October 18, 2017

Transformation plan to deliver €110 million savings in 2018

AkzoNobel publishes Q3 2017 results

Akzo Nobel N.V. (AKZA.AS; AKZOY)

Q3:

- Volumes 2% higher driven by Decorative Paints and

Performance Coatings

- Revenue up 1%, mainly due to volume growth and

acquisitions, partly offset by unfavorable currencies

- EBIT1 at €383 million (2016: €442 million), impacted by

unfavorable currencies, temporary disruption to the manufacturing

and supply chain, continued headwinds for Marine and Protective

Coatings and margin pressure from raw material cost inflation

- Direct impact of around €25 million on EBIT related to

Hurricane Harvey and other events

- Adjusted EPS at €1.07 (2016: €1.20)

- Initiating phase one of transformation plan to create a

fit for purpose Paints and Coatings organization to deliver €110

million savings in 2018 contributing towards the 2020 financial

guidance

- Extraordinary General Meeting (EGM) to be held on

November 30, 2017

- Creating two focused high-performing businesses:

- Separation of Specialty Chemicals is on track to be

completed by April 2018

- €1 billion special cash dividend as advance proceeds to

be paid on December 7, 2017, following shareholder approval for the

separation

- Capacity expansions in the UK (Decorative Paints), China

(Performance Coatings) and Sweden (Specialty Chemicals)

- Number one in the Chemicals Industry Group on the Dow

Jones Sustainability Index, for the fifth time in six years

CEO Thierry Vanlancker, commented:

"We have continued to grow our business with higher volumes and

increased revenues despite challenging market conditions in

selected areas of our business, especially in Marine and Protective

Coatings.

"We have also initiated phase one of our transformation plan to

create a fit for purpose Paints and Coatings organization which

will deliver €110 million annual savings in 2018 contributing

towards our 2020 financial guidance.

"EBIT for 2017 is now expected to be in line with 2016, due to

adverse foreign exchange, ongoing industry specific headwinds and

supply chain disruptions, including the adverse impact of Hurricane

Harvey in the US.

"There continues to be significant interest in our Specialty

Chemicals business and we look forward to the separation process

officially kicking off in the coming weeks. We have announced

several capacity expansions to accelerate growth for the business,

including a €20 million investment to increase production at

Sundsvall, Sweden for our Expancel expandable

microspheres."Outlook:

We anticipate positive developments for EMEA (excluding the UK),

North America and Asia, while Latin America is expected to

stabilize.

Industry specific headwinds continue, including higher raw

material prices and challenges for marine and protective

coatings.

We are implementing various measures to mitigate current market

challenges, including increased selling prices and additional cost

control.

EBIT for 2017 is now expected to be in line with 2016, due to

ongoing industry specific headwinds and supply chain

disruptions.

Q3 2017 in € million

| |

Q3

2016 |

Q3

2017 |

Delta

% |

| Revenue |

3,600 |

3,624 |

1 |

| EBIT1 |

442 |

383 |

(13) |

| Return on sales (ROS)2

% |

12.3 |

10.6 |

|

| Net income attributable to

shareholders |

285 |

216 |

(24) |

| |

|

|

|

Year-to-date January - September 2017 in € million

| |

YTD

2016 |

YTD

2017 |

Delta

% |

| Revenue |

10,741 |

11,070 |

3 |

| EBIT1 |

1,267 |

1,220 |

(4) |

| Return on sales (ROS)2

% |

11.8 |

11.0 |

|

| Return on investment

(ROI)3 % |

15.2 |

14.2 |

|

| Net income attributable to

shareholders |

837 |

757 |

(10) |

Decorative Paints

Third quarter volumes increased by 5% due to positive

developments in Asia. Revenue was down 1%, with positive volume

development more than offset by adverse currency and price/mix

effects. EBIT was adversely impacted by continued higher raw

material costs in the paints and coatings industry, not yet fully

compensated, and geographical/product mix effects. Appropriate

measures are being taken to address higher raw material costs,

including increased selling prices and additional cost control.

AkzoNobel opened a new facility in Ashington,

UK, which is the world's most advanced and sustainable paint

factory. This hi-tech plant is the new center of production for

Dulux, the world's leading decorative paint brand.

Performance Coatings

Volumes were up by 1% in the third quarter, with growth for

Industrial and Powder Coatings, partly offset by adverse conditions

in the marine and oil and gas industries. Revenue was up 2%, due to

volume growth and the acquired Industrial Coatings business, partly

offset by currency effects. EBIT was adversely impacted by ongoing

weakness in the marine and oil and gas industries, as well as

increased costs of raw materials in the paints and coatings

industry and adverse currency effects. Measures being implemented

to mitigate current industry specific headwinds include increased

selling prices and additional cost control.

The company opened a facility in Dongguan, China, dedicated to

producing aerospace coatings for the North and South Asian aviation

market. This new facility will offer improved and faster service to

existing, as well as new, customers in this rapidly-growing

market.

Specialty Chemicals

Third quarter volumes were flat, despite significant global

supply chain disruptions including Hurricane Harvey in the Houston

area of the US. Revenue was up 1% due to positive price/mix

effects, mostly offset by adverse currencies. EBIT was up 1% with

favorable price/mix developments and cost savings partly offset by

unfavorable currencies and global supply chain disruptions.

Positive price/mix reflects the successful pass through of raw

material price inflation.

During Q3, AkzoNobel announced a novel technology platform for

producing a wide range of ethylene amines and their derivatives

from ethylene oxide. The process involves lower raw material

consumption and has an improved cost and sustainability profile

when compared with existing processes. Construction of a

demonstration unit will start next year.

Business Area highlights in € million

|

Decorative Paints |

|

|

|

|

|

| Q3

2016 |

Q3

2017 |

Delta

% |

|

YTD

2016 |

YTD

2017 |

Delta% |

| 1,021 |

1,007 |

(1) |

Revenue |

2,937 |

2,975 |

1 |

| 123 |

95 |

(23) |

EBIT1 |

306 |

293 |

(4) |

| 12.0 |

9.4 |

|

ROS2 % |

10.4 |

9.8 |

|

|

Performance Coatings |

|

| Q3

2016 |

Q3

2017 |

Delta% |

|

YTD

2016 |

YTD

2017 |

Delta% |

| 1,406 |

1,428 |

2 |

Revenue |

4,267 |

4,403 |

3 |

| 199 |

147 |

(26) |

EBIT1 |

607 |

536 |

(12) |

| 14.2 |

10.3 |

|

ROS2 % |

14.2 |

12.2 |

|

|

Specialty Chemicals |

|

|

| Q3

2016 |

Q3

2017 |

Delta% |

|

YTD

2016 |

YTD

2017 |

Delta% |

| 1,202 |

1,209 |

1 |

Revenue |

3,614 |

3,757 |

4 |

| 168 |

169 |

1 |

EBIT1 |

511 |

524 |

3 |

| 14.0 |

14.0 |

|

ROS2 % |

14.1 |

13.9 |

|

- Operating income excluding identified items

- ROS% is EBIT divided by revenue

- Moving average ROI% is 12 months EBIT divided by 12 months

average invested capital

The Q3 report can be viewed and downloaded

at www.akzonobel.com/quarterlyresults

- - -

About AkzoNobel

AkzoNobel creates everyday essentials to make people's lives

more liveable and inspiring. As a leading global paints and

coatings company and a major producer of specialty chemicals, we

supply essential ingredients, essential protection and essential

color to industries and consumers worldwide. Backed by a pioneering

heritage, our innovative products and sustainable technologies are

designed to meet the growing demands of our fast-changing planet,

while making life easier. Headquartered in Amsterdam, the

Netherlands, we have approximately 46,000 people in around 80

countries, while our portfolio includes well-known brands such as

Dulux, Sikkens, International, Interpon and Eka. Consistently

ranked as a leader in sustainability, we are dedicated to

energizing cities and communities while creating a protected,

colorful world where life is improved by what we do.

Not for publication - for more

information

| Corporate Media

Relations |

Corporate Investor

Relations |

| T +31 (0)88 - 969

7833 |

T +31 (0)88 - 969

7856 |

| Contact: Diana

Abrahams |

Contact: Lloyd

Midwinter |

Safe Harbor StatementThis press release

contains statements which address such key issues such as

AkzoNobel's growth strategy, future financial results, market

positions, product development, products in the pipeline and

product approvals. Such statements should be carefully considered,

and it should be understood that many factors could cause

forecasted and actual results to differ from these statements.

These factors include, but are not limited to, price fluctuations,

currency fluctuations, developments in raw material and personnel

costs, pensions, physical and environmental risks, legal issues,

and legislative, fiscal, and other regulatory measures. Stated

competitive positions are based on management estimates supported

by information provided by specialized external agencies. For a

more comprehensive discussion of the risk factors affecting our

business please see our latest annual report, a copy of which can

be found on our website: www.akzonobel.com.

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/4bb9444d-aaf2-48af-acce-f5a9369b4674

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/04cf4980-b0be-46da-9eb5-97d606d46b3e

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/53fef7f4-50f6-4403-93d4-fd8d2b5927c9

Attachments:

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/34227b60-48c1-4764-99eb-7a7a6c7c263a

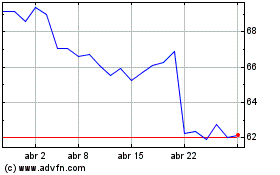

Akzo Nobel NV (EU:AKZA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Akzo Nobel NV (EU:AKZA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024