false

0000866706

0000866706

2025-02-04

2025-02-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date of earliest event reported):

February 4, 2025

ESCO TECHNOLOGIES INC.

(Exact Name

of Registrant as Specified in Charter)

| Missouri |

1-10596 |

43-1554045 |

| (State or Other |

(Commission |

(I.R.S. Employer |

| Jurisdiction of Incorporation) |

File Number) |

Identification No.) |

| 9900A Clayton Road, St. Louis, Missouri |

63124-1186 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: 314-213-7200

Securities registered pursuant to section 12(b) of

the Act:

| |

|

|

|

Name of each exchange |

| Title of each class |

|

Trading Symbol(s) |

|

on which registered |

| Common Stock, par value $0.01 per share |

|

ESE |

|

New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2 (b) under the Exchange Act (17 CFR 240.14d-2 (b))

¨ Pre-commencement

communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.113d-4 (c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition |

Today, February 6, 2025, the Registrant is issuing a press release

(furnished as Exhibit 99.1 to this report) announcing its fiscal 2025 first quarter financial and operating results. See Item 7.01, Regulation

FD Disclosure, below.

| Item 5.07 | Submission of Matters to a Vote of Security Holders |

The 2025 Annual Meeting of the Registrant’s stockholders was

held on February 4, 2025. Each of the 25,793,175 shares of common stock entitled to vote at the meeting was entitled to one vote on each

matter voted on at the meeting. The affirmative vote of a majority of the shares represented in person or by proxy at the meeting was

required to elect each director and to approve each of the other proposals considered at the meeting. The vote totals below are rounded

down to the nearest whole share, and Broker Non-Votes are not considered to be entitled to vote on the matter in question and are therefore

not counted in determining the number of votes required for approval.

At the meeting, there were 24,391,092 shares represented and entitled

to vote on one or more matters at the meeting, or approximately 94.6% of the outstanding shares. The voting on each of the proposals was

as follows:

Proposal 1 – Election of Directors (for terms expiring at the 2028Annual Meeting):

| Nominee |

|

“For” |

|

“Withhold” |

|

Broker

Non-Votes |

|

Percent of Shares

Represented and

Entitled to Vote

on the

Nominee

Voting “For” |

|

Percent of all

Outstanding

Shares

Voting “For” |

| David A. Campbell |

|

23,724,425 |

|

80,428 |

|

586,238 |

|

99.7% |

|

92.0% |

| Penelope M. Conner |

|

23,574,824 |

|

230,030 |

|

586,238 |

|

99.0% |

|

91.4% |

| Gloria L. Valdez |

|

22,221,416 |

|

1,576,898 |

|

592,778 |

|

93.4% |

|

86.2% |

Because each nominee received a majority of the shares represented at the meeting and entitled to vote on the nominee, all of the nominees

were duly elected.

Proposal 2 – Advisory vote

on the resolution to approve the compensation of the Registrant’s executive officers (“Say on Pay”):

| “For” |

|

“Against” |

|

“Abstain” |

|

Broker

Non-Votes |

|

Percent of Shares

Represented

and

Entitled to Vote

on the Proposal

Voting “For” |

|

Percent of all

Outstanding

Shares

Voting “For” |

| 23,540,436 |

|

257,874 |

|

6,542 |

|

586,238 |

|

98.9% |

|

91.3% |

Because the proposal received a majority of the shares represented

at the meeting and entitled to vote on the matter, it was duly approved.

Proposal 3 – Ratification of the Registrant’s appointment of Grant Thornton LLP as the Registrant’s independent registered public accounting

firm for the 2025fiscal year:

| “For” | |

“Against” | |

“Abstain” | |

Broker

Non-Votes | |

Percent of Shares

Represented and

Entitled to Vote

on the Proposal

Voting “For” | |

Percent of all

Outstanding

Shares

Voting “For” |

| 24,371,595 | |

16,945 | |

2,551 | |

0 | |

99.9% | |

94.5% |

Because the proposal received a majority of the shares represented

at the meeting and entitled to vote on the matter, it was duly approved.

See also Item 8.01, Other Events, below.

| Item 7.01 | Regulation FD Disclosure |

Today, February 6, 2025, the Registrant is issuing a press release

(furnished as Exhibit 99.1 to this report) announcing its fiscal 2025 first quarter financial and operating results. The press release

will be posted on the Registrant’s investor website (https://investor.escotechnologies.com), although the Registrant reserves the

right to discontinue that availability at any time.

The Registrant will conduct a related webcast conference call today

at 4:00 p.m. Central Time. The conference call webcast will be available on the Registrant’s investor website (https://investor.escotechnologies.com).

A slide presentation will be utilized during the call and will be posted on the website prior to the call. For those unable to participate,

a webcast replay will be available after the call on the website, although the Registrant reserves the right to discontinue that availability

at any time.

Effective at the 2025 Annual Meeting, as previously approved and reported,

Leon J. Olivier retired from the Board of Directors upon the expiration of his term as a director, and the authorized size of the Board

of Directors was reduced from nine to eight directors.

| Item 9.01 | Financial Statements and Exhibits |

Other Matters

The information in this report furnished pursuant to Item 2.02 and

Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934 as amended (“Exchange Act”) or otherwise subject to the liabilities of that section, unless the Registrant incorporates

it by reference into a filing under the Securities Act of 1933 as amended or the Exchange Act.

References to the Registrant’s web site address are included

in this Form 8-K and the press release only as inactive textual references, and the Registrant does not intend them to be active links

to its web site. Information contained on the Registrant’s web site does not constitute part of this Form 8-K or the press release.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 6, 2025

| | ESCO TECHNOLOGIES INC. |

| | | |

| | By: | /s/David M. Schatz |

| | | David M. Schatz |

| | | Senior Vice President, General Counsel and Secretary |

Exhibit 99.1

| NEWS FROM |

|

For more information contact:

Kate

Lowrey - VP of Investor Relations

(314)

213-7277 / klowrey@escotechnologies.com

ESCO

REPORTS FIRST QUARTER FISCAL 2025 RESULTS

- Q1 Sales increase 13% to $247 Million

-

- Q1 GAAP EPS increases 54% to $0.91 -

- Q1 Adjusted EPS as defined in prior guidance

increases 48% to $0.92 -

- Q1 Adjusted EPS excluding Acquisition

Related Amortization increases 41% to $1.07 -

ST. LOUIS, February 6, 2025 – ESCO Technologies Inc. (NYSE:

ESE) (ESCO, or the Company) today reported its operating results for the first quarter ended December 31, 2024 (Q1 2025).

Operating

Highlights

| · | Q1

2025 Sales increased $28.7 million (13.2 percent) to $247.0 million compared to $218.3 million

in Q1 2024. |

| · | Q1

2025 Entered Orders were $275.0 million for a book-to-bill ratio of 1.11x, resulting in record

backlog of $907 million. |

| · | Q1

2025 GAAP EPS increased 54 percent to $0.91 per share compared to $0.59 per share in Q1 2024. |

| · | Q1

2025 Adjusted EPS as defined in prior guidance increased 48 percent to $0.92 per share compared

to $0.62 per share in Q1 2024. |

| · | Beginning

in Q1 2025 we are excluding acquisition related amortization (which was $0.15 per share in

Q1 2025) from our Adjusted EPS calculation. Q1 2025 Adjusted EPS excluding acquisition related

amortization increased 41 percent to $1.07 per share compared to $0.76 per share in Q1 2024. |

| · | Net

cash provided by operating activities was $34 million in Q1 2025, an increase of $25 million

compared to the prior year period, as cash flow was positively impacted by higher net earnings

and favorable working capital impacts. |

Bryan

Sayler, Chief Executive Officer and President, commented, “Our fiscal year got off to an outstanding start as we delivered

13 percent top line growth, over 200 basis points of Adjusted EBITDA margin expansion, and a 41 percent increase in Adjusted EPS compared

to the prior year. All three segments delivered solid revenue growth, highlighted by notable strength across our Navy, commercial aerospace

and utility end-markets. It was also great to see our Test business deliver a solid quarter with improving order flow, double digit revenue

growth, and over 500 basis points of margin expansion.

“The ESCO team continues to build upon our strong position in

attractive markets to increase value across the enterprise. Overall, it was a great way to start the year, with continuing momentum across

our end markets giving us the confidence to raise our full year earnings guidance.”

Segment Performance

Aerospace & Defense (A&D)

| · | Sales

increased $19.6 million (21 percent) to $114.3 million in Q1 2025 from $94.7 million in Q1

2024. The Q1 increase was driven by strength in Navy and commercial aerospace, partially

offset by lower defense aerospace. |

| · | Q1

2025 EBIT and Adjusted EBIT both increased $4.9 million to $21.6 million (18.9 percent margin)

from $16.7 million (17.6 percent margin) in Q1 2024. Margin improvement was driven by leverage

on higher volume and price increases, partially offset by inflationary pressures and mix. |

| · | Entered

Orders decreased $51 million (30 percent) to $121 million in Q1 2025 compared to $172 million

in Q1 2024. The decrease in orders was primarily driven by large Navy orders for Virginia

Class Block V surface hull tiles and Block VI long lead material procurement for the

Light-Weight Wide Aperture Array (LWWAA) in Q1 2024, partially offset by higher Q1 2025 Navy

ejection valve and spares orders. Orders in the quarter resulted in a segment book-to-bill

of 1.06x and record ending backlog of $607 million. |

Utility Solutions Group (USG)

| · | Sales

increased $3.7 million (4 percent) to $86.7 million in Q1 2025 from $83.0 million in Q1 2024.

Doble’s sales increased by $7.9 million (12 percent) driven by a strong quarter for

offline and protection testing products and services. NRG sales decreased $4.2 million (22

percent) due to moderation in renewable energy projects in the quarter. |

| · | EBIT

increased $2.9 million in Q1 2025 to $20.5 million from $17.6 million in Q1 2024. Adjusted

EBIT increased $2.8 million to $20.5 million (23.6 percent margin) from $17.7 million (21.4

percent margin) in Q1 2024. Margin was favorably impacted by leverage on higher volume, price

increases, and mix, partially offset by inflationary pressures. |

| · | Entered

Orders increased $13 million (16 percent) to $90 million in Q1 2025. Doble orders increased

by $10 million (15 percent) on strength across their product portfolio and highlighted by

a $4.3 million order for offline test equipment at Phenix. NRG orders increased by $3 million

in the quarter. The segment book-to-bill was 1.03x in the quarter and resulted in an ending

backlog of $123 million. |

RF Test & Measurement (Test)

| · | Sales

increased $5.5 million (13 percent) to $46.1 million in Q1 2025 from $40.6 million in Q1

2024. Sales growth primarily related to higher U.S. shielding, Test and Measurement in EMEA,

and MPE filter sales. |

| · | EBIT

increased $2.6 million in Q1 2025 to $4.4 million from $1.8 million in Q1 2024. Adjusted

EBIT increased $2.8 million in Q1 2025 to $4.9 million (10.6 percent margin) from $2.1 million

(5.1 percent margin) in Q1 2024. Margin was favorably impacted by leverage on higher volume,

price increases, and cost reduction efforts, partially offset by inflationary pressures and

mix. |

| · | Entered

Orders increased $20 million (43 percent) to $65 million in Q1 2025. The increase was driven

by a strong quarter for EMC Test & Measurement, A&D, and medical and industrial

shielding orders. The segment book-to-bill was 1.41x in the quarter and resulted in ending

backlog of $177 million. |

Business

Outlook – 2025

Beginning in Q1 2025, acquisition related amortization will be excluded

from our Adjusted Earnings calculation. Our current assessment of FY 2025 acquisition related amortization does not include the impact

of the pending SM&P acquisition. The initial fiscal 2025 guidance issued in our November press release is revised as follows:

| | |

Guidance Range | |

| November FY 2025 Adjusted EPS Guidance | |

$ | 4.70 | | |

$ | 4.90 | |

| Acquisition Related Amortization | |

$ | 0.60 | | |

$ | 0.60 | |

| Revised November FY 2025 Adjusted EPS Guidance | |

$ | 5.30 | | |

$ | 5.50 | |

Due to strong market conditions and continued improvement in operational

performance, we are raising our full-year guidance by $0.25 to a range of $5.55 to $5.75 (16 to 21 percent growth over the prior year)

from $5.30 to $5.50. This guidance is in line with our initial revenue guidance range of $1.09 to $1.11 billion (6 to 8 percent annual

growth).

| | |

Guidance Range | |

| Revised November FY 2025 Adjusted EPS Guidance | |

$ | 5.30 | | |

$ | 5.50 | |

| Guidance Increase | |

$ | 0.25 | | |

$ | 0.25 | |

| Revised FY 2025 Adjusted EPS Guidance | |

$ | 5.55 | | |

$ | 5.75 | |

Management’s current expectation is for Q2 Adjusted EPS in the

range of $1.20 to $1.30, which represents 10 to 19 percent growth over the prior year quarter.

| | |

Guidance Range | |

| Q2 2025 Adjusted EPS Guidance (prior methodology) | |

$ | 1.05 | | |

$ | 1.15 | |

| Acquisition Related Amortization | |

$ | 0.15 | | |

$ | 0.15 | |

| Q2 2025 Adjusted EPS Guidance | |

$ | 1.20 | | |

$ | 1.30 | |

SM&P Acquisition

As announced on July 8, 2024, ESCO has agreed to acquire the

Signature Management & Power (SM&P) business of Ultra Maritime for a purchase price of $550 million. The closing of the

transaction is subject to certain conditions, including the completion of the regulatory approval processes in the United States (US)

and the United Kingdom (UK). The US closing conditions have been met. We are in the final stages of the UK government assessment of the

transaction and we are optimistic that the assessment will be positively resolved in the near term. Our current expectation would be

to close the transaction either in our second or early in our third fiscal quarter. SM&P’s sole source product offerings will

add significant scale to the ESCO Navy business, providing increased content on domestic Navy submarine and surface ship programs and

expansion into vital UK and AUKUS navy platforms.

Dividend

Payment

The

next quarterly cash dividend of $0.08 per share will be paid on April 17, 2025 to stockholders of record on April 2,

2025.

Conference Call

The

Company will host a conference call today, February 6, at 4:00 p.m. Central Time, to discuss the Company’s Q1 2025 results.

A live audio webcast and an accompanying slide presentation will be available in the Investor Center of ESCO’s website.

Participants may also access the webcast using this registration link. For those unable to participate, a webcast replay will

be available after the call in the Investor Center of ESCO’s website.

Forward-Looking Statements

Statements

in this press release regarding Management’s intentions, expectations and guidance for fiscal 2025, including restructuring

and cost reduction actions, sales, orders, revenues, margin, earnings, Adjusted EPS, acquisition related amortization, and any other

statements which are not strictly historical, are “forward-looking statements” within the meaning of the safe harbor provisions

of the U.S. securities laws.

Investors are cautioned that such statements are only predictions

and speak only as of the date of this presentation, and the Company undertakes no duty to update them except as may be required by applicable

laws or regulations. The Company’s actual results in the future may differ materially from those projected in the forward-looking

statements due to risks and uncertainties that exist in the Company’s operations and business environment including but not limited

to those described in Item 1A, “Risk Factors”, of the Company’s Annual Report on Form 10-K for the fiscal year

ended September 30, 2024 and the following: the timing and outcome, if any, of the Company’s strategic alternatives review

of VACCO and its Space business; of the Company’s pending acquisition of SM&P; the impacts of climate change and related regulation

of greenhouse gases; the impacts of labor disputes, civil disorder, wars, elections, political changes, tariffs and trade disputes, terrorist

activities, cyberattacks or natural disasters on the Company’s operations and those of the Company’s customers and suppliers;

disruptions in manufacturing or delivery arrangements due to shortages or unavailability of materials or components or supply chain disruptions;

inability to access work sites; the timing and content of future contract awards or customer orders; the timely appropriation, allocation

and availability of Government funds; the termination for convenience of Government and other customer contracts or orders; weakening

of economic conditions in served markets; the success of the Company’s competitors; changes in customer demands or customer insolvencies;

competition; intellectual property rights; technical difficulties or data breaches; the availability of acquisitions; delivery delays

or defaults by customers; performance issues with key customers, suppliers and subcontractors; material changes in the costs and availability

of certain raw materials; material changes in the cost of credit; changes in laws and regulations including but not limited to changes

in accounting standards and taxation; changes in interest, inflation and employment rates; costs relating to environmental matters arising

from current or former facilities; uncertainty regarding the ultimate resolution of current disputes, claims, litigation or arbitration;

and the integration and performance of acquired businesses.

Non-GAAP Financial Measures

The financial measures EBIT, Adjusted EBIT, EBITDA, Adjusted EBITDA,

and Adjusted EPS are presented in this press release. The Company defines “EBIT” as earnings before interest and taxes, “EBITDA”

as earnings before interest, taxes, depreciation and amortization, “Adjusted EBIT” and “Adjusted EBITDA” as excluding

the net impact of the items described in the attached Reconciliation of Non-GAAP Financial Measures, and “Adjusted EPS” as

GAAP earnings per share excluding the net impact of the items described and reconciled in the attached Reconciliation of Non-GAAP Financial

Measures.

EBIT,

Adjusted EBIT, EBITDA, Adjusted EBITDA, and Adjusted EPS are not recognized in accordance with U.S. generally accepted accounting principles

(GAAP). However, Management believes EBIT, Adjusted EBIT, EBITDA, and Adjusted EBITDA are useful in assessing the operational profitability

of the Company’s business segments because they exclude interest, taxes, depreciation, and amortization, which are generally accounted

for across the entire Company on a consolidated basis. EBIT is also one of the measures used by Management in determining resource allocations

within the Company as well as incentive compensation. The presentation of EBIT, Adjusted EBIT, EBITDA, Adjusted EBITDA, and Adjusted

EPS provides important supplemental information to investors by facilitating comparisons with other companies, many of which use similar

non-GAAP financial measures to supplement their GAAP results. The use of non-GAAP financial measures is not intended to replace

any measures of performance determined in accordance with GAAP.

About ESCO

ESCO

is a global provider of highly engineered products and solutions serving diverse end-markets. It manufactures filtration and fluid control

products for the aviation, Navy, space, and process markets worldwide and composite-based products and solutions for Navy, defense, and

industrial customers. ESCO is an industry leader in designing and manufacturing RF test and measurement products and systems; and provides

diagnostic instruments, software and services to industrial power users and the electric utility and renewable energy industries. Headquartered

in St. Louis, Missouri, ESCO and its subsidiaries have offices and manufacturing facilities worldwide. For more information on ESCO and

its subsidiaries, visit the Company’s website at www.escotechnologies.com.

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Operations (Unaudited)

(Dollars in thousands, except per share amounts)

| | |

Three Months

Ended

December 31,

2024 | | |

Three Months

Ended

December 31,

2023 | |

| Net Sales | |

$ | 247,026 | | |

| 218,314 | |

| Cost and Expenses: | |

| | | |

| | |

| Cost of sales | |

| 148,642 | | |

| 134,151 | |

| Selling, general and administrative expenses | |

| 58,784 | | |

| 53,968 | |

| Amortization of intangible assets | |

| 7,993 | | |

| 7,868 | |

| Interest expense | |

| 2,257 | | |

| 2,667 | |

| Other (income) expenses, net | |

| (591 | ) | |

| 206 | |

| Total costs and expenses | |

| 217,085 | | |

| 198,860 | |

| | |

| | | |

| | |

| Earnings before income taxes | |

| 29,941 | | |

| 19,454 | |

| Income tax expense | |

| 6,468 | | |

| 4,285 | |

| | |

| | | |

| | |

| Net earnings | |

$ | 23,473 | | |

| 15,169 | |

| | |

| | | |

| | |

| Earnings Per Share (EPS) | |

| | | |

| | |

| | |

| | | |

| | |

| Diluted - GAAP | |

$ | 0.91 | | |

| 0.59 | |

| | |

| | | |

| | |

| Diluted - As Adjusted Basis | |

| $1.07 | (1) | |

| 0.76 | (2) |

| | |

| | | |

| | |

| Diluted average common shares O/S: | |

| 25,834 | | |

| 25,846 | |

| (1) | Q1

2025 Adjusted EPS excludes $0.16 per share of after-tax charges consisting primarily of $0.01 of restructuring charges within the Test

segment and acquisition related costs at Corporate and $0.15 of acquisition related amortization. |

| (2) | Q1

2024 Adjusted EPS excludes $0.17 per share of after-tax charges consisting primarily of $0.03 of MPE acquisition inventory step-up and

backlog charges and acquisition related costs and $0.14 of acquisition related amortization. |

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES

Condensed Business Segment Information (Unaudited)

(Dollars in thousands)

| | |

GAAP | | |

As Adjusted | |

| | |

Q1 2025 | | |

Q1 2024 | | |

Q1 2025 | | |

Q1 2024 | |

| Net Sales | |

| | | |

| | | |

| | | |

| | |

| Aerospace & Defense | |

$ | 114,301 | | |

| 94,733 | | |

| 114,301 | | |

| 94,733 | |

| USG | |

| 86,660 | | |

| 82,984 | | |

| 86,660 | | |

| 82,984 | |

| Test | |

| 46,065 | | |

| 40,597 | | |

| 46,065 | | |

| 40,597 | |

| Totals | |

$ | 247,026 | | |

| 218,314 | | |

| 247,026 | | |

| 218,314 | |

| | |

| | | |

| | | |

| | | |

| | |

| EBIT | |

| | | |

| | | |

| | | |

| | |

| Aerospace & Defense | |

$ | 21,596 | | |

| 16,663 | | |

| 21,622 | | |

| 16,663 | |

| USG | |

| 20,489 | | |

| 17,625 | | |

| 20,489 | | |

| 17,745 | |

| Test | |

| 4,422 | | |

| 1,779 | | |

| 4,887 | | |

| 2,052 | |

| Corporate | |

| (14,309 | ) | |

| (13,946 | ) | |

| (9,310 | ) | |

| (8,600 | ) |

| Consolidated EBIT | |

| 32,198 | | |

| 22,121 | | |

| 37,688 | | |

| 27,860 | |

| Less: Interest expense | |

| (2,257 | ) | |

| (2,667 | ) | |

| (2,257 | ) | |

| (2,667 | ) |

| Less: Income tax expense | |

| (6,468 | ) | |

| (4,285 | ) | |

| (7,730 | ) | |

| (5,605 | ) |

| Net earnings | |

$ | 23,473 | | |

| 15,169 | | |

| 27,701 | | |

| 19,588 | |

Note

1: Adjusted net earnings of $27.7 million in Q1 2025 exclude $4.2 million (or $0.16 per share) of after-tax charges consisting primarily

of restructuring charges within the Test segment and acquisition related costs at Corporate, and acquisition related amortization.

Note 2: Adjusted net earnings of $19.6 million in Q1 2024 exclude $4.4 million (or $0.17 per share) of after-tax charges consisting primarily of MPE acquisition inventory step-up and backlog charges and acquisition related costs, and acquisition related amortization.

| EBITDA Reconciliation to Net earnings: | |

| | |

| | |

Adjusted | | |

Adjusted | |

| | |

Q1 2025 | | |

Q1 2024 | | |

Q1 2025 | | |

Q1 2024 | |

| Consolidated EBITDA | |

$ | 46,005 | | |

| 35,573 | | |

| 46,498 | | |

| 36,408 | |

| Less: Depr & Amort | |

| (13,807 | ) | |

| (13,452 | ) | |

| (8,810 | ) | |

| (8,548 | ) |

| Consolidated EBIT | |

| 32,198 | | |

| 22,121 | | |

| 37,688 | | |

| 27,860 | |

| Less: Interest expense | |

| (2,257 | ) | |

| (2,667 | ) | |

| (2,257 | ) | |

| (2,667 | ) |

| Less: Income tax expense | |

| (6,468 | ) | |

| (4,285 | ) | |

| (7,730 | ) | |

| (5,605 | ) |

| Net earnings | |

$ | 23,473 | | |

| 15,169 | | |

| 27,701 | | |

| 19,588 | |

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets (Unaudited)

(Dollars in thousands)

| | |

December 31,

2024 | | |

September 30,

2024 | |

| Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 71,284 | | |

| 65,963 | |

| Accounts receivable, net | |

| 202,661 | | |

| 240,680 | |

| Contract assets | |

| 131,404 | | |

| 130,534 | |

| Inventories | |

| 219,383 | | |

| 209,164 | |

| Other current assets | |

| 20,779 | | |

| 22,308 | |

| Total current assets | |

| 645,511 | | |

| 668,649 | |

| Property, plant and equipment, net | |

| 168,468 | | |

| 170,596 | |

| Intangible assets, net | |

| 396,302 | | |

| 407,602 | |

| Goodwill | |

| 532,312 | | |

| 539,899 | |

| Operating lease assets | |

| 38,710 | | |

| 37,744 | |

| Other assets | |

| 13,761 | | |

| 14,130 | |

| | |

$ | 1,795,064 | | |

| 1,838,620 | |

| | |

| | | |

| | |

| Liabilities and Shareholders' Equity | |

| | | |

| | |

| Current maturities of long-term debt | |

$ | 20,000 | | |

| 20,000 | |

| Accounts payable | |

| 75,881 | | |

| 98,371 | |

| Contract liabilities | |

| 129,737 | | |

| 124,845 | |

| Other current liabilities | |

| 90,491 | | |

| 106,638 | |

| Total current liabilities | |

| 316,109 | | |

| 349,854 | |

| Deferred tax liabilities | |

| 75,520 | | |

| 75,333 | |

| Non-current operating lease liabilities | |

| 36,400 | | |

| 34,810 | |

| Other liabilities | |

| 38,102 | | |

| 39,273 | |

| Long-term debt | |

| 92,000 | | |

| 102,000 | |

| Shareholders' equity | |

| 1,236,933 | | |

| 1,237,350 | |

| | |

$ | 1,795,064 | | |

| 1,838,620 | |

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(Dollars in thousands)

| | |

Three Months

Ended

December 31,

2024 | | |

Three Months

Ended

December 31,

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net earnings | |

$ | 23,473 | | |

| 15,169 | |

| Adjustments to reconcile net earnings to net cash | |

| | | |

| | |

| provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 13,807 | | |

| 13,452 | |

| Stock compensation expense | |

| 2,524 | | |

| 2,180 | |

| Changes in assets and liabilities | |

| (7,151 | ) | |

| (22,539 | ) |

| Effect of deferred taxes | |

| 1,521 | | |

| 484 | |

| Net cash provided by operating activities | |

| 34,174 | | |

| 8,746 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Acquisition of business, net of cash acquired | |

| - | | |

| (56,179 | ) |

| Capital expenditures | |

| (5,208 | ) | |

| (7,848 | ) |

| Additions to capitalized software | |

| (2,587 | ) | |

| (2,942 | ) |

| Net cash used by investing activities | |

| (7,795 | ) | |

| (66,969 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from long-term debt | |

| 42,000 | | |

| 99,000 | |

| Principal payments on long-term debt and short-term borrowings | |

| (52,000 | ) | |

| (29,000 | ) |

| Dividends paid | |

| (2,064 | ) | |

| (2,064 | ) |

| Purchases of common stock into treasury | |

| - | | |

| - | |

| Other | |

| (6,031 | ) | |

| (1,432 | ) |

| Net cash (used) provided by financing activities | |

| (18,095 | ) | |

| 66,504 | |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

| (2,963 | ) | |

| 1,249 | |

| | |

| | | |

| | |

| Net increase in cash and cash equivalents | |

| 5,321 | | |

| 9,530 | |

| Cash and cash equivalents, beginning of period | |

| 65,963 | | |

| 41,866 | |

| Cash and cash equivalents, end of period | |

$ | 71,284 | | |

| 51,396 | |

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES

Other Selected Financial Data (Unaudited)

(Dollars in thousands)

| Backlog And Entered Orders - Q1 2025 | |

A&D | | |

USG | | |

Test | | |

Total | |

| Beginning Backlog - 10/1/24 | |

$ | 600,382 | | |

| 119,943 | | |

| 158,644 | | |

| 878,969 | |

| Entered Orders | |

| 120,606 | | |

| 89,574 | | |

| 64,825 | | |

| 275,005 | |

| Sales | |

| (114,301 | ) | |

| (86,660 | ) | |

| (46,065 | ) | |

| (247,026 | ) |

| Ending Backlog - 12/31/24 | |

$ | 606,687 | | |

| 122,857 | | |

| 177,404 | | |

| 906,948 | |

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES

Reconciliation of Non-GAAP Financial Measures (Unaudited)

| EPS – Adjusted Basis Reconciliation – Q1 2025 | |

| |

| EPS – GAAP Basis – Q1 2025 | |

$ | 0.91 | |

| Adjustments (defined below) | |

| 0.16 | |

| EPS – As Adjusted Basis – Q1 2025 | |

$ | 1.07 | |

Adjustments

exclude $0.16 per share consisting primarily of $0.01 of restructuring charges within the Test segment and acquisition related costs

at Corporate and $0.15 of acquisition related amortization. The $0.16 of EPS adjustments per share consists of $5,490K of pre-tax charges

offset by $1,262K of tax benefit for net impact of $4,228K.

| EPS – Adjusted Basis Reconciliation – Q1 2024 | |

| |

| EPS – GAAP Basis – Q1 2024 | |

$ | 0.59 | |

| Adjustments (defined below) | |

| 0.17 | |

| EPS – As Adjusted Basis – Q1 2024 | |

$ | 0.76 | |

Adjustments

exclude $0.17 per share consisting primarily of $0.03 of MPE acquisition inventory step-up and backlog charges and acquisition

related costs and $0.14 of acquisition related amortization. The $0.17 of EPS adjustments per share consists of $5,739K of pre-tax

charges offset by $1,320K of tax benefit for net impact of $4,419K.

| EPS – Adjusted Basis Reconciliation – Q2 2025 Guidance | |

Low | | |

High | |

| EPS – GAAP Basis – Q2 2025 | |

$ | 1.05 | | |

| 1.15 | |

| Adjustments (defined below) | |

| 0.15 | | |

| 0.15 | |

| EPS – As Adjusted Basis – Q2 2025 | |

$ | 1.20 | | |

| 1.30 | |

Adjustments

exclude an estimated $0.15 of acquisition related amortization. The estimated $0.15 of EPS adjustment per share consists of $5.0 million

of pre-tax charges offset by $1.15 million of tax benefit for net impact of $3.85 million.

| EPS – Adjusted Basis Reconciliation – FY 2025 Guidance | |

Low | | |

High | |

| EPS – GAAP Basis – FY 2025 | |

$ | 4.94 | | |

| 5.14 | |

| Adjustments (defined below) | |

| 0.61 | | |

| 0.61 | |

| EPS – As Adjusted Basis – FY 2025 | |

$ | 5.55 | | |

| 5.75 | |

Adjustments exclude $0.61 per share consisting

primarily of $0.01 of restructuring charges within the Test segment and acquisition related costs at Corporate and an estimated $0.60

of acquisition related amortization. The estimated $0.61 of EPS adjustments per share consists of $20.5 million of pre-tax

charges offset by $4.7 million of tax benefits for net impact of $15.8 million.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

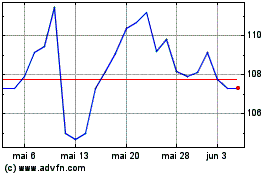

ESCO Technologies (NYSE:ESE)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

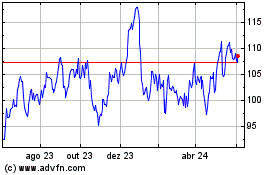

ESCO Technologies (NYSE:ESE)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025