Will the S&P 500 Index Touch a New 52-Week Low?

25 Setembro 2022 - 6:20PM

Finscreener.org

The equity markets in the United

States tumbled yet again in the week that ended on September 23,

2022. The

Dow Jones Industrial Average index briefly entered the bear market territory

and closed at a new low as investors remain concerned over the

prospect of an upcoming recession as the Federal Bank

raised interest rates

by 75% to curb inflation.

In the last week, the Dow fell

4%, while the

S&P 500 and

Nasdaq contracted by 4.7% and 5%,

respectively.

Treasury yields also rose to

their highest levels since 2008. The yield curve inversion deepened

as the 2-year Treasury note increased by over 4.2%, which is a sign

of investor pessimism regarding the health of the economy in the

near term.

Oil prices too cooled down on

Friday due to a strong U.S. dollar and recession fears. The U.S.

dollar rose to multi-decade highs against the British Pound and

euro, startling global investors. The prices for the WTI or West

Texas Intermediate fell 5% to $79 per barrel, which was its lowest

level since January.

The next week is the final week

of Q3, as well as September, which has historically been the worst

month for stock market investors. It has so far been the fifth

worst start of a year for the equity markets in the U.S.

Earnings and macro news to drive the S&P 500 this

week

In the upcoming week, several

companies such as Nike (NYSE: NKE),

Micron Technology (NASDAQ:

MU), Bed Bath &

Beyond (NASDAQ:

BBBY), and Carnival Corp.

(NYSE:

CCL) will report their

quarterly earnings.

On Tuesday, the S&P 500

will report the Case-Shiller Home Price Index, which will track

home prices. Housing price growth is expected to have decelerated

in July after rising 0.4% in June, which was the slowest growth in

two years. Home price growth peaked in March and has slowed due to

rising bond yields.

The 30-Year mortgage rates just

hit 6.7%, more than double compared to the year-ago period and the

highest levels since 2008. The velocity of the recent move in

rates is pretty spectacular. Jerome Powell couldn’t have been more

explicit during his recent speech: “The housing market may have to

go through a correction,” which is a kiss of death for the housing

market.

Some key observations

include:

- US real estate affordability

dropped violently, it has reached levels not seen since the

1980s

- Buyers purchasing a $500,000

house today, compared to last year, will pay a minimum of $265,000

more in interest alone and a 100% increase in the monthly

payment.

- In August, 37.6% of homes in

the U.S. sold below the list price

- Luxury home purchases have sunk

28% - the most on record

- Home-flipper

Opendoor (NASDAQ:

OPEN) lost money on 42% of the properties it sold in

August

Why should you watch real estate

closely?

Global real estate is the largest

asset class in the world, representing upwards of $300 trillion.

This is 3x fixed income and equities at ~$100 trillion.

The slowdown we are seeing in

real estate prices will reduce demand for other assets such as

equities and fixed income via the wealth effect. This, of course,

is in addition to the inflation everyone is facing.

With mortgage payments rising

dramatically. Buyers who overpaid for houses they couldn’t afford

in 2020/2021 (when rates were low) are now feeling the pain, and

this will have knock-on repercussions across financial

markets.

Consumer confidence

reports

The Conference Board will also

release the September update for its CCI or Consumer Confidence

reports. It measures consumer optimism with regard to their

personal finances and the state of the economy.

Estimates project an increase in

confidence from 103.2 in August to 104 in September. Economists

also expect the Consumer Sentiment Index to read 59.5, compared to

58.2 in August, due to lower gas prices and moderating inflation

numbers.

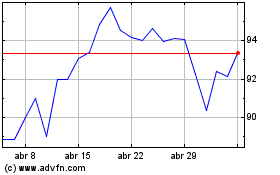

Nike (NYSE:NKE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

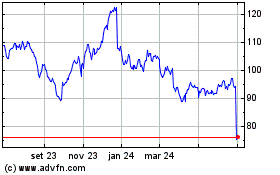

Nike (NYSE:NKE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024