false

0000883948

0000883948

2025-02-05

2025-02-05

0000883948

us-gaap:CommonStockMember

2025-02-05

2025-02-05

0000883948

us-gaap:SeriesAPreferredStockMember

2025-02-05

2025-02-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 5, 2025

ATLANTIC

UNION BANKSHARES CORPORATION

(Exact name of registrant as specified in its

charter)

| Virginia |

001-39325 |

54-1598552 |

| (State or other jurisdiction |

(Commission |

(I.R.S. Employer |

| of incorporation) |

File Number) | Identification No.) |

4300

Cox Road

Glen

Allen, Virginia 23060

(Address of principal executive offices, including

Zip Code)

Registrant’s telephone number, including

area code: (804) 633-5031

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $1.33 per share |

|

AUB |

|

New

York Stock Exchange |

| Depositary

Shares, Each Representing a 1/400th Interest in a Share of 6.875% Perpetual Non-Cumulative Preferred Stock, Series A |

|

AUB.PRA |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company |

¨ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use

the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section

13(a) of the Exchange Act. |

¨ |

Item 5.07 Submission of Matters to a Vote of Security Holders.

Atlantic Union Bankshares Corporation (“Atlantic

Union”) held a special meeting of shareholders on February 5, 2025 (the “Atlantic Union special meeting”). At

the Atlantic Union special meeting, the following two proposals were considered:

| · | Proposal

1: a proposal to approve the Agreement and Plan of Merger, dated as of October 21,

2024, by and between Atlantic Union and Sandy Spring Bancorp, Inc. (“Sandy Spring”)

(as amended from time to time, the “merger agreement”) and the transactions contemplated

thereby, including the merger (the “merger”) and the issuance of shares of Atlantic

Union common stock to holders of Sandy Spring common stock pursuant to the merger agreement

(including for purposes of complying with NYSE Listing Rule 312.03, which requires approval

of the issuance of shares of Atlantic Union common stock in an amount that exceeds 20% of

the currently outstanding shares of Atlantic Union common stock) (the “Atlantic Union

merger proposal”); and |

| · | Proposal

2: a proposal to adjourn or postpone the Atlantic Union special meeting, if necessary

or appropriate, to solicit additional proxies if, immediately prior to such adjournment or

postponement, there are not sufficient votes to approve the Atlantic Union merger proposal

or to ensure that any supplement or amendment to the accompanying joint proxy statement/prospectus

is timely provided to holders of Atlantic Union common stock (the “Atlantic Union adjournment

proposal”) |

Each proposal considered and voted on was

approved by the requisite vote of Atlantic Union’s shareholders. The final voting results for the Atlantic Union merger

proposal, rounded down to the nearest whole share, is presented below. Because a quorum was present at the special meeting and the

Atlantic Union merger proposal received the requisite vote needed for approval, a vote on the Atlantic Union adjournment proposal

was withdrawn and not called. For more information on each of these proposals, see the definitive joint proxy statement/prospectus

filed by Atlantic Union with the U.S. Securities and Exchange Commission on December 17, 2024.

Proposal 1: Atlantic Union merger proposal

| Votes

For |

|

Votes

Against |

|

Abstain |

|

Broker

Non-Votes |

| 67,439,091 |

|

2,400,633 |

|

87,269 |

|

0 |

Item 8.01 Other Events.

On February 5, 2025, Atlantic Union and Sandy

Spring issued a joint press release announcing the results of the Atlantic Union special meeting and the results of the Sandy Spring special meeting of stockholders held on February 5, 2025. The parties also announced that they have received

the necessary bank regulatory approvals to complete the merger. Atlantic Union and Sandy Spring expect to complete the merger on or about

April 1, 2025, subject to the satisfaction or waiver of customary closing conditions. A copy of the joint press release is attached

hereto as Exhibit 99.1 and is incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this

Form 8-K constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act

of 1995, Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of

the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder, which statements involve inherent risks and

uncertainties. Examples of forward-looking statements include, but are not limited to, statements regarding the outlook and expectations

of Atlantic Union and Sandy Spring, respectively, with respect to the proposed transaction, the strategic and financial benefits of the

proposed transaction, including the expected timing of the closing of the proposed transaction. Such statements are often characterized

by the use of qualified words (and their derivatives) such as “may,” “will,” “anticipate,” “could,”

“should,” “would,” “believe,” “contemplate,” “expect,” “estimate,”

“continue,” “plan,” “project” and “intend,” as well as words of similar meaning or other

statements concerning opinions or judgment of Atlantic Union or Sandy Spring or their respective management about future events. Forward-looking

statements are based on assumptions as of the time they are made and are subject to risks, uncertainties and other factors that are difficult

to predict with regard to timing, extent, likelihood and degree of occurrence, which could cause actual results to differ materially

from anticipated results expressed or implied by such forward-looking statements. Such risks, uncertainties and assumptions, include,

among others, the following:

| · | the

occurrence of any event, change or other circumstances that could give rise to the right

of one or both of the parties to terminate the merger agreement; |

| · | the

possibility that the proposed transaction does not close when expected or at all because

the conditions to closing are not satisfied on a timely basis or at all; |

| · | the

outcome of any legal proceedings that may be instituted against Atlantic Union or Sandy Spring; |

| · | the

possibility that the anticipated benefits of the proposed transaction, including anticipated

cost savings and strategic gains, are not realized when expected or at all, including as

a result of changes in, or problems arising from, general economic and market conditions,

interest and exchange rates, monetary policy, laws and regulations and their enforcement,

and the degree of competition in the geographic and business areas in which Atlantic Union

and Sandy Spring operate; |

| · | the

possibility that the integration of the two companies may be more difficult, time-consuming

or costly than expected; |

| · | the

impact of purchase accounting with respect to the proposed transaction, or any change in

the assumptions used regarding the assets acquired and liabilities assumed to determine their

fair value and credit marks; |

| · | the

possibility that the proposed transaction may be more expensive or take longer to complete

than anticipated, including as a result of unexpected factors or events; |

| · | the

diversion of management’s attention from ongoing business operations and opportunities; |

| · | potential

adverse reactions of Atlantic Union’s or Sandy Spring’s customers or changes

to business or employee relationships, including those resulting from the announcement or

completion of the proposed transaction; |

| · | a

material adverse change in the financial condition of Atlantic Union or Sandy Spring; changes

in Atlantic Union’s or Sandy Spring’s share price before closing; |

| · | risks

relating to the potential dilutive effect of shares of Atlantic Union’s common stock

to be issued in the proposed transaction; |

| · | general

competitive, economic, political and market conditions; |

| · | major

catastrophes such as earthquakes, floods or other natural or human disasters, including infectious

disease outbreaks; and |

| · | other

factors that may affect future results of Atlantic Union or Sandy Spring, including, among

others, changes in asset quality and credit risk; the inability to sustain revenue and earnings

growth; changes in interest rates; deposit flows; inflation; customer borrowing, repayment,

investment and deposit practices; the impact, extent and timing of technological changes;

capital management activities; and other actions of the Federal Reserve Board and legislative

and regulatory actions and reforms. |

These factors are not necessarily

all of the factors that could cause Atlantic Union’s, Sandy Spring’s or the combined company’s actual results, performance

or achievements to differ materially from those expressed in or implied by any of the forward-looking statements. Other factors, including

unknown or unpredictable factors, also could harm Atlantic Union’s, Sandy Spring’s or the combined company’s results.

Although each of Atlantic

Union and Sandy Spring believes that its expectations with respect to forward-looking statements are based upon reasonable assumptions

within the bounds of its existing knowledge of its business and operations, there can be no assurance that actual results of Atlantic

Union or Sandy Spring will not differ materially from any projected future results expressed or implied by such forward-looking statements.

Additional factors that could cause results to differ materially from those described above can be found in (i) Atlantic Union’s

most recent annual report on Form 10-K for the fiscal year ended December 31, 2023 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000883948/000088394824000030/aub-20231231x10k.htm),

quarterly reports on Form 10-Q, Current Reports on Form 8-K and other documents subsequently filed by Atlantic Union with the

Securities Exchange Commission (“SEC”), (ii) in Sandy Spring’s most recent annual report on Form 10-K for

the fiscal year ended December 31, 2023 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/824410/000082441024000011/sasr-20231231.htm),

and its other filings with the SEC and quarterly reports on Form 10-Q, Current Reports on Form 8-K and other documents subsequently

filed by Sandy Spring with the SEC and (iii) the definitive joint proxy statement/prospectus related to the merger, which was filed

by Atlantic Union with the SEC on December 17, 2024 (and which is available at https://www.sec.gov/Archives/edgar/data/883948/000110465924129289/tm2428626-7_424b3.htm).

The actual results anticipated

may not be realized or, even if substantially realized, they may not have the expected consequences to or effects on Atlantic Union,

Sandy Spring or each of their respective businesses or operations. Investors are cautioned not to rely too heavily on any such forward-looking

statements. Atlantic Union and Sandy Spring urge you to consider all of these risks, uncertainties and other factors carefully in evaluating

all such forward-looking statements made by Atlantic Union and Sandy Spring. Forward-looking statements speak only as of the date they

are made and Atlantic Union and/or Sandy Spring undertake no obligation to update or clarify these forward-looking statements, whether

as a result of new information, future events or otherwise, except to the extent required by applicable law. All forward-looking statements

attributable to Atlantic Union, Sandy Spring, the combined company, or persons acting on Atlantic Union or Sandy Spring's behalf, are

expressly qualified in their entirety by the cautionary statements set forth above.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ATLANTIC UNION BANKSHARES CORPORATION |

| |

|

|

| |

|

|

| |

|

|

| Date: February 5, 2025 |

By: |

/s/

Robert M. Gorman |

| |

|

Robert M. Gorman |

| |

|

Executive Vice President

and |

| |

|

Chief Financial Officer |

Exhibit 99.1

Atlantic Union Bankshares

Corporation and Sandy Spring Bancorp, Inc. Announce Receipt

of All Shareholder and Bank Regulatory Approvals to Complete Merger

Richmond, Va. and Olney, Md., February 5,

2025 – Atlantic Union Bankshares Corporation (“Atlantic Union”) (NYSE: AUB) and Sandy Spring Bancorp, Inc. (“Sandy

Spring”) (NASDAQ: SASR) today jointly announced that Atlantic Union’s shareholders and Sandy Spring’s stockholders have

approved the previously announced merger of Sandy Spring with and into Atlantic Union at their respective special meetings held today.

Additionally, all required bank regulatory approvals have been received to complete the merger.

“We are pleased to have received all

necessary bank regulatory approvals and each company’s shareholder and stockholder approvals to proceed with the merger and remain

on track to close the transaction on April 1, 2025,” said John C. Asbury, President and CEO of Atlantic Union. “The merger

will create a unique franchise by combining the #1 regional depository market share bank in Virginia with the #1 regional depository market

share bank in Maryland. We believe the merger will benefit our customers and markets with an expanded and even more convenient branch

network, enhanced product offerings, a robust community benefit plan and access to more capital. We also believe it will benefit our Teammates

with expanded career opportunities, resources and capabilities. Further, we believe the merger will benefit the combined company’s

shareholders by positioning us well to deliver differentiated financial performance.”

“We are very excited to reach this important

milestone as we work to bring together two great companies. It has been inspiring to see colleagues from both banks design, collaborate,

and transform together to make this combination a success. This partnership will begin a new chapter, and we can’t wait to

see what we accomplish together,” said Daniel J. Schrider, Chair, President and CEO of Sandy Spring.

The merger is expected to close on April 1,

2025, subject to the satisfaction or waiver of customary closing conditions.

About Atlantic Union Bankshares Corporation

Headquartered in Richmond, Virginia, Atlantic

Union Bankshares Corporation (NYSE: AUB) is the holding company for Atlantic Union Bank. Atlantic Union Bank had 129 branches located

throughout Virginia and in portions of Maryland and North Carolina as of December 31, 2024. Certain non-bank financial services affiliates

of Atlantic Union Bank include: Atlantic Union Equipment Finance, Inc., which provides equipment financing; Atlantic Union Financial Consultants,

LLC, which provides brokerage services; and Union Insurance Group, LLC, which offers various lines of insurance products.

About Sandy Spring Bancorp, Inc.

Sandy Spring Bancorp, Inc., headquartered in Olney, Maryland, is the

holding company for Sandy Spring Bank, a premier community bank in the Greater Washington, D.C. region. With over 50 locations, the bank

offers a broad range of commercial and retail banking, mortgage, private banking, and trust services throughout Maryland, Virginia, and

Washington, D.C. Through its subsidiaries, Rembert Pendleton Jackson and West Financial Services, Inc., Sandy Spring Bank also offers

a comprehensive menu of wealth management services.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release constitute “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of

1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and

Rule 3b-6 promulgated thereunder, which statements involve inherent risks and uncertainties. Examples of forward-looking statements

include, but are not limited to, statements regarding the outlook and expectations of Atlantic Union and Sandy Spring, respectively, with

respect to the proposed transaction, the strategic and financial benefits of the proposed transaction and the expected timing of the closing

of the proposed transaction. Such statements are often characterized by the use of qualified words (and their derivatives) such as “may,”

“will,” “anticipate,” “could,” “should,” “would,” “believe,” “contemplate,”

“expect,” “estimate,” “continue,” “plan,” “project” and “intend,”

as well as words of similar meaning or other statements concerning opinions or judgment of Atlantic Union or Sandy Spring or their respective

management about future events. Forward-looking statements are based on assumptions as of the time they are made and are subject to risks,

uncertainties and other factors that are difficult to predict with regard to timing, extent, likelihood and degree of occurrence, which

could cause actual results to differ materially from anticipated results expressed or implied by such forward-looking statements. Such

risks, uncertainties and assumptions, include, among others, the following:

| · | the occurrence of any event, change or other circumstances that could

give rise to the right of one or both of the parties to terminate the merger agreement; |

| | · | the possibility that the proposed transaction does not close when

expected or at all because the conditions to closing are not satisfied on a timely basis or at all; |

| | · | the outcome of any legal proceedings that may be instituted against

Atlantic Union or Sandy Spring; |

| | · | the possibility that the anticipated benefits of the proposed transaction,

including anticipated cost savings and strategic gains, are not realized when expected or at all, including as a result of changes in,

or problems arising from, general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and

their enforcement, and the degree of competition in the geographic and business areas in which Atlantic Union and Sandy Spring operate; |

| | · | the possibility that the integration of the two companies may be more

difficult, time-consuming or costly than expected; |

| | · | the impact of purchase accounting with respect to the proposed transaction,

or any change in the assumptions used regarding the assets acquired and liabilities assumed to determine their fair value and credit marks; |

| | · | the possibility that the proposed transaction may be more expensive

or take longer to complete than anticipated, including as a result of unexpected factors or events; |

| | · | the diversion of management’s attention from ongoing business

operations and opportunities; |

| | · | potential adverse reactions of Atlantic Union’s or Sandy Spring’s

customers or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed

transaction; |

| | · | a material adverse change in the financial condition of Atlantic Union

or Sandy Spring; changes in Atlantic Union’s or Sandy Spring’s share price before closing; |

| | · | risks relating to the potential dilutive effect of shares of Atlantic

Union’s common stock to be issued in the proposed transaction; |

| | · | general competitive, economic, political and market conditions; |

| | · | major catastrophes such as earthquakes, floods or other natural or

human disasters, including infectious disease outbreaks; |

| | · | other factors that may affect future results of Atlantic Union or

Sandy Spring, including, among others, changes in asset quality and credit risk; the inability to sustain revenue and earnings growth;

changes in interest rates; deposit flows; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent

and timing of technological changes; capital management activities; and other actions of the Federal Reserve Board and legislative and

regulatory actions and reforms. |

These factors are not necessarily all of the factors that could cause

Atlantic Union’s, Sandy Spring’s or the combined company’s actual results, performance or achievements to differ materially

from those expressed in or implied by any of the forward-looking statements. Other factors, including unknown or unpredictable factors,

also could harm Atlantic Union’s, Sandy Spring’s or the combined company’s results.

Although each of Atlantic Union and Sandy Spring believes that its

expectations with respect to forward-looking statements are based upon reasonable assumptions within the bounds of its existing knowledge

of its business and operations, there can be no assurance that actual results of Atlantic Union or Sandy Spring will not differ materially

from any projected future results expressed or implied by such forward-looking statements. Additional factors that could cause results

to differ materially from those described above can be found in (i) Atlantic Union’s most recent annual report on Form 10-K for

the fiscal year ended December 31, 2023 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000883948/000088394824000030/aub-20231231x10k.htm),

quarterly reports on Form 10-Q, Current Reports on Form 8-K and other documents subsequently filed by Atlantic Union with the Securities

Exchange Commission (“SEC”), (ii) in Sandy Spring’s most recent annual report on Form 10-K for the fiscal year ended

December 31, 2023 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/824410/000082441024000011/sasr-20231231.htm),

and its other filings with the SEC and quarterly reports on Form 10-Q, Current Reports on Form 8-K and other documents subsequently filed

by Sandy Spring with the SEC and (iii) the definitive joint proxy statement/prospectus related to the proposed transaction, which were

filed by Atlantic Union and Sandy Spring with the SEC on December 17, 2024 (and which are available at https://www.sec.gov/Archives/edgar/data/883948/000110465924129289/tm2428626-7_424b3.htm

and https://www.sec.gov/Archives/edgar/data/824410/000110465924129292/tm2428626-8_defm14a.htm, respectively).

The actual results anticipated may not be realized or, even if substantially

realized, they may not have the expected consequences to or effects on Atlantic Union, Sandy Spring or each of their respective businesses

or operations. Investors are cautioned not to rely too heavily on any such forward-looking statements. Atlantic Union and Sandy Spring

urge you to consider all of these risks, uncertainties and other factors carefully in evaluating all such forward-looking statements made

by Atlantic Union and Sandy Spring. Forward-looking statements speak only as of the date they are made and Atlantic Union and/or Sandy

Spring undertake no obligation to update or clarify these forward-looking statements, whether as a result of new information, future events

or otherwise, except to the extent required by applicable law. All forward-looking statements attributable to Atlantic Union, Sandy Spring,

the combined company, or persons acting on Atlantic Union or Sandy Spring’s behalf, are expressly qualified in their entirety by

the cautionary statements set forth above.

Contact:

Bill Cimino (804) 448-0937, SVP and Director of Investor Relations

of Atlantic Union

Jennifer Schell (301) 570-8331, Division Executive, Marketing &

Corporate Communications for Sandy Spring Bank

###

v3.25.0.1

Cover

|

Feb. 05, 2025 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 05, 2025

|

| Entity File Number |

001-39325

|

| Entity Registrant Name |

ATLANTIC

UNION BANKSHARES CORPORATION

|

| Entity Central Index Key |

0000883948

|

| Entity Tax Identification Number |

54-1598552

|

| Entity Incorporation, State or Country Code |

VA

|

| Entity Address, Address Line One |

4300

Cox Road

|

| Entity Address, City or Town |

Glen

Allen

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23060

|

| City Area Code |

(804)

|

| Local Phone Number |

633-5031

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common

Stock, par value $1.33 per share

|

| Trading Symbol |

AUB

|

| Security Exchange Name |

NYSE

|

| Series A Preferred Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Depositary

Shares, Each Representing a 1/400th Interest in a Share of 6.875% Perpetual Non-Cumulative Preferred Stock, Series A

|

| Trading Symbol |

AUB.PRA

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

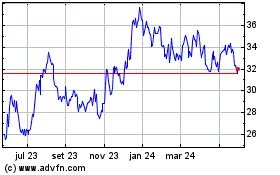

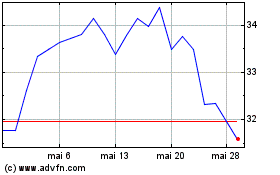

Atlantic Union Bankshares (NYSE:AUB)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Atlantic Union Bankshares (NYSE:AUB)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025