Will The S&P 500 Index Move Higher In the Last Week of June?

26 Junho 2022 - 1:32PM

Finscreener.org

The first six months of 2022 have

been extremely painful for equity investors as most major indices

have experienced a downward spiral in this period. In fact, the

stock market may close out its worst first half in several decades

in the upcoming week which has set the stage for an era of

volatility and uncertainty.

However, indices may now gain

momentum in the next two weeks due to an oversold market. Several

fund managers also rebalance their portfolios and shift their

investments to take advantage of depressed valuations and changing

market conditions, towards the end of a quarter.

According to

JPMorgan (NYSE:

JPM), the rebalancing of portfolios might drive stocks

higher by 7% in the next week, given the

S&P 500 index is

down 13.7% in Q2 and has declined almost 18%

year-to-date.

Towards the end of Q1, the

S&P 500 index slumped by 10% but the last week of the

quarter saw a rally of 7%. JPMorgan emphasized that cash balances

are at record levels in a period of low liquidity. Add in an

oversold market and substantial shorting activity to the mix and we

can see why the investment bank is optimistic about a short-term

rally.

Even if the equity markets trade

higher in the last week of June, the third quarter has been among

the worst-performing ones historically due to uncertainties

associated with mid-term elections. Data from CFRA suggests the

S&P 500 has declined by 0.5% on average in the second year

of a presidential term after a 1.9% decline in Q2.

If the markets remain at similar

levels at the end of Q2, it would mark the worst first six months

for equities since 1970.

What to expect in the week ahead?

In the upcoming week, there are a

few key economic reports as well as corporate earnings which will

impact the market, especially if companies miss estimates or report

tepid guidance for the upcoming months.

The personal consumption

expenditures data will be released on Thursday. This data includes

the PCE deflator reading and is closely watched by the Fed.

Additionally, ISM Manufacturing data will be released on Friday

while consumer confidence and S&P/Case-Shiller home price

data will be released on Tuesday.

The key catalyst for stock prices

for the second half of 2022 will be the upcoming earnings season.

The major banks will report earnings between July 14 and 15 which

means earnings season takes off in the second week of the next

month. So, equity markets will be extremely volatile in the

following month especially if companies report weaker-than-expected

forecasts.

Interest rates and the S&P 500

While stock indices inched higher

on Friday, bond yields continue to recover from a steep decline.

The

10-year Treasury yield

touched a high of 3.48% on June 14 and stood at 3% last Thursday.

It ended at 3.13% on June 24. Comparatively, the S&P 500

rose 6.4% to close the week at 3,911.

In addition to corporate

earnings, investors will be waiting to see if inflation will

continue to move leading to higher interest rate hikes which is a

perfect recipe for an economic recession.

There is a chance for the Fed to

maintain a hawkish stance and increase yields by 0.75% in July

after a similar hike earlier this month.

In a CNBC interview, George

Goncalves, the head of U.S. macro strategy at MUFG explained, “It’s

a narrative in overdrive. You go from inflation fears, and a 75

basis point hike... to only realize the more the Fed hikes,

eventually they’re going to tip us into recession. All this in a

matter of a week.”

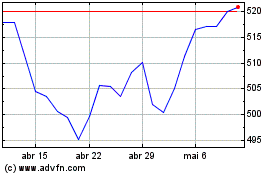

SPDR S&P 500 (AMEX:SPY)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

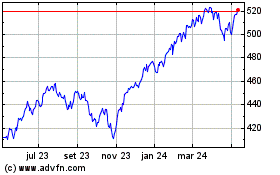

SPDR S&P 500 (AMEX:SPY)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024