ENDEAVOUR INCREASES ITY'S INDICATED RESOURCE

BY 65% SINCE FEASIBILITY STUDY

View News Release in PDF Format

ITY EXPLORATION Highlights:

- Significant exploration efforts in H1-2017 have increased the

Indicated Resource by 1.0Moz to 3.8Moz

- The Indicated Resource inventory for the CIL Project has

increased by 1.5Moz (+65%) compared to the inventory on which the

2016 Feasibility Study was based

- In light of this strong resource growth, an Optimization Study

is expected to be published in September 2017, which is expected to

be based on a larger CIL plant of circa 4.0Mtpa, up from the

previously contemplated 3.0Mtpa

- Endeavour expects its internal contruction team to transition

from Houndé to Ity in Q4-2017, with a formal investment decision

currently expected to be taken by the Board in September 2017

- Exploration activities in H2-2017 will focus on follow-up

extension drilling on existing deposits, delineating a maiden

resource at the recently discoverd Le Plaque area, and drilling

several other near-mine exploration targets

Abidjan, July 27, 2017 - Endeavour Mining

(TSX:EDV)(OTCQX:EDVMF) is pleased to announce that its exploration

program at its Ity CIL Project, in Cote d'Ivoire, has increased the

Indicated Resource by 1.0 million ounces since the beginning of the

year, to reach 3.8 million ounces.

As illustrated in Table 1, this marks a 1.5

million ounce increase in the Indicated Resource base since the

publication of the November 2016 Feasibility Study ("FS"),

representing a 65% increase. An updated reserve estimate is

expected to be published in September as part of an Optimization

Study ("OS") which is expected to be based on a circa 4.0Mtpa

gravity circuit/Carbon-In-Leach ("CIL") plant, an increase from the

previously contemplated 3.0Mtpa plant, to better capture the value

created from recent exploration success.

Table 1: Summarized Resource Evolution

Following Publication of 2016 CIL Feasibility Study

|

(On a 100% basis) |

2017 OPTIMIZATION STUDY INVENTORY |

YEAR-END 2016 INVENTORY |

2016 FEASIBILITY STUDY INVENTORY |

VARIANCE (OS VS. FS) |

| P&P Reserves (only

CIL) |

update

in progress |

1.9

Moz |

1.9

Moz |

n/a |

| M&I

Resources(inclusive of Reserves) |

3.8

Moz |

2.8

Moz |

2.3

Moz |

+1.5 Moz |

| Inferred

Resources |

0.8 Moz |

1.4 Moz |

1.3 Moz |

(0.5 Moz) |

Reserves shown exclude the Heap Leach operation

Reserves. Resource estimated to the Indicated status, as such

no Measured Resources available. Mineral Reserve estimates

follow the Canadian Institute of Mining, Metallurgy and Petroleum

("CIM") definitions standards for mineral resources and reserves

and have been completed in accordance with the Standards of

Disclosure for Mineral Projects as defined by National Instrument

43-101. Notes for the 2017 Optimization Study Inventory Mineral

Resource estimate are provided in Section "About the Mineral

Resources" of this Press Release, with effective date May 31, 2017.

Full details on the Year-End 2016 Inventory and the 2016

Feasibility Study Inventory are available in the Company's

published press releases dated respectively March 7, 2017 and

November 10, 2016.

Patrick Bouisset, Executive Vice-President

Exploration and Growth at Endeavour, said: "Our exploration team

has done exceptional work over the past months which has led to a

significant increase in the resource base at Ity ahead of the

Optimization Study. These results and the numerous other identified

targets, on which initial drilling reconnaissance is currently

being conducted, further demonstrate the prospective nature of the

greater Ity area and our confidence in delivering against our

5-year exploration strategy disclosed last November. We believe

that the 80km Ity corridor which we control is among the most

prospective areas in West Africa and we look forward to building on

our exploration success."

Sébastien de Montessus, President & CEO,

stated: "Under Patrick's leadership, Ity has been transformed from

a 20-year operation nearing the end of its life into an asset that

now has the potential to be one of our flagship

operations. Our ability to quickly grow the Indicated Resource

demonstrates the robustness of Ity, as well as the quality of our

exploration team. We now look forward to announcing the results of

the Optimisation Study and making a formal investment decision in

September, following which we will transition the construction team

from Houndé to Ity later this year."

EXPLORATION EFFORTS Ahead of the

Optimization Study, exploration efforts since the beginning of the

year have been mainly directed at increasing Indicated Resources on

known deposits through in-fill, delineation, and extension

drilling, with up to eight rigs deployed. As shown in Figure 1

below, more than 31,000 meters of diamond drilling were conducted,

with efforts mainly focused on Daapleu, Bakatouo, Verse Ouest,

Colline Sud and Mont Ity/Ity Flat deposits.

In parallel, initial drilling also took place on

several other exploration targets in the vicinity of the Ity mine

and the Le Plaque discovery, which was announced earlier this year.

This exploration program will be pursued during the second half of

2017, following the integration of pending analysis results.

Figure 1: Ity Mining Complex H1-2017

Exploration Drilling Focus

Compared to the resource inventory used to build

the 2016 Feasibility Study, a total of 1.5Moz of Indicated

Resources were added, with the main increases coming from the

discovery of Bakatouo (+704koz), and additional Indicated resources

outlined at Daapleu (+384koz), Mont Ity / Flat (+189koz), and Verse

Ouest (+187koz), as shown Table 2 below.

Table 2: Resource Evolution Following

Publication of 2016 CIL Feasibility Study

| |

2017 OPTIMIZATION STUDY INVENTORY |

|

2016 FEASIBILITY STUDY INVENTORY |

| Deposits on a 100% basis |

Indicated Resources |

|

Inferred Resources |

|

Indicated Resources |

|

Inferred Resources |

|

Tonnage (Mt) |

Grade (Au g/t) |

Content (Au koz) |

|

Tonnage (Mt) |

Grade (Au g/t) |

Content (Au koz) |

|

Tonnage (Mt) |

Grade (Au g/t) |

Content (Au koz) |

|

Tonnage (Mt) |

Grade (Au g/t) |

Content (Au koz) |

| Open Pits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Daapleu |

28.1 |

1.50 |

1,349 |

|

0.7 |

0.92 |

22 |

|

19.9 |

1.51 |

965 |

|

4.3 |

1.15 |

160 |

| Mont Ity /

Flat |

10.1 |

2.20 |

716 |

|

9.7 |

1.40 |

436 |

|

7.5 |

2.19 |

527 |

|

11.1 |

1.92 |

684 |

| Gbeitouo |

2.9 |

1.35 |

124 |

|

0.3 |

1.48 |

13 |

|

2.9 |

1.35 |

124 |

|

0.3 |

1.48 |

13 |

| Walter |

1.6 |

1.23 |

65 |

|

0.6 |

1.35 |

26 |

|

2.1 |

1.21 |

81 |

|

0.7 |

1.32 |

28 |

| Zia NE |

6.7 |

1.28 |

274 |

|

4.0 |

1.40 |

178 |

|

7.7 |

1.31 |

325 |

|

4.0 |

1.39 |

179 |

| Bakatouo |

10.2 |

2.14 |

704 |

|

0.6 |

2.27 |

44 |

|

- |

- |

- |

|

- |

- |

- |

|

Colline Sud |

1.0 |

2.14 |

66 |

|

0.4 |

2.11 |

28 |

|

- |

- |

- |

|

- |

- |

- |

|

Sub-total |

60.6 |

1.69 |

3,298 |

|

16.3 |

1.43 |

747 |

|

40.1 |

1.57 |

2,022 |

|

20.4 |

1.62 |

1,064 |

| Existing

Stockpiles |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Aires |

5.8 |

1.09 |

202 |

|

0.2 |

0.78 |

6 |

|

5.8 |

1.09 |

202 |

|

0.2 |

0.78 |

6 |

| Teckraie |

2.8 |

1.07 |

97 |

|

0.1 |

0.55 |

2 |

|

2.8 |

1.07 |

97 |

|

0.1 |

0.55 |

2 |

|

Verse Ouest |

5.9 |

0.99 |

187 |

|

2.3 |

0.50 |

37 |

|

- |

- |

- |

|

8.4 |

0.85 |

230 |

|

Sub-total |

14.5 |

1.04 |

486 |

|

2.6 |

0.54 |

45 |

|

8.6 |

1.08 |

300 |

|

8.7 |

0.85 |

238 |

|

Total |

75.1 |

1.57 |

3,784 |

|

18.9 |

1.30 |

792 |

|

48.7 |

1.48 |

2,322 |

|

29.1 |

1.39 |

1,302 |

Resource estimated to the Indicated status, as

such no Measured Resources available. Mineral Reserve

estimates follow the Canadian Institute of Mining, Metallurgy and

Petroleum ("CIM") definitions standards for mineral resources and

reserves and have been completed in accordance with the Standards

of Disclosure for Mineral Projects as defined by National

Instrument 43-101. Notes for the 2017 Optimization Study Inventory

Mineral Resource estimate are provided in Section "About the

Mineral Resources" of this Press Release, with effective date April

30, 2017. Full details on the Year-End 2016 Inventory and the 2016

Feasibility Study Inventory are available in the Company's

published press releases dated respectively March 7, 2017 and

November 10, 2016.

BAKATOUO DEPOSITA total of 4,700 meters comprising 30

holes were drilled on the Bakatouo deposit following the

publication of its maiden resource in late 2016, with both infill

and extension drilling done as shown in Figure 2 below.

Figure 2: Bakatouo Drill Area

Drilling conducted during the first half of 2017

has identified additional mineralization within the previous

resource envelope and at depth, as well as through some extensions

which remain partially open to the southeast, southwest, northwest

and northeast of the deposit. Additional drilling is planned

in the second half of the year to test these extensions, with the

priority being the northeast extension.

Figure 3: Bakatouo Cross-Section

As shown in the table below, the H1-2017 program

added 229koz of Indicated Resources while the average grade

decreased as ounces added through the defined extensions were of

lower grade than the central part of the deposit. The Indicated

resource however remains very robust with more than 35% of its

Indicated Resource grading above 4.5 g/t and 50% grading above 3.0

g/t. Due to its higher-grade nature, the Optimization Study

envisages Bakatouo to be mined in the first years of the CIL

production.

Table 3: Bakatouo Resource Evolution

|

|

|

AS AT APRIL 30, 2017 |

AS AT DEC 31, 2016 |

| Indicated Resource |

Tonnage (Mt) |

10.2 |

4.8 |

| Grade (Au g/t) |

2.14 |

3.07 |

|

Content (Au koz) |

704 |

475 |

| Inferred Resource |

Tonnage (Mt) |

0.6 |

0.8 |

| Grade (Au g/t) |

2.27 |

2.86 |

|

Content (Au koz) |

44 |

70 |

DAAPLEU DEPOSITA total of over 14,860 meters, comprising

77 holes, were drilled on the Daapleu deposit consisting of both

infill drilling and resource delineation outside of and as an

extension of the down dip of the 2016 resource boundary, as

illustrated in Figure 4 below, increasing the Daapleu Indicated

Resource by 384koz to 1,349koz.

Figure 4: Daapleu Drill Area

The H1-2017 program has demonstrated the high

continuity of mineralization (Fluidized Rhyolite and high grade

shear zone) within the Daapleu deposit, which remains fully open at

depth towards the northwest as illustrated in Figure 5 below.

Figure 5: Daapleu Cross-Section

MONT ITY/ITY FLAT DEPOSITA total of over 8,300 meters,

comprising 77 holes, were drilled at the Mont Ity /Ity Flat

deposits during the first half of 2017, concentrating on the

northeast high grade zone which was not previously accessible for

drilling due to ongoing mining activities. This drill campaign

confirmed the continuity of mineralization between the two areas,

which are now considered to be a single deposit, and added 189koz

of Indicated Resources. An additional drilling program is ongoing

on the central part of the Mont Ity deposit in order to convert

additional Inferred Resources into Indicated status before

year-end.

The results demonstrate the very high grade

mineralization in this area of the deposit, as shown in selected

intercepts illustrated in Figure 6 below.

Figure 6: Mont Drill Area

Within the drilled area, mineralization remains

clearly open at depth, as shown in Figure 7 below.

Figure 7: Mont Ity/Flat Cross-Section

OTHER NEARBY TARGETSIn H1-2017, initial

exploration drilling, for which the results are still pending, also

took place on several other exploration targets in the vicinity of

the Ity mine (as per the blue dashed area in the Figure 8 below)

and on the Le Plaque discovery which was announced earlier this

year. This area, located within 5km from the current Ity mining

complex, represents a small portion of the 80km corridor controlled

by Endeavour.

This exploration program will be pursued in

Q4-2017, after the end of the rainy season and the integration of

pending analysis results, with the main focus on delineating a

maiden Inferred Resource at the Le Plaque discovery.

Figure 8: Ity Mine Area and Surrounding

Exploration Targets

NEXT STEPS

- Follow-up drilling on the Bakatouo extensions

- Drilling campaign on Le Plaque to delineate the extent of

mineralized potential and aim for Inferred status by year-end

- Follow-up drilling on other exploration targets in the vicinity

of the Ity mining complex

- Follow-up on the airborne geophysical survey, soil

geochemistry, and auger drill results obtained in H1-2017 on the

Greater Ity regional area

QUALIFIED PERSONS

The scientific and technical content of this

news release has been reviewed, verified and compiled by Gérard de

Hert, EurGeol, Senior VP West Africa Exploration for Endeavour

Mining. Gérard de Hert has more than 19 years of mineral

exploration and mining experience, and is a "Qualified Person" as

defined by National Instrument 43-101 - Standards of Disclosure for

Mineral Projects ("NI 43-101").

ASSAYS AND QUALITY ASSURANCE/QUALITY

CONTROL

All the related drill samples were prepared in

accordance with National Instrument 43-101 Standards of Disclosure

for Mineral Projects. All samples were diamond drill core (HQ and

NQ size at Daapleu and Bakatouo, HQ and NTW at Ity-Ity FLat). After

photography, and geologic and geotechnical logging, the core was

marked up for sampling via approved procedures and was cut in half

with electric saw and diamond impregnated core blades. Sampling

involved collecting the left-hand side at designated sampling

intervals for processing and analysis, and leaving the right-hand

side in core boxes for reference.

Samples were dried, crushed and pulverized on

site at the SMI Ity exploration mechanical preparation facilities.

The facilities were constructed and commissioned with Bureau

Veritas Laboratories (Abidjan), an independent laboratory services

provider, whom also designed and implemented site procedures and

protocols and supervised training. In January 2017, SGS

Laboratories (SGS Cote D'Ivoire SA) took over the management and

running of the preparation facilities, as part of a new contract

with SGS to build and run an onsite laboratory to process present

and future exploration and mine sample processing requirements. The

new laboratory maintains separate dedicated preparation equipment

for both exploration and mine samples.

The pulverized samples (pulps) were stored in

200g kraft paper packets and shipped to SGS Burkina SA in

Ouagadougou for gold analysis. Samples were analyzed using a

standard 50-gram gold fire assay with an Atomic Absorption finish

(FAA505); above detection limit samples were re-analyzed via

gravimetric procedure (FAG505).

Sampling and assay data were monitored through a

quality assurance/quality control program designed to follow NI

43-101 and industry best practice. Certified reference materials

were sourced from Geostats Pty Ltd Australia. Standards (oxide and

sulphide at different grades) duplicate and blank control samples

were inserted at a rate of 18 in every batch of 100 samples

submitted to SGS. Results are loaded electronically into the

company's Acquire database.

ABOUT THE MINERAL RESOURCE

The insitu Mineral Resources, which include

Daapleu, Mont Ity / Ity Flat, Bakatouo, Gbeitouo, Walter, Zia NE

and Colline Sud, have been reported inside optimised pit shells and

above a 0.5 g/t Au cut-off. Reporting within an optimised pit shell

satisfies the requirement for the Mineral Resource to have

reasonable prospects for future economic extraction. The pit

optimisation assumes a US$1,500/oz Au price.

The Mineral Resource for the rock dumps, which

include the Teckraie and Verse Ouest Mineral Resources and also the

Aires heap leach pad, have not been reported inside an optimised

pit shell. These deposits have been built up above the existing

topography and the associated shallow laterite located directly

below, therefore satisfying the requirement for the Mineral

Resource to have reasonable prospects for future economic

extraction. The Teckraie and Verse Ouest rock dump Mineral

Resources and Aires leach pad Mineral Resources have been reported

above 0.0 g/t Au because there is unlikely to be any grade

selectivity during mining. The underlying laterite Mineral

Resources for each of the deposits has been reported above 0.5 g/t

Au given the possibility for some mining selectivity. All Mineral

Resources are current as at April 30, 2017. Mineral resources which

are not mineral reserves do not have demonstrated economic

viability.

Reported tonnage and grade figures have been

rounded from raw estimates to reflect the relative accuracy of the

estimate. Minor variations may occur during the addition of rounded

numbers.

The statistical analysis, geological modelling

and resource estimation for Colline Sud were prepared by Kevin

Harris, CPG. Mr. Harris is Endeavour Mining's Group Resource

Manager and is a "Qualified Person" as defined by National

Instrument 43-101 - Standards of Disclosure for Mineral Projects

("NI 43-101").

The statistical analysis, geological modelling

and resource estimation for Bakatouo, Mt Ity/Ity flat, Daapleu and

Verse Ouest were prepared by Mark Zammit, CPG. Mr. Zammit is a

principal consultant geologist with Cube Consulting Pty Ltd and is

a "Qualified Person" as defined by National Instrument 43-101 -

Standards of Disclosure for Mineral Projects ("NI 43-101").

CONTACT INFORMATION

|

Martino De CiccioVP - Strategy & Investor Relations +44

203 640 8665 mdeciccio@endeavourmining.com |

DFH

Public Affairs in TorontoJohn Vincic, Senior Advisor (416)

206-0118 x.224 jvincic@dfhpublicaffairs.com Brunswick Group LLP

in LondonCarole Cable, Partner +44 7974 982 458

ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is a TSX-listed intermediate

gold producer, focused on developing a portfolio of high quality

mines in the prolific West-African region, where it has established

a solid operational and construction track record.

Endeavour is ideally positioned as the major

pure West-African multi-operation gold mining company, operating 5

mines across Côte d'Ivoire (Agbaou and Ity), Burkina Faso (Karma),

Mali (Tabakoto), and Ghana (Nzema). In 2017, it expects to produce

between 600koz and 640koz at an AISC of US$860 to US$905/oz.

Endeavour is currently building its Houndé project in Burkina Faso,

which is expected to commence production in Q4-2017 and to become

its flagship low-cost mine with an average annual production of

190koz at an AISC of US$709/oz over an initial 10-year mine life,

based on reserves. The development of the Houndé and Ity CIL

projects are expected to lift Endeavour's group production to

+900kozpa and decrease its average AISC to circa $800/oz by 2019,

while exploration aims to extend all mine lives to +10 years.

Corporate Office: 5 Young St, Kensington,

London W8 5EH, UK

This news release contains "forward-looking

statements" including but not limited to, statements with respect

to Endeavour's plans and operating performance, the estimation of

mineral reserves and resources, the timing and amount of estimated

future production, costs of future production, future capital

expenditures, and the success of exploration activities. Generally,

these forward-looking statements can be identified by the use of

forward-looking terminology such as "expects", "expected",

"budgeted", "forecasts", and "anticipates". Forward-looking

statements, while based on mana gement's best estimates and

assumptions, are subject to risks and uncertainties that may cause

actual results to be materially different from those expressed or

implied by such forward-looking statements, including but not

limited to: risks related to the successful integration of

acquisitions; risks related to international operations; risks

related to general economic conditions and credit availability,

actual results of current exploration activities, unanticipated

reclamation expenses; changes in project parameters as plans

continue to be refined; fluctuations in prices of metals including

gold; fluctuations in foreign currency exchange rates, increases in

market prices of mining consumables, possible variations in ore

reserves, grade or recovery rates; failure of plant, equipment or

processes to operate as anticipated; accidents, labour disputes,

title disputes, claims and limitations on insurance coverage and

other risks of the mining industry; delays in the completion of

development or construction activities, changes in national and

local government regulation of mining operations, tax rules and

regulations, and political and economic developments in countries

in which Endeavour operates. Although Endeavour has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. Please refer to Endeavour's

most recent Annual Information Form filed under its profile at

www.sedar.com for further information respecting the risks

affecting Endeavour and its business. AISC, all-in sustaining costs

at the mine level, cash costs, operating EBITDA, all-in sustaining

margin, free cash flow, net free cash flow, free cash flow per

share, net debt, and adjusted earnings are non-GAAP financial

performance measures with no standard meaning under IFRS, further

discussed in the section Non-GAAP Measures in the most recently

filed Management Discussion and Analysis.

Appendix A:

Figure 9: Endeavour Controlled 80km Ity Mine

Corridor

Attachments:

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/41c9f555-400a-40f4-8b93-073cfdd27414

Attachments:

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/28df79e5-0656-4ffd-80cf-36f5381f8a98

Attachments:

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/eea36c30-31dd-46f8-a879-fca2941c10d7

Attachments:

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/976c3a8b-5ae0-494c-b63a-64d9af72269e

Attachments:

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/104064f7-7b7c-46ef-8505-6e923866871d

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/a5874b03-8986-41fd-8f62-4cfa2bc95092

Attachments:

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/0f77ef71-7827-48fc-9126-c9daae27683e

Attachments:

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/c7ab160a-1a5b-41be-b9a5-f778d87d405c

Attachments:

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/352c31fc-f758-43c6-a87e-03ba512080a4

Attachments:

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/6075c121-b044-4b1f-a067-b2360224ea94

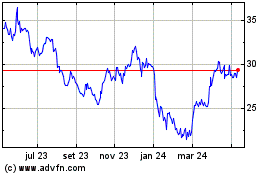

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

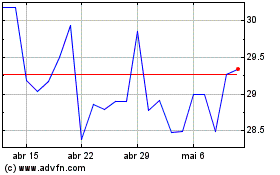

Endeavour Mining (TSX:EDV)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025