Will the S&P 500 Move Lower In Q4 of 2023 as Inflation Remains High?

18 Setembro 2023 - 8:40AM

Finscreener.org

The equity markets have recovered

a portion of their losses in 2023, rising over 14% year-to-date.

While volatility has declined significantly in recent months, macro

pressures continue to persist, ranging from inflation and interest

rates to the threat of an economic recession.

An increasing number of

businesses are sounding the alarm about rising fuel costs and wage

increases impacting their quarterly profits.

Airline profits remain under pressure

Aerospace companies, as well as delivery

giant UPS, are grappling with significant new labor agreements.

Concurrently, unions across various sectors, from the automotive

world to the entertainment industry, are advocating for improved

pay. The airline industry, where significant outlays are

concentrated on jet fuel and staff wages, is feeling the squeeze

intensely.

Last Thursday,

Delta Air Lines (NYSE:

DAL) revised its

projected adjusted earnings for Q3, setting the range between $1.85

and $2.05 per share, a decrease from the previously estimated $2.20

to $2.50. While the airline cited unanticipated fuel expenses as a

primary reason, it also mentioned that maintenance costs exceeded

expectations.

As per the industry body-

Airlines for America, the average jet fuel price at prominent US

airports stood at $3.42 per gallon as of Tuesday, marking a 38%

increase over the past two months.

Earlier this month,

American Airlines (NYSE:

AAL) joined the list of carriers adjusting their

earnings outlook, following earlier revisions by

Alaska Airlines (NYSE:

ALK) and

Southwest Airlines (NYSE:

LUV) .

American Airlines now expects its

adjusted earnings per share for Q3 to range between $0.20 and $0.30

per share, a substantial drop from its earlier projection of up to

$0.95 a share. The revision comes in the wake of escalating fuel

prices and a fresh labor agreement with pilots.

Interest rate hikes in focus

On Tuesday, the Federal Open

Market Committee (FOMC) of the Federal Reserve will convene for its

two-day meeting, culminating in an anticipated interest rate

announcement and a press briefing by Chair Jerome Powell on

Wednesday.

As indicated by CME GroupU+02019s

fed funds futures, current market sentiments hint at the Fed

maintaining the current interest rates. However, there might be one

more rate increment by yearU+02019s end, contingent on inflation

trends. The benchmark federal funds rate is anticipated to remain

above 5% until at least the subsequent summer to steer inflation

closer to its 2% goal.

The Bank of England (BoE) will

hold its interest rate deliberations on Thursday. A 25 basis point

increase to 5.5% is projected by economists polled by Reuters—this

would be the peak since 2008. If this materializes, it will signify

the 15th successive rate increment since its initiation in December

2021, addressing the swiftest inflation surge in the U.K. in recent

times.

Upcoming News on the Housing

Market Next week will bring fresh insights on the housing scene,

encompassing data on building permits, housing initiations, and the

sales statistics for pre-owned homes in August, coupled with the

NAHB’s Housing Market Index for September.

Predictions suggest a slight drop

in housing initiations to 1.44 million units in August from 1.45

million in July. On the other hand, sales of pre-existing homes are

estimated to be marginally higher at 4.1 million, up from

JulyU+02019s 4.07 million.

After witnessing a 6-point drop

in August, the NAHB’s Housing Market Index, a gauge for

homebuildersU+02019 future sales projections, is expected to

recover to 53 this month.

This is a downturn from the

zenith of 84 during the pandemic in 2021 before the FedU+02019s

rate augmentations led to a surge in mortgage rates and diminished

demand. Still, itU+02019s notably above the trough of 31 seen last

December.

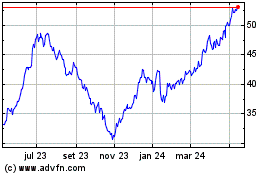

Delta Air Lines (NYSE:DAL)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Delta Air Lines (NYSE:DAL)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024