Filed by MetroCity Bankshares, Inc.

pursuant to Rule 425 under the Securities

Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: First IC Corporation

MetroCity Bankshares, Inc. Commission File

No.: 001-39068

Date: March 17, 2025

We look forward to welcoming you to the Metro City

Bank family!

Metro City Bank and First IC Bank are strong community

banking organizations with an excellent history serving our local markets, and the combined Metro City / First IC will be one of the

largest, best performing community banks serving our communities. As an employee of First IC, you may have questions surrounding our

recently announced pending merger. In the following pages we have compiled a list of frequently asked questions (“FAQs”)

for your review.

In addition, in the coming weeks we will be providing

you with additional information on our bank and our bank products as we plan for a successful and smooth transition for our customers.

This account information guide will provide important information about the features and terms associated with customer accounts, action

items and answers to questions.

We expect our merger to be completed early in the

fourth quarter of 2025, but will advise you when a firm date is set. In the meantime, business will continue as usual at both of our

respective banks.

We are very excited about the prospects for our combined

organization with enhanced opportunities for both our customers and our employees.

| /s/

Nack Y. Paek |

|

/s/

Chong Chun |

| |

|

|

| Nack Y. Paek |

|

Chong Chun |

| Chairman &

CEO |

|

Chairman |

| MetroCity Bankshares, Inc. |

|

First IC Corporation |

Employee FAQs

Employee FAQs

We

would like to provide you with answers to your questions in reference to the merger. At this time, we do not have all the answers, but

we will continue to update these FAQ’s once further information becomes available. If you have a personal question to ask,

contact the Employee Hotline at 1-866-201-0678. Calls will be answered during normal business hours between 9:00 a.m. and 5:00 p.m. Monday-Friday.

You may also review the information and documents that MetroCity Bankshares, Inc. (“MetroCity”) has filed with the U.S.

Securities and Exchange Commission (“SEC”). Thank you!

What does the merger mean to me?

Right now, nothing changes. It

is business as usual. Other specifics about the transition are still being worked out, although we do anticipate changes eventually -

including evaluation and adoption of new systems and processes that support our future growth, and achievement of efficiencies through

sharing of services. After the merger, we expect to have more products and services, and a broader geographic footprint - enabling us

to do even more for our customers. Ultimately, we believe this makes the bank stronger and helps to build on our current momentum. We

are counting on you to help us maintain the focus on our customers and our strategic objectives during this transition.

When will the merger be completed?

We expect the merger transaction

to close in the fourth quarter of 2025. Closing is subject to regulatory approvals, the approval of the shareholders of First IC and

other customary closing conditions.

Why did First IC Corporation (“First IC”)

decide to merge with MetroCity Bankshares, Inc.?

We saw an opportunity for a great

strategic fit between two financially strong, Georgia-based organizations with well-aligned community banking philosophies and an abiding

commitment to our respective customers and communities. We also have compatible management styles, strategies and credit guidelines.

Ultimately, the merger gives us a stronger foundation from which we can serve our commercial, mortgage and consumer customers with even

greater convenience, expanded products and services, and additional lending capacity.

Who is Metro City Bank?

Metro City Bank, based in Doraville,

Georgia, was founded in 2006 and is highly regarded as an independent, community bank with an unwavering commitment to convenience and

quality customer service. It offers a full range of financial services to individuals, businesses and nonprofit organizations through

20 banking centers across the Eastern United States and Texas. Metro City Bank has a strong board and a seasoned management team, much

like First IC Bank.

Employee FAQs

Will there be other internal changes as a result

of the merger?

Both banks recognize that our

strength lies in the stability of our teams, and we are committed to maintaining this as much as possible. While we expect to find efficiencies

by sharing services, we will carefully review job functions and expertise over the coming months to ensure we make the best use of our

resources.

Will my health & welfare benefits be changing? If

so, how?

Nothing is changing at this time.

All current non-retirement employee benefit options will remain unchanged through the closing of a transaction. Open enrollment for Metro

City Bank takes place each year in November. Once the merger is complete, you will receive open enrollment communications within the

subsequent month explaining how to confirm your current benefits or make changes to your benefits via Anthem Blue Cross Blue Shield.

What will happen to First IC's 401(k) Plan?

First IC’s 401(k) plan

will continue to be maintained by First IC prior to the merger date. Immediately prior to the effective time of the closing of the merger

transaction, the 401(k) plan will be terminated. As a result of the plan termination, all participants in the 401(k) plan will

become 100% vested on the termination date. In the next few months, we will provide you with additional information

regarding the retirement benefits that will be available to you after the merger transaction closes.

What happens to First IC's Severance Pay Plan?

MetroCity knows how important

benefits are to First IC employees. As such, MetroCity is implementing a severance policy benefit to assure First IC employees they will

be compensated in the event they are terminated within one year after closing (excluding terminations for cause). This plan will entitle

First IC employees to receive compensation based on 2 weeks of base salary pay for each year of service, subject to a minimum of 4 weeks’

pay and a maximum of 26 weeks’ pay. In addition, MetroCity will be allowing First IC to apply for any posted openings within its

bank to provide additional opportunities for First IC employees to be retained.

Will my length of service with First IC be honored

by MetroCity?

Your length of service with First

IC will be honored by MetroCity for purposes of eligibility, participation and vesting under such employee benefit plan(s) of MetroCity

to the extent that it was recognized immediately prior to the merger date under a corresponding employee benefit plan of First IC in

which you were eligible to participate. However, recognition of service shall not (i) result in duplication of benefits with

respect to the same period of time, (ii) apply for purposes of retiree medical benefits, or (iii) apply for purposes of any

plan (A) under which MetroCity employees do not receive credit for prior service, or (B) that is grandfathered or frozen with

respect to benefits or participation.

Employee FAQs

Will we continue to receive our payroll on a semi-monthly

basis?

Nothing is changing at this

time. Over the next several months, First IC and MetroCity will work together to determine how best to integrate our current payroll/HR

systems, as part of this transition period. We promise to keep you informed as we work out the details.

What will happen to my annual bonus payment from

First IC?

MetroCity and First IC understand

how important your annual bonus payments are to you. Moreover, we truly value your continued service to First IC, as it is essential

for a smooth transition for the merger. Therefore, to show our commitment, First IC will continue to accrue your annual bonus payments

as we have in the past, and will pay them out at the closing of the merger based on the amount accrued until that time.

Will we continue to be covered

by the same insurance?

Yes. First IC employees will

remain on their current health insurance until after the closing of a transaction. Open enrollment for Metro City takes place each year

in November. Once the merger is complete, you will receive open enrollment communications within the subsequent month explaining how

to confirm your current benefits or make changes to your benefits via Anthem Blue Cross Blue Shield.

Employee FAQs

Cautionary Statement Regarding

Forward-Looking Statements

This

communication contains forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and

statements about the benefits of the proposed transaction, the plans, objectives, expectations and intentions of First IC and MetroCity,

the expected timing of completion of the proposed transaction, and other statements that are not historical facts. Such statements reflect

the current views of MetroCity and First IC with respect to future events and financial performance, and are subject to numerous assumptions,

risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs, expectations,

plans, predictions, forecasts, objectives, assumptions or future events or performance, are forward-looking statements. Forward-looking

statements often, but not always, may be identified by words such as “anticipate,” “believes,” “can,”

“could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,”

“plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends”

and similar words or phrases. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A

of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Exchange Act of 1934, as amended,

and the Private Securities Litigation Reform Act of 1995.

MetroCity

and First IC caution that the forward-looking statements in this communication are not guarantees of future performance and involve a

number of known and unknown risks, uncertainties and assumptions that are difficult to assess and are subject to change based on factors

which are, in many instances, beyond MetroCity’s and First IC’s control. While there is no assurance that any list of risks

and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those

contained or implied in the forward-looking statements: (1) changes in general economic, political, or industry conditions; (2) uncertainty

in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve Board; (3) volatility and disruptions

in global capital and credit markets; (4) movements in interest rates; (5) the resurgence of elevated levels of inflation or

inflationary pressures in the United States and the First IC and MetroCity market areas; (6) increased competition in the markets

of MetroCity and First IC; (7) success, impact, and timing of business strategies of MetroCity and First IC; (8) the nature,

extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations; (9) the expected

impact of the proposed transaction between First IC and MetroCity on the combined entities’ operations, financial condition, and

financial results; (10) the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the

imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction); (11)

the failure to obtain First IC shareholder approval or to satisfy any of the other conditions to the proposed transaction on a timely

basis or at all or other delays in completing the proposed transaction; (12) the occurrence of any event, change or other circumstances

that could give rise to the right of one or both of the parties to terminate the Reorganization Agreement; (13) the outcome of any legal

proceedings that may be instituted against MetroCity or First IC; (14) the possibility that the anticipated benefits of the proposed

transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration

of the two companies or as a result of the strength of the economy and competitive factors in the areas where MetroCity and First IC

do business; (15) the possibility that the proposed transaction may be more expensive to complete than anticipated, including as a result

of unexpected factors or events; (16) diversion of management’s attention from ongoing business operations and opportunities; (17)

potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion

of the proposed transaction; (18) the dilution caused by MetroCity’s issuance of additional shares of its capital stock in connection

with the proposed transaction; (19) cyber incidents or other failures, disruptions or breaches of our operational or security systems

or infrastructure, or those of our third-party vendors or other service providers, including as a result of cyber-attacks; and (20) other

factors that may affect the future results of MetroCity and First IC.

Employee FAQs

Additional

factors that could cause results to differ materially from those described above can be found in MetroCity’s Annual Report on Form 10-K

for the year ended December 31, 2024, including in the respective “Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” sections of such report, as well as in subsequent SEC filings, each

of which is on file with the SEC and available in the “SEC Filings” section of MetroCity’s website, www.metrocitybank.bank/investor-relations/sec-filings,

and in other documents MetroCity files with the SEC.

All

forward-looking statements speak only as of the date they are made and are based on information available at that time. Neither MetroCity

nor First IC assumes any obligation to update forward-looking statements to reflect circumstances or events that occur after the date

the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by applicable law. As

forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on

such statements. All forward-looking statements, express or implied, included in the document are qualified in their entirety by this

cautionary statement.

Additional Information

and Where to Find It

This

communication is being made with respect to the proposed transaction involving MetroCity and First IC. This material is not a solicitation

of any vote or approval of the First IC shareholders and is not a substitute for the proxy statement/prospectus or any other documents

that MetroCity and First IC may send to their respective shareholders in connection with the proposed transaction. This communication

does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities

in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10

of the Securities Act.

Employee FAQs

In

connection with the proposed transaction between MetroCity and First IC, MetroCity will file with the SEC a Registration Statement on

Form S-4 (the “Registration Statement”) that will include a proxy statement for a special meeting of First IC’s

shareholders to approve the proposed transaction and that will also constitute a prospectus for the MetroCity common stock that will

be issued in the proposed transaction, as well as other relevant documents concerning the proposed transaction. BEFORE MAKING ANY VOTING

OR INVESTMENT DECISIONS, INVESTORS AND SHAREHOLDERS OF METROCITY AND FIRST IC ARE URGED TO READ THE REGISTRATION STATEMENT AND THE

PROXY STATEMENT/PROSPECTUS IN THEIR ENTIRETY REGARDING THE PROPOSED TRANSACTION WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS

FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. When

final, First IC will mail the proxy statement/prospectus to its shareholders. Investors and security holders are also urged to carefully

review and consider MetroCity’s public filings with the SEC, including, but not limited to, their proxy statements, Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. Copies of the Registration Statement and

proxy statement/prospectus and other filings incorporated by reference therein, as well as other filings containing information about

MetroCity, all of which may be obtained, free of charge, as they become available at the SEC’s website at www.sec.gov. You

will also be able to obtain these documents, when they are filed, free of charge, from MetroCity at www.metrocitybank.bank/investor-relations/sec-filings.

Copies of the proxy statement/prospectus can also be obtained, when they become available, free of charge, by directing a request to

MetroCity Bankshares, Inc., 5114 Buford Highway, Doraville, GA 30340, Attention: Lucas Stewart, Chief Financial Officer, Telephone:

(678) 580-6414.

Participants

in the Solicitation

MetroCity, First IC, and certain

of their respective directors, executive officers and employees may, under the SEC’s rules, be deemed to be participants in the

solicitation of proxies from the shareholders of First IC in connection with the proposed transaction. Information regarding MetroCity’s

directors and executive officers is available in its definitive proxy statement relating to its 2024 Annual Meeting of Shareholders,

which was filed with the SEC on April 12, 2024, and its Annual Report on Form 10-K for the year ended December 31, 2024,

which was filed with the SEC on March 10, 2025, and other documents filed by MetroCity with the SEC. Other information regarding

the persons who may, under the SEC’s rules, be deemed to be participants in the proxy solicitation of First IC’s shareholders

in connection with the proposed transaction, and a description of their direct and indirect interests, by security holdings or otherwise,

will be contained in the proxy statement/prospectus regarding the proposed transaction and other relevant materials filed with the SEC

when they become available, which may be obtained free of charge as described in the preceding paragraph. Investors should read the proxy

statement/prospectus carefully when it becomes available before making any voting or investment decisions.

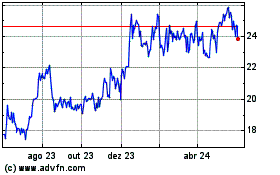

MetroCity Bankshares (NASDAQ:MCBS)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

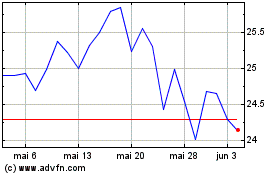

MetroCity Bankshares (NASDAQ:MCBS)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025