Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

03 Março 2025 - 6:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2025

Commission File Number: 001-39436

KE Holdings Inc.

(Registrant’s Name)

Oriental Electronic Technology Building,

No. 2 Chuangye Road, Haidian District,

Beijing 100086

People’s Republic of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

KE Holdings Inc. |

| |

|

|

|

| |

By |

: |

/s/ XU Tao |

| |

Name |

: |

XU Tao |

| |

Title |

: |

Chief Financial Officer |

Date:

March 3, 2025

Exhibit 99.1

| FF305

Page 1 of 6 v 1.3.0

Next Day Disclosure Return

(Equity issuer - changes in issued shares or treasury shares, share buybacks and/or on-market sales of treasury shares)

Instrument: Equity issuer Status: New Submission

Name of Issuer: KE Holdings Inc.

Date Submitted: 26 February 2025

Section I must be completed by a listed issuer where there has been a change in its issued shares or treasury shares which is discloseable pursuant to rule 13.25A of the Rules Governing the

Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Exchange”) (the “Main Board Rules”) or rule 17.27A of the Rules Governing the Listing of Securities on GEM of the

Exchange (the “GEM Rules”).

Section I

1. Class of shares WVR ordinary shares Type of shares A Listed on the Exchange Yes

Stock code (if listed) 02423 Description

A. Changes in issued shares or treasury shares

Events

Changes in issued shares

(excluding treasury shares)

Number of issued

shares (excluding

treasury shares)

As a % of existing

number of issued

shares (excluding

treasury shares) before

the relevant event

(Note 3)

Changes in treasury

shares

Number of treasury

shares

Issue/ selling price per

share (Note 4)

Total number of issued

shares

Opening balance as at (Note 1) 10 February 2025 3,446,810,889 0 3,446,810,889

1). Other (please specify)

Issuance of Class A ordinary shares which are registered in the name of

our depositary bank for future issuance of American depositary shares upon

the exercise or vesting of awards granted under the Share Incentive Plans

respectively

Date of changes 26 February 2025

30,900,000 0.861 % USD 0.00002

Closing balance as at (Notes 5 and 6) 26 February 2025 3,477,710,889 0 3,477,710,889

|

| FF305

Page 2 of 6 v 1.3.0

B. Shares redeemed or repurchased for cancellation but not yet cancelled as at the closing balance date (Notes 5 and 6) Not applicable

Remarks: (1) The existing total number of issued shares before relevant share issue was 3,590,853,365 (comprising 3,446,810,889 Class A ordinary shares and 144,042,476

Class B ordinary shares).

(2) For illustrative purpose only, conversions of US$ to HK$ are based on the exchange rate of US$1.00 = HK$7.85. |

| FF305

Page 3 of 6 v 1.3.0

Confirmation

Pursuant to Main Board Rule 13.25C / GEM Rule 17.27C, we hereby confirm to the best knowledge, information and belief that, in relation to each issue of shares or sale or transfer of treasury

shares as set out in Section I, it has been duly authorised by the board of directors of the listed issuer and carried out in compliance with all applicable listing rules, laws and other regulatory

requirements and, insofar as applicable:

(Note 7)

(i) all money due to the listed issuer in respect of the issue of shares, or sale or transfer of treasury shares has been received by it;

(ii) all pre-conditions for the listing imposed by the Main Board Rules / GEM Rules under "Qualifications of listing" have been fulfilled;

(iii) all (if any) conditions contained in the formal letter granting listing of and permission to deal in the securities have been fulfilled;

(iv) all the securities of each class are in all respects identical (Note 8);

(v) all documents required by the Companies (Winding Up and Miscellaneous Provisions) Ordinance to be filed with the Registrar of Companies have been duly filed and that compliance has

been made with all other legal requirements;

(vi) all the definitive documents of title have been delivered/are ready to be delivered/are being prepared and will be delivered in accordance with the terms of issue, sale or transfer;

(vii) completion has taken place of the purchase by the issuer of all property shown in the listing document to have been purchased or agreed to be purchased by it and the purchase

consideration for all such property has been duly satisfied; and

(viii) the trust deed/deed poll relating to the debenture, loan stock, notes or bonds has been completed and executed, and particulars thereof, if so required by law, have been filed with the

Registrar of Companies.

Notes to Section I:

1. Please insert the closing balance date of the last Next Day Disclosure Return published pursuant to Main Board Rule 13.25A / GEM Rule 17.27A or Monthly Return pursuant to Main

Board Rule 13.25B / GEM Rule 17.27B, whichever is the later.

2. Please set out all changes in issued shares or treasury shares requiring disclosure pursuant to Main Board Rule 13.25A / GEM Rule 17.27A together with the relevant dates of

changes. Each category will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer's Monthly Return. For

example, multiple issues of shares as a result of multiple exercises of share options under the same share option scheme or of multiple conversions under the same convertible note

must be aggregated and disclosed as one category. However, if the issues resulted from exercises of share options under 2 share option schemes or conversions of 2 convertible

notes, these must be disclosed as 2 separate categories.

3. The percentage change in the number of issued shares (excluding treasury shares) of the listed issuer is to be calculated by reference to the opening balance of the number of issued

shares (excluding treasury shares) being disclosed in this Next Day Disclosure Return. |

| FF305

Page 4 of 6 v 1.3.0

4. In the case of a share repurchase or redemption, the “issue/ selling price per share” shall be construed as “repurchase price per share” or “redemption price per share”.

Where shares have been issued/ sold/ repurchased/ redeemed at more than one price per share, a volume-weighted average price per share should be given.

5. The closing balance date is the date of the last relevant event being disclosed.

6. For repurchase or redemption of shares, disclosure is required when the relevant event has occurred (subject to the provisions of Main Board Rules 10.06(4)(a), 13.25A and 13.31 /

GEM Rules 13.13(1), 17.27A and 17.35), even if the repurchased or redeemed shares have not yet been cancelled.

If repurchased or redeemed shares are to be cancelled upon settlement of such repurchase or redemption after the closing balance date, they shall remain part of the issued shares as

at the closing balance date in Part A. Details of these repurchased or redeemed shares shall be disclosed in Part B.

7. Items (i) to (viii) are suggested forms of confirmation. The listed issuer may amend the item(s) that is/are not applicable to meet individual cases.

8. “Identical” means in this context:

- the securities are of the same nominal value with the same amount called up or paid up;

- they are entitled to dividend/interest at the same rate and for the same period, so that at the next ensuing distribution, the dividend/interest payable per unit will amount to

exactly the same sum (gross and net); and

- they carry the same rights as to unrestricted transfer, attendance and voting at meetings and rank pari passu in all other respects. |

| FF305

Page 5 of 6 v 1.3.0

Section II must also be completed by a listed issuer where it has made a repurchase of shares which is discloseable under Main Board Rule 10.06(4)(a) / GEM Rule 13.13(1).

Repurchase report Not applicable |

| FF305

Page 6 of 6 v 1.3.0

Section III must also be completed by a listed issuer where it has made a sale of treasury shares on the Exchange or any other stock exchange on which the issuer is listed which is discloseable

under Main Board Rule 10.06B / GEM Rule 13.14B.

Report of on-market sale of treasury shares Not applicable

Submitted by: Siting Li

(Name)

Title: Joint Company Secretary

(Director, Secretary or other Duly Authorised Officer) |

Exhibit 99.2

KE Holdings Inc. Upgraded to ‘A’

in MSCI ESG Rating

Beijing, China, February 28, 2025 (GLOBE

NEWSWIRE) -- KE Holdings Inc. (“Beike” or the “Company”) (NYSE: BEKE and HKEX: 2423), a leading

integrated online and offline platform for housing transactions and services, is pleased to announce today a significant upgrade in its

Environmental, Social and Governance (ESG) rating by Morgan Stanley Capital International (“MSCI”) from “BBB”

to “A.” This achievement marks the second consecutive year of improvement for Beike, reflecting its steadfast commitment to

excellence in ESG practices within the industry.

In MSCI’s latest evaluation, Beike earned

an impressive overall score of 7.2 in the ESG social category, outperforming the global industry average of 4.3. This accomplishment is

attributed to the Company’s continuous efforts in human capital development through tailored vocational training programs and structured

career paths for service providers, together with its robust privacy and data security measures. Additionally, Beike made notable strides

in exploring opportunities in incorporating green concepts across various business scenarios, such as establishing the “Lianjia

Green Store Standard” to regulate eco-friendly renovations, material recycling, and smart energy control installations for the brokerage

stores. These efforts contributed to a remarkable 1.8-point increase in the ESG environmental category from the previous year.

The MSCI ESG Rating, developed by a leading provider

of critical decision support tools and services for the global investment community, MSCI, serves as a benchmark for institutional investors

to measure a company’s resilience to financially material ESG risks and to deploy capital in ways that maximize investment return

over their time horizon.

With its mission of “admirable service,

joyful living,” Beike is dedicated to creating long-term, sustainable value by reshaping China’s residential services industry

through its infrastructure transformation and technology-driven innovation. This commitment empowers service providers to enhance their

professional growth and deliver exceptional living experiences for consumers.

About KE Holdings Inc.

KE Holdings Inc. is a leading integrated online

and offline platform for housing transactions and services. The Company is a pioneer in building infrastructure and standards to reinvent

how service providers and customers efficiently navigate and complete housing transactions and services in China, ranging from existing

and new home sales, home rentals, to home renovation and furnishing, and other services. The Company owns and operates Lianjia,

China’s leading real estate brokerage brand and an integral part of its Beike platform. With more than 23 years of operating

experience through Lianjia since its inception in 2001, the Company believes the success and proven track record of Lianjia

pave the way for it to build its infrastructure and standards and drive the rapid and sustainable growth of Beike.

Safe

Harbor Statement

This

press release contains statements that may constitute “forward-looking” statements pursuant to the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology

such as “will,” “expects,” “anticipates,” “aims,” “future,” “intends,”

“plans,” “believes,” “estimates,” “likely to,” and similar statements. Beike may also

make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”)

and The Stock Exchange of Hong Kong Limited (the “Hong Kong Stock Exchange”), in its annual report to shareholders,

in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements

that are not historical facts, including statements about KE Holdings Inc.'s beliefs, plans, and expectations, are forward-looking statements.

Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially

from those contained in any forward-looking statement, including but not limited to the following: Beike’s goals and strategies;

Beike's future business development, financial condition and results of operations; expected changes in the Company’s revenues,

costs or expenditures; Beike’s ability to empower services and facilitate transactions on Beike platform; competition

in the industry in which Beike operates; relevant government policies and regulations relating to the industry; Beike’s ability

to protect the Company’s systems and infrastructures from cyber-attacks; Beike’s dependence on the integrity of brokerage

brands, stores and agents on the Company’s platform; general economic and business conditions in China and globally; and assumptions

underlying or related to any of the foregoing. Further information regarding these and other risks is included in KE Holdings Inc.’s

filings with the SEC and the Hong Kong Stock Exchange. All information provided in this press release is as of the date of this press

release, and KE Holdings Inc. does not undertake any obligation to update any forward-looking statement, except as required under applicable

law.

For more information, please visit: https://investors.ke.com

For investor and media inquiries, please contact:

In China:

KE Holdings Inc.

Investor Relations

Siting Li

E-mail: ir@ke.com

Piacente Financial Communications

Jenny Cai

Tel: +86-10-6508-0677

E-mail: ke@tpg-ir.com

In the United States:

Piacente Financial Communications

Brandi Piacente

Tel: +1-212-481-2050

E-mail: ke@tpg-ir.com

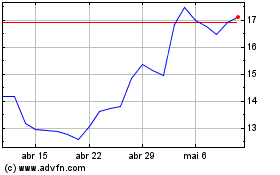

KE (NYSE:BEKE)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

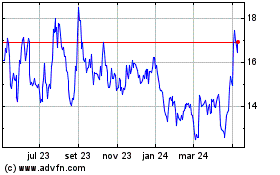

KE (NYSE:BEKE)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025