Filed

pursuant to Rule 424(b)(5)

Registration

Statement No. 333-273357

PROSPECTUS

SUPPLEMENT

(To Prospectus

dated July 28, 2023, as supplemented

by Prospectus

Supplement dated August 21, 2023)

Workhorse

Group Inc.

$35,000,000

Principal Amount of Senior Secured Convertible Notes Due 2026

Warrants

to Purchase 55,045,655 Shares of Common Stock

Pursuant

to this prospectus supplement and the accompanying prospectus, Workhorse Group Inc. (the “Company,” “we,” “us,”

or “our”) is offering $35,000,000 aggregate principal amount of our senior secured convertible notes (“Notes”),

which Notes are convertible into shares of our common stock, par value $0.001 per share, under certain conditions more fully described

below, and warrants (“Warrants”) to purchase up to 55,045,655 shares of our common stock. The Notes and Warrants are immediately

separable and will be issued separately, but will be purchased together as a single unit in this offering.

We

are also offering by this prospectus supplement and the accompanying prospectus shares of our common stock issuable from time to time

upon conversion or otherwise under the Notes, and up to 55,045,655 shares of common stock issuable from time to time upon exercise of

the Warrants. Our obligations under the Notes will be guaranteed by all of our subsidiaries.

The

Notes have an original issue discount of 12.5% resulting in gross proceeds to us of $30,625,000, before fees and other expenses. The

Notes will bear interest at a rate of 9.0% per annum, payable in arrears on the first trading day of each calendar quarter, beginning

April 1, 2025, payable, at our option, either in cash or in-kind by compounding and becoming additional principal. Upon the occurrence

and during the continuance of an event of default, the interest rate on the Notes will increase to 18.0% per annum. Unless earlier converted

or redeemed, the Notes will mature on the one year anniversary of the issuance date, subject to extension at the option of the holders

in certain circumstances as provided in the Notes. All amounts due under the Notes are convertible at any time, in whole or in part,

and subject to certain beneficial ownership limitations, at the option of the holders into shares of our common stock at a conversion

price equal to the lower of (a) $0.4244, which we refer to as the “reference price,” or (b) the greater of (x) $0.1000, which

we refer to herein as the “floor price,” and (y) 87.5% of the volume weighted average price of our common stock during the

ten trading days ending and including the trading day immediately preceding the delivery or deemed delivery of the applicable conversion

notice, as elected by the converting holder. The reference price and floor price are subject to customary adjustments upon any stock

split, stock dividend, stock combination, recapitalization or similar event. Upon the satisfaction of certain conditions, we may prepay

outstanding Notes upon 15 business days’ written notice by paying an amount equal to the then outstanding amounts due under the

Notes at a 25% premium, or the then outstanding amounts due under the Notes at a 75% premium if certain redemption conditions are not

satisfied. The Notes will be our senior secured obligation and will rank senior to the right to payment of the holders of our unsecured

debt, except as described herein. Our obligations under the Notes will be fully and unconditionally guaranteed by all of our subsidiaries.

The

Warrants will expire on the ten-year anniversary of the initial issuance date and are exercisable for shares of our common stock at $0.6999

per share.

The

Notes and Warrants are being sold pursuant to a securities purchase agreement, or the Securities Purchase Agreement, among us and the

investors in the Notes, dated as of March 15, 2024. The Notes are being issued pursuant to a twelfth supplemental indenture, or the Twelfth

Supplemental Indenture, dated as of February 12, 2025, between us and U.S. Bank Trust Company, National Association, as trustee, or the

Trustee. The Twelfth Supplemental Indenture supplements the indenture entered into by and between us and the Trustee, dated as of December

27, 2023, or the Base Indenture. We refer to the Base Indenture, together with the Twelfth Supplemental Indenture, as the Indenture.

The Indenture has been qualified under the Trust Indenture Act of 1939, and the terms of the Notes include those set forth in the Indenture

and those made part of the Indenture by reference to the Trust Indenture Act. We have previously issued Notes under the Securities Purchase

Agreement in the aggregate original principal amount of $42,485,714 and warrants exercisable for 15,640,900 shares of common stock in

the aggregate (following adjustment in connection with the Company’s 1-for-20 reverse stock split, which became effective on June

17, 2024). As of February 11, 2025, $8,350,000 aggregate principal amount remained outstanding under the Notes, and no shares had been

issued pursuant to the Warrants. Upon our filing of one or more additional prospectus supplements, and our satisfaction of certain other

conditions, either we or an investor may elect to consummate additional closings of up to $61,514,286 in aggregate principal amount of

senior secured convertible notes at additional closings, or the Additional Notes, pursuant to the Securities Purchase Agreement. At any

such additional closings, we may, at the option of an investor, issue to the applicable purchasers Warrants, or the Additional Warrants,

to purchase a number of shares of our common stock equal to equal to 80% of the number of shares issuable upon conversion of the Additional

Notes to be issued at such closing calculated at the Alternate Conversion Price (as defined in the Notes) then in effect, assuming conversion

occurs on the trading day immediately prior to the applicable closing date. Any Additional Warrants would be issued at an exercise price

equal to the lower of (i) $10.00 (as adjusted for stock splits, stock dividends, stock combinations, recapitalizations and similar events),

(ii) 140% of the closing bid price of our common stock on the trading day immediately prior to the applicable additional closing date

or (iii) $7.00. However, we are not registering pursuant to this prospectus supplement the issuance of any such Additional Notes or Additional

Warrants (or shares of common stock issuable upon conversion or otherwise of such Additional Notes or upon exercise of such Additional

Warrants) that may be issued, from time to time, at such additional closings under the Securities Purchase Agreement.

Pursuant

to a letter agreement entered into between the Company and the investor in connection with the Notes issued hereunder (the “Lockbox

Letter”), such proceeds, after fees and expenses, will be deposited into a lockbox account under the control of the collateral

agent under the Securities Purchase Agreement. Funds may be released from the lockbox from time to time (i) in an amount corresponding

to the principal amount converted, if the investor converts any portion of the Notes issued hereunder; (ii) in the amount of $2,625,000

each calendar month, if the Company satisfies the conditions of a Market Release Event (as defined in the Lockbox Letter), including

minimum common stock price and trading volume conditions; or (iii) otherwise, with the consent of the investor.

Although

the Company expects that it will receive the funds held in the lockbox account during the term of the Notes issued hereunder, it is possible

that the foregoing events will not occur with respect to some or all of the principal amount of the Notes and that, accordingly, it will

not be able to draw some or all of the funds in the lockbox account.

No

public market currently exists for the Notes or Warrants, and we do not intend to apply to list the Notes or Warrants on any securities

exchange or for quotation on any inter-dealer quotation system. Our common stock is listed on the Nasdaq Capital Market, or Nasdaq, under

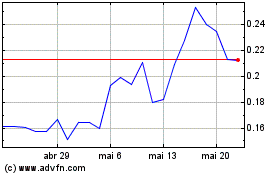

the symbol “WKHS.” On February 11, 2025, the last reported sale price of our common stock on Nasdaq was $0.4999 per share.

Delivery

of the Notes and Warrants by us is expected to be made on or about February 12, 2025, subject to customary closing conditions.

Investing

in our securities involves a high degree of risk. Before making an investment decision, you should carefully review and consider all

of the information set forth in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein

and therein, including the risks and uncertainties described under “Risk Factors” beginning on page S-6 of this prospectus

supplement and any risk factors that are included in our filings with the Securities and Exchange Commission, or the SEC, that are incorporated

by reference herein.

Neither

the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of

this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus supplement is February 12, 2025.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying base prospectus are part of a registration statement that we filed with the SEC using a “shelf”

registration process. Each time we conduct an offering to sell securities under the accompanying base prospectus, we will provide a prospectus

supplement that contains specific information about the terms of that offering, including the price, the amount of securities being offered

and the plan of distribution. The shelf registration statement was initially filed with the SEC on July 20, 2023, and was declared effective

by the SEC on July 28, 2023, and supplemented on August 21, 2023. This prospectus supplement describes the specific details regarding

this offering and may add, update or change information contained in the accompanying base prospectus. The accompanying base prospectus

provides general information about us and our securities, some of which may not apply to this offering. This prospectus supplement and

the accompanying base prospectus are an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions

where it is lawful to do so. We are not making offers to sell or solicitations to buy our securities in any jurisdiction in which an

offer or solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone

to whom it is unlawful to make an offer or solicitation.

If

information in this prospectus supplement is inconsistent with the accompanying base prospectus or the information incorporated by reference

with an earlier date, you should rely on this prospectus supplement. This prospectus supplement, together with the base prospectus, the

documents incorporated by reference into this prospectus supplement and the accompanying base prospectus and any free writing prospectus

we have authorized for use in connection with this offering include all material information relating to this offering. We have not authorized

anyone to provide you with different or additional information, and you must not rely on any unauthorized information or representations.

You should assume that the information appearing in this prospectus supplement, the accompanying base prospectus, the documents incorporated

by reference into this prospectus supplement and the accompanying base prospectus and any free writing prospectus we have authorized

for use in connection with this offering is accurate only as of the respective dates of those documents. Our business, financial condition,

results of operations and prospects may have changed since those dates. You should carefully read this prospectus supplement,

the accompanying base prospectus and the information and documents incorporated by reference herein and therein, as well as any free

writing prospectus we have authorized for use in connection with this offering, before making an investment decision. See “Incorporation

of Certain Information by Reference” and “Where You Can Find More Information” in this prospectus supplement and in

the accompanying base prospectus.

This

prospectus supplement and the accompanying base prospectus contain summaries of certain provisions contained in some of the documents

described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their

entirety by the full text of the actual documents, some of which have been filed or will be filed and incorporated by reference herein.

See “Where You Can Find More Information” in this prospectus supplement. The representations, warranties and covenants made

by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into this prospectus supplement

or the accompanying base prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for

the purpose of allocating risk among the parties to such agreements, speak only to the date that such representations, warranties, and

covenants were made, and should not be deemed to be a representation, warranty or covenant to you. Accordingly, such representations,

warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This

prospectus supplement and the accompanying base prospectus contain and incorporate by reference certain market data and industry statistics

and forecasts that are based on Company-sponsored studies, independent industry publications and other publicly available information.

Although we believe these sources are reliable, they are subject to risks and uncertainties, and are subject to change based on various

factors, including those discussed under “Risk Factors” in this prospectus supplement and the accompanying base prospectus

and under similar headings in the documents incorporated by reference herein and therein. Accordingly, investors should not place undue

reliance on this information.

Unless

otherwise stated or the context requires otherwise, references to “we,” “us,” the “Issuer” and “Workhorse”

refer to Workhorse Group Inc. and unless otherwise differentiated, its wholly-owned subsidiaries.

PROSPECTUS

SUPPLEMENT SUMMARY

This

prospectus summary highlights information contained in this prospectus supplement, the accompanying base prospectus and the documents

incorporated by reference herein and therein. Because it is a summary, it does not contain all of the information that you should consider

before investing. You should read this entire prospectus supplement and the accompanying base prospectus carefully, including the section

entitled “Risk Factors” beginning on page S-6 and in our periodic filings with the SEC, our consolidated financial statements

and the related notes and the other information incorporated by reference into this prospectus supplement and the accompanying base prospectus,

before making an investment decision.

Our Company

Workhorse

is a technology company focused on providing ground-based electric vehicles to the last-mile delivery sector. As an American original

equipment manufacturer, we design and build high performance, battery-electric trucks. Workhorse also develops cloud-based, real-time

telematics performance monitoring systems that are fully integrated with our vehicles and enable fleet operators to optimize energy and

route efficiency. All Workhorse vehicles are designed to make the movement of people and goods more efficient and less harmful to the

environment.

Corporate

Information

We

are a Nevada corporation. Our executive offices are located at 3600 Park 42 Drive, Suite 160E, Sharonville, Ohio 45241, and our telephone

number is (888) 646-5205. Our website is www.workhorse.com. Information contained in, or accessible through, our website does not constitute

part of, and should not be construed as being incorporated by reference into, this prospectus and inclusions of our website address in

this prospectus are inactive textual references only.

The

Offering

The

following is a brief summary of some of the terms of the offering and is qualified in its entirety by reference to the more detailed

information appearing elsewhere in this prospectus supplement and the accompanying base prospectus.

| Issuer: |

|

Workhorse Group

Inc., a Nevada corporation |

| |

|

|

| Securities

Offered |

|

$35,000,000 aggregate principal

amount of our senior secured convertible notes (“Notes”) and warrants (the “Warrants”) to purchase 55,045,655

shares of our common stock. This prospectus supplement also relates to the offering of shares of our common stock issuable from time

to time upon conversion of the Notes, and up to 55,045,655 shares of common stock issuable from time to time upon exercise of the

Warrants. |

| |

|

|

| Purchase

Price |

|

The purchase price for

the Notes and Warrants is equal to the aggregate principal amount, less a 12.5% original issue discount, resulting in an issue price

equal to 87.5% of the aggregate principal amount of the Notes. |

| |

|

|

| Description

of the Notes |

|

|

| |

|

|

| Maturity |

|

Unless earlier converted

or redeemed, the Notes will mature on the one year anniversary of the issuance date, subject to extension at the option of the holders

in certain circumstances as provided in the Notes. |

| |

|

|

| Interest |

|

The Notes will bear interest

at a rate of 9.0% per annum, payable in arrears on the first trading day of each calendar quarter, beginning April 1, 2025, payable

either in cash or in-kind by compounding and becoming additional principal, at our option. Upon the occurrence and during the continuance

of an event of default, the interest rate on the Notes will increase to 18.0% per annum. |

| |

|

|

| Ranking |

|

The Notes will be our senior

secured obligation and will rank senior to the right to payment of the holders of our unsecured debt, except as described herein.

|

| |

|

|

| Security

and Guaranty |

|

The Notes will be secured

by first priority liens on substantially all of our tangible and intangible assets, subject to certain limitations. Our obligations

under the Notes will be guaranteed by our subsidiaries. |

| |

|

|

| Conversion

at Option of Holder |

|

Each

holder of Notes may convert all, or any part, of the amounts due under the Notes, at any time at such holder’s option, into

shares of our common stock at the “Conversion Price,” which, at the election of the converting holder, is equal to the

lower of:

●

$0.4244, which we refer to as the “reference price;” or

●

the greater of:

n

$0.1000, which we refer to herein as the “floor price,” and

n

87.5% of the volume weighted average price of our common stock during the ten trading days ending and including the trading day immediately

preceding the delivery or deemed delivery of the applicable conversion notice.

The

reference price and floor price are subject to customary adjustments upon any stock split, stock dividend, stock combination, recapitalization

or similar event.

The

reference price is also subject to full-ratchet adjustment in connection with a subsequent offering at a per share price less than

the reference price then in effect. |

| Voluntary

Adjustment Right |

|

Subject to

the rules and regulations of Nasdaq, we have the right, at any time, with the written consent of the investor, to lower the reference

price to any amount and for any period of time deemed appropriate by our board of directors. |

| |

|

|

| Limitations

of Conversion: |

|

|

| |

|

|

| Beneficial

Ownership Limitation |

|

Conversions and issuance

of our common stock pursuant to the Notes are prohibited if such conversion or issuance would cause the applicable holder (together

with its affiliates) to beneficially own in excess of 9.99% of the outstanding shares of our common stock. |

| |

|

|

| Holder

Optional Redemption Rights: |

|

|

| |

|

|

| Event

of Default Redemption |

|

Upon an event of default,

each holder of Notes may require us to redeem in cash all, or any portion, of the Notes at the greater of (i) the face value of our

common stock underlying the Notes at a 75% premium and (ii) the equity value of our common stock underlying the Notes. |

| |

|

|

| Bankruptcy

Event of Default Mandatory Redemption |

|

Upon any bankruptcy event

of default, we shall immediately redeem in cash all amounts due under the Notes at a 75% premium unless the holder waives such right

to receive such payment. |

| |

|

|

| Change

of Control Redemption |

|

In connection with a change

of control of the Company, each holder may require us to redeem in cash all, or any portion, of the Notes at a price equal to the

greatest of: |

| |

|

● |

the face value

of the Notes to be redeemed at a 25% premium (or at a 75% premium, if certain redemption conditions are not satisfied or during the

occurrence and continuance of an event of default), except that if the Company is required to make a redemption under the Note issued

hereunder and no event of default has occurred and is continuing and there is no redemption conditions failure, the redemption premium

on principal and interest of the Note issued hereunder corresponding to funds held in the lockbox account will be 10%; |

| |

|

● |

the equity

value of our common stock underlying such Notes; and |

| |

|

● |

the equity value of the change of

control consideration payable to the holder of our common stock underlying such Notes. |

| Subsequent

Placement Redemption Right |

|

The holders

of the Notes may require us to redeem the Notes, in whole or in part, upon the occurrence of certain offerings of equity or equity-linked

securities with 20% of the gross proceeds of such an offering. |

| |

|

|

| Asset Sale Redemption

Right |

|

Upon the occurrence of

certain asset sales, each holder of Notes may require us to redeem such holder’s Notes, all or any portion of the pro rata

portion of the gross proceeds from such asset sale payable to such holder. |

| Company Redemption Right |

|

At any time,

we have the right to redeem in cash all, but not less than all, the amount then outstanding under the Notes at the greater of (i)

the face value of the Notes at premium of 25% (or 75% during the occurrence and continuance of an event of default) and (ii) the

equity value of the shares of common stock underlying the Notes. |

Description

of the Warrants |

|

|

Shares

Issuable on Exercise |

|

Up

to 55,045,655 shares of common stock, subject to customary adjustments upon any stock split, stock dividend, stock combination, recapitalization

or similar event. |

Exercise

Price |

|

$0.6999

per share, subject to customary adjustments upon any stock split, stock dividend, stock combination, recapitalization or similar

event. |

Cashless

Exercise |

|

If

at the time of exercise of the Warrants, there is no effective registration statement registering the shares of our common stock

underlying the Warrants, such warrants may be exercised on a cashless basis pursuant to their terms. |

Exercise

Period |

|

The

Warrants will be exercisable upon their issuance and will expire ten years following the date of their issuance. |

Limitations

on Exercise |

|

|

Beneficial Ownership

Limitation |

|

The

Warrants include a blocker provision that provides a Warrant may not be exercised if, after giving effect to the exercise, the holder

of the Warrant being exercised, together with its affiliates, would beneficially own in excess of 4.99% of our outstanding shares

of Common Stock. This blocker provision may be raised or lowered to any other percentage not in excess of 9.99%, except that any

increase will only be effective upon 61-days’ prior notice to us. |

| |

|

|

| Other Matters |

|

|

| |

|

|

| Use of Proceeds |

|

We expect to use the net

proceeds from this offering for working capital and general corporate purposes. See “Use of Proceeds” in this prospectus

supplement. |

| |

|

|

| Risk Factors: |

|

Investing in our securities

involves a high degree of risk. See “Risk Factors” in this prospectus supplement and the other information included or

incorporated by reference in this prospectus supplement and the accompanying base prospectus for a discussion of factors you should

carefully consider before deciding to invest in the Note or our common stock. |

| |

|

|

| Certain U.S. Federal Income Tax Considerations: |

|

You should consult your

tax advisor with respect to the U.S. federal income tax consequences of owning the Notes, the Warrants or any shares of common

stock into which the Notes may be converted and may be issued upon exercise of the Warrants in light of your own particular situation

and with respect to any tax consequences arising under the laws of any state, local, foreign or other taxing jurisdiction. See “Certain

Material U.S. Federal Income Tax Considerations” in this prospectus supplement. |

| Additional Closings: |

|

We have previously issued Notes

under the Securities Purchase Agreement in the aggregate original principal amount of $42,485,714 and warrants exercisable for 15,640,900

shares of common stock in the aggregate (following adjustment in connection with the Company’s 1-for-20 reverse stock split,

which became effective on June 17, 2024). As of February 11, 2025, $8,350,000 aggregate principal amount remained outstanding under

the Notes, and no shares had been issued pursuant to the Warrants. Upon our filing of one or more additional prospectus supplements,

and our satisfaction of certain other conditions, either we or an investor may elect to consummate additional closings of up to $61,514,286

in aggregate principal amount Additional Notes pursuant to the Securities Purchase Agreement. At any such additional closings, we

may, at the option of an investor, issue to the applicable investors Additional Warrants to purchase a number of shares of our common

stock equal to equal to 80% of the number of shares issuable upon conversion of the Additional Notes to be issued at such closing

calculated at the Alternate Conversion Price (as defined in the Note) then in effect, assuming conversion occurs on the trading day

immediately prior to the applicable closing date. Any Additional Warrants would be issued at an exercise price equal to the lower

of (i) $10.00 (as adjusted for stock splits, stock dividends, stock combinations, recapitalizations and similar events), (ii) 140%

of the closing bid price of our common stock on the trading day immediately prior to the applicable additional closing date, or (iii)

7.00. However, we are not registering pursuant to this prospectus supplement the issuance of any such Additional Notes or Additional

Warrants (or shares of common stock issuable upon conversion or otherwise of such Additional Notes or upon exercise of such Additional

Warrants) that may be issued, from time to time, at such additional closings under the Securities Purchase Agreement |

| |

|

|

| NASDAQ

Capital Market Symbol: |

|

No public market currently

exists for the Notes or Warrants, and we do not intend to apply to list the Notes or Warrants on any securities exchange or for quotation

on any inter-dealer quotation system. Our Common Stock is listed on the Nasdaq Capital Market under the symbol “WKHS.” |

Lockbox: |

|

Pursuant

to a letter agreement entered into between the Company and the investor in connection with the Notes issued hereunder (the “Lockbox

Letter”), the proceeds to be received from the issuance of the Notes hereunder, after fees and expenses, will be deposited

into a lockbox account under the control of the collateral agent under the Securities Purchase Agreement. Funds may be released from

the lockbox from time to time (i) in an amount corresponding to the principal amount converted, if the investor converts any portion

of the Notes issued hereunder; (ii) in the amount of $2,625,000 each calendar month, if the Company satisfies the conditions of a

Market Release Event (as defined in the Lockbox Letter), including minimum common stock price and trading volume conditions; or (iii)

otherwise, with the consent of the investor. |

RISK

FACTORS

Investing

in the securities involves a high degree of risk. Before making an investment decision, you should read and consider carefully the following

risk factors as well as all other information contained and incorporated by reference in this prospectus supplement and the accompanying

base prospectus, including our consolidated financial statements and the related notes. Please see the “Risk Factors” sections

in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and in our Quarterly Report on Form 10-Q for the fiscal

quarter ended September 30, 2024. Each of these risk factors, either alone or taken together, could adversely affect our business, operating

results and financial condition, as well as adversely affect the value of an investment in our Securities or our common stock. There

may be additional risks that we do not presently know of or that we currently believe are immaterial, which could also impair our business

and financial position. If any of the events described below or in the information incorporated by reference herein were to occur, our

financial condition, our ability to access capital resources, our results of operations and/or our future growth prospects could be materially

and adversely affected, and the market price of our securities could decline. As a result, you could lose some or all of any investment

you may make in our securities.

Risks

Related to this Offering

We

will not receive the net proceeds from the Notes immediately and may never receive certain of such proceeds. Any proceeds received pursuant

to the Notes will be received only upon satisfaction of certain terms and conditions set forth in the Lockbox Letter.

Pursuant

to the Lockbox Letter, the proceeds from the issuance of the Notes, after fees and expenses, will be deposited into a lockbox account

under the control of the collateral agent under the Securities Purchase Agreement. Funds may be released from the lockbox from time to

time (i) in an amount corresponding to the principal amount converted, if the investor converts any portion of the Notes issued hereunder;

(ii) in the amount of $2,625,000 each calendar month, if the Company satisfies the conditions of a Market Release Event (as defined in

the Lockbox Letter), including minimum common stock price and trading volume conditions; or (iii) otherwise, with the consent of the

investor. There is no guarantee that we will receive all of the net proceeds from the issuance of the Notes.

We

have broad discretion in the use of the available net proceeds of the offering contemplated by this prospectus supplement and, despite

our efforts, we may use such proceeds in a manner that does not improve our operating results or increase the value of your investment.

Once

any proceeds are received by us pursuant to the Lockbox Letter, we currently anticipate that the net proceeds from the offering of our

securities contemplated by this prospectus supplement will be used as described in the “Use of Proceeds” section of this

prospectus supplement. However, we have not determined the specific use of the net proceeds from the offering contemplated by this prospectus

supplement. Our management will have broad discretion over the use and investment of those funds, and, accordingly, investors will need

to rely upon the judgment of our management with respect to the use of such proceeds, with only limited information concerning our specific

intentions. These proceeds could be applied in ways that do not improve our operating results or increase the value of your investment.

Servicing

our debt requires a significant amount of cash, and we may not have sufficient cash flow from our business to pay our obligations under

the Notes.

Our

ability to make payments of principal or to pay interest on or to refinance the Notes depends on our future performance, which is subject

to economic, financial, competitive and other factors, some of which are beyond our control. Our business may not continue to generate

cash flow from operations in the future sufficient to satisfy our obligations under the Notes. If we are unable to generate such cash

flow, we may be required to adopt one or more alternatives, such as reducing or delaying investments or capital expenditures, selling

assets, refinancing or obtaining additional equity capital on terms that may be onerous or highly dilutive. Our ability to refinance

the Notes will depend on the capital markets and our financial condition at such time. We may not be able to engage in any of these activities

or engage in these activities on desirable terms, which could result in a default on the Notes.

There

is no existing trading market for the Notes or the Warrants.

There

is no existing trading market for the Notes or the Warrants. We do not intend to apply for listing of the Notes or the Warrants on any

securities exchange or to arrange for quotation on any interdealer quotation system. It is unlikely that an active trading market will

develop for the Notes or Warrants. Unless an active trading market develops, you may not be able to sell the Notes or Warrants at a particular

time or at a favorable price.

The

holders of the Notes will not be entitled to any rights with respect to our common stock but will be subject to all changes made with

respect to our common stock.

Subject

to limited contractual rights, the holders of the Notes will not be entitled to any rights with respect to our common stock until the

Notes are converted, but will be subject to all changes affecting our common stock. For example, if an amendment is proposed to our articles

of incorporation requiring stockholder approval and the record date for determining the stockholders of record entitled to vote on the

amendment occurs prior to the relevant holder acquiring shares of our common stock as a result of conversion of such holder’s Note,

such holder will not be entitled to vote on the amendment, although such holder will nevertheless be subject to any changes in the powers,

preferences or special rights of our common stock.

We

are currently out of compliance with the Nasdaq’s continuing listing requirements, and if we fail to satisfy all such applicable

Nasdaq continued listing requirements, our common stock may be delisted from Nasdaq, which could adversely affect the liquidity and market

price of our common stock.

Our

common stock is currently listed on The Nasdaq Capital Market, which has qualitative and quantitative continued listing requirements,

including corporate governance requirements, public float requirements and a $1.00 minimum closing bid price requirement. Our common

stock price has been and may in the future be below the minimum bid price for continued listing on Nasdaq. On October 2, 2024, we received

notice from Nasdaq indicating that the closing bid price for our common stock had fallen below the minimum bid price for continued listing

for 30 consecutive trading days and was no longer in compliance with the minimum bid price requirement. In order to regain compliance,

the closing bid price of our common stock must be equal to or above $1.00 for a period of 10 consecutive trading days prior to March

31, 2025. The closing price of our common stock was equal to or above $1.00 for 15 consecutive trading days during the 15-trading day

period ended December 13, 2024. However, Nasdaq has discretion to extend the 10-trading day period, and, as of February 11, 2025, we

have not yet received notice from Nasdaq indicating that we had regained compliance with the minimum closing bid price requirement. In

the event the Company fails to regain compliance by March 31, 2025, the Company may be eligible for an additional grace period of 180

days, so long as it meets the applicable market value of publicly held shares requirement and other applicable listing standards for

the Nasdaq Capital Market, other than the minimum bid price requirement, on the trading date prior to the deadline, and informs Nasdaq

of its intent to cure this deficiency. If we fail to meet these requirements or fail to satisfy any other continued listing requirements,

Nasdaq may take steps to delist our common stock.

In

addition, Nasdaq has recently adopted new rules that could hinder our ability to cure our deficiency and maintain the continued listing

of our common stock. These new rules, which became effective in January 2025, provide for the immediate delisting with no grace period

of any listed company that falls out of compliance after the effective date with the minimum bid price requirement for the second time

in a twelve-month period, provide for immediate delisting if a listed company effects a reverse stock split that causes it to fall out

of compliance with certain other listing requirements, and limit the ratio of reverse stock splits to a cumulative ratio of 1-to-250

in any two-year period. Delisting would likely have an adverse effect on the liquidity of our common stock, decrease the market price

of our common stock, result in the potential loss of confidence by investors, suppliers, customers, and employees, and fewer business

development opportunities, and adversely affect our ability to obtain financing for our continuing operations, including our ability

to issue and sell additional notes to the Investor party to the 2024 Securities Purchase Agreement.

The

sale or availability for sale of shares issuable upon conversion of the Notes may depress the price of our common stock and encourage

short sales by third parties, which could further depress the price of our common stock.

To

the extent that one or more investors in the Notes sell shares of our common stock issued upon conversion of the Notes, the market price

of such shares may decrease due to the additional selling pressure in the market. In addition, the risk of dilution from issuances of

such shares may cause stockholders to sell their shares of our common stock, which could further contribute to any decline in the price

of our common stock. Any downward pressure on the price of our common stock caused by the sale or potential sale of such shares could

encourage short sales by third parties. Such sales could place downward pressure on the price of our common stock by increasing the number

of shares of our common stock being sold, which could further contribute to any decline in the market price of our common stock.

If

you purchase Notes in this offering, you may experience future dilution as a result of future equity offerings, convertible debt offerings

or other equity issuances.

In

order to raise additional capital, we may in the future offer and issue additional shares of our common stock or other securities convertible

into or exchangeable for shares of our common stock. We cannot assure you that we will be able to sell shares or other securities in

any offering at a price per share that is equal to or greater than the price per share paid by investors in previous offerings, and investors

purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which

we sell additional shares of our common stock or other securities convertible into or exchangeable for shares of our common stock in

future transactions may be higher or lower than the price per share in previous offerings. Further, we may choose to raise additional

capital due to market conditions or strategic considerations, even if we believe we have sufficient funds for our current or future operating

plans. In addition, the exercise of outstanding stock options and warrants or the settlement of outstanding restricted stock units, or

the issuance of shares of our common stock upon conversion of Notes, would result in further dilution of your investment. The issuance

of such additional shares of our common stock (including pursuant to the exercise of outstanding stock options or warrants or the conversion

of Notes), or securities convertible into or exchangeable or exercisable for shares of our common stock, may result in downward pressure

on the price of our common stock.

Provisions

in the Notes may deter or prevent a business combination that may be favorable to you.

Under

the terms of the Notes, we are prohibited from engaging in certain mergers or acquisitions unless, among other things, the surviving

entity in certain circumstances assumes our obligations under the Notes. In addition, pursuant to the terms of the Notes, we may be required

to redeem the Notes for cash at a premium in the event of certain change of control transactions. In addition, in the event of a non-stock

takeover of our company, we may be required to redeem the Notes for cash at a premium. These and other provisions could prevent or deter

a third party from acquiring us, even where the acquisition could be beneficial to you.

If

you are a U.S. holder, you may be deemed to receive a taxable distribution without the receipt of any cash or property.

The

conversion rate of the Notes is subject to adjustment in certain circumstances. Adjustments to the conversion rate of the Notes that

have the effect of increasing your proportionate interest in our assets or “earnings and profits” may in some circumstances

result in a constructive distribution subject to U.S. federal income tax without the receipt of any cash. You are urged to consult your

tax advisors with respect to the U.S. federal income tax consequences resulting from an adjustment to the conversion rate of the Notes.

See “Certain Material U.S. Federal Income Tax Considerations.” Similarly, any adjustment to the number of shares that will

be issued on the exercise of a Warrant, or an adjustment to the exercise price of a Warrant, may be treated as a constructive distribution

to you if, and to the extent that, such adjustment has the effect of increasing your proportionate interest in our assets or “earnings

and profits.” An adjustment can be treated as a constructive distribution regardless of whether you ever exercise the Warrant or

receive any cash or property as a result of the adjustment (or, in certain circumstances, a failure to adjust). You are urged to consult

your tax advisors with respect to the U.S. federal income tax consequences resulting from an adjustment to the number of shares that

will be issued on the exercise of a Warrant, or an adjustment to the exercise price of a Warrant. See “Certain Material U.S. Federal

Income Tax Considerations.”

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain

statements contained in or incorporated by reference into this prospectus supplement, other than purely historical information, including,

but not limited to, estimates, projections, statements relating to our business plans, objectives and expected operating results, and

the assumptions upon which those statements are based, contain forward-looking statements reflecting our current expectations that involve

risks and uncertainties. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation

Reform Act of 1995. When used in this prospectus supplement, the words “anticipate,” “expect,” “plan,”

“believe,” “seek,” “estimate” and similar expressions are intended to identify forward-looking statements.

These are statements that relate to future periods and include, but are not limited to, statements about the features, benefits and performance

of our products, our ability to introduce new product offerings and increase revenue from existing products, expected expenses including

those related to selling and marketing, product development and general and administrative, our beliefs regarding the health and growth

of the market for our products, anticipated increase in our customer base, expansion of our products functionalities, expected revenue

levels and sources of revenue, expected impact, if any, of legal proceedings, the adequacy of our liquidity and capital resources, the

likelihood of us obtaining additional financing in the immediate future and the expected terms of such financing, and expected growth

in business. Forward-looking statements are statements that are not historical facts. Such forward-looking statements are subject to

risks and uncertainties, which could cause actual results to differ materially from the forward-looking statements contained in this

prospectus supplement. Factors that could cause actual results to differ materially include, but are not limited to: our

ability to develop and manufacture our new product portfolio, including the W4 CC, W750, W56 and other programs; our ability to attract

and retain customers for our existing and new products; the possible implementation of changes to the existing tariff regime by the incoming

Presidential Administration; risks associated with obtaining orders and executing upon such orders; the unavailability, reduction, elimination

or adverse application of government subsidies and incentives or any failure by the federal government, states or other governmental

entities to adopt or enforce regulations such as the California Air Resource Board’s Advanced Clean Fleet regulation; supply chain

disruptions, including constraints on steel, semiconductors and other material inputs and resulting cost increases impacting our Company,

our customers, our suppliers or the industry; our ability to capitalize on opportunities to deliver products to meet customer requirements;

our limited operations and need to expand and enhance elements of our production process to fulfill product orders; our general inability

to raise additional capital to fund our operations and business plan; our ability to obtain financing to meet our immediate liquidity

needs and the potential costs, dilution and restrictions imposed by any such financing; our ability to regain compliance with the current

and proposed listing requirements of the Nasdaq Capital Market and otherwise maintain the listing of our securities thereon and the impact

of the steps we take to regain such compliance, on our operations, stock price and future access to liquidity; our ability to protect

our intellectual property; market acceptance of our products; our ability to obtain sufficient liquidity from operations and financing

activities to continue as a going concern and, our ability to control our expenses; the effectiveness of our cost control measures and

impact such measures could have on our operations, including the effects of furloughing employees; potential competition, including without

limitation shifts in technology; volatility in and deterioration of national and international capital markets and economic conditions;

global and local business conditions; acts of war (including without limitation the conflicts in Ukraine and Israel) and/or terrorism;

the prices being charged by our competitors; our inability to retain key members of our management team; our inability to satisfy our

customer warranty claims; the outcome of any regulatory or legal proceedings, including with Coulomb Solutions Inc.; our ability to consummate

and realize the benefits of a potential sale and leaseback transaction of our Union City Facility; and other risks and uncertainties

and other factors discussed from time to time in our filings with the SEC. Forward-looking statements speak only as of the date hereof.

We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained

herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any

such statement is based, except as required by law.

Discussions

containing these forward-looking statements may be found, among other places, in “Business” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” incorporated by reference from our most recent Annual

Report on Form 10-K and our Quarterly Reports on Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the

SEC or in any Current Report on Form 8-K. These forward-looking statements involve known and unknown risks, uncertainties and other factors

that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed

or implied by these forward-looking statements. While we believe that we have a reasonable basis for each forward-looking statement contained

in this prospectus, we caution you that these statements are based on a combination of facts and factors currently known by us and our

projections of the future, about which we cannot be certain. As a result of these factors, we cannot assure you that the forward-looking

statements in this prospectus and the documents incorporated by reference herein will prove to be accurate. Furthermore, if our forward-looking

statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking

statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our

objectives and plans in any specified time frame, or at all. You should not place undue reliance on these forward-looking statements,

which apply only as of the date of this prospectus supplement. You should read this prospectus supplement, the base prospectus, and the

documents incorporated by reference herein and therein completely and with the understanding that our actual future results may be materially

different from what we expect.

We

undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

You are advised, however, to consult any further disclosures we make on related subjects in our Annual Reports on Form 10-K, Quarterly

Reports on Form 10-Q, Current Reports on Form 8-K, as well as any amendments thereto.

USE

OF PROCEEDS

Pursuant

to the Lockbox Letter, the proceeds to be received from the issuance of the Notes hereunder, after fees and expenses, will be deposited

into a lockbox account under the control of the collateral agent under the Securities Purchase Agreement. Funds may be released from

the lockbox from time to time (i) in an amount corresponding to the principal amount converted, if the investor converts any portion

of the Notes issued hereunder; (ii) in the amount of $2,625,000 each calendar month, if the Company satisfies the conditions of a Market

Release Event (as defined in the Lockbox Letter), including minimum common stock price and trading volume conditions; or (iii) otherwise,

with the consent of the investor.

We

estimate that our net proceeds from this offering will be approximately $30.5 million, after deducting estimated offering expenses payable

by us, all of which will be deposited into the lockbox account and subject to the conditions on release described above. If the Warrants

that we are offering are fully exercised for cash at an exercise price of $0.6999 per share, we will receive additional proceeds of up

to approximately $38.6 million. We expect to use the net proceeds from this offering for working capital and other general corporate

purposes.

DIVIDEND

POLICY

We

have never declared or paid cash dividends on our common stock. We currently anticipate that we will retain all future earnings to fund

the operations of our business and do not anticipate paying dividends on the common stock in the foreseeable future.

DESCRIPTION

OF THE NOTES

We

are offering $35,000,000 aggregate principal amount of our senior secured convertible notes (“Notes”), which Notes are convertible

into shares of our common stock, par value $0.001 per share, under certain conditions more fully described below. The Notes are being

sold pursuant to this prospectus supplement, the Indenture (as defined below), and the terms of the securities purchase agreement dated

as of March 15, 2024 (the “Securities Purchase Agreement”) between us and in the purchaser(s) of the Notes. This prospectus

supplement also covers the shares of our common stock issuable from time to time upon conversion or otherwise under the Notes.

The

following is a description of the material terms of the Notes and the Indenture, and supplements the information under the heading “Description

of Debt Securities” in the accompanying prospectus and, to the extent it is inconsistent, replaces the description in the accompanying

prospectus. It does not purport to be complete. This summary is subject to and is qualified by reference to all the provisions of the

Notes and the Indenture, including the definitions of certain terms used therein. We urge you to read these documents and the Securities

Purchase Agreement because they, and not this description, define your rights as a holder of the Notes. You may request copies of the

Indenture, the form of Note and the Securities Purchase Agreement as set forth under the caption “Where You Can Find More Information.”

General

The

Notes are being issued pursuant to the Twelfth Supplemental Indenture, dated as of February 12, 2025, between us and U.S. Bank Trust

Company, National Association, as trustee, or the Trustee. The Twelfth Supplemental Indenture supplements the indenture entered into

between us and the Trustee, dated as of December 27, 2023, or the Base Indenture. We refer to the Base Indenture, as supplemented by

the Twelfth Supplemental Indenture, as the Indenture. The Indenture has been qualified under the Trust Indenture Act of 1939, and the

terms of the Notes include those set forth in the Indenture and those made part of the Indenture by reference to the Trust Indenture

Act.

We

will issue the Notes as senior secured obligations of the Company under the Indenture. The Notes are being issued with an original issue

discount of 12.5%. The Notes will be issued in certificated form and not as global securities.

Closing;

Prior Closings; Additional Closings

At

the closing of this offering, we will issue $35,000,000 in aggregate principal amount of senior secured convertible notes, or the Notes,

to certain institutional investors.

We

have previously issued Notes under the Securities Purchase Agreement in the aggregate original principal amount of $42,485,714 and warrants

exercisable 15,640,900 shares of common stock in the aggregate (following adjustment in connection with the Company’s 1-for-20

reverse stock split, which became effective on June 17, 2024). As of February 11, 2025, $8,350,000 aggregate principal amount remained

outstanding under the Notes, and no shares had been issued pursuant to the Warrants. Upon our filing of one or more additional prospectus

supplements, and our satisfaction of certain other conditions, either we or an investor may elect to consummate additional closings of

up to $61,514,286 in aggregate principal amount of senior secured convertible notes at additional closings, or the Additional Notes,

pursuant to the Securities Purchase Agreement. However, we are not registering pursuant to this prospectus supplement the issuance of

any such Additional Notes (or shares of common stock issuable upon conversion or otherwise of such Additional Notes) that may be issued,

from time to time, at such additional closings under the Securities Purchase Agreement. Except as otherwise set forth in the Additional

Notes, the Additional Notes will be identical in all material respect to the Notes, except that they will be issued pursuant to an additional

prospectus supplement and a separate supplemental indenture and will have a maturity date of the first anniversary of the date of such

issuance thereof, subject to extension at the option of the holders in certain circumstances more fully described below.

Maturity

Date

Unless

earlier converted, or redeemed, the Notes will mature on the one year anniversary of the issuance date, which we refer to herein as the

“Maturity Date”, subject to the right of the investors to extend the date:

| |

(i) |

if

an event of default under the Notes has occurred and is continuing (or any event shall have occurred and be continuing that with

the passage of time and the failure to cure would result in an event of default under the Notes); and/or |

| |

|

|

| |

(ii) |

for

a period of 20 business days after the consummation of a fundamental transaction if certain events occur. |

We

are required to pay, on the Maturity Date, all outstanding principal, accrued and unpaid interest and accrued and unpaid late charges

on such principal and interest, if any.

Interest

The

Notes bear interest at the rate of 9.0% per annum and (a) shall commence accruing on the date of issuance, (b) shall be computed on the

basis of a 360-day year and twelve 30-day months and (c) shall be payable either in cash or in-kind by compounding and becoming additional

principal, at our option, in arrears on the first calendar day of each quarter. If a holder elects to convert or redeem all or any portion

of a Note prior to the Maturity Date, all accrued and unpaid interest on the amount being converted or redeemed will also be payable.

The

interest rate of the Notes will automatically increase to 18.0% per annum, or the Default Rate, upon the occurrence and continuance of

an event of default (See “— Events of Default” below).

Ranking;

Security

The

Notes will be senior secured obligations of the Company and will be secured by a first priority perfected security interest in all of

the existing and future assets of the Company and its direct and indirect subsidiaries. Our obligations under the Notes will be fully

and unconditionally guaranteed by all of our subsidiaries.

Late

Charges

We

are required to pay a late charge of 18% on any amount of principal or other amounts that are not paid when due (solely to the extent

such amounts are not then accruing interest at the Default Rate).

Conversion

Conversions

at Option of Holder

Each

holder of Notes may convert all, or any part, of the outstanding principal of the Notes, together with accrued and unpaid interest and

any late charges thereon, at any time at such holder’s option, into shares of our common stock at the “Conversion Price,”

which, at the election of the converting holder, is equal to the lower of:

| |

● |

87.5% of the volume weighted

average price of our common stock during the ten trading days ending and including the trading day immediately preceding the delivery

or deemed delivery of the applicable conversion notice. |

The

reference price is subject to (i) proportional adjustment upon the occurrence of any stock split, stock dividend, stock combination and/or

similar transactions, and (ii) full-ratchet adjustment in connection with a subsequent offering at a per share price less than the fixed

conversion price then in effect, subject to certain customary exceptions.

Voluntary

Adjustment Right

Subject

to the rules and regulations of Nasdaq, we have the right, at any time, with the written consent of the investor, to lower the reference

price to any amount and for any period of time deemed appropriate by our board of directors.

Conversion

Limitations

Beneficial

Ownership Limitation

Conversions

and issuance of our common stock pursuant to the Notes are prohibited if such conversion or issuance would cause the applicable holder

(together with its affiliates) to beneficially own in excess of 9.99% of the outstanding shares of our common stock.

Events

of Default

Under

the terms of the Indenture, the events of default contained in the Indenture shall not apply to the Notes. Rather, the Notes contain

standard and customary events of default including, among others, the following:

| ● | the

suspension from trading or the failure of our common stock to be trading or listed on an

eligible stock exchange for a period of five consecutive trading days; |

| ● | our

failure to deliver shares of common stock upon conversion of the Notes or exercise of the

Warrants within prescribed timeframes; |

| ● | our

failure to maintain required reserves of shares of our common stock to be issued upon conversion

of the Notes; |

| ● | our

failure to pay to any amount due under the Notes when and as due (subject to any applicable

cure periods); |

| ● | the

occurrence of any unscheduled redemption or acceleration of maturity of at least an aggregate

of $250,000 of Indebtedness (as defined in the Securities Purchase Agreement) of the Company

or any of its subsidiaries, other than with respect to any other Notes issued pursuant to

the Securities Purchase Agreement; |

| ● | if

any bankruptcy, insolvency, reorganization or liquidation proceedings or other proceedings

for the relief of debtors shall be instituted by or against us or any subsidiary and, if

instituted against us or any subsidiary by a third party, shall not be dismissed within thirty

(30) days of their initiation; |

| ● | the

commencement by us or any subsidiary of a voluntary case or proceeding under any applicable

federal, state or foreign bankruptcy, insolvency, reorganization or other similar law or

of any other case or proceeding to be adjudicated a bankrupt or insolvent, or similar occurrences; |

| ● | a

final judgment or judgments for the payment of money aggregating in excess of $250,000 are

rendered against the Company and/or any of its subsidiaries and which judgments are not,

within 30 days after the entry thereof, bonded, discharged, settled or stayed pending appeal,

or are not discharged within 30 days after the expiration of such stay, subject to specified

exceptions; |

| ● | the

Company and/or any subsidiary either (i) fails to pay, when due, or within any applicable

grace period, any payment with respect to any Indebtedness in excess of $250,000 due to any

third party or is otherwise in breach or violation of any agreement for monies owed or owing

in an amount in excess of $250,000, which breach or violation permits the other party thereto

to declare a default or otherwise accelerate amounts due thereunder, or (ii) suffer to exist

any other circumstance or event that would result in a default under any agreement binding

the Company or any subsidiary that would or is likely to have a material adverse effect on

the Company’s business, assets, operations, liabilities, properties, condition or prospects; |

| ● | breaches

by the Company of any representation or warranty in any material respect, or any covenant

or other term or condition of any transaction document associated with this offering; |

| ● | the

delivery of a materially false or inaccurate certification by the Company that certain equity

conditions are satisfied, there has been no failure to satisfy the equity conditions, or

as to whether any event of default has occurred; |

| ● | any

breach or failure in any respect by the Company or any subsidiary to comply with certain

covenants specified in the Notes or the applicable Supplemental Indenture; |

| ● | the

occurrence of any Material Adverse Effect (as defined in the Securities Purchase Agreement)

occurs; |

| ● | if

any provision of the transaction documents associated with this offering shall cease to be

valid and binding on or enforceable against the parties thereto, or the validity or enforceability

thereof shall be contested by any party thereto; |

| ● | if

the security agreements associated with this offering fail or cease to create a separate

valid and perfected and, except to the extent permitted by the terms hereof or thereof, first

priority lien in favor of the Collateral Agent (as defined in the Securities Purchase Agreement); |

| ● | The

occurrence of any material damage to, or loss, theft or destruction of, any collateral, whether

or not insured, or any strike, lockout, labor dispute, embargo, condemnation, act of God

or public enemy, or other casualty which causes, for more than 15 consecutive days, the cessation

or substantial curtailment of revenue producing activities at any facility of the Company

or any subsidiary, if any such event or circumstance could have a material adverse effect;

or |

| ● | any

Event of Default (as defined in the any other Notes issued pursuant to the Securities Purchase

Agreement). |

Holder

Redemption Rights

Event

of Default Redemption

Upon

an event of default, each holder of Notes may require us to redeem in cash all, or any portion, of the Notes at the greater of (i) the

face value of our common stock underlying the Notes at a 75% premium and (ii) the equity value of our common stock underlying the Notes.

The

equity value of our common stock underlying the Notes is calculated using the greatest closing sale price of our common stock during

the period immediately preceding such event of default and ending the we make the entire payment required.

Bankruptcy

Event of Default Mandatory Redemption

If

any bankruptcy event of default occurs, we shall immediately redeem in cash all, or any portion of the Notes at a 75% redemption premium,

unless the holder waives such right to receive payment.

Change

of Control Redemption

In

connection with a change of control of the Company, each holder may require us to redeem in cash all, or any portion, of the Notes at

a price equal to the greatest of:

| ● | the

face value of the Notes to be redeemed at a 25% premium (or at a 75% premium, if certain

redemption conditions are not satisfied or during the occurrence and continuance of an event

of default), except that if the Company is required to make a redemption under the Note issued

hereunder and no event of default has occurred and is continuing and there is no redemption

conditions failure, the redemption premium on principal and interest of the Note issued hereunder

corresponding to funds held in the lockbox account will be 10%; |

| ● | the

equity value of our common stock underlying such Notes; and |

| ● | the

equity value of the change of control consideration payable to the holder of our common stock

underlying such Notes. |

The

equity value of our common stock underlying the Notes is calculated using the greatest volume weighted average price of our common stock

during the period immediately preceding the consummation or the public announcement of the change of control and ending on the date the

holder gives notice of such redemption.

The

equity value of the change of control consideration payable to the holder of our common stock underlying the Notes is calculated using

the aggregate cash consideration per share of our common stock to be paid to the holders of our common stock upon the change of control.

Subsequent

Placement Redemption Right

The

holders of the Notes may require us to redeem the Notes, in whole or in part, upon the occurrence of certain offerings of equity or equity-linked

securities. In such an event, we would be required to redeem Notes using 20% of the gross proceeds of such an offering.

Asset

Sale Redemption Right

Upon

the occurrence of certain asset sales, each holder of Notes may require us to redeem such holder’s Notes, all or any portion of

the pro rata portion of the gross proceeds from such asset sale payable to such holder.

Redemption

Upon Insufficient Authorized Shares

In

the event we are not able to issue all shares of common stock subject to a conversion notice due to an Authorized Share Failure (as defined

in the Notes), the Company shall pay cash in exchange for the redemption of the conversion amount that cannot be converted, based on

the greatest volume weighted average price of our common stock during the period commencing on the delivery or deemed delivery of the

applicable conversion notice and ending on the date we make the required payment, plus any brokerage commissions and other out of pocket

expenses, if any, the holder incurred in connection with such Authorized Share Failure.

Company

Redemption Right

At

any time, we have the right to redeem in cash all, but not less than all, the amount then outstanding under the Notes at the greater

of (i) the face value of the Notes at premium of 25% (or 75% during the occurrence and continuance of an event of default) and (ii) the

equity value of the shares of common stock underlying the Notes.

The

equity value of our common stock underlying the Notes is calculated using the two greatest volume weighted average prices of our common

stock during the period immediately preceding the date of such redemption and ending on the date we make the required payment.

Participation

Rights

The

holders of the Notes are entitled to receive any dividends paid or distributions made to the holders of our shares of common stock on

an “as if converted” basis.

Pursuant

to the terms of the Securities Purchase Agreement, investors in this offering may participate in any financing completed by us prior

to the third anniversary of the issuance of the Notes (or, if later, the date no Notes remain outstanding), in an amount up to thirty

five percent (35%) of the amount raised in said financings, subject to standard carve outs and excluding certain transactions, including

certain at-the-market offerings.

Purchase

Rights

If

we issue options, convertible securities, warrants, shares, or similar securities to holders of our shares of common stock, each Note

holder has the right to acquire the same as if the holder had converted its Note.

Fundamental

Transactions

The

Notes prohibit us from entering specified fundamental transactions (including, without limitation, mergers, business combinations and

similar transactions) unless we (or our successor) is a public company that assumes in writing all of our obligations under the Notes,

other than Going-Private Change of Control (as defined in the Notes).

Covenants

The

Notes contain a variety of obligations on our part not to engage in specified activities, which are typical for transactions of this

type, as well as the following covenants:

| ● | we

and our subsidiaries will not, directly or indirectly, incur any indebtedness except for

permitted indebtedness; |

| ● | we

and our subsidiaries will not, directly or indirectly, redeem or repay all or any portion

of any indebtedness (other than the Notes) if at the time the payment is due or is made or,

after giving effect to the payment, an event constituting, or that with the passage of time

and without being cured would constitute, an event of default under the Notes has occurred

and is continuing; |

| ● | we

and our subsidiaries will not (directly or indirectly) engage in a material line of business

substantially different from those lines of business as of the date of the issuance of the

Notes; |

| |

● |

we and our subsidiaries

will maintain and our existence, rights, and privileges, to become or remain, duly qualified and in good standing in each jurisdiction

in which the transaction of its business makes such qualification necessary; |

| |

|

|

| |

● |

we and our subsidiaries

will maintain and preserve, all of its properties which are necessary or useful in the proper conduct of our business; |

| |

|

|

| |

● |

we and our subsidiaries

will take all action necessary or advisable to maintain all of our intellectual property rights that are necessary or material to

the conduct of its business in full force and effect; |

| |

● |

we and our subsidiaries

will maintain insurance with in such amounts and covering such risks as is required by any governmental authority having jurisdiction

with respect thereto or as is in accordance with sound business practice by similarly situated companies; |

| |

● |

we and our subsidiaries

will not, (directly or indirectly), enter into, renew, extend or be a party to, any transaction or series of related transactions

with any affiliate, except transactions in the ordinary course of business and on terms that are comparable to an arm’s length

transaction with a non-affiliate; |

| |

● |

we will not, directly or

indirectly, without the prior written consent of the holders of a majority in aggregate principal amount of the Notes then outstanding,

(i) issue any Notes (other than as contemplated by the Securities Purchase Agreement and the Notes) or (ii) issue any other securities

that would cause a breach or default under the Notes or the Warrants; |

| |

● |

we will maintain, as of

the end of each fiscal quarter (and/or fiscal year, as applicable) a balance of available cash (excluding cash held in restricted

accounts or otherwise unavailable for unrestricted use by the Company or its subsidiaries) in an aggregate amount equal to $1.5 million

prior to the consummation of a sale-leaseback of the Company’s Union City, Indiana facility, and $4.0 million thereafter; provided,

however, that if the proceeds of the sale-leaseback have been used to redeem Notes, then the minimum available cash amount

shall be $1.5 million on any date of determination on which the outstanding principal amount of the Notes does not exceed $1.0 million;

and |

| |

● |

we and our subsidiaries

will pay when due all taxes, fees or other charges of any nature whatsoever now or hereafter imposed or assessed us, subject to certain

exceptions. |

Governing

Law

The

Notes will be governed by, and construed in accordance with, the laws of Delaware without regard to its conflicts of law principles.

Additional

Provisions of Twelfth Supplemental Indenture

No

Global Securities

Under

the Twelfth Supplemental Indenture, none of the Notes shall be represented by global securities.

Amendments

to Twelfth Supplemental Indenture and Notes

The

Twelfth Supplemental Indenture may be amended by the written consent of the Company, the Trustee and the holders of a majority of the