Uranium Resources Sets Closing Date for Sale of Assets and Announces Amended Terms and Conditions

05 Dezembro 2016 - 11:00AM

Uranium Resources, Inc. (NASDAQ:URRE) (ASX:URI)

announced today that it has executed a Letter of Intent (LOI) to

amend its Share Purchase Agreement (“Agreement”) with Laramide

Resources Ltd. (TSX:LAM) (ASX:LAM) (Laramide) whereby URI is

selling its Churchrock and Crownpoint properties in New

Mexico. The LOI sets the closing date for December 22, 2016

and amends certain other terms and conditions, including removal of

the condition that Laramide have completed a financing before

closing. The LOI is non-binding but contemplates that the

parties will negotiate and enter into a binding amendment to the

Agreement not later than December 9, 2016.

URI and Laramide have agreed to maintain the

value of the transaction at $12.5 million but to reduce the cash to

be paid and the amount of the promissory note to be issued at

closing, in exchange for equity, a royalty and an additional

option. Under the amended Agreement, at closing Laramide will

acquire Churchrock and Crownpoint for $2.5 million in cash, will

issue shares of its common stock and warrants to URI valued at

$500,000, will issue URI a 3-year promissory note in the amount of

$5 million and will grant URI a 4% net smelter royalty valued at

$4.5 million on Churchrock. In addition, Laramide has reduced

the price for URI’s option to purchase Laramide’s La Sal project to

$3 million and will provide a new option for URI to purchase

Laramide’s La Jara Mesa project for $5 million.

The sale of the Churchrock and Crownpoint

properties continues URI’s proactive M&A strategy, with the

sale representing URI’s third asset monetization transaction in the

last three years. URI is focused on improving its uranium portfolio

alignment with its production experience and expertise in in-situ

recovery of uranium, targeting uranium operations that fit into the

lowest quartile of operating costs. The proceeds received

from the sale will be used to fund expansion of URI’s energy metals

strategy which includes developing its new lithium business while

maintaining optionality on the future rising uranium price.

Christopher M. Jones, President and Chief

Executive Officer of Uranium Resources, said, “We are pleased to

have worked with Laramide to achieve this strategic transaction for

our respective shareholders. Churchrock’s new royalty structure

significantly improves projects economics, enabling the more rapid

development of this project. At the same time, other improvements

we have made to the transaction enable URI to more fully

participate in the success of this venture.”

Definitive documentation reflecting these

amended terms is expected to be executed by December 9, 2016.

The closing, now set for December 22, 2016, is subject to

customary conditions, including applicable stock exchange

approvals, and regulatory approvals for the transfer of the

projects to Laramide, including the transfer of URI’s NRC license

as it pertains to the sale properties; however, Laramide has

removed financing as a condition of closing. If Laramide is

unable to close because it has not been able to raise the necessary

funds, Laramide would be required to pay the break fee called for

in the Agreement.

About Uranium Resources

(URI)

URI is focused on developing energy-related

metals. The Company has developed a dominant land position in

two prospective lithium brine basins in Nevada and Utah in

preparation for exploration and potential development of any

resources that may be discovered there. URI remains focused

on advancing the Temrezli in-situ recovery (ISR) uranium project in

Central Turkey when uranium prices permit economic development of

this project. URI controls extensive exploration properties in

Turkey under nine exploration and operating licenses covering

approximately 32,000 acres (over 13,000 ha) with numerous

exploration targets, including the potential satellite Sefaatli

Project, which is 30 miles (48 km) southwest of the Temrezli

Project. In Texas, the Company has two licensed and currently idled

processing facilities and approximately 11,000 acres (4,400 ha) of

prospective ISR uranium projects. In New Mexico, the Company

controls mineral rights encompassing approximately 190,000 acres

(76,900 ha) in the prolific Grants Mineral Belt, which is one of

the largest concentrations of sandstone-hosted uranium deposits in

the world. Incorporated in 1977, URI also owns an extensive uranium

information database of historic drill hole logs, assay

certificates, maps and technical reports for the Western United

States.

Cautionary Statement

This news release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are subject to

risks, uncertainties and assumptions and are identified by words

such as "expects," "estimates," "projects," "anticipates,"

"believes," "could," and other similar words. All statements

addressing events or developments that the Company expects or

anticipates will occur in the future, including but not limited to

statements relating to the execution of definitive documents

relating to the amendment to the Agreement, the closing of the

transaction with Laramide, including the timing of the closing, and

developments at the Company’s projects, including future

exploration costs and results, are forward-looking

statements. Because they are forward-looking, they should be

evaluated in light of important risk factors and

uncertainties. These risk factors and uncertainties include,

but are not limited to, (a) the Company's ability to raise

additional capital in the future; (b) spot price and long-term

contract price of uranium and lithium; (c) risks associated with

our foreign operations, (d) operating conditions at the Company's

projects; (e) government and tribal regulation of the uranium

industry, the lithium industry, and the power industry; (f)

world-wide uranium and lithium supply and demand, including the

supply and demand for lithium based batteries; (g) maintaining

sufficient financial assurance in the form of sufficiently

collateralized surety instruments; (h) unanticipated geological,

processing, regulatory and legal or other problems the Company may

encounter in the jurisdictions where the Company operates,

including in Texas, New Mexico, Utah, Nevada and Turkey; (i) the

ability of the Company to enter into and successfully close

acquisitions or other material transactions, including closing the

proposed transaction with Laramide; (j) the results of the

Company’s lithium brine exploration activities at the Columbus

Basin and Sal Rica Projects, and (k) other factors which are more

fully described in the Company's Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, and other filings with the

Securities and Exchange Commission. Should one or more of these

risks or uncertainties materialize, or should any of the Company's

underlying assumptions prove incorrect, actual results may vary

materially from those currently anticipated. In addition, undue

reliance should not be placed on the Company's forward-looking

statements. Except as required by law, the Company disclaims any

obligation to update or publicly announce any revisions to any of

the forward-looking statements contained in this news release.

Uranium Resources Contact:

Christopher M. Jones, President and CEO

303.531.0472

Jeff Vigil, VP Finance and CFO

303.531.0473

Email: Info@uraniumresources.com

Website: www.uraniumresources.com

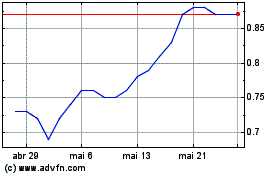

Laramide Resources (TSX:LAM)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Laramide Resources (TSX:LAM)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025