UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

Report of

Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

UNDER the

Securities Exchange Act of 1934

For the month of March 3, 2025

Commission File Number: 001-39766

ORLA MINING LTD.

(Translation of registrant's name into English)

1010-1075

West Georgia Street

Vancouver,

BC

V6E

3C9

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

ORLA MINING LTD.. |

| |

|

| Date: March 3, 2025 |

|

/s/ Etienne Morin |

| |

Name: Etienne Morin

Title: Chief Financial Officer

|

| |

|

EXHIBIT INDEX

Exhibit 99.1

| News Release |  |

Orla Mining Completes Strategic Acquisition of

the Musselwhite Gold Mine

VANCOUVER, BC, March 3, 2025 /CNW/ - Orla Mining

Ltd. (TSX: OLA) (NYSE: ORLA) ("Orla" or the "Company") is pleased to announce that the Company has completed

its acquisition (the "Transaction") of the Musselwhite Gold Mine ("Musselwhite") in Ontario, Canada from

Newmont Corporation ("Newmont"). (All amounts in this press release are in US dollars unless otherwise indicated).

"The addition of Musselwhite transforms Orla

into a North American-centred, geographically diversified intermediate gold producer with multiple gold-producing assets and a self-funded

growth portfolio. Musselwhite strengthens our North American presence and more than doubles our annual gold production. This important

Canadian gold mine also offers growth potential through optimization and mine life extension, something we intend to aggressively pursue.

On behalf of the entire Orla Mining team, I want

to thank our shareholders who have overwhelmingly supported our growth ambitions. I would also like to extend my sincere gratitude to

Prem Watsa of Fairfax, and Pierre Lassonde, for their trust, support, and encouragement throughout the transaction process.

Orla intends to place a strong emphasis on local

stakeholders in Northern Ontario. We will maintain all existing relationships and honour all existing contracts with First Nations partners,

businesses, suppliers, contractors, and vendors.

To the Musselwhite employees, we are thrilled to

welcome you to the Orla team and look forward to building upon your foundation of hard work, dedication, and success. We are committed

to investing in you and the operation for many years to come and we're excited to hit the ground running."

- Jason Simpson,

President and CEO, Orla Mining

Musselwhite Mine

| • | Musselwhite is a producing, underground gold mine located

on the shore of Opapimiskan Lake in Northwestern Ontario. It has been in operation for over 25 years, having produced close to 6 million

ounces of gold to date, with a long history of resource growth and conversion. |

| • | Based only on the current technical report, Musselwhite has

a mine life until 2030 with average annual gold production of 202 koz at $1,269/oz all-in sustaining cost ("AISC")1,2.

Significant opportunities exist to optimize the operation and extend mine life through known extensions of the ore body. |

| • | The NPV5% at January 1, 2025, of Musselwhite is estimated

at approximately $1 billion using a flat $2,500 gold price2. |

| • | The addition of Musselwhite transforms Orla into a multi-asset

intermediate producer with an immediate 140% increase in annual gold production to over 300 koz at competitive costs. |

| • | This acquisition builds on Orla's established track record

of development and operating success and is aligned with the Company's strategy for growth and value creation, as exemplified by an over

500% share return in the Company's less than 10-year history. |

| • | The upfront cash consideration for the acquisition of $810

million and gold-price linked contingent consideration of $40 million3. |

| ________________________________________ |

| 1 Non-GAAP measure. Excludes exploration and project growth spending. Refer to the "Non-GAAP Measures" section of this news release. |

| 2 Per the Company's technical report for the Musselwhite Mine entitled "Technical Report - Musselwhite Mine Project, Ontario, Canada" with an effective date of November 18, 2024 (the "Musselwhite Technical Report") |

Transaction Structure and Acquisition Financing

As noted in the Company's press release on November

18, 2024, the Transaction has been structured to take advantage of Orla's strong balance sheet and financial flexibility and avoids any

upfront equity dilution. The $810 million in upfront consideration has been funded from a combination of debt, gold prepayment, new

convertible notes, and cash on hand (collectively, the "Transaction Financing") including:

| • | $250 million credit facility (the "Credit Facility")

with a syndicate of lenders comprised of the Bank of Nova Scotia, Bank of Montreal, Canadian Imperial Bank of Commerce and ING Capital

LLC, and consisting of: |

| • | $150 million from the Company's existing revolving credit

facility, with an August 2027 maturity. |

| • | $100 million under a three-year term loan, with quarterly

repayments of $5 million beginning December 31, 2025, and the balance to be paid at maturity. |

The interest rate under the Credit Facility

is based on the term Secured Overnight Financing Rate (SOFR), plus an applicable margin ranging from 2.50% to 3.75% based on the Company's

leverage ratio at the end of each fiscal quarter, provided that for the first two quarters there will be a minimum applicable margin of

3.0%. Orla will have the ability to repay the Credit Facility in full, without penalties, at any time prior to the maturity date.

| • | $360 million gold prepayment (the "Gold Prepayment")

executed with the Bank of Montreal, ING Capital Markets LLC and Canadian Imperial Bank of Commerce, with the following terms. |

| • | The Company has received an upfront payment of $360 million

based on gold forward prices averaging approximately $2,834 per ounce. |

| • | In exchange, the Company will make 36 equal monthly deliveries

of gold ounces from March 2025 to February 2028 totaling 144,887 gold ounces. |

| • | $200 million in senior unsecured convertible notes (the "Convertible

Notes") led by the Company's cornerstone shareholders, Fairfax Financial Holdings Limited ("Fairfax"), Pierre Lassonde,

and Trinity Capital Partners Corporation: |

| • | Coupon: 4.5% per annum, payable in cash. |

| • | Maturity: Five years from the date of issuance. |

| • | Conversion Right: The Convertible Notes may be

converted in full or in part at any time prior to the maturity date, by the holder thereof, into common shares (the "Shares")

of Orla. |

| • | Conversion Price: The initial conversion price for

the Convertible Notes will be C$7.90 per Share (the "Conversion Price"), which will be translated to US dollars at a fixed exchange

rate of 1.40 CAD/USD. The Conversion Price represents a premium of 42% relative to the closing price of the Shares on Friday November

15, 2024, the last trading day prior to the announcement of the Transaction. Based on the Conversion Price, 35,443,026 Shares are issuable

on conversion of the Convertible Notes. |

| • | Redemption Right: After the 18-month anniversary of

the issuance, the Company may redeem the Convertible Notes, provided that the 20-day volume weighted average price of the Shares is not

less than 130% of the Conversion Price. |

| • | Warrants: The holders of Convertible Notes received

a total of 23,392,397 common share purchase warrants (the "Warrants"), representing 0.66 Warrants for each Share issuable upon

conversion of the Convertible Notes. The Warrants shall have an exercise price of C$11.50 per Share and shall expire on the fifth anniversary

of the closing of the Transaction. |

| _________________________________________ |

| 3 $20 million to be paid to Newmont should the average spot gold price exceed $2,900/oz for the initial one-year period following closing of the Transaction; and $20 million to be paid to Newmont should the average spot gold price exceed $3,000/oz for the second full year period following closing of the Transaction. |

At the close of the Transaction, the Company had approximately

$191 million in cash, and $450 million in long-term debt, resulting in approximately $259 million in net debt4.

Next Steps

| • | The Musselwhite operation will be integrated into Orla through

2025. In the second quarter, the Company plans to provide updated 2025 guidance to include the Musselwhite Mine. |

| • | The Company intends to immediately begin an aggressive exploration

campaign to test historical drilling that suggests at least two to three kilometres of mineralized strike potential beyond the current

reserves. |

| __________________________________ |

| 4 Non-GAAP measure. Refer to the "Non-GAAP Measures" section of this news release. |

About Orla Mining Ltd.

Orla's corporate strategy is to acquire, develop,

and operate mineral properties where the Company's expertise can substantially increase stakeholder value. The Company has three material

projects, consisting of two operating mines and one development project, all 100% owned by the Company: (1) Camino Rojo, in Zacatecas

State, Mexico, an operating gold and silver open-pit and heap leach mine. The property covers over 139,000 hectares which contains a large

oxide and sulphide mineral resource, (2) Musselwhite Mine, in Northwestern Ontario, Canada, an underground gold mine that has been in

operation for over 25 years and produced close to 6 million ounces of gold, with a long history of resource growth and conversion, and

(3) South Railroad, in Nevada, United States, a feasibility-stage, open pit, heap leach gold project located on the Carlin trend in Nevada.

The technical reports for the Company's material projects are available on Orla's website at www.orlamining.com, and on SEDAR+ and EDGAR

under the Company's profile at www.sedarplus.ca and www.sec.gov, respectively.

Fairfax Early Warning Disclosure

Fairfax, through its insurance company subsidiaries,

acquired Convertible Notes in an aggregate principal amount of $150 million (approximately C$216.6 million) (the "Fairfax Convertible

Notes") and an aggregate of 17,544,302 Warrants (the "Fairfax Warrants" and together with the Fairfax Convertible Notes,

the "Fairfax Orla Securities"). The Fairfax Convertible Notes are convertible for an aggregate of 26,582,275 Shares. Immediately

prior to its acquisition of the Fairfax Orla Securities, Fairfax, through its insurance company subsidiaries, beneficially owned and controlled

56,817,229 Shares (or approximately 17.63% of all Shares), no Warrants and no Convertible Notes. Following its acquisition of the Fairfax

Orla Securities, assuming the conversion and exercise, as applicable, in full of all Fairfax Convertible Notes and Fairfax Warrants, Fairfax,

through its insurance company subsidiaries would own and control 100,943,806 Shares (representing approximately 27.55% of all Shares,

and an increase in Fairfax's interest in the Company by 9.92%).

The Fairfax Orla Securities were acquired by Fairfax

for investment purposes, and in the future, it may discuss with management and/or the board of directors of the Company any of the transactions

listed in clauses (a) to (k) of item 5 of Form F1 of National Instrument 62-103 - The Early Warning System and Related Take-over Bid

and Insider Reporting Issues and it may further purchase, hold, vote, trade, dispose or otherwise deal in the securities of the Company,

in such manner as it deems advisable to benefit from changes in market prices of the Company's securities, publicly disclosed changes

in the operations of the Company, its business strategy or prospects or from a material transaction of the Company.

An early warning report will be filed by Fairfax in

accordance with applicable securities laws and will be available on SEDAR+ at www.sedarplus.com or may be obtained directly from

John Varnell, Vice President, Corporate Development of Fairfax upon request at (416) 367-4941.

Fairfax's head and registered office is located at

95 Wellington Street West, Suite 800, Toronto, Ontario, M5J 2N7.

Orla's head and registered office is located at 1010-1075

W. Georgia St., Vancouver, British Columbia V6E 3C9.

Fairfax is a holding company which, through its subsidiaries,

is primarily engaged in property and casualty insurance and reinsurance and the associated investment management.

Qualified Persons Statement

The scientific and technical information in this news

release was reviewed and approved by Mr. J. Andrew Cormier, P. Eng., Chief Operating Officer of the Company, who is the Qualified Person

as defined under NI 43-101 standards.

Non-GAAP Measures

The Company has included certain performance measures

in this news release which are not specified, defined, or determined under generally accepted accounting principles (in the Company's

case, International Financial Reporting Standards ("IFRS")). These are common performance measures in the gold mining industry,

but because they do not have any mandated standardized definitions, they may not be comparable to similar measures presented by other

issuers. Accordingly, the Company uses such measures to provide additional information, and you should not consider them in isolation

or as a substitute for measures of performance prepared in accordance with generally accepted accounting principles ("GAAP").

In this section, all currency figures in tables are in millions, except per-share and per-ounce amounts.

All-In Sustaining Cost

The Company has provided AISC performance measures

that reflect all the expenditures that are required to produce an ounce of gold from operations. While there is no standardized meaning

of the measure across the industry, the Company's definition conforms to the AISC definition as set out by the World Gold Council in its

guidance dated November 14, 2018. Orla believes that this measure is useful to market participants in assessing operating performance

and the Company's ability to generate cash flow from operating activities.

Net Cash

Net cash is calculated as cash and cash equivalents

and short-term investments less total debt at the end of the reporting period. This measure is used by management to measure the

Company's debt leverage. The Company believes that net cash is useful in evaluating the Company's leverage and is also a key metric

in determining the cost of debt.

The figures below are as of February 28, 2025.

| NET CASH (DEBT) |

February 28, 2025 |

Dec 31, 2024 |

| Cash and cash equivalents |

$ 191 |

$ 161 |

| Long term debt |

$ (450) |

- |

| Net cash (debt) |

$ (259) |

$ 161 |

Preliminary Financial Results

The financial results contained in this news release

are preliminary. Such results represent the most current information available to the Company's management, as the Company completes its

financial procedures. The Company's audited consolidated financial statements for such period may result in material changes to the financial

information contained in this news release (including by any one financial metric, or all of the financial metrics, being below or above

the figures indicated) as a result of the completion of normal accounting procedures and adjustments.

Forward-looking Statements

This news release contains certain "forward-looking

information" and "forward-looking statements" within the meaning of Canadian securities legislation and within the meaning

of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended,

the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United States Securities and Exchange Commission,

all as may be amended from time to time, including, without limitation, statements regarding the potential benefits to be derived from

the Transaction; projected NPV, production, costs, growth potential, mine life extension and potential mineralization at Musselwhite;

annual gold production; the timing of update guidance and exploration plans for Musselwhite; and the Company's goals and strategies. Forward-looking

statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects

to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements

are made, and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements

were made, including without limitation, assumptions regarding: the successful integration of Musselwhite; the future price of gold and

silver; anticipated costs and the Company's ability to fund its programs; the Company's ability to carry on exploration, development,

and mining activities; tonnage of ore to be mined and processed; ore grades and recoveries; decommissioning and reclamation estimates;

currency exchange rates remaining as estimated; prices for energy inputs, labour, materials, supplies and services remaining as estimated;

the Company's ability to secure and to meet obligations under property agreements, including the layback agreement with Fresnillo plc;

that all conditions of the Credit Facility and the Gold Prepayment will be met; the timing and results of drilling programs; mineral reserve

and mineral resource estimates and the assumptions on which they are based; the discovery of mineral resources and mineral reserves on

the Company's mineral properties; the obtaining of a subsequent agreement with Fresnillo to access the sulphide mineral resource at the

Camino Rojo Project and develop the entire Camino Rojo Project mineral resources estimate; that political and legal developments will

be consistent with current expectations; the timely receipt of required approvals and permits, including those approvals and permits required

for successful project permitting, construction, and operation of projects; the timing of cash flows; the costs of operating and exploration

expenditures; the Company's ability to operate in a safe, efficient, and effective manner; the Company's ability to obtain financing as

and when required and on reasonable terms; that the Company's activities will be in accordance with the Company's public statements and

stated goals; and that there will be no material adverse change or disruptions affecting the Company, its properties or Musselwhite. Consequently,

there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially

from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which

could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: risk related to the

acquisition of the Musselwhite Mine from Newmont; uncertainty and variations in the estimation of mineral resources and mineral reserves;

risks related to the Company's indebtedness and gold prepayment obligations; risks related to exploration, development, and operation

activities; foreign country and political risks, including risks relating to foreign operations; delays in obtaining or failure to obtain

governmental permits, or non-compliance with permits; environmental and other regulatory requirements; tailings risks; delays in or failures

to enter into a subsequent agreement with Fresnillo with respect to accessing certain additional portions of the mineral resource at the

Camino Rojo Project and to obtain the necessary regulatory approvals related thereto; the mineral resource estimations for the Camino

Rojo Project being only estimates and relying on certain assumptions; risks related to the Cerro Quema Project; loss of, delays in, or

failure to get access from surface rights owners; uncertainties related to title to mineral properties; water rights; risks related to

natural disasters, terrorist acts, health crises, and other disruptions and dislocations; financing risks and access to additional capital;

risks related to guidance estimates and uncertainties inherent in the preparation of feasibility studies; uncertainty in estimates of

production, capital, and operating costs and potential production and cost overruns; the fluctuating price of gold and silver; unknown

labilities in connection with acquisitions; global financial conditions; uninsured risks; climate change risks; competition from other

companies and individuals; conflicts of interest; risks related to compliance with anti-corruption laws; volatility in the market price

of the Company's securities; assessments by taxation authorities in multiple jurisdictions; foreign currency fluctuations; the Company's

limited operating history; litigation risks; the Company's ability to identify, complete, and successfully integrate acquisitions; intervention

by non-governmental organizations; outside contractor risks; risks related to historical data; the Company not having paid a dividend;

risks related to the Company's foreign subsidiaries; risks related to the Company's accounting policies and internal controls; the Company's

ability to satisfy the requirements of Sarbanes-Oxley Act of 2002; enforcement of civil liabilities; the Company's status as a passive

foreign investment company for U.S. federal income tax purposes; information and cyber security; the Company's significant shareholders;

gold industry concentration; shareholder activism; other risks associated with executing the Company's objectives and strategies; as well

as those risk factors discussed in the Company's most recently filed management's discussion and analysis, as well as its annual information

form dated March 19, 2024, which are available on www.sedarplus.ca and www.sec.gov. Except as required by the securities disclosure laws

and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management's

beliefs, estimates or opinions, or other factors, should change. Past results are not indicative of future performance.

SOURCE Orla Mining Ltd.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/March2025/03/c5220.html

%CIK: 0001680056

For further information: For further information, please contact:

Jason Simpson, President & Chief Executive Officer; Andrew Bradbury, Vice President, Investor Relations & Corporate Development,

www.orlamining.com, investor@orlamining.com

CO: Orla Mining Ltd.

CNW 06:00e 03-MAR-25

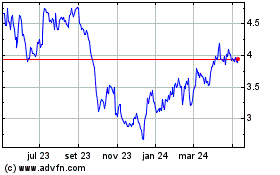

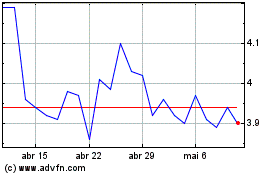

Orla Mining (AMEX:ORLA)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Orla Mining (AMEX:ORLA)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025