Hydrogenics Reports First Quarter 2014 Results

07 Maio 2014 - 7:30AM

MISSISSAUGA, Ontario, May 7, 2014 (GLOBE NEWSWIRE) --

Hydrogenics Corporation (Nasdaq:HYGS) (TSX:HYG)

("Hydrogenics" or "the Company"), a leading developer and

manufacturer of hydrogen generation and hydrogen-based power

modules, today reported first quarter 2014 financial results.

Results are reported in US dollars and are prepared in accordance

with International Financial Reporting Standards (IFRS).

"We began the year with a light quarter that reflected lower

deliveries, as previously announced, impacting our performance

during the period," said Daryl Wilson, President and Chief

Executive Officer. "However, we again grew our backlog on the

strength of additional electrolyzer orders and remain upbeat about

the outlook for fiscal 2014 given current demand trends across our

various business segments. In that vein, and based on current

customer requirements, our objective remains on track for at least

$50 million in revenue. At that level of revenue and at a gross

margin target of 30%, we believe we will achieve the goal of

positive Adjusted EBITDA2 for the year.

"Energy storage applications continue to be the focus of intense

interest across the globe. Presently we have $12 million of energy

storage projects in backlog and $14 million in projects where we

have responded to formal Requests for Proposals. In addition,

approximately $38 million of prospective projects and $6 million in

R&D projects are also active. These four components total

$70 million of energy storage projects in various stages of

maturity."

Recent Highlights (compared to the quarter ended March

31, 2013, unless otherwise noted)

- Revenue for the three months ended March 31, 2014 was $8.1

million compared with $12.4 million for the three months ended

March 31, 2013. The prior year's first quarter benefitted from

the partial delivery of fuel cell modules for the

Company's major telecom backup power partner for which there was no

comparable revenue in the first quarter of 2014.

- Gross profit declined to $1.9 million, or 23.8% of revenue, for

the quarter primarily reflecting reduced overhead absorption in

both the Power Systems and OnSite Generation segments and increased

costs within OnSite Generation.

- Cash Operating Costs1 were consistent with the comparable

period.

- The Company reported an Adjusted EBITDA2 loss of $1.7 million

versus Adjusted EBITDA of $0.2 million in the prior-year period,

reflecting decreased revenue and gross profit.

- Hydrogenics secured $9.5 million of orders for renewable energy

storage, industrial gas, and power system applications during the

quarter, resulting in an order backlog of $58.5 million as of March

31, 2014. Order backlog movement during the first quarter (in $

millions) was as follows:

| |

Dec 31/2013 Backlog |

Orders Received |

FX |

Orders Delivered |

March 31/2014 Backlog |

| |

|

|

|

|

|

| OnSite Generation |

$ 22.5 |

$ 8.1 |

$ (0.1) |

$ (6.0) |

$ 24.5 |

| Power Systems |

34.5 |

1.7 |

(0.2) |

(2.1) |

34.0 |

| Total |

$ 57.0 |

$ 9.8 |

$ (0.3) |

$ (8.0) |

$ 58.5 |

- The Company exited the first quarter with $11.6 million of cash

and restricted cash, a $2.2 million decrease from December 31, 2013

primarily reflecting: (i) $3.8 million of cash used in operating

activities; and (ii) $0.3 million related to the purchase of

property, plant and equipment; partially offset by (iii) $1.7

million of increased borrowings; and (iv) $0.1 million of exercised

stock options and warrants.

- All remaining warrants outstanding at December 31, 2013 were

fully exercised in the three months ended March 31, 2014.

Notes

- Cash operating costs are defined as the sum of SG&A and

R&D, less amortization and depreciation, and stock-based

compensation expense inclusive of compensation costs indexed to the

Company's share price. This is a non-IFRS measure and may not be

comparable to similar measures used by other companies. Management

uses this measure as a rough estimate of the amount of fixed costs

to operate the Corporation and believes this is a useful measure

for investors for the same purpose.

- Adjusted EBITDA is defined as net loss excluding stock based

compensation (both cash settled long term compensation indexed to

share price and share based compensation), other finance income and

expenses, depreciation and amortization. These items are considered

by management to be outside of Hydrogenics' ongoing operational

results. Adjusted EBITDA is a non-IFRS measure and may not be

comparable to similar measures used by other companies.

Conference Call Details

Hydrogenics will hold a conference call at 1:00 p.m. EDT today,

May 7, 2014 to review the first quarter results. The telephone

number for the conference call is (877) 307-1373 or, for

international callers, (678) 224-7873. A live webcast of the

call will also be available on the company's website,

www.hydrogenics.com.

An archived copy of the conference call and webcast will be

available on the company's website, www.hydrogenics.com,

approximately six hours following the call.

About Hydrogenics

Hydrogenics Corporation is a world leader in engineering and

building the technologies required to enable the acceleration of a

global power shift. Headquartered in Mississauga, Ontario,

Hydrogenics provides hydrogen generation, energy storage and

hydrogen power modules to its customers and partners around the

world. Hydrogenics has manufacturing sites in Germany,

Belgium and Canada and service centres in Russia, Europe, the US

and Canada.

Forward-looking Statements

This release contains forward-looking statements within the

meaning of the "safe harbor" provisions of the U.S. Private

Securities Litigation Reform Act of 1995, and under applicable

Canadian securities law. These statements are based on management's

current expectations and actual results may differ from these

forward-looking statements due to numerous factors, including: our

inability to increase our revenues or raise additional funding to

continue operations, execute our business plan, or to grow our

business; inability to address a slow return to economic growth,

and its impact on our business, results of operations and

consolidated financial condition; our limited operating history;

inability to implement our business strategy; fluctuations in

our quarterly results; failure to maintain our customer base that

generates the majority of our revenues; currency fluctuations;

failure to maintain sufficient insurance coverage; changes in value

of our goodwill; failure of a significant market to develop

for our products; failure of hydrogen being readily available on a

cost-effective basis; changes in government policies and

regulations; failure of uniform codes and standards for hydrogen

fuelled vehicles and related infrastructure to develop; liability

for environmental damages resulting from our research, development

or manufacturing operations; failure to compete with other

developers and manufacturers of products in our industry; failure

to compete with developers and manufacturers of traditional and

alternative technologies; failure to develop partnerships with

original equipment manufacturers, governments, systems integrators

and other third parties; inability to obtain sufficient materials

and components for our products from suppliers; failure to manage

expansion of our operations; failure to manage foreign sales and

operations; failure to recruit, train and retain key management

personnel; inability to integrate acquisitions; failure to develop

adequate manufacturing processes and capabilities; failure to

complete the development of commercially viable products; failure

to produce cost-competitive products; failure or delay in field

testing of our products; failure to produce products free of

defects or errors; inability to adapt to technological advances or

new codes and standards; failure to protect our intellectual

property; our involvement in intellectual property litigation;

exposure to product liability claims; failure to meet rules

regarding passive foreign investment companies; actions of our

significant and principal shareholders; dilution as a result of

significant issuances of our common shares and preferred shares;

inability of US investors to enforce US civil liability judgments

against us; volatility of our common share price; and dilution as a

result of the exercise of options. Readers should not place undue

reliance on Hydrogenics' forward-looking statements. Investors are

encouraged to review the section captioned "Risk Factors" in

Hydrogenics' regulatory filings with the Canadian securities

regulatory authorities and the US Securities and Exchange

Commission for a more complete discussion of factors that could

affect Hydrogenics' future performance. Furthermore, the

forward-looking statements contained herein are made as of the date

of this release, and Hydrogenics undertakes no obligations to

revise or update any forward-looking statements in order to reflect

events or circumstances that may arise after the date of this

release, unless otherwise required by law. The forward-looking

statements contained in this release are expressly qualified by

this.

| Reconciliation of

Adjusted EBITDA to Net Loss |

| (in thousands of US dollars) |

| (unaudited) |

| |

| |

3 months

ended |

| |

31-Mar-14 |

31-Mar-13 |

| |

|

|

| Adjusted EBITDA |

(1,729) |

169 |

| Less: |

|

|

| Stock-based compensation |

136 |

176 |

| Cash settled compensation indexed to share

price |

1,561 |

401 |

| Net Finance losses |

183 |

533 |

| Depreciation and amortization |

140 |

198 |

| Other loss |

-- |

-- |

| Net Loss |

(3,749) |

(1,139) |

| |

| |

| Hydrogenics

Corporation |

| Consolidated Interim Balance

Sheets |

| (in thousands of US dollars) |

| (unaudited) |

| |

| |

March 31 2014 |

December 31 2013 |

| |

|

|

| Assets |

|

|

| Current assets |

|

|

| Cash and cash equivalents |

$ 9,343 |

$ 11,823 |

| Restricted cash |

1,154 |

635 |

| Trade and other receivables |

8,205 |

5,391 |

| Inventories |

16,635 |

12,821 |

| Prepaid expenses |

1,330 |

979 |

| |

36,667 |

31,649 |

| Non-current assets |

|

|

| Restricted cash |

1,123 |

1,389 |

| Property, plant and equipment |

1,838 |

1,684 |

| Intangible assets |

171 |

100 |

| Goodwill |

5,246 |

5,248 |

| |

8,378 |

8,421 |

| Total assets |

$ 45,045 |

$ 40,070 |

| Liabilities |

|

|

| Current liabilities |

|

|

| Trade and other payables |

$ 17,261 |

$ 13,193 |

| Operating Borrowings |

1,722 |

-- |

| Warranty provisions |

2,268 |

1,912 |

| Deferred revenue |

9,148 |

6,348 |

| Warrants |

-- |

1,075 |

| |

30,399 |

22,528 |

| Non-current liabilities |

|

|

| Other non-current liabilities |

2,991 |

3,095 |

| Non-current warranty provisions |

798 |

981 |

| Non-current deferred revenue |

6,988 |

7,305 |

| Total liabilities |

41,176 |

33,909 |

| Equity |

|

|

| Share capital |

334,698 |

333,312 |

| Contributed surplus |

18,525 |

18,449 |

| Accumulated other comprehensive loss |

(254) |

(249) |

| Deficit |

(349,100) |

(345,351) |

| Total equity |

3,869 |

6,161 |

| Total equity and

liabilities |

$ 45,045 |

$ 40,070 |

| |

| |

| Hydrogenics

Corporation |

| Consolidated Interim Statements

of Operations and Comprehensive Loss |

| (in thousands of US dollars,

except share and per share amounts) |

| (unaudited) |

| |

| |

| |

Three months ended

March 31 |

| |

2014 |

2013 |

| |

|

As Revised |

| |

|

|

| Revenues |

$ 8,059 |

$ 12,391 |

| Cost of sales |

6,142 |

8,515 |

| Gross profit |

1,917 |

3,876 |

| |

|

|

| Operating expenses |

|

|

| Selling, general and administrative

expenses |

4,567 |

3,622 |

| Research and product development

expenses |

916 |

860 |

| |

5,483 |

4,482 |

| Loss from operations |

(3,566) |

(606) |

| |

|

|

| Finance income

(expenses) |

|

|

| Interest income |

2 |

7 |

| Interest expense |

(134) |

(92) |

| Foreign currency gains |

148 |

115 |

| Foreign currency losses |

(59) |

(212) |

| Other finance gains (losses), net |

(140) |

(351) |

| Finance income (loss),

net |

(183) |

(533) |

| |

|

|

| Loss before income

taxes |

(3,749) |

(1,139) |

| Income tax expense |

-- |

-- |

| Net loss for the period |

(3,749) |

(1,139) |

| |

|

|

| Items that will be reclassified subsequently

to net loss: |

|

|

| Exchange differences on translating foreign

operations |

(5) |

(298) |

| Comprehensive loss for the

period |

$ (3,754) |

$ (1,437) |

| |

|

|

| Net loss per share |

|

|

| Basic and diluted |

$ (0.41) |

$ (0.15) |

| |

|

|

| Weighted average number of common shares

outstanding |

9,073,527 |

7,843,373 |

| |

| |

| Hydrogenics

Corporation |

| Consolidated Interim Statements

of Cash Flows |

| (in thousands of US dollars) |

| (unaudited) |

| |

Three months ended March

31 |

| |

2014 |

2013 |

| |

|

|

| |

|

As Revised |

| Cash and cash equivalents provided by

(used in): |

|

|

| Operating activities |

|

|

| Net loss for the year |

$ (3,749) |

$ (1,139) |

| Increase in restricted cash |

(253) |

(225) |

| Items not affecting cash: |

|

|

| Amortization and depreciation |

140 |

198 |

| Other finance losses (gains), net |

140 |

351 |

| Unrealized foreign exchange (gains)

losses |

87 |

111 |

| Stock-based compensation |

136 |

176 |

| Accreted non-cash interest |

118 |

89 |

| Payment of post-retirement benefit

liability |

(24) |

(27) |

| Liabilities for compensation indexed to

share price |

1,561 |

401 |

| Net change in non-cash working

capital |

(1,972) |

(6,093) |

| Cash used in operating

activities |

(3,816) |

(6,158) |

| |

|

|

| Investing activities |

|

|

| Proceeds from disposals |

9 |

-- |

| Purchase of property, plant and

equipment |

(306) |

(189) |

| Purchase of intangible assets |

(80) |

-- |

| Cash used in investing

activities |

(377) |

(189) |

| |

|

|

| Financing activities |

|

|

| Repayment of repayable government

contributions |

(50) |

-- |

| Proceeds of operating borrowings |

1,722 |

1,412 |

| Common shares issued and warrants exercised,

net of issuance costs |

109 |

423 |

| Cash provided by financing

activities |

1,781 |

1,835 |

| |

|

|

| Effect of exchange rate fluctuations on cash

and cash equivalents held |

(68) |

(325) |

| |

|

|

| Decrease in cash and cash equivalents during

the period |

(2,480) |

(4,837) |

| Cash and cash equivalents - Beginning

of period |

11,823 |

13,020 |

| Cash and cash equivalents - End of

period |

$ 9,343 |

$ 8,183 |

CONTACT: Hydrogenics Contacts:

Bob Motz, Chief Financial Officer

Hydrogenics Corporation

(905) 361-3660

investors@hydrogenics.com

Chris Witty

Hydrogenics Investor Relations

(646) 438-9385

cwitty@darrowir.com

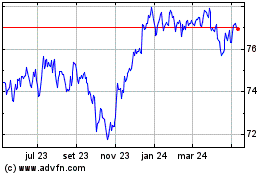

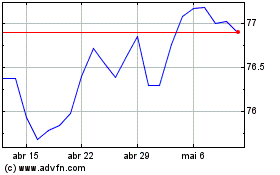

iShares iBoxx Dollar Hig... (AMEX:HYG)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

iShares iBoxx Dollar Hig... (AMEX:HYG)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024