Summit State Bank (Nasdaq:SSBI) today reported net income for the

quarter ended March 31, 2014 of $1,210,000, a 21% increase over the

quarter ended March 31, 2013. A quarterly dividend of $0.11 per

share was declared for common shareholders.

Dividend

The Board of Directors declared an $0.11 quarterly dividend to

be paid on May 23, 2014 to shareholders of record on May 15,

2014.

Net Income and Results of Operations

The Bank had net income of $1,210,000 and net income available

for common stockholders of $1,176,000, or $0.24 per diluted share,

for the quarter ended March 31, 2014 compared to net income of

$1,002,000 and net income available for common stockholders of

$862,000, or $0.18 per diluted share, for the quarter ended March

31, 2013.

"Our stronger earnings continue to be driven by the quality of

our team and its deep commitment and hard work to support our

growing portfolio of quality customer relationships resulting in

our best quarter to date," said Tom Duryea, President &

CEO.

Net interest income increased 3.8% at $4,270,000 for the first

quarter of 2014 compared to $4,115,000 for the same quarter in

2013. The net interest margin was stable at 3.92% for the first

quarter of 2014 compared to 3.93% in the first quarter of 2013.

Non-interest income was $462,000 in the first quarter of 2014

compared to $363,000 in the first quarter of 2013. The increase was

primarily attributed to a gain realized on the sale of a foreclosed

property.

Total assets increased 5% to $460,133,000 at March 31, 2014

compared to $438,266,000 at March 31, 2013. The asset growth was

funded by a $29,207,000 increase in demand, savings and money

market deposits. The mix of deposits changed between the periods in

favor of demand, savings and money market deposits now comprising

57% of total deposits at March 31, 2014 compared to 51% at March

31, 2013.

Return on average assets and average common equity for the

quarter ended March 31, 2014 was 1.07% and 9.73% compared to 0.93%

and 7.06% for the first quarter of 2013.

Gross loans were $293,054,000 at March 31, 2014 compared to

$280,172,000 at March 31, 2013. Loan growth between the periods was

predominantly in commercial real estate lending.

"Loan production picked up in the first quarter with annualized

growth of 7%. This is a result of both the strong efforts of our

community banking team and the steady and continuing improvement of

the Sonoma County economy" said Linda Bertauche, Chief Operating

Officer

The Bank's efficiency ratio, which expresses operating costs as

a percentage of revenues, was 57% for the first quarter of 2014

compared to 62% for the same quarter in 2013. Operating expense

between the quarters declined 3.6% with $2,673,000 in operating

expense in 2014 compared to $2,773,000 in 2013. The operating

expense decline was due in part to lower occupancy costs and

controlled overhead expenses.

The Bank recorded no provision for loan losses for the first

quarters of 2014 and 2013. The coverage of allowance for loan

losses to gross loans was 1.85% at March 31, 2014 compared to 2.13%

at March 31, 2013. Nonperforming assets declined to $9,445,000 from

$9,956,000 for March 31, 2014 compared to March 31, 2013. This

represents a decline in the ratio of nonperforming assets to total

assets to 2.05% compared to 2.27%. Nonperforming assets at March

31, 2014 included $5,394,000 in loans on non-accrual, primarily

secured by commercial real estate, and $4,051,000 of income

generating foreclosed property.

The Bank's regulatory capital remains well above the required

capital ratios with a Tier 1 capital leverage ratio of 13.3%, a

Tier 1 risk-based capital ratio of 17.2% and a Total risk-based

capital ratio of 18.5% at March 31, 2014.

About Summit State Bank

Summit State Bank has total assets of $460 million and total

equity of $63 million at March 31, 2014. Headquartered in Sonoma

County, the Bank provides diverse financial products and services

throughout Sonoma, Napa, San Francisco, and Marin Counties. Summit

has been recognized as one of the Top 75 Corporate Philanthropists

in the Bay Area by the San Francisco Business Times and Top

Corporate Philanthropist by the North Bay Business Journal. In

addition, Summit State Bank received the 2013 Rising Star Award

from the California Independent Bankers, the 2012 Community Bank

Award from the American Bankers Association for its nonprofit work,

and has been recognized as one of the North Bay's Best Places to

Work by the North Bay Business Journal. Summit has also been

consistently recognized as a high performing bank by Findley

Reports. Summit State Bank's stock is traded on the Nasdaq Global

Market under the symbol SSBI. Further information can be found at

www.summitstatebank.com.

Forward-looking Statements

Except for historical information contained herein, the

statements contained in this news release, are forward-looking

statements within the meaning of the "safe harbor" provisions of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. This

release may contain forward-looking statements that are subject to

risks and uncertainties. Such risks and uncertainties may include

but are not necessarily limited to fluctuations in interest rates,

inflation, government regulations and general economic conditions,

and competition within the business areas in which the Bank will be

conducting its operations, including the real estate market in

California and other factors beyond the Bank's control. Such risks

and uncertainties could cause results for subsequent interim

periods or for the entire year to differ materially from those

indicated. You should not place undue reliance on the

forward-looking statements, which reflect management's view only as

of the date hereof. The Bank undertakes no obligation to publicly

revise these forward-looking statements to reflect subsequent

events or circumstances.

| SUMMIT STATE BANK AND

SUBSIDIARY |

| CONSOLIDATED STATEMENTS

OF INCOME |

| (In thousands except earnings

per share data) |

| |

|

|

| |

Three Months

Ended |

| |

|

|

| |

March 31, 2014 |

March 31, 2013 |

| |

(Unaudited) |

(Unaudited) |

| |

|

|

| Interest income: |

|

|

| Interest and fees on loans |

$ 3,549 |

$ 3,610 |

| Interest on Federal funds

sold |

1 |

-- |

| Interest on investment

securities and deposits in banks |

936 |

867 |

| Dividends on FHLB stock |

43 |

13 |

| Total interest income |

4,529 |

4,490 |

| Interest expense: |

|

|

| Deposits |

222 |

351 |

| FHLB advances |

37 |

24 |

| Total interest expense |

259 |

375 |

| Net interest income before

provision for loan losses |

4,270 |

4,115 |

| Provision for loan losses |

-- |

-- |

| Net interest income after

provision for loan losses |

4,270 |

4,115 |

| Non-interest income: |

|

|

| Service charges on deposit

accounts |

134 |

139 |

| Rental income |

132 |

125 |

| Net securities gains |

-- |

2 |

| Net gain on other real estate

owned |

73 |

-- |

| Loan servicing, net |

3 |

4 |

| Other income |

120 |

93 |

| Total non-interest income |

462 |

363 |

| Non-interest expense: |

|

|

| Salaries and employee

benefits |

1,368 |

1,432 |

| Occupancy and equipment |

292 |

408 |

| Other expenses |

1,013 |

933 |

| Total non-interest expense |

2,673 |

2,773 |

| Income before provision for

income taxes |

2,059 |

1,705 |

| Provision for income taxes |

849 |

703 |

| Net income |

$ 1,210 |

$ 1,002 |

| Less: preferred dividends |

34 |

140 |

| Net income available for common

stockholders |

$ 1,176 |

$ 862 |

| |

|

|

| Basic earnings per common share |

$ 0.25 |

$ 0.18 |

| Diluted earnings per common share |

$ 0.24 |

$ 0.18 |

| |

|

|

| Basic weighted average shares of common stock

outstanding |

4,778 |

4,746 |

| Diluted weighted average shares of common

stock outstanding |

4,821 |

4,776 |

| |

| SUMMIT STATE BANK AND

SUBSIDIARY |

| CONSOLIDATED BALANCE

SHEETS |

| (In thousands except share and

per share data) |

| |

|

|

|

| |

|

|

|

| |

March 31, 2014 |

December 31,

2013 |

March 31, 2013 |

| |

(Unaudited) |

|

(Unaudited) |

| |

|

|

|

| ASSETS |

|

|

|

| |

|

|

|

| Cash and due from banks |

$ 18,193 |

$ 16,128 |

$ 14,888 |

| Federal funds sold |

1,631 |

-- |

-- |

| Total cash and cash

equivalents |

19,824 |

16,128 |

14,888 |

| |

|

|

|

| Time deposits with banks |

1,985 |

1,985 |

2,977 |

| |

|

|

|

| Investment securities: |

|

|

|

| Held-to-maturity, at amortized cost |

15,558 |

15,558 |

17,055 |

| Available-for-sale (at fair market value;

amortized cost of $114,722 |

|

|

|

| $116,947 and $104,908) |

113,016 |

113,568 |

107,706 |

| Total investment

securities |

128,574 |

129,126 |

124,761 |

| |

|

|

|

| Loans, less allowance for loan losses of

$5,432, $5,412 and $5,967 |

287,622 |

282,667 |

274,205 |

| Bank premises and equipment, net |

5,790 |

5,505 |

5,009 |

| Investment in Federal Home Loan Bank stock,

at cost |

2,578 |

2,578 |

2,265 |

| Goodwill |

4,119 |

4,119 |

4,119 |

| Other Real Estate Owned |

4,051 |

4,771 |

4,983 |

| Accrued interest receivable and other

assets |

5,590 |

7,195 |

5,059 |

| |

|

|

|

| Total assets |

$ 460,133 |

$ 454,074 |

$ 438,266 |

| |

|

|

|

| LIABILITIES AND SHAREHOLDERS'

EQUITY |

|

|

|

| |

|

|

|

| Deposits: |

|

|

|

| Demand - non

interest-bearing |

$ 70,752 |

$ 62,865 |

$ 54,911 |

| Demand - interest-bearing |

48,693 |

43,879 |

39,237 |

| Savings |

26,086 |

25,740 |

23,272 |

| Money market |

57,307 |

55,971 |

56,211 |

| Time deposits, $100,000 and

over |

116,576 |

114,435 |

120,762 |

| Other time deposits |

39,000 |

38,378 |

47,861 |

| Total deposits |

358,414 |

341,268 |

342,254 |

| |

|

|

|

| Federal Home Loan Bank advances |

37,400 |

48,500 |

30,000 |

| Accrued interest payable and other

liabilities |

1,062 |

2,676 |

2,579 |

| |

|

|

|

| Total liabilities |

396,876 |

392,444 |

374,833 |

| |

|

|

|

| Shareholders' equity |

|

|

|

| Preferred stock, no par value;

20,000,000 shares authorized; shares issued and outstanding -

13,750 Series B; per share redemption of $1,000 for total

liquidation preference of $13,750 |

13,666 |

13,666 |

13,666 |

| Common stock, no par value;

shares authorized - 30,000,000 shares; issued and outstanding

4,777,670, 4,777,670 and 4,752,586 |

36,615 |

36,608 |

36,459 |

| Retained earnings |

13,966 |

13,316 |

11,685 |

| Accumulated other comprehensive

income (loss) |

(990) |

(1,960) |

1,623 |

| |

|

|

|

| Total shareholders' equity |

63,257 |

61,630 |

63,433 |

| |

|

|

|

| Total liabilities and

shareholders' equity |

$ 460,133 |

$ 454,074 |

$ 438,266 |

| |

| Earnings

Summary |

| (In

Thousands) |

| |

|

|

| |

|

|

| |

Three Months Ended |

| |

|

|

| |

March 31, 2014 |

March 31, 2013 |

| |

|

|

| |

(Unaudited) |

(Unaudited) |

| Statement of Income

Data: |

|

|

| Net interest income |

$ 4,270 |

$ 4,115 |

| Provision for loan losses |

-- |

-- |

| Non-interest income |

462 |

363 |

| Non-interest expense |

2,673 |

2,773 |

| Provision for income taxes |

849 |

703 |

| Net income |

$ 1,210 |

$ 1,002 |

| Less: preferred dividends |

34 |

140 |

| Net income available for common

stockholders |

$ 1,176 |

$ 862 |

| |

|

|

| Selected per Common Share

Data: |

|

|

| Basic earnings per common share |

$ 0.25 |

$ 0.18 |

| Diluted earnings per common share |

$ 0.24 |

$ 0.18 |

| Dividend per share |

$ 0.11 |

$ 0.09 |

| Book value per common share (2)(3) |

$ 10.38 |

$ 10.47 |

| |

|

|

| Selected Balance Sheet

Data: |

|

|

| Assets |

$ 460,133 |

$ 438,266 |

| Loans, net |

287,622 |

274,205 |

| Deposits |

358,414 |

342,254 |

| Average assets |

457,628 |

437,831 |

| Average earning assets |

441,671 |

424,328 |

| Average shareholders' equity |

62,679 |

63,201 |

| Average common shareholders' equity |

49,014 |

49,535 |

| Nonperforming loans |

5,394 |

4,973 |

| Other real estate owned |

4,051 |

4,983 |

| Total nonperforming assets |

9,445 |

9,956 |

| Troubled debt restructures (accruing) |

4,395 |

5,892 |

| |

|

|

| Selected Ratios: |

|

|

| Return on average assets (1) |

1.07% |

0.93% |

| Return on average common equity (1) |

9.73% |

7.06% |

| Efficiency ratio (4)(5) |

57.37% |

61.95% |

| Net interest margin (1) |

3.92% |

3.93% |

| Tier 1 leverage capital ratio |

13.3% |

13.3% |

| Tier 1 risk-based capital ratio |

17.2% |

17.4% |

| Total risk-based capital ratio |

18.5% |

18.7% |

| Common dividend payout ratio (6) |

0.00% |

49.54% |

| Average equity to average assets |

13.70% |

14.44% |

| Nonperforming loans to total loans (2) |

1.84% |

1.78% |

| Nonperforming assets to total assets (2) |

2.05% |

2.27% |

| Allowance for loan losses to total loans

(2) |

1.85% |

2.13% |

| Allowance for loan losses to nonperforming

loans (2) |

100.72% |

119.99% |

| |

| (1) Annualized |

| (2) As of period end |

| (3) Total shareholders' equity,

less preferred stock, divided by total common shares

outstanding |

| (4) Non-interest expenses to net

interest and non-interest income |

|

| (5) Excludes net gains (losses)

on securities and other real estate owned |

| (6) Common dividends divided by

net income available for common stockholders |

CONTACT: Thomas Duryea, President and CEO, Summit State Bank (707) 568-4920

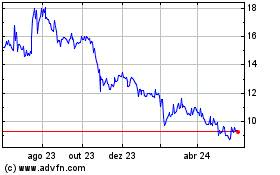

Summit State Bank (NASDAQ:SSBI)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

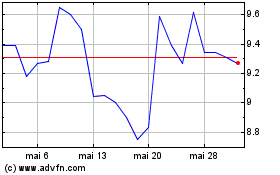

Summit State Bank (NASDAQ:SSBI)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025