0001000209false00010002092025-01-302025-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 30, 2025

MEDALLION FINANCIAL CORP.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

001-37747

(Commission File Number)

04-3291176

(IRS Employer Identification No.)

437 MADISON AVENUE, 38th Floor

NEW YORK, New York 10022

(Address of Principal Executive Offices) (Zip Code)

(212) 328-2100

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

MFIN |

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation FD Disclosure.

Medallion Bank, a wholly owned subsidiary of Medallion Financial Corp. (the “Company”), issued a press release to the news media announcing, among other things, Medallion Bank's results for the quarter and year ended December 31, 2024.

A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The information in the press release is being furnished, not filed, pursuant to Item 7.01. Accordingly, the information in the press release will not be incorporated by reference into any registration statement filed by the Company under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

The following exhibits are being filed with this Current Report on Form 8-K:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 30, 2025

|

|

|

MEDALLION FINANCIAL CORP. |

|

|

By: |

|

/s/ Anthony N. Cutrone |

|

|

Name: Anthony N. Cutrone |

|

|

Title: Chief Financial Officer |

FOR IMMEDIATE RELEASE:

MEDALLION BANK REPORTS 2024 FOURTH QUARTER AND FULL-YEAR RESULTS AND DECLARES SERIES F PREFERRED STOCK DIVIDEND

SALT LAKE CITY, UT – January 30, 2025 – Medallion Bank (Nasdaq: MBNKP, the “Bank”), an FDIC-insured bank specializing in consumer loans for the purchase of recreational vehicles, boats, and home improvements, as well as loan products and services offered through fintech strategic partners, today announced its results for the quarter and year ended December 31, 2024. The Bank is a wholly owned subsidiary of Medallion Financial Corp. (Nasdaq: MFIN).

2024 Fourth Quarter Highlights

•Net income of $15.6 million, compared to $21.9 million in the prior year quarter.

•Net interest income of $53.1 million, compared to $48.9 million in the prior year quarter.

•Net interest margin of 8.28%, compared to 8.62% in the prior year quarter.

•Total provision for credit losses was $20.5 million, compared to $9.7 million in the prior year quarter. Total provision for credit losses included $0.9 million of net taxi medallion recoveries, compared to $12.0 million of net taxi medallion recoveries in the prior year quarter.

•Annualized net charge-offs were 3.28% of average loans outstanding, compared to 1.04% in the prior year quarter.

•In December 2024, the Bank signed a letter of intent to sell up to $121 million of recreation loans at a premium to par value.

2024 Full-Year Highlights

• Net income of $60.6 million, compared to net income of $79.9 million in 2023.

•Net interest income of $204.7 million, compared to $188.9 million in 2023.

•Net interest margin of 8.48%, compared to 8.84% in 2023.

•Total provision for credit losses was $75.8 million, compared to $36.5 million in 2023. Total provision for credit losses included $4.9 million of net taxi medallion recoveries, compared to $18.1 million of net taxi medallion recoveries in 2023.

•Total net charge-offs were 2.82% of average loans outstanding, compared to 1.52% in 2023.

•Return on assets and return on equity were 2.52% and 16.62%, respectively, compared to 3.74% and 24.57% in 2023.

•Total loan portfolio grew 13% to $2.4 billion.

•Total assets were $2.5 billion, total capital was $382.4 million, and the Tier 1 leverage ratio was 15.68% as of December 31, 2024.

Donald Poulton, President and Chief Executive Officer of Medallion Bank, stated, “We finished 2024 on a solid note, with quarterly earnings of $15.6 million and net interest income above $53 million. Volumes in our strategic partnership business tripled to $124 million from $40 million in the third quarter. As anticipated, recreation and home improvement loan volumes slowed with the winter season, and loan delinquency and net charge-offs rose in the quarter as is expected. With record recreation loan originations of more than $526 million in 2024, we initiated another loan sale — our fifth since 2016 — in preparation for the projected demand from our customers in 2025. We view loan sales as an efficient method to recycle capital that can also generate earnings when demand exceeds our capacity. Reclassifying these recreation loans as held for sale resulted in a release of $3.9 million in related allowance for credit losses. As we look ahead, our priorities remain constant: loan originations of predictable credit quality and managed growth that continues to deliver increasing net interest income while maintaining or growing our market position.”

Recreation Lending Segment

•The Bank’s recreation loan portfolio grew 15% to $1.543 billion as of December 31, 2024, compared to $1.336 billion at December 31, 2023. Loan originations were $72.2 million in the fourth quarter 2024, compared to $62.7 million in the prior year quarter. For the year, loan originations were $526.6 million, compared to $447.0 million in 2023.

•Net interest income was $39.4 million for the fourth quarter 2024, compared to $36.2 million in the prior year quarter. For the year, net interest income was $153.1 million, compared to $140.3 million in 2023.

•Recreation loans were 65% of loans receivable as of December 31, 2024, compared to 64% at December 31, 2023.

•Annualized net charge-offs were 4.35% of average recreation loans outstanding in the fourth quarter 2024, compared to 4.23% in the prior year quarter. For the year, total net charge-offs were 3.72% of average recreation loans outstanding, compared to 3.04% in 2023.

•The provision for recreation credit losses was $17.7 million in the fourth quarter 2024, compared to $14.8 million in the prior year quarter. For the year, the provision for recreation credit losses was $68.0 million, compared to $44.6 million in 2023. The provisions for the three and twelve months ended December 31, 2024 included $3.9 million of allowance for credit losses released as $121 million of recreation loans were reclassified as held for sale.

•The recreation allowance for credit losses was 5.00% of the outstanding balance as of December 31, 2024, compared to 4.31% of the outstanding balance as of December 31, 2023. The Bank does not record an allowance for loans held for sale, so the allowance as of December 31, 2024 relates only to the remaining recreation loans held for investment.

Home Improvement Lending Segment

•The Bank’s home improvement loan portfolio grew 9% to $827.2 million as of December 31, 2024, compared to $760.6 million at December 31, 2023. Loan originations were $82.5 million in the fourth quarter 2024, compared to $66.0 million in the prior year quarter. For the year, loan originations were $298.7 million, compared to $357.4 million in 2023.

•Net interest income was $13.1 million for the fourth quarter 2024, compared to $12.2 million in the prior year quarter. For the year, net interest income was $50.2 million, compared to $46.6 million in 2023.

•Home improvement loans were 35% of loans receivable as of December 31, 2024, compared to 36% at December 31, 2023.

•Annualized net charge-offs were 1.75% of average home improvement loans outstanding in the fourth quarter 2024, compared to 1.67% in the prior year quarter. For the year, total net charge-offs were 1.78% of average home improvement loans outstanding, compared to 1.33% in 2023.

•The provision for home improvement credit losses was $4.4 million in the fourth quarter 2024, compared to $6.9 million in the prior year quarter. For the year, the provision for home improvement credit losses was $13.5 million, compared to $17.6 million in 2023.

•The home improvement allowance for credit losses was 2.48% of the outstanding balance at December 31, 2024, compared to 2.76% of the outstanding balance at December 31, 2023.

Series F Preferred Stock Dividend

On January 23, 2025, the Bank’s Board of Directors declared a quarterly cash dividend of $0.50 per share on the Bank’s Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series F, which trades on the Nasdaq Capital Market under the ticker symbol “MBNKP.” The dividend is payable on April 1, 2025, to holders of record at the close of business on March 17, 2025.

* * *

About Medallion Bank

Medallion Bank specializes in providing consumer loans for the purchase of recreational vehicles, boats, and home improvements, along with loan origination services to fintech strategic partners. The Bank works directly with thousands of dealers, contractors and financial service providers serving their customers throughout the United States. Medallion Bank is a Utah-chartered, FDIC-insured industrial bank headquartered in Salt Lake City and is a wholly owned subsidiary of Medallion Financial Corp. (Nasdaq: MFIN).

For more information, visit www.medallionbank.com

Please note that this press release contains forward-looking statements that involve risks and uncertainties relating to business performance, cash flow, costs, sales (including loan sales), net investment income, earnings, returns and growth. These statements are often, but not always, made through the use of words or phrases such as “remains,” “anticipated,” “continue,” “may,” “maintain” or the negative versions of these words or other comparable words or phrases of a future or forward-looking nature. These statements may relate to our future earnings, returns, capital levels, sources of funding, growth prospects, asset quality and pursuit and execution of our strategy. Medallion Bank’s actual results may differ significantly from the results discussed in such forward-looking statements. For a description of certain risks to which Medallion Bank is or may be subject, please refer to the factors discussed under the captions “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” included in Medallion Bank’s Form 10-K for the year ended December 31, 2023, and in its Quarterly Reports on Form 10-Q, filed with the FDIC. Medallion Bank’s Form 10-K, Form 10-Qs and other FDIC filings are available in the Investor Relations section of Medallion Bank’s website. Medallion Bank’s financial results for any period are not necessarily indicative of Medallion Financial Corp.’s results for the same period.

Company Contact:

Investor Relations

212-328-2176

InvestorRelations@medallion.com

MEDALLION BANK

STATEMENTS OF OPERATIONS

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

For the Years Ended December 31, |

|

(In thousands) |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Interest income |

|

|

|

|

|

|

|

|

|

|

|

Loan interest including fees |

$ |

71,577 |

|

|

$ |

61,668 |

|

|

$ |

268,914 |

|

|

$ |

231,496 |

|

Investments |

|

1,564 |

|

|

|

1,585 |

|

|

|

6,306 |

|

|

|

5,171 |

|

Total interest income |

|

73,141 |

|

|

|

63,253 |

|

|

|

275,220 |

|

|

|

236,667 |

|

Interest expense |

|

20,039 |

|

|

|

14,401 |

|

|

|

70,509 |

|

|

|

47,785 |

|

Net interest income |

|

53,102 |

|

|

|

48,852 |

|

|

|

204,711 |

|

|

|

188,882 |

|

Provision for credit losses |

|

20,500 |

|

|

|

9,717 |

|

|

|

75,845 |

|

|

|

36,457 |

|

Net interest income after provision for credit losses |

|

32,602 |

|

|

|

39,135 |

|

|

|

128,866 |

|

|

|

152,425 |

|

Other non-interest income |

|

16 |

|

|

|

839 |

|

|

|

2,134 |

|

|

|

2,102 |

|

Non-interest expense |

|

|

|

|

|

|

|

|

|

|

|

Salaries and benefits |

|

5,014 |

|

|

|

4,997 |

|

|

|

19,985 |

|

|

|

19,001 |

|

Loan servicing |

|

3,173 |

|

|

|

2,903 |

|

|

|

12,248 |

|

|

|

11,626 |

|

Collection costs |

|

1,517 |

|

|

|

1,492 |

|

|

|

6,095 |

|

|

|

5,965 |

|

Regulatory fees |

|

969 |

|

|

|

692 |

|

|

|

3,795 |

|

|

|

3,176 |

|

Professional fees |

|

508 |

|

|

|

631 |

|

|

|

1,694 |

|

|

|

2,243 |

|

Information technology |

|

329 |

|

|

|

281 |

|

|

|

1,186 |

|

|

|

1,031 |

|

Occupancy and equipment |

|

541 |

|

|

|

206 |

|

|

|

1,167 |

|

|

|

830 |

|

Other |

|

938 |

|

|

|

818 |

|

|

|

3,624 |

|

|

|

3,524 |

|

Total non-interest expense |

|

12,989 |

|

|

|

12,020 |

|

|

|

49,794 |

|

|

|

47,396 |

|

Income before income taxes |

|

19,629 |

|

|

|

27,954 |

|

|

|

81,206 |

|

|

|

107,131 |

|

Provision for income taxes |

|

4,040 |

|

|

|

6,011 |

|

|

|

20,624 |

|

|

|

27,279 |

|

Net income |

$ |

15,589 |

|

|

$ |

21,943 |

|

|

$ |

60,582 |

|

|

$ |

79,852 |

|

Less: Preferred stock dividends |

|

1,512 |

|

|

|

1,512 |

|

|

|

6,047 |

|

|

|

6,047 |

|

Net income attributable to common shareholder |

$ |

14,077 |

|

|

$ |

20,431 |

|

|

$ |

54,535 |

|

|

$ |

73,805 |

|

MEDALLION BANK

BALANCE SHEETS

(UNAUDITED)

|

|

|

|

|

|

|

|

|

(In thousands) |

|

December 31, 2024 |

|

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

|

Cash and federal funds sold |

|

$ |

126,196 |

|

|

$ |

110,043 |

|

Investment securities, available-for-sale |

|

|

54,805 |

|

|

|

54,282 |

|

Loans held for sale, at the lower of amortized cost or fair value |

|

|

128,226 |

|

|

— |

|

Loan receivables, inclusive of net deferred loan acquisition cost and fees |

|

|

2,249,613 |

|

|

|

2,100,338 |

|

Allowance for credit losses |

|

|

(91,638 |

) |

|

|

(79,283 |

) |

Loans, net |

|

|

2,157,975 |

|

|

|

2,021,055 |

|

Loan collateral in process of foreclosure |

|

|

3,326 |

|

|

|

4,165 |

|

Fixed assets and right-of-use lease assets, net |

|

|

9,126 |

|

|

|

8,140 |

|

Deferred tax assets |

|

|

14,036 |

|

|

|

12,761 |

|

Accrued interest receivable |

|

|

15,083 |

|

|

|

13,439 |

|

Other assets |

|

|

40,326 |

|

|

|

38,171 |

|

Total assets |

|

$ |

2,549,099 |

|

|

$ |

2,262,056 |

|

Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

Deposits and other funds borrowed |

|

$ |

2,125,071 |

|

|

$ |

1,866,657 |

|

Accrued interest payable |

|

|

5,586 |

|

|

|

4,029 |

|

Income tax payable |

|

|

17,951 |

|

|

|

21,219 |

|

Other liabilities |

|

|

17,204 |

|

|

|

17,509 |

|

Due to affiliates |

|

|

910 |

|

|

|

849 |

|

Total liabilities |

|

|

2,166,722 |

|

|

|

1,910,263 |

|

Shareholder’s Equity |

|

|

|

|

|

|

Series E Preferred stock |

|

|

26,303 |

|

|

|

26,303 |

|

Series F Preferred stock |

|

|

42,485 |

|

|

|

42,485 |

|

Common stock |

|

|

1,000 |

|

|

|

1,000 |

|

Additional paid in capital |

|

|

77,500 |

|

|

|

77,500 |

|

Accumulated other comprehensive loss, net of tax |

|

|

(4,480 |

) |

|

|

(4,529 |

) |

Retained earnings |

|

|

239,569 |

|

|

|

209,034 |

|

Total shareholders’ equity |

|

|

382,377 |

|

|

|

351,793 |

|

Total liabilities and shareholders’ equity |

|

$ |

2,549,099 |

|

|

$ |

2,262,056 |

|

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

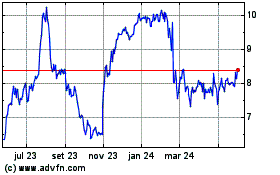

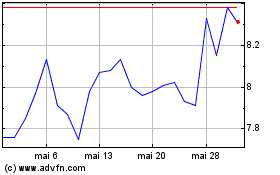

Medallion Financial (NASDAQ:MFIN)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Medallion Financial (NASDAQ:MFIN)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025