0001579214false00015792142025-02-262025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 26, 2025 |

Emerald Holding, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38076 |

42-1775077 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

100 Broadway, 14th Floor |

|

New York, New York |

|

10005 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (949) 226-5700 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.01 per share |

|

EEX |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On February 26, 2025, Emerald Holding, Inc. (the “Company”) issued a press release announcing that it will release its financial results for the fourth quarter and full year 2024 before the market open on Friday, March 14, 2025, and will host a conference call to discuss the results at 8:30am ET on the same day. The Company also announced that its Board of Directors declared a dividend on February 25, 2025 for the quarter ending March 31, 2025, of $0.015 per share payable on March 20, 2025 to holders of Emerald’s common stock as of March 10, 2025.

A copy of the press release is attached to this report as Exhibit 99.1. The information furnished pursuant to Item 8.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

EMERALD HOLDING, INC. |

|

|

|

|

Date: |

February 26, 2025 |

By: |

/s/ David Doft |

|

|

|

David Doft

Chief Financial Officer |

Emerald Announces Date for Fourth Quarter and Full Year 2024 Financial Results Conference Call; Declares Quarterly Dividend

NEW YORK - February 26, 2025 - Emerald Holding, Inc. (NYSE: EEX) (“Emerald” or the “Company”), today announced that it will release its financial results for the fourth quarter and full year 2024 before the market open on Friday, March 14, 2025. The Company will hold a conference call to discuss the results at 8:30am ET on the same day.

The conference call can be accessed by dialing 1-800-715-9871 (domestic) or 1-646-307-1963 (international). A telephonic replay will be available beginning at 11:30am ET by dialing 1-800-770-2030, or for international callers, 1-647-362-9199. The passcode for the replay is 2638215. The replay will be available until 11:59pm ET on March 21, 2025.

Interested investors and other parties can access the webcast of the live conference call by visiting the Investors section of Emerald’s website at https://investor.emeraldx.com. An online replay will be available on the same website immediately following the call.

In addition, on February 25, 2025, Emerald’s Board of Directors declared a dividend for the quarter ending March 31, 2025, of $0.015 per share payable on March 20, 2025 to holders of Emerald’s common stock as of March 10, 2025.

About Emerald

Emerald Holding, Inc. (NYSE: EEX) is the largest U.S.-based B2B event organizer, empowering businesses year-round by expanding meaningful connections, developing influential content, and delivering powerful commerce-driven solutions. As the owner and operator of a curated portfolio of B2B events spanning trade shows, conferences, B2C showcases and a scaled hosted buyer platform, Emerald also delivers dynamic solutions across leading industries through its robust content and e-commerce marketplace. Emerald is a trusted partner for its thousands of customers, predominantly small and medium-sized businesses, playing a pivotal role in driving ongoing commerce through streamlined buying, selling, and networking opportunities. Powered by an experienced team, Emerald is fostering impactful engagement and delivering unparalleled market access with a commitment to driving business growth 365 days a year. For more:  http://www.emeraldx.com

http://www.emeraldx.com

Forward-Looking Statements

The information set forth in this release contains certain forward-looking statements regarding the Company and its subsidiaries, including, without limitation, statements regarding the Company’s ability to continue staging live events and scale its business beyond pre-COVID levels; statements about general economic conditions, or more specifically about the markets in which the Company operates, and the Company’s expectations, beliefs, plans, strategies, objectives, prospects, assumptions or future events or performance; the multiple avenues to return to organic growth; expectations regarding interest rates and economic conditions; the Company’s ability to successfully identify and acquire acquisition targets; and the Company’s intention to continue to pay regular quarterly dividends, among others. In particular, the declaration, timing and amount of any future dividends will be subject to the discretion and approval of the Company’s Board of Directors and will depend on a number of factors. The forward-looking statements contained herein are based on management’s current expectations as well as estimates and assumptions prepared by management as of the date hereof, and although they are believed to be reasonable, they are inherently uncertain and not guaranteed. These statements involve risks and uncertainties outside of the Company’s control that may cause actual results, performance, or achievements to differ materially, and there can be no assurance that the forward-looking statements included herein will prove to be accurate. In addition, even if the Company’s results of operations, financial condition and liquidity, and events in the industry in which it operates, are consistent with the forward-looking statements contained herein, they may not be predictive of results or developments in future periods. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Forward looking statements include all statements that are not historical facts and can be identified by terms such as “anticipate,” “believe, “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” or “would” or similar expressions and the negatives of those terms. For factors that could cause actual results to differ materially from the forward-looking statements included herein, please see the risks and uncertainties identified under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s most recently filed annual report on Form 10-K for the year ended December 31, 2023, which is available on the Company’s Investor Relations website at investor.emeraldx.com and on the SEC’s EDGAR website at www.sec.gov. The Company disclaims any obligation to update or revise any of the forward-looking statements contained herein, whether as a result of new information, future events or otherwise. Past results are not indicative of future performance.

Emerald Holding, Inc.

Investor Relations

investor.relations@emeraldx.com

1-866-339-4688 (866EEXINVT)

Source: Emerald Holding, Inc.

v3.25.0.1

Document And Entity Information

|

Feb. 26, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 26, 2025

|

| Entity Registrant Name |

Emerald Holding, Inc.

|

| Entity Central Index Key |

0001579214

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-38076

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

42-1775077

|

| Entity Address, Address Line One |

100 Broadway, 14th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10005

|

| City Area Code |

(949)

|

| Local Phone Number |

226-5700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

EEX

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

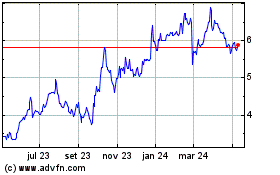

Emerald (NYSE:EEX)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

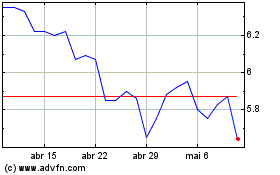

Emerald (NYSE:EEX)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025