545 |

|

|

|

2.58 |

% |

Borrowings |

|

|

46,253 |

|

|

|

504 |

|

|

|

4.33 |

% |

|

|

49,147 |

|

|

|

663 |

|

|

|

5.35 |

% |

Federal funds purchased |

|

|

284 |

|

|

|

4 |

|

|

|

5.60 |

% |

|

|

1,755 |

|

|

|

26 |

|

|

|

5.88 |

% |

Junior subordinated debt |

|

|

3,499 |

|

|

|

86 |

|

|

|

9.78 |

% |

|

|

3,454 |

|

|

|

87 |

|

|

|

9.99 |

% |

Total Interest-Bearing Liabilities |

|

|

1,074,180 |

|

|

|

7,063 |

|

|

|

2.62 |

% |

|

|

1,059,408 |

|

|

|

7,321 |

|

|

|

2.74 |

% |

Non-Interest-Bearing Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand deposits |

|

|

377,596 |

|

|

|

|

|

|

|

|

|

386,001 |

|

|

|

|

|

|

|

Other liabilities |

|

|

9,965 |

|

|

|

|

|

|

|

|

|

10,666 |

|

|

|

|

|

|

|

Total Liabilities |

|

|

1,461,741 |

|

|

|

|

|

|

|

|

|

1,456,075 |

|

|

|

|

|

|

|

Shareholders' Equity |

|

|

165,198 |

|

|

|

|

|

|

|

|

|

139,116 |

|

|

|

|

|

|

|

Total Liabilities & Shareholders' Equity |

|

$ |

1,626,939 |

|

|

|

|

|

|

|

|

$ |

1,595,191 |

|

|

|

|

|

|

|

Net Interest Income (FTE) |

|

|

|

|

$ |

12,321 |

|

|

|

|

|

|

|

|

$ |

10,839 |

|

|

|

|

Interest Rate Spread 2 |

|

|

|

|

|

|

|

|

2.43 |

% |

|

|

|

|

|

|

|

|

2.10 |

% |

Cost of Funds |

|

|

|

|

|

|

|

|

1.94 |

% |

|

|

|

|

|

|

|

|

2.01 |

% |

Interest Expense as a Percentage of

Average Earning Assets |

|

|

|

|

|

|

|

|

1.84 |

% |

|

|

|

|

|

|

|

|

1.95 |

% |

Net Interest Margin (FTE) 3 |

|

|

|

|

|

|

|

|

3.21 |

% |

|

|

|

|

|

|

|

|

2.89 |

% |

1 Tax-exempt income for investment securities has been adjusted to a fully tax-equivalent basis (FTE), using a Federal income tax rate of 21%.

Refer to the Reconcilement of Non-GAAP Measures table at the end of this release.

2 Interest spread is the average yield earned on earning assets less the average rate paid on interest-bearing liabilities.

3 Net interest margin (FTE) is net interest income expressed as a percentage of average earning assets.

VIRGINIA NATIONAL BANKSHARES CORPORATION

AVERAGE BALANCES, INCOME AND EXPENSES, YIELDS AND RATES (TAXABLE EQUIVALENT BASIS)

(dollars in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the twelve months ended |

|

|

|

December 31, 2024 |

|

|

December 31, 2023 |

|

|

|

|

|

|

Interest |

|

|

|

|

|

|

|

|

Interest |

|

|

|

|

|

|

Average |

|

|

Income/ |

|

|

Average |

|

|

Average |

|

|

Income/ |

|

|

Average |

|

|

|

Balance |

|

|

Expense |

|

|

Yield/Cost |

|

|

Balance |

|

|

Expense |

|

|

Yield/Cost |

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Earning Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable Securities and Dividends |

|

$ |

249,858 |

|

|

$ |

7,120 |

|

|

|

2.85 |

% |

|

$ |

400,189 |

|

|

$ |

11,921 |

|

|

|

2.98 |

% |

Tax Exempt Securities 1 |

|

|

66,399 |

|

|

|

1,649 |

|

|

|

2.48 |

% |

|

|

66,895 |

|

|

|

1,655 |

|

|

|

2.47 |

% |

Total Securities 1 |

|

|

316,257 |

|

|

|

8,769 |

|

|

|

2.77 |

% |

|

|

467,084 |

|

|

|

13,576 |

|

|

|

2.91 |

% |

Loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate |

|

|

908,356 |

|

|

|

51,532 |

|

|

|

5.67 |

% |

|

|

839,326 |

|

|

|

47,996 |

|

|

|

5.72 |

% |

Commercial |

|

|

220,276 |

|

|

|

12,430 |

|

|

|

5.64 |

% |

|

|

100,122 |

|

|

|

5,121 |

|

|

|

5.11 |

% |

Consumer |

|

|

37,013 |

|

|

|

2,572 |

|

|

|

6.95 |

% |

|

|

41,140 |

|

|

|

2,936 |

|

|

|

7.14 |

% |

Total Loans |

|

|

1,165,645 |

|

|

|

66,534 |

|

|

|

5.71 |

% |

|

|

980,588 |

|

|

|

56,053 |

|

|

|

5.72 |

% |

Fed Funds Sold |

|

|

14,663 |

|

|

|

765 |

|

|

|

5.22 |

% |

|

|

3,825 |

|

|

|

207 |

|

|

|

5.41 |

% |

Other interest-bearing deposits |

|

|

8,220 |

|

|

|

206 |

|

|

|

2.51 |

% |

|

|

15,489 |

|

|

|

501 |

|

|

|

3.23 |

% |

Total Earning Assets |

|

|

1,504,785 |

|

|

|

76,274 |

|

|

|

5.07 |

% |

|

|

1,466,986 |

|

|

|

70,337 |

|

|

|

4.79 |

% |

Less: Allowance for Credit Losses |

|

|

(8,350 |

) |

|

|

|

|

|

|

|

|

(7,907 |

) |

|

|

|

|

|

|

Total Non-Earning Assets |

|

|

109,503 |

|

|

|

|

|

|

|

|

|

115,908 |

|

|

|

|

|

|

|

Total Assets |

|

$ |

1,605,938 |

|

|

|

|

|

|

|

|

$ |

1,574,987 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Bearing Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Bearing Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Checking |

|

$ |

269,136 |

|

|

$ |

272 |

|

|

|

0.10 |

% |

|

$ |

321,154 |

|

|

$ |

346 |

|

|

|

0.11 |

% |

Money Market and Savings Deposits |

|

|

425,386 |

|

|

|

11,803 |

|

|

|

2.77 |

% |

|

|

421,083 |

|

|

|

9,673 |

|

|

|

2.30 |

% |

Time Deposits |

|

|

333,139 |

|

|

|

15,410 |

|

|

|

4.63 |

% |

|

|

220,348 |

|

|

|

8,617 |

|

|

|

3.91 |

% |

Total Interest-Bearing Deposits |

|

|

1,027,661 |

|

|

|

27,485 |

|

|

|

2.67 |

% |

|

|

962,585 |

|

|

|

18,636 |

|

|

|

1.94 |

% |

Borrowings |

|

|

36,111 |

|

|

|

1,691 |

|

|

|

4.68 |

% |

|

|

37,286 |

|

|

|

1,934 |

|

|

|

5.19 |

% |

Federal funds purchased |

|

|

489 |

|

|

|

29 |

|

|

|

5.93 |

% |

|

|

2,632 |

|

|

|

138 |

|

|

|

5.24 |

% |

Junior subordinated debt |

|

|

3,482 |

|

|

|

346 |

|

|

|

9.94 |

% |

|

|

3,436 |

|

|

|

313 |

|

|

|

9.11 |

% |

Total Interest-Bearing Liabilities |

|

|

1,067,743 |

|

|

|

29,551 |

|

|

|

2.77 |

% |

|

|

1,005,939 |

|

|

|

21,021 |

|

|

|

2.09 |

% |

Non-Interest-Bearing Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand deposits |

|

|

370,178 |

|

|

|

|

|

|

|

|

|

418,091 |

|

|

|

|

|

|

|

Other liabilities |

|

|

10,597 |

|

|

|

|

|

|

|

|

|

11,514 |

|

|

|

|

|

|

|

Total Liabilities |

|

|

1,448,518 |

|

|

|

|

|

|

|

|

|

1,435,544 |

|

|

|

|

|

|

|

Shareholders' Equity |

|

|

157,420 |

|

|

|

|

|

|

|

|

|

139,443 |

|

|

|

|

|

|

|

Total Liabilities & Shareholders' Equity |

|

$ |

1,605,938 |

|

|

|

|

|

|

|

|

$ |

1,574,987 |

|

|

|

|

|

|

|

Net Interest Income (FTE) |

|

|

|

|

$ |

46,723 |

|

|

|

|

|

|

|

|

$ |

49,316 |

|

|

|

|

Interest Rate Spread 2 |

|

|

|

|

|

|

|

|

2.30 |

% |

|

|

|

|

|

|

|

|

2.70 |

% |

Cost of Funds |

|

|

|

|

|

|

|

|

2.06 |

% |

|

|

|

|

|

|

|

|

1.48 |

% |

Interest Expense as a Percentage of

Average Earning Assets |

|

|

|

|

|

|

|

|

1.96 |

% |

|

|

|

|

|

|

|

|

1.43 |

% |

Net Interest Margin (FTE) 3 |

|

|

|

|

|

|

|

|

3.10 |

% |

|

|

|

|

|

|

|

|

3.36 |

% |

1 Tax-exempt income for investment securities has been adjusted to a fully tax-equivalent basis (FTE), using a Federal income tax rate of 21%.

Refer to the Reconcilement of Non-GAAP Measures table at the end of this release.

2 Interest spread is the average yield earned on earning assets less the average rate paid on interest-bearing liabilities.

3 Net interest margin (FTE) is net interest income expressed as a percentage of average earning assets.

VIRGINIA NATIONAL BANKSHARES CORPORATION

RECONCILIATION OF CERTAIN QUARTERLY NON-GAAP FINANCIAL MEASURES

(dollars in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

|

|

December 31, 2024 |

|

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

Fully tax-equivalent measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

$ |

12,235 |

|

|

$ |

12,024 |

|

|

$ |

11,181 |

|

|

$ |

10,936 |

|

|

$ |

10,753 |

|

Fully tax-equivalent adjustment |

|

|

86 |

|

|

|

87 |

|

|

|

87 |

|

|

|

87 |

|

|

|

86 |

|

Net interest income (FTE) 1 |

|

$ |

12,321 |

|

|

$ |

12,111 |

|

|

$ |

11,268 |

|

|

$ |

11,023 |

|

|

$ |

10,839 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Efficiency ratio 2 |

|

|

60.6 |

% |

|

|

58.9 |

% |

|

|

63.1 |

% |

|

|

67.2 |

% |

|

|

64.4 |

% |

Fully tax-equivalent adjustment |

|

|

-0.4 |

% |

|

|

-0.3 |

% |

|

|

-0.4 |

% |

|

|

-0.4 |

% |

|

|

-0.4 |

% |

Efficiency ratio (FTE) 3 |

|

|

60.2 |

% |

|

|

58.6 |

% |

|

|

62.7 |

% |

|

|

66.8 |

% |

|

|

64.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest margin |

|

|

3.19 |

% |

|

|

3.22 |

% |

|

|

3.01 |

% |

|

|

2.91 |

% |

|

|

2.87 |

% |

Fully tax-equivalent adjustment |

|

|

0.02 |

% |

|

|

0.02 |

% |

|

|

0.03 |

% |

|

|

0.02 |

% |

|

|

0.02 |

% |

Net interest margin (FTE) 1 |

|

|

3.21 |

% |

|

|

3.24 |

% |

|

|

3.04 |

% |

|

|

2.93 |

% |

|

|

2.89 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

December 31, 2024 |

|

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

Other financial measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Book value per share |

|

$ |

29.85 |

|

|

$ |

30.89 |

|

|

$ |

28.70 |

|

|

$ |

28.31 |

|

|

$ |

28.52 |

|

Impact of intangible assets 4 |

|

|

(2.15 |

) |

|

|

(2.21 |

) |

|

|

(2.27 |

) |

|

|

(2.32 |

) |

|

|

(2.40 |

) |

Tangible book value per share (non-GAAP) |

|

$ |

27.70 |

|

|

$ |

28.68 |

|

|

$ |

26.43 |

|

|

$ |

25.99 |

|

|

$ |

26.12 |

|

|

|

|

|

|

|

|

|

|

|

|

For the Twelve Months Ended |

|

|

|

December 31,

2024 |

|

|

December 31,

2023 |

|

Fully tax-equivalent measures |

|

|

|

|

|

|

Net interest income |

|

$ |

46,376 |

|

|

$ |

48,969 |

|

Fully tax-equivalent adjustment |

|

|

347 |

|

|

|

347 |

|

Net interest income (FTE) 1 |

|

$ |

46,723 |

|

|

$ |

49,316 |

|

|

|

|

|

|

|

|

Efficiency ratio 2 |

|

|

62.4 |

% |

|

|

58.7 |

% |

Fully tax-equivalent adjustment |

|

|

-0.4 |

% |

|

|

-0.4 |

% |

Efficiency ratio (FTE) 3 |

|

|

62.0 |

% |

|

|

58.3 |

% |

|

|

|

|

|

|

|

Net interest margin |

|

|

3.08 |

% |

|

|

3.34 |

% |

Fully tax-equivalent adjustment |

|

|

0.02 |

% |

|

|

0.02 |

% |

Net interest margin (FTE) 1 |

|

|

3.10 |

% |

|

|

3.36 |

% |

1 FTE calculations use a Federal income tax rate of 21%.

2 The efficiency ratio, GAAP basis, is computed by dividing noninterest expense by the sum of net interest income and noninterest income.

3 The efficiency ratio, FTE, is computed by dividing noninterest expense by the sum of net interest income (FTE) and noninterest income.

4 Intangible assets include goodwill and core deposit intangible assets, net of accumulated amortization, for all periods presented.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |