Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

04 Fevereiro 2025 - 6:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2025

Commission File Number: 001-36298

GeoPark Limited

(Exact name of registrant as specified in its

charter)

Calle 94 N° 11-30 8° piso

Bogota, Colombia

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

GEOPARK LIMITED

TABLE OF CONTENTS

| ITEM |

|

| 1. |

Press Release dated February 3, 2025 titled “GeoPark Successfully Completes a $550 Million Notes Offering and Refinances More Than 80% of its Outstanding Notes Due 2027” |

Item

1

FOR IMMEDIATE DISTRIBUTION

GEOPARK SUCCESSFULLY COMPLETES A $550 MILLION

NOTES OFFERING AND REFINANCES MORE THAN 80% OF ITS OUTSTANDING NOTES DUE 2027

Bogota, Colombia – February 3, 2025 –

GeoPark Limited (“GeoPark” or the “Company”) (NYSE: GPRK), a leading independent energy company with over 20 years

of successful operations across Latin America, announced today that it has completed a notes offering of an aggregate principal amount

of $550.0 million senior notes due 2030 (“Notes due 2030”). GeoPark has used a portion of the net proceeds from the notes

offering to repurchase $405.3 million of the Company’s outstanding senior notes due 2027 (“Notes due 2027”) tendered

by holders in a concurrent tender offer and intends to repay with the remaining balance amounts due under an offtake and prepayment agreement

related to the acquisition of assets in Vaca Muerta in Argentina.

The following table summarizes key terms of the

Notes due 2030:

| Term: |

5 Years |

| Principal: |

$550.0 million |

| Settlement Date: |

January 31, 2025 |

| Maturity Date: |

January 31, 2030 |

| Issue Price: |

100% |

| Amortization: |

Bullet |

| Interest Payments: |

Semi-annual |

| Coupon: |

8.750% |

| Credit Rating: |

B+ (S&P) / B+ (Fitch) |

The order book was oversubscribed by approximately

2 times and included more than 120 investors from the United States, Europe, Asia and Latin America, reflecting the confidence of the

market in the Company and its credit profile.

This transaction provides the Company financial

flexibility and mitigates the Company’s refinancing risk by extending the average life of GeoPark’s debt to 4.6 years (an

extension of approximately 2.6 years).

Breakdown of Notes Outstanding

The following table details the aggregate principal

amounts outstanding of GeoPark notes as of September 30, 2024 (last reporting date) and pro-forma upon closing of the notes offering and

concurrent tender:

| Notes Outstanding |

September 30, 2024 |

Pro-forma |

| Notes due 2027 |

$500.0 million |

$94.7 million |

| Notes due 2030 |

- |

$550.0 million |

For further information, please

contact:

INVESTORS:

|

Maria Catalina Escobar

Shareholder Value and Capital Markets Director |

mescobar@geo-park.com |

| |

|

|

Miguel Bello

Investor Relations Officer |

mbello@geo-park.com

|

| |

|

|

Maria Alejandra Velez

Investor Relations Leader |

mvelez@geo-park.com

|

MEDIA:

| Communications Department |

communications@geo-park.com |

NOTICE

Additional information about GeoPark can be found

in the “Invest with Us” section on the website at www.geo-park.com.

Certain amounts included in this press release

have been rounded for ease of presentation. Accordingly, certain amounts included in this press release may not sum due to rounding.

CAUTIONARY

STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION

This press release contains statements that constitute

forward-looking statements. Many of the forward-looking statements contained in this press release can be identified by the use of forward-looking

words such as ‘‘anticipate,’’ ‘‘believe,’’ ‘‘could,’’ ‘‘expect,’’

‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’ ‘‘will,’’

‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in a number

of places in this press release include, but are not limited to, statements regarding the intent, belief or current expectations, regarding

various matters, including, the company’s intention to repay amounts due under an offtake and prepayment agreement. Forward-looking

statements are based on management’s beliefs and assumptions, and on information currently available to the management. Such statements

are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking

statements due to various factors.

Forward-looking statements speak only as of the

date they are made, and the Company does not undertake any obligation to update them in light of new information or future developments

or to release publicly any revisions to these statements in order to reflect later events or circumstances, or to reflect the occurrence

of unanticipated events. For a discussion of the risks facing the Company which could affect whether these forward-looking statements

are realized, see filings with the U.S. Securities and Exchange Commission (SEC).

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

GeoPark Limited |

| |

|

| |

|

| |

By: |

/s/ Jaime Caballero Uribe |

| |

|

Name: |

Jaime Caballero Uribe |

| |

|

Title: |

Chief Financial Officer |

Date: February 4, 2025

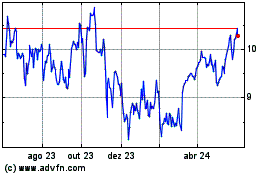

GeoPark (NYSE:GPRK)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

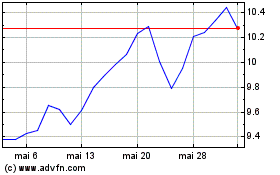

GeoPark (NYSE:GPRK)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025