SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For February, 2025

(Commission File No. 1-31317)

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

(Exact name of registrant as specified in its charter)

Basic Sanitation Company of the State of Sao Paulo - SABESP

(Translation of Registrant's name into English)

Rua Costa Carvalho, 300

São Paulo, S.P., 05429-900

Federative Republic of Brazil

(Address of Registrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1)__.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7)__.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

| |

COMPANHIA

DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO

|

|

| |

|

|

COMPANHIA DE SANEAMENTO BÁSICO

DO ESTADO DE SÃO PAULO – SABESP

PUBLICLY-HELD COMPANY

Corporate Taxpayer’s ID (CNPJ):

43.776.517/0001-80

Company Registry (NIRE): 35.3000.1683-1

EXCERPT FROM THE MINUTES OF THE

BOARD OF DIRECTORS' MEETING

HELD ON JANUARY 06, 2025

| 1. | Date, Time and Place:

January 06, 2025, at 9 a.m., on an extraordinary basis, via videoconference, at the headquarters of Companhia de Saneamento Básico

do Estado de São Paulo – SABESP (“Company” or “Issuer”), located at Rua

Costa Carvalho nº 300, CEP 05429-900, in the City and State of São Paulo. |

| 2. | Call Notice: Conducted

under the terms of the head provision and paragraph 5 of Article 15 of the Bylaws. |

| 3. | Presiding: Karla Bertocco

Trindade presided over the meeting, and Marialve de Sousa Martins acted as Secretary. |

| 4. | Attendance: The members

of the Company’s Board of Directors Karla Bertocco Trindade (Chair), Alexandre Gonçalves Silva (Independent board member),

Anderson Marcio de Oliveira (Board member), Augusto Miranda da Paz Júnior (Board member), Claudia Polto da Cunha (Board member),

Gustavo Rocha Gattass (Independent board member), Mateus Affonso Bandeira (Independent board member), Tiago de Almeida Noel (Board member),

and Tinn Freire Amado (Board member) attended the meeting; and Marialve de Sousa Martins acted as Executive Secretary of the Board of

Directors. |

| 5. | Guests: Carlos Augusto

Leone Piani (Chief Executive Officer) and Daniel Szlak (Chief Financial Officer and Investor Relations Officer). |

| 6. | Agenda: 6.1. Matters for

Resolution: I. Approval of the conditions applicable to the 33rd debenture issue. Persons in charge: Carlos Augusto Leone

Piani and Daniel Szlak. |

| | |

Companhia de Saneamento Básico do Estado de São Paulo – SABESP Unit | Corporate Governance Address: R. Costa Carvalho, 300 – Pinheiros – CEP 05429-900 – São Paulo - SP www.sabesp.com.br | Page 1 of 15 |

| | COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO |  |

| | | |

6.1. Matters

for Resolution:

I.

Approval of the conditions applicable to the 33rd

debenture issue. The presented material

was made available on the electronic platform of the meeting. The members of the Company’s Board of Directors resolved on the following

items: (i) approval of the conditions applicable to the 33rd (thirty-third) issue of simple, non-convertible, unsecured debentures,

in 3 (three) series, for public distribution, under an automatic distribution, targeted at Professional Investors (as defined below),

under the terms of the “Private Instrument of Indenture of the 33rd (thirty-third) Issue of Simple, Non-Convertible,

Unsecured Debentures, in up to Three Series, for Public Distribution, under an Automatic Distribution Registration, targeted at Professional

Investors, of Companhia de Saneamento Básico do Estado de São Paulo – SABESP” (“Indenture”),

in compliance with Resolution 160 of the Brazilian Securities and Exchange Commission (“CVM”), of July 13,

2022, as amended (“CVM Resolution 160”), Law 6,385, of December 7, 1976, as amended (“Capital Markets

Law”), and other legal and regulatory provisions (“Debentures”, “Offering”

or “Issue”); (ii) authorization for the Company’s Executive Board, or its duly appointed proxies, observing

legal and regulatory provisions, to carry out any acts related to the Issue, including, but not limited to, negotiating and executing

the Indenture, the Distribution Agreement (as defined below), as well as executing any amendments to the respective documents, including

the amendment that will ratify the result of the Book Building Process (as defined below); and (iii) ratification of all other acts already

carried out by the Company’s Executive Board relating to the aforementioned items.

In compliance with paragraph

1 of article 59 of Law 6,404, of December 15, 1976, as amended (“Brazilian Corporation Law”), and item X of

article 16 of the Bylaws, the conditions applicable to the Offering, pursuant to the terms as follows, have been unanimously approved,

which will be detailed and regulated by the Indenture:

1.

Issuer:

Companhia de Saneamento Básico do Estado de São Paulo - SABESP.

2.

Total Issue Amount: The

Total Issue Amount is R$3,700,000,000.00 (three billion and seven hundred million reais) on the Issue Date (as defined below) (“Total

Issue Amount”).

3.

Number of Series: The

Issue will be conducted in 3 (three) series. The Debentures that are the object of the Offering distributed within the scope of the first

series are hereinafter referred to as “First Series Debentures”; the Debentures that are the object of the Offering

distributed within the scope of the second series are hereinafter referred to as “Second Series Debentures”;

and the Debentures that are the object of the Offering distributed within the scope of the third series are hereinafter referred to as

“Third Series Debentures”, with the First Series Debentures hereinafter referred to as “Institutional

Debentures”, and the Second Series Debentures and the Third Series Debentures jointly hereinafter referred to as “Incentive

Debentures”.

| | |

Companhia de Saneamento Básico do Estado de São Paulo – SABESP Unit | Corporate Governance Address: R. Costa Carvalho, 300 – Pinheiros – CEP 05429-900 – São Paulo - SP www.sabesp.com.br | Page 2 of 15 |

| | COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO |  |

| | | |

4.

Quantity of Debentures:

A total of 3,700,000 (three million and seven hundred thousand) Debentures will be issued: (i) being 1,000,000 (one million) First Series

Debentures; (ii) the allotment of the Second Series Debentures and the Third Series Debentures will be calculated according to the Book

Building Process (as defined below), considering the communicating vessel system, provided it be issued at least (ii.a) 700,000 (seven

hundred thousand) Second Series Debentures (“Minimum Quantity of Second Series Debentures”) and (ii.b) 1,300,000

(one million and three hundred thousand) Third Series Debentures (“Minimum Quantity of Third Series Debentures”)

and (iii) 700,000 (seven hundred thousand) Debentures will be allotted between the Second Series and the Third Series Debentures under

the communicating vessel system (“Communicating Vessel System”). The quantity of the Second Series Debentures

and the Third Series Debentures will be defined according to the Book Building Process, observing (i) the Minimum Quantity of Second

Series Debentures and the Minimum Quantity of Third Series Debentures; and (ii) that 700,000 (seven hundred thousand) Debentures will

be allotted between the Second Series Debentures and the Third Series Debentures under the Communicating Vessel System.

5.

Placement and Distribution Procedure:

The Debentures will be the object of a public distribution offering, under an automatic distribution registration, with no prior need

for analysis, exclusively intended for subscription by Professional Investors (as defined below), pursuant to CVM Resolution 160, under

the firm placement guarantee regime for the Total Issue Amount, to be provided by institutions that are part of the securities distribution

system (“Managers”, with the leading intermediary institution referred to as “Lead Manager”),

on an individual rather than on a joint and several basis among the Managers, within the limit of participation established for each Manager,

under the terms of the “Private Instrument of Coordination, Placement and Public Distribution Agreement, under an Automatic Distribution

Registration, targeted at Professional Investors, of Simple, Non-Convertible, and Unsecured Debentures, in 3 (three) Series, under the

Firm Placement Guarantee Regime, of the 33rd (thirty-third) Issue by Companhia de Saneamento Básico do Estado de São

Paulo – SABESP”, to be entered into between the Company and the Managers (“Distribution Agreement”). The

partial distribution of the Debentures will not be permitted. The distribution plan for the Offering will follow the procedure set out

in CVM Resolution 160 and the provisions of the Distribution Agreement. There will be no limitation on the number of investors to access

the debentures or to be allotted to them, provided the Offering be exclusively targeted at professional investors, pursuant to the terms

of articles 11 and 13 of CVM Resolution 30, of May 11, 2021 (“CVM Resolution 30” and “Professional

Investors,” respectively).

6.

Book Building Process:

The book building process will be adopted and organized by the Managers, with no minimum or maximum lots, observing the Minimum Quantity

of Second Series Debentures and the Minimum Quantity of Third Series Debentures (“Book Building Process”),

in order to define, in agreement with the Company: (i) the quantity of Second Series Debentures and Third Series Debentures to be effectively

issued, observing the Minimum Quantity of Second Series Debentures, the Minimum Quantity of Third Series Debentures and the amount of

R$700,000,000.00 (seven hundred million reais) that will be allotted between the Second Series Debentures and the Third Series Debentures

under the Communicating Vessel System; and (ii) the Final Remuneration Rate of the First Series, the Second Series, and the Third Series

Debentures (as defined below). The result of the Book Building Process will be ratified through the execution of an amendment to the

Indenture, as already authorized by this Meeting of the Company’s Board of Directors, without the need for any approval by the

debenture holders gathered at the General Meeting of Debenture Holders (as defined in the Indenture) and/or a new corporate approval

by the Company, prior to the First Payment Date (as defined below).

| | |

Companhia de Saneamento Básico do Estado de São Paulo – SABESP Unit | Corporate Governance Address: R. Costa Carvalho, 300 – Pinheiros – CEP 05429-900 – São Paulo - SP www.sabesp.com.br | Page 3 of 15 |

| | COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO |  |

| | | |

7.

Deposit for Distribution and Trading: The

Debentures will be deposited for:

(i) distribution in the primary market through the Asset Distribution Module - MDA, administered and operated by B3 S.A. – Brasil,

Bolsa, Balcão – Balcão B3 (“B3”), with distribution being financially settled through B3;

and (ii) trading in the secondary market through CETIP21 - Marketable Securities, administered and operated by B3, with trades being financially

settled and the Debentures held in electronic custody at B3. Notwithstanding the provisions of this item, as the Company is categorized

as a frequent issuer of fixed-income marketable securities (EFRF), and the Debentures are exclusively targeted at Professional Investors,

they can be traded on an over-the-counter market (i) freely among Professional Investors; (ii) only after 3 (three) months have elapsed from the Offering Closing

date (as defined below), for Qualified Investors (as defined below); and (iii) only after 6 (six) months have elapsed from the Offering

Closing date, for Investors in General (as defined below), pursuant to item I of article 86 of CVM Resolution 160.

For the purposes of this meeting, (i) “Qualified Investors” are the ones referred to in articles 12 and 13 of

CVM Resolution 30; (ii) “Investors in General” are the ones referred to in item XXI of article 2 of CVM Resolution

160; and (iii) “Closing of the Offering”: as provided for in item IX of article 2 of CVM Resolution 160, the

public offering will be considered closed after the distribution of all securities that are the object of the offering, including those

contained in the additional lot, as well as the potential exercise of the option to distribute the supplemental lot, or after the cancellation

of the balance of unplaced securities, in the event of partial distribution, and the publication of the announcement of the closing of

the distribution.

8.

Allotment of Funds:

All the proceeds arising from the Issue of Institutional Debentures will be used to refinance financial commitments falling due in 2025

and/or to recompose and/or reinforce the Company’s cash position. Pursuant to paragraphs 1 and 1-B of article 2 of Law 12,431,

of June 24, 2011 (“Law 12,431”), Decree 11,964, of March 26, 2024, Resolution 5,034 of the Brazilian Monetary

Council (“CMN”), of July 21, 2022, and Ordinance 1,234, of October 29, 2024, of the Ministry of Cities, published

in the Official Federal Gazette on December 23, 2024, the funds raised by the Company through the Issue of Incentive Debentures will

be exclusively utilized to (i) reimburse expenses, costs or debts related to the expansion of the Barueri sewage treatment plant, located

in the state of São Paulo (“Project”), occurred 24 (twenty-four) months prior to the closing date of

the Offering; and/or (iii) pay future expenses, costs and/or debts to be incurred as from the closing date of the Offering and related

to the Project, under the terms of Law 12,431.

| | |

Companhia de Saneamento Básico do Estado de São Paulo – SABESP Unit | Corporate Governance Address: R. Costa Carvalho, 300 – Pinheiros – CEP 05429-900 – São Paulo - SP www.sabesp.com.br | Page 4 of 15 |

| | COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO |  |

| | | |

9.

Issue Date:

For all legal purposes, the issue date of the Debentures will be defined in the Indenture (“Issue Date”).

10.

Form, Type, and Proof of Ownership:

The Debentures will be registered and book-entry, with no issue of certificates or provisory certificates. For all legal purposes, the

ownership of the Debentures will be proven by the deposit account statement issued by the Bookkeeping Agent (to be defined in the Indenture).

Additionally, regarding the Debentures electronically held in custody at B3, as applicable, a statement in the name of the Debenture Holder

shall be issued by B3, serving as proof of ownership of such Debentures.

11.

Convertibility:

The Debentures will be simple, that is, not convertible into shares issued by the Company.

12.

Type: The

Debentures will be unsecured, under the terms of the head provision of article 58 of Brazilian Corporation Law, with no real or personal

guarantee, nor any segregation of the Company’s assets as collateral for the Debenture Holders in the event of the need for judicial

or extrajudicial rulings of the Company's obligations arising from the Debentures and the Indenture, without granting any special or general

privileges to the Debenture Holders.

13.

Due Date: (1)

The First Series Debentures will be due in 7 (seven) years, as of the Issue Date, thus maturing on the date to be defined in the Indenture

(“First Series Debentures Due Date”); (2) the Second Series Debentures will be due in 10 (ten) years, as of

the Issue Date, thus maturing on the date to be defined in the Indenture (“Second Series Debentures Due Date”);

and (3) the Third Series Debentures will be due in 15 (fifteen) years, as of the Issue Date, thus maturing on the date to be defined

in the Indenture (“Third Series Debentures Due Date”, and jointly with the First Series Debentures Due Date

and the Second Series Debenture Due Date, “Due Dates”). Except in the events of: (i) redemption of the Debentures,

in the event of the absence or nonapplicability of rate, as provided for in the Indenture; (ii) Optional Acquisition (as defined below),

with the consequent cancellation of all Debentures; (iii) Total Optional Early Redemption (as defined below); (iv) redemption of the

Debentures arising from the Early Redemption Offering (as defined below); and/or (v) early maturity of the Debentures, as provided for

in the Indenture, the Company is obliged, on the respective Due Dates and the other dates stipulated in the Indenture, as applicable,

to pay for the Debentures of the respective Series based on the balance of the Face Value (as defined below) of the First Series Debentures

or the Restated Face Value (as defined below) of the Second Series Debentures and the Third Series Debentures, as applicable, plus the

respective Remuneration and potential amounts due and unpaid, calculated as per the provisions of the Indenture.

| | |

Companhia de Saneamento Básico do Estado de São Paulo – SABESP Unit | Corporate Governance Address: R. Costa Carvalho, 300 – Pinheiros – CEP 05429-900 – São Paulo - SP www.sabesp.com.br | Page 5 of 15 |

| | COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO |  |

| | | |

14.

Face Value:

The face value of the Debentures will be R$1,000.00 (one thousand reais) on the Issue Date (“Face Value").

15.

Guarantee: None.

16.

Amortization of the Face Value or the Restated Face

Value, as applicable: Except in the events

(i) of (a) redemption of the First Series Debentures in the event of the absence or nonapplicability of the DI rate, as provided

for in the Indenture; (b) Optional Acquisition, with the consequent cancellation of all First Series Debentures, (c) Total Optional Early

Redemption of the Institutional Debentures, (d) Optional Extraordinary Amortization of the Institutional Debentures, (e) redemption arising

from the Early Redemption Offering of the First Series Debentures, and/or (f) early maturity of the First Series Debentures, the Face

Value of the First Series Debentures or the balance of the Face Value of the First Series Debentures, as applicable, will be paid in 1

(one) single installment, on the First Series Debentures Due Date; (ii) (a) redemption of the Second Series Debentures, in the

event of the absence or nonapplicability of the Extended National Consumer Price Index (IPCA) (as defined below), (b) Optional Acquisition

of Second Series Debentures, with the consequent cancellation of all Debentures, (c) Total Optional Early Redemption of the Incentive

Debentures, (d) Optional Extraordinary Amortization of Second Series Debentures, if permitted, as provided for in the Indenture, (e) redemption

arising from the Early Redemption Offering of the Second Series Debentures and/or (f) early maturity of the Second Series Debentures,

the Restated Face Value of the Second Series Debentures will be paid in 1 (one) single installment on the Second Series Debentures Due

Date; (iii) (a) redemption of the Third Series Debentures, in the event of the absence or nonapplicability of the Extended National

Consumer Price Index (IPCA), (b) Optional Acquisition, with the consequent cancellation of all Third Series Debentures, (c) Total Optional

Early Redemption of Incentive Debentures, (d) Optional Extraordinary Amortization of the Third Series Debentures, if permitted, relating

to the Third Series Debentures, as provided for in the Indenture, (e) redemption arising from the Early Redemption Offering of the Third

Series Debentures, and/or (f) early maturity of the Third Series Debentures, the Restated Face Value will be paid in 3 (three) annual

consecutive installments, as per the dates and percentages to be defined in the Indenture.

17.

Inflation Adjustment and Remuneration:

17.1. Inflation

Adjustment of the Debentures. The Face Value

or the balance of the Face Value of the First Series Debentures will not be restated by any inflation index. The Face Value (or

the balance of the Face Value, as applicable) of the Second Series Debentures and the Third Series Debentures will be restated by

the accumulated variation of the Extended National Consumer Price Index (“IPCA”), calculated and disclosed

by the Brazilian Institute of Geography and Statistics - IBGE, from the First Payment Date (inclusive) to its effective payment date

(exclusive) (“Inflation Adjustment”), with the result of Inflation Adjustment automatically incorporated

into the Face Value (or the balance of the Face Value, as applicable) of the Second Series Debentures and the Third Series

Debentures (“Restated Face Value”). The Inflation Adjustment will be calculated as per the formula to be

provided for in the Indenture.

| | |

Companhia de Saneamento Básico do Estado de São Paulo – SABESP Unit | Corporate Governance Address: R. Costa Carvalho, 300 – Pinheiros – CEP 05429-900 – São Paulo - SP www.sabesp.com.br | Page 6 of 15 |

| | COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO |  |

| | | |

17.2.

Remuneration

(a)

Remuneration of First Series Debentures: The First Series Debentures will be entitled to a remuneration interest (“Remuneration

of the First Series Debentures”) equivalent to 100% (one hundred percent) of the accumulated variation of the average daily

rates of one-day interbank deposits - DI, over extra group, expressed as an annual percentage based on 252 (two hundred and fifty-two)

business days, calculated and disclosed on a daily basis by B3, in its daily bulletin available on its website (http://www.b3.com.br)

(“DI Rate”), plus an exponential increase of a surcharge to be defined in the Book Building Process, limited to 0.51%

(zero point fifty-one percent) per year based on 252 (two hundred and fifty-two) business days. The Remuneration of the First Series Debentures

will be calculated exponentially and cumulatively pro rata temporis by business days elapsed, levied on the Face Value of the First

Series Debentures (or the balance of the Face Value of the First Series Debentures, as applicable), from the First Payment Date of the

Debentures or the last Payment Date of the Remuneration of First Series Debentures (as defined below), as applicable, and paid at the

end of each Yield Period (as defined below). The Remuneration of the First Series Debentures will be calculated as per the formula to

be provided for in the Indenture;

(b)

Remuneration of Second Series Debentures: The Restated Face Value of the Second Series Debentures will be entitled to remuneration

interest to be defined in the Book Building Process and, in any case, limited to whichever is higher between: (i) the internal rate of

return of Tesouro IPCA+ (the new name of the Brazilian Treasury Note “Nota do Tesouro Nacional, Série B – NTN-B”),

due on May 15, 2035, based on the indicative prices disclosed by ANBIMA on its website (http://www.anbima.com.br), calculated at the market

close of the business day of the holding of the Book Building Process, less an exponential surcharge of 0.12% (zero point twelve percent)

per year, based on 252 (two hundred and fifty-two) business days; or (ii) 6.37% (six point thirty-seven percent) per year, based on 252

(two hundred and fifty-two) business days (“Remuneration of the Second Series Debentures”), levied from the

First Payment Date, or the immediately previous Payment Date of the Remuneration of Second Series Debentures (as defined below) to the effective payment date. The Remuneration of the Second Series Debentures will be calculated as per the formula

to be provided for in the Indenture;

| | |

Companhia de Saneamento Básico do Estado de São Paulo – SABESP Unit | Corporate Governance Address: R. Costa Carvalho, 300 – Pinheiros – CEP 05429-900 – São Paulo - SP www.sabesp.com.br | Page 7 of 15 |

| | COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO |  |

| | | |

(c)

Remuneration of Third Series Debentures: The Restated Face Value of the Third Series Debentures will be entitled to remuneration

interest to be defined in the Book Building Process and, in any case, limited to whichever is higher between: (i) the internal rate of

return of Tesouro IPCA+ (the new name of the Brazilian Treasury Note “Nota do Tesouro Nacional, Série B – NTN-B”),

due on August 15, 2040, based on the indicative prices disclosed by ANBIMA on its website (http://www.anbima.com.br), calculated at the

market close of the business day of the holding of the Book Building Process, less an exponential surcharge of 0.08% (zero point zero

eight percent) per year, based on 252 (two hundred and fifty-two) business days; or (ii) 6.42% (six point forty-two percent) per year,

based on 252 (two hundred and fifty-two) business days (“Remuneration of the Third Series Debentures”, and

jointly with the Remuneration of First Series Debentures and the Remuneration of Second Series Debentures, “Remuneration”),

levied from the First Payment Date, or the immediately previous Payment Date of the Remuneration of Third Series Debentures (as defined

below), as applicable, to the effective payment date.

The Remuneration of Third Series Debentures will be calculated as per the formula to be provided for in the Indenture;

(d)

Yield Period: For the purposes of calculation of the Remuneration of each series, “Yield Period” is the time interval beginning on the First Payment Date (inclusive), in the case of the first

Yield Period, or on the immediately previous Remuneration Payment Date of the respective series (inclusive), in the case of the other

Yield Periods, and ending on the Payment Date of the Remuneration of the respective series (exclusive), corresponding to the period in

question.

18.

Remuneration Payment: Except

in the events of: (a) (i) Redemption of the First Series Debentures, in the event of the absence or nonapplicability of the DI

Rate; (ii) Optional Acquisition, with the consequent cancellation of all the First Series Debentures; (iii) Total Optional Early Redemption

of the Institutional Debentures; (iv) Optional Extraordinary Amortization of the Institutional Debentures; (v) redemption arising from

the Early Redemption Offering (as defined below) of the First Series Debentures; and/or (vi) early maturity of the First Series Debentures,

as provided for in the Indenture, the amounts relating to the Remuneration of the First Series Debentures will be paid half yearly, as

of the Issue Date, on the dates to be defined in the Indenture (“Payment Date of the Remuneration of First Series Debentures”),

and (b) (i) redemption of the Second Series Debentures and/or the Third Series Debentures in the event of the absence or nonapplicability

of the Extended National Consumer Price Index (IPCA), (ii) Optional Acquisition, with the consequent cancellation of all the Second Series

Debentures and/or the Third Series Debentures, (iii) Total Optional Early Redemption of the Incentive Debentures, (iv) Optional Extraordinary

Amortization of the Second Series Debentures and/or the Optional Extraordinary Amortization of the Third Series Debentures, if permitted,

as provided for in the Indenture, (v) redemption arising from the Early Redemption Offering of the Second Series Debentures and/or the

Third Series Debentures, and/or (vi) early maturity of the Second Series Debentures and/or the Third Series Debentures, the amounts relating

to the Remuneration of the Second Series Debentures and the Remuneration of the Third Series Debentures will be paid annually, as of

the Issue Date, on the dates to be defined in the Indenture (“Payment Date of the Remuneration of Third Series Debentures”,

“Payment Date of the Remuneration of Second Series Debentures”, and jointly with the Payment Date of the Remuneration

of First Series Debentures, “Payment Date of the Remuneration of the Debentures”).

| | |

Companhia de Saneamento Básico do Estado de São Paulo – SABESP Unit | Corporate Governance Address: R. Costa Carvalho, 300 – Pinheiros – CEP 05429-900 – São Paulo - SP www.sabesp.com.br | Page 8 of 15 |

| | COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO |  |

| | | |

19.

Place of Payment:

Payments due to the Debentures will be made by the Company on their respective due dates using, as applicable: (i) the procedures adopted

by B3 for Debentures electronically held in custody at B3; and/or (ii) the procedures adopted by the Bookkeeping Agent for Debentures

not electronically held in custody at B3 (“Place of Payment”).

20.

Extension of Deadlines:

The deadlines for the payment of any obligation related to the Debentures will be extended until the 1st (first) subsequent business day

if the respective due date coincides with a day on which there are no business or banking hours at the Place of Payment or in the City

of São Paulo (in the State of São Paulo), with no increases of any amounts payable, except in the cases whose payments must

be made through B3. In such case, the deadlines will only be extended when the payment date coincides with a Brazilian official holiday,

Saturdays and/or Sundays.

21.

Late Payment Charges:

Without prejudice to the Remuneration, if the payment of any amounts owed to the Debenture Holders is late, the overdue debts will be

subject to (i) a non-compensatory late payment fine of 2% (two percent) on the amount due and late payment interest calculated from the date of default

to the date of effective payment, at the rate of 1% (one percent) per month, on the amount due, regardless of notice, notification, or

judicial or extrajudicial demand, in addition to the expenses incurred by the Debenture Holders for the collection of their credits.

22.

Subscription Price and Payment:

The Debentures will be paid in cash, in national currency, upon subscription, in the primary market, based on their Face Value on the

first payment date (“First Payment Date”) and, if the payment of the Debentures occurs on more than one date,

the Debentures that are not paid on the First Payment Date of the respective series, they will be paid as follows: (i) First Series Debentures

will be paid based on their Face Value; and

(ii) Second Series Debentures and/or Third Series Debentures will be paid based on the Restated Face Value, in both cases, plus the Remuneration

of the Debentures of the respective series, calculated pro rata temporis from the First Date of Payment of the respective series

to the date of their effective payment, utilizing 8 (eight) decimal places, with no rounding up/down. Additionally, the subscription

price on the First Payment Date and the subsequent payment dates may be placed with a premium or discount, at the sole discretion of

the Managers, by mutual agreement.

If applicable, the premium/discount will be equally applied to all the Debentures of the same series and/or paid on the same date.

| | |

Companhia de Saneamento Básico do Estado de São Paulo – SABESP Unit | Corporate Governance Address: R. Costa Carvalho, 300 – Pinheiros – CEP 05429-900 – São Paulo - SP www.sabesp.com.br | Page 9 of 15 |

| | COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO |  |

| | | |

23.

Renegotiation: The

debentures will not be renegotiated.

24.

Risk Rating: The

Company hired Moody’s Local BR Agência de Classificação de Risco Ltda. to assign a risk rating to the Debentures

up until the First Payment Date.

25.

Optional Acquisition:

The Company may, (a) at any time, in relation to the Institutional Debentures, and (b) after 2 (two) years have elapsed from the Issue

Date, pursuant to the provisions of Law 12,431 and the applicable regulations of the CVM and the CMN, or before said date, provided it

be legally permitted, under the terms of item II of paragraph 1 of article 1 of Law 12,431, the regulations of the CVM or other applicable legislation or regulations, relating to the Second Series Debentures and the

Third Series Debentures, acquire the First Series Debentures, the Second Series Debentures and/or the Third Series Debentures Outstanding,

as applicable, observing the provisions of paragraph 3 of article 55 of Brazilian Corporation Law and the terms and conditions of CVM

Resolution 77, of March 29, 2022 (“CVM Resolution 77” and “Optional Acquisition”,

respectively), for: (i) an amount equal to or lower than their respective Face Value relating to the First Series Debentures, or their

respective Restated Face Value, relating to the Second Series Debentures and the Third Series Debentures, with said fact set out in the

Company’s management report and financial statements; or (ii) an amount higher than their respective Face Value relating to the

First Series Debentures, or their respective Restated Face Value, relating to the Second Series Debentures and the Third Series Debentures,

provided any rules issued by the CVM, including the terms of CVM Resolution 77, be observed. The Debentures acquired by the Company according

to this item may, at the Company’s discretion, be:

(i) cancelled, should it be legally permitted, pursuant to the provisions of Law 12,431, the rules issued by the CMN and the applicable

regulations, as appropriate; (ii) remain in the Company’s treasury; or (iii) re-placed on the market, observing the trading restrictions

provided for in CVM Resolution 160. The Debentures acquired by the Company to remain in treasury under the terms of the Indenture, if

and when re-placed on the market, observing the trading restrictions provided for in CVM Resolution 160, will be entitled to the same

Remuneration of the other Debentures of the respective series.

| | |

Companhia de Saneamento Básico do Estado de São Paulo – SABESP Unit | Corporate Governance Address: R. Costa Carvalho, 300 – Pinheiros – CEP 05429-900 – São Paulo - SP www.sabesp.com.br | Page 10 of 15 |

| | COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO |  |

| | | |

26.

Total Optional Early Redemption:

26.1.

The optional early redemption of all the Institutional

Debentures may, at the Company’s discretion, occur as of the 37th (thirty-seventh) month as from the Issue Date, that is, the date

to be defined in the Indenture (inclusive) (“Total Optional Early Redemption of Institutional Debentures”).

The Total Optional Early Redemption of the Institutional Debentures will occur upon the payment of (i) the Face Value of the First Series

Debentures (or the balance of the Face Value of the First Series Debentures, as applicable), plus (ii) the Remuneration of the First

Series Debentures, calculated pro rata temporis as from the First Payment Date or the last Date of Payment of the Remuneration

of First Series Debentures, as applicable, up until the date of the effective Total Optional Early Redemption of the Institutional Debenture,

levied on the Face Value or the balance of the Face Value of the Institutional Debenture, plus (iii) charges due and unpaid up until

said date, and (iv) a premium equivalent to 0.30% (zero point thirty percent) per year, pro rata temporis, based on 252 (two hundred

and fifty-two) business days, considering the number of business days to elapse between the date of the effective Total Optional Early

Redemption of the Institutional Debentures and the Due Date of the First Series Debentures, levied on the result of the sum of the amounts

provided for in items (i) and (ii).

26.2.

The optional early redemption of all the Second

Series Debentures and/or the Third Series Debentures may, at the Company’s discretion, occur, as long as it is observed the provisions

of item II of paragraph 1 of article 1, and paragraph 1 of article 2 of Law 12,431, under the provisions of CMN Resolution 4,751, of

September 26, 2019, as amended (“CMN Resolution 4,751”), or regulation that may replace it, and other applicable

legal and regulatory provisions, as well as the minimum weighted average term of 4 (four) years relating to the payments elapsed between

the Issue Date and the date of the effective Total Optional Early Redemption of the Second Series Debentures and/or the Third Series

Debentures (or a shorter term that may be authorized by the applicable legislation or regulations) (“Total Optional Early

Redemption of the Incentive Debentures”, and jointly with the Total Optional Early Redemption of the Institutional Debentures,

“Total Optional Early Redemption”). The Total Optional Early Redemption of the Incentive Debentures will occur

upon the payment of the highest amount between (i) the Restated Face Value of the Second Series Debentures and/or the Third Series Debentures,

plus the Remuneration of the Second Series Debentures or the Remuneration of the Third Series Debentures, as applicable, calculated pro

rata temporis from the First Date of Payment of the Second Series Debentures and/or the Third Series Debentures or the immediately

previous payment date of the Remuneration of the Second Series Debentures or the Remuneration of the Third Series Debentures, as applicable

(inclusive), to the date of the Total Optional Early Redemption of the Incentive Debentures (exclusive), the default charges and any

pecuniary obligations and other additions referring to the Incentive Debentures that are the object of the Total Optional Early Redemption

of the Incentive Debentures; and (ii) the present value of the remaining installments of Amortization of the Restated Face Value of the

Second Series Debentures and/or the Third Series Debentures that are object of the Total Optional Early Redemption of the Incentive Debentures

and the payment of the Remuneration of the Second Series Debentures or the Remuneration of the Third Series Debentures, as applicable,

utilizing as the discount rate the coupon of the Brazilian Treasury Note “Tesouro IPCA + com Juros Semestrais (NTN-B)”, with

duration closer to the remaining duration of the Second Series Debentures and/or the Third Series Debentures that are the object of the

Total Optional Early Redemption of the Incentive Debentures, as applicable, calculated as per the formula to be provided for in the Indenture,

on the date of the Total Optional Early Redemption of the Incentive Debentures, utilizing the indicative prices disclosed by ANBIMA on

its website (http://www.anbima.com.br) calculated on the second business day immediately prior to the date of the Optional Early Redemption

of the Incentive Debentures, exponentially decreased by 0.25% (zero point twenty-five percent) per year, plus any amounts due and unpaid,

to be calculated as per the calculation formula to be provided for in the Indenture.

| | |

Companhia de Saneamento Básico do Estado de São Paulo – SABESP Unit | Corporate Governance Address: R. Costa Carvalho, 300 – Pinheiros – CEP 05429-900 – São Paulo - SP www.sabesp.com.br | Page 11 of 15 |

| | COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO |  |

| | | |

27.

Optional Extraordinary Amortization:

27.1.

The optional extraordinary amortization of the

Institutional Debentures is limited to 98% (ninety-eight percent) of the Face Value of the Institutional Debentures and may occur as of

the 37th (thirty-seventh) month as from the Issue Date, that is, the date to be defined in the Indenture (inclusive),

at the Company’s discretion, as of the Issue Date (exclusive), relating to the total Institutional Debentures, proportionally

(“Optional Extraordinary Amortization of the Institutional Debentures”). The Optional Extraordinary Amortization

of the First Series Debentures will occur upon the payment of: (i) the portion of the Face Value of the First Series Debentures to be

amortized, plus (ii) the Remuneration of the Institutional Debentures levied on the portion to be amortized calculated pro rata temporis

from the First Date of Payment of the Institutional Debentures or the last Date of Payment of the Remuneration of the First Series

Debentures, as applicable, to the date of the effective Optional Extraordinary Amortization of the Institutional Debentures, plus (iii)

charges due and unpaid up until said date, and (iv) a premium equivalent to 0.30% (zero point thirty percent) per year, pro rata temporis,

based on 252 (two hundred and fifty-two) business days, considering the number of business days to elapse between the date of the effective Optional

Extraordinary Amortization of the Institutional Debentures and the Due Date of the First Series Debentures, levied on the result

of the sum of the amounts provided for in items (i) and (ii).

| | |

Companhia de Saneamento Básico do Estado de São Paulo – SABESP Unit | Corporate Governance Address: R. Costa Carvalho, 300 – Pinheiros – CEP 05429-900 – São Paulo - SP www.sabesp.com.br | Page 12 of 15 |

| | COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO |  |

| | | |

27.2.

While not expressly authorized by the applicable

legislation and/or regulations, the Second Series Debentures and the Third Series Debentures will not be subject to extraordinary amortization

by the Company. Should it be expressly authorized by the applicable legislation and/or regulations, the Second Series Debentures and

the Third Series Debentures may be extraordinarily amortized by the Company, observing the terms of said applicable legislation and/or

regulations and the conditions set forth in the Indenture (“Optional Extraordinary Amortization of Second Series Debentures”

and “Optional Extraordinary Amortization of Third Series Debentures”, respectively, and when jointly referred to,

“Optional Extraordinary Amortization of the Incentive Debentures”, and jointly with the Optional Extraordinary

Amortization of the Institutional Debentures”, “Optional Extraordinary Amortization”).

The Optional Extraordinary Amortization of the Second Series Debentures and/or the Optional Extraordinary Amortization of the Third Series

Debentures will occur upon the payment of the highest amount between (i) the Restated Face Value of the Second Series Debentures and/or

the Third Series Debentures, plus the Remuneration of the Second Series Debentures and/or the Remuneration of the Third Series Debentures,

as applicable, calculated pro rata temporis from the First Payment Date of the Second Series Debentures and/or the Third Series

Debentures or the immediately previous date of payment of the Remuneration of the Second Series Debentures or the Remuneration of the

Third Series Debentures, as applicable (inclusive), to the date of the Optional Extraordinary Amortization of the Second Series Debentures

and/or the Optional Extraordinary Amortization of the Third Series Debentures (exclusive), the default charges and any pecuniary obligations

and other additions referring to the Incentive Debenture that are the object of the Optional Extraordinary Amortization of the Second

Series Debentures and/or the Third Series Debentures; and (ii) the present value of the remaining installments of Amortization of the

Restated Face Value of the Second Series Debentures and/or the Third Series Debentures that are the object of the Optional Extraordinary

Amortization of the Incentive Debentures and the payment of the Remuneration of the Second Series Debentures or the Remuneration of the

Third Series Debentures, as applicable, utilizing as the discount rate the coupon of the Brazilian Treasury Note “Tesouro IPCA

+ com Juros Semestrais (NTN-B)”, with duration closer to the remaining duration of the Second Series Debentures and/or the Third

Series Debentures that are the object of the Optional Extraordinary Amortization of the Incentive Debentures, as applicable, calculated

as per the formula to be provided for in the Indenture, on the date of the Optional Extraordinary Amortization of the Second Series Debentures

and/or the Optional Extraordinary Amortization of the Third Series Debentures, utilizing the indicative prices disclosed by ANBIMA on

its website (http://www.anbima.com.br), calculated on the second business day immediately prior to the date of the Optional Extraordinary

Amortization of the Incentive Debentures, exponentially decreased by 0.25% (zero point twenty-five percent) per year, plus any amounts

due and unpaid, to be calculated as per the calculation formula to be provided for in the Indenture.

28.

Early Redemption Offering: The Company may conduct an early redemption offering for all the Debentures of one, two or all the series,

targeted at all the Debenture Holders of all series or all the Debenture Holders of the respective series that will the object of the

early redemption offering, as determined by the Company, at its sole discretion, (i) relating to the First Series Debentures, at any

time, and (ii) relating to the Second Series Debentures and the Third Series Debentures, observing the provisions of item II of paragraph

1 of article 1, and paragraph 1 of article 2 of Law 12,431, under the provisions of CMN Resolution 4,751, or regulation that may replace

it, and other applicable legal and regulatory provisions, as well as the minimum weighted average term of 4 (four) years relating to

the payments elapsed between the Issue Date and date of the effective Early Redemption Offering of the Second Series Debentures and/or

the Third Series Debentures, ensuring that the Holders of the First Series Debentures, the Holders of the Second Series Debentures and/or

the Holders of the Third Series Debentures, as applicable, will have the right to either accept or refuse to redeem their First Series

Debentures, Second Series Debentures and/or Third Series Debentures, under the terms to be provided for in the Indenture and the applicable

legislation, including, but no limited to Brazilian Corporation Law (“Early Redemption Offering”).

| | |

Companhia de Saneamento Básico do Estado de São Paulo – SABESP Unit | Corporate Governance Address: R. Costa Carvalho, 300 – Pinheiros – CEP 05429-900 – São Paulo - SP www.sabesp.com.br | Page 13 of 15 |

| | COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO |  |

| | | |

29. Early Maturity: The

Debentures will have their early maturity set out in the hypotheses and the terms to be provided for in the Indenture.

30. Debenture Split: The

Face Value, the Restated Face Value, the Remuneration, and the other rights granted to the Debenture Holders may not be split, pursuant

to item IX of article 59 of Brazilian Corporation Law.

31. Other Characteristics:

The other characteristics and conditions for the Issue and the Debentures will be provided for in the Indenture.

The Board of Directors also

authorized the members of the Company’s Executive Board, or their duly appointed proxies, observing the legal and statutory provisions,

to carry out any acts related to the Issue, including, but no limited to, negotiating and executing the Indenture, the Distribution Agreement,

and any amendments to the respective documents, including the amendment that will ratify the result of the Book Building Process. Finally,

the Board of Directors ratified all the acts related to the Issue that have previously been carried out by the Executive Board.

| 7. | Closure, Drawing Up and

Approval of the Minutes: There being no more business to address, Chair of the Board of Directors Karla Bertocco Trindade adjourned

the meeting for the drawing up of these minutes, which were read, approved and signed by me, Marialve de Sousa Martins, Executive Secretary

of the Board of Directors, and by the following attending board members: Alexandre Gonçalves Silva, Anderson Marcio de Oliveira,

Augusto Miranda da Paz Junior, Claudia Polto da Cunha, Gustavo Rocha Gattass, Karla Bertocco Trindade, Mateus Affonso Bandeira, Tiago

de Almeida Noel, and Tinn Freire Amado. |

This is a free

English translation of the minutes drawn up in the book of Minutes of the Board of Directors’

Meetings.

| | |

Companhia de Saneamento Básico do Estado de São Paulo – SABESP Unit | Corporate Governance Address: R. Costa Carvalho, 300 – Pinheiros – CEP 05429-900 – São Paulo - SP www.sabesp.com.br | Page 14 of 15 |

| | COMPANHIA DE SANEAMENTO BÁSICO DO ESTADO DE SÃO PAULO |  |

| | | |

São

Paulo, January 06, 2025.

| Karla Bertocco Trindade |

Marialve de Sousa Martins |

| Chair of the Board of Directors |

Secretary of the Board of Directors |

| | |

Companhia de Saneamento Básico do Estado de São Paulo – SABESP Unit | Corporate Governance Address: R. Costa Carvalho, 300 – Pinheiros – CEP 05429-900 – São Paulo - SP www.sabesp.com.br | Page 15 of 15 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the city São Paulo, Brazil.

Date: February 5, 2025

|

Companhia de Saneamento Básico do Estado de São Paulo - SABESP |

|

|

|

| By: |

/s/ Daniel Szlak

|

|

| |

Name: Daniel Szlak

Title: Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

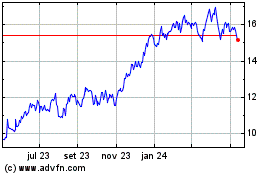

Companhia Sanea (NYSE:SBS)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

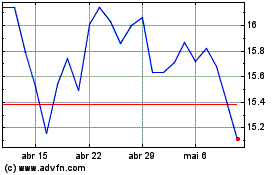

Companhia Sanea (NYSE:SBS)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025