Goldmoney Inc. (TSX:XAU) (“Goldmoney”) (the “Company”), a precious

metal financial service and technology company, today announced

that investee company Menē Inc. will complete a listing transaction

on the TSX Venture Exchange through a business combination with

Amador Gold Corp. (TSXV:AGX/H). Additionally, Goldmoney provided

insight into the transaction and the long-term strategy agreed to

by the board for distributing its 32% ownership stake in Menē Inc.

to Goldmoney shareholders. The transaction is subject to regulatory

approval. Additional details are included in the Amador Gold Corp.

press release available on SEDAR:

http://www.sedar.com/DisplayProfile.do?lang=EN&issuerType=03&issuerNo=00007733.

The Creation of Menē and Investment by

Goldmoney Inc.

Menē Inc. was founded by Roy Sebag in early 2016

as an exploratory venture within Goldmoney Inc., which was

incorporated in Delaware in November 2016. Co-Founder and Chief

Artistic Officer Diana W. Picasso joined the venture in early 2017.

In March of 2017, multifaceted designer Sunjoo Moon joined as

Creative Director.

As the project gained momentum, it became

apparent that both the opportunity and investment were greater than

originally conceived. Based on the projected capital requirements,

higher risk-reward parameters, divergent business model, and

stringent voting-control requisites imposed by the Picasso family,

the Goldmoney board ultimately decided to limit the Company’s

investment in Menē Inc. sharing in the risk with outside investors,

primarily comprised of the founders and other important

stakeholders in the venture.

Menē has built the core infrastructure necessary

to achieve its business mission of retailing 24 karat gold and

platinum investment jewelryTM by weight at prevailing prices for

precious metals. Key events necessary as part of the de-risking the

proof of concept include:

- The investment in an independent jewelry manufacturing

operation in New Jersey, USA.

- The acquisition, importation, and installation of custom

machinery from Italy, Rhode Island, and other locations around the

world.

- The build out of a proprietary vaulting, fulfillment, and

buy-back facility in a joint venture with Brink’s Global Services

in New Jersey, USA.

- The development of an artistic and creative team led by Diana

W. Picasso and Sunjoo Moon which has already designed nearly 1,500

SKUs, including: bracelets, earrings, necklaces, pendants, rings,

and gifts.

- The engineering and development of a proprietary technology and

e-commerce platform (mene.com) that manages: the real-time pricing

of all inventory by gram weight, sales via multiple payment

options, buy-backs, customer relationship management, wish lists,

gifting, and refer-a-friend.

- The development and branding of unique Menē packaging and

luxury user experience with the leading packaging manufacturer in

the fashion and lifestyle industries.

- The negotiation and execution of a multi-million dollar

inventory facility with a leading institutional bank.

- The collaboration with Karla Otto, a leading fashion

consultancy, for digital communications, social media, and public

relations.

- Hiring of key personnel in fashion, design, customer service,

logistics, and jewelry manufacturing in Paris, Toronto, and New

Jersey.

- The launch of the business in private-beta, and successful sale

and shipment of jewelry to multiple countries in just two weeks of

beta-operations.

Virtually all of these events were successfully

achieved due to the direct contributions of Mr. Sebag and Ms. W.

Picasso as founders of Menē Inc. operating independently from

Goldmoney.

Exclusive Distribution Agreement with

Goldmoney

As previously discussed in the press release

dated June 15, 2017, Menē and Goldmoney entered into a 10-year

exclusive agreement whereby Menē will purchase and sell precious

metals directly through Goldmoney. Additionally, Goldmoney was

provided with the option to distribute Menē jewelry to Goldmoney

clients at what is effectively Menē’s cost. This agreement implies

that effectively each $1 of jewelry sold on Mene.com will result in

$1 of revenue and $.05 cents of gross profit to Goldmoney Inc.

Moreover, Goldmoney’s investment in the venture has resulted in a

31% economic stake that is sizeable and has become increasingly

more valuable.

Spinning Off Goldmoney Inc. Stake in

Menē to Shareholders and Rationale for RTO Process

As Menē grows and scales its operations, the

company requires its own independent sources of capital from

institutional investors that are experienced with the luxury and

fashion sectors. Several investors have already approached the

company expressing their interest in investing and at favorable

valuations. Given the group’s track record with the listing and

execution of the Goldmoney (formerly BitGold) business, a decision

was made in the summer to seek a target for a reverse take-over

going public transaction (RTO). The most salient considerations for

this process vs. a direct prospectus listing were: desire to

expeditiously separate the Menē Balance Sheet, Income Statement,

and business performance from Goldmoney’s own financial results

under IFRS, the timing and costs associated with both alternatives,

and the ability to distribute Goldmoney Inc.’s shares of Menē to

investors in tranches, over-time.

Public Listing Through Business

Combination with Amador Gold

Following an extensive due diligence process

whereby management had reviewed several dozen targets, a decision

was made to enter into an agreement with Amador Gold Inc.

(TSXV:AGX.H), a TSX Venture listed publicly traded company with

roughly $400,000 in cash and no liabilities. Pursuant to the RTO,

Amador Gold will acquire 100% of Menē Inc. at a deemed valuation of

$27 million. This will result in the issuance of 163,696,602 Class

A Superior Voting Shares and 82,350,000 Class B Subordinate Voting

Shares. Only the Class B shares, of which Goldmoney Inc. owns

79,800,000, will be trading on the TSX Venture with the Class A

shares primarily owned by Mr. Sebag and Ms. W. Picasso.

At the deemed amalgamation price of 11 cents,

Menē Inc. and therefore Goldmoney Inc. shareholders are achieving a

go-public event at a cost of around $250,000, which represents the

excess value attributed to Amador Gold shares beyond the cash per

share value of 7 cents per share in that company.

Menē Inc. Board of

Directors

As disclosed in Menē’s October 19, 2017 press

release, Menē has appointed a leading Board of Directors with

experience in Luxury, Fashion, Tech, and Art.

Roy Sebag – Chairman – Chief Executive

Officer

Roy Sebag is an entrepreneur who has enjoyed a

successful 15-year career in diverse industries ranging from

technology, precious metals, and investment management.

Mr. Sebag began his career as a portfolio

manager founding a hedge-fund that specialized in contrarian

investing in global public equity markets. His training and

evolution as a contrarian investor conditioned him to think

differently in other realms such as economics, philosophy, and

history. It was this mind-set which led him to be one of the few

investors who predicted and capitalized on the 2008 financial

crisis. During this period, he invested in gold mining and natural

resource assets studying geology, engineering, and physics. He also

authored the world’s most comprehensive ranking of gold deposits,

which is still relied upon as a trusted industry reference.

Ultimately, these experiences helped lead to the

creation of Goldmoney® which has become the world’s largest

gold savings and payments platform in less than 3 years, signing up

clients in over 150 countries who now entrust the firm with nearly

$2 billion of their precious metal savings.

Mr. Sebag is an independent writer and scholar

on the history of precious metals, money,

and jewelry. The idea for Menē was conceived as a direct

result of his extensive inquiry and writing about the global

jewelry industry. Along with his friend Diana W. Picasso, he hopes

to create a paradigm-shift in how consumers view jewelry, restoring

the ancient wisdom of jewelry as a store of enduring value.

In 2012 Mr. Sebag established the Braavos

Foundation which makes philanthropic investments supporting

exceptional organizations that tackle important social issues.

Braavos Foundation has supported organizations including: Gordon

Parks Foundation, Global Witness, Seeds of Africa Fund, Pencils of

Promise, Foundational Questions Institute, and Bergson

Institute.

Diana W. Picasso – Director – Chief

Artistic Officer

Diana Widmaier-Picasso is an art historian and

curator specialized in modern and contemporary art. She holds a

master degree in Art History (Paris-Sorbonne) and a master degree

in business law (Paris-Assas). She is the author of the forthcoming

catalogue raisonné of Pablo Picasso's sculptures.

She has written many essays about her

grandfather including “Pablo Picasso's Sheet-Metal Sculptures,

Vallauris 1954-1965: Design, Materials and Experimentation” (in

cat. exh. Sylvette, Sylvette, Sylvette. Picasso and the Model,

Kunsthalle Bremen, Münich, Prestel, 2014), “Picasso

Finished/Unfinished”, (in cat. exh. Unfinished: Thoughts left

visible, New York, The Metropolitan Museum of Art, New Haven, Yale

University Press, 2016), and “Marie-Thérèse Walter, muse de

Boisgeloup”, Boisgeloup, l'atelier normand de Picasso (in cat.

exh., Rouen, Réunion des musées métropolitains de Rouen-Normandie,

Artlys Editions, 2017).

She has curated major exhibitions such as

“Picasso and Marie-Thérèse: L'amour fou” (Gagosian Gallery, New

York, 2011), “Picasso.Mania” (Grand Palais, Paris, 2015-2016),

“Picasso's Picassos: A Selection from the Collection of Maya

Ruiz-Picasso” (Gagosian Gallery, New York, 2016-2017), and “Desire”

(Deitch Gallery, Miami Basel 2016).

Shireen Jiwan – Director

Shireen Jiwan is the founder and CEO of Sleuth,

the leading brand consultancy at the intersection of luxury,

lifestyle and technology. Named in part for Shireen’s signature

discrete working style, Sleuth’s strategy work is behind some of

the world’s most influential brands, including Microsoft, Amazon,

Netflix, Ralph Lauren, Rolex, DeBeers, Creative Artists Agency,

Harry Winston, Xbox, PepsiCo, Target Style, The Coca Cola Company

and others.

A challenger-brand champion, Shireen builds

category-disruptive, business-driving brand narratives from the

inside out. Her activation plans engage all channels and

departments, turning everything from retail and e-Com design to

social media and product design into powerful messaging channels

and margin-drivers.

Prior to Sleuth, Shireen held senior strategic

planning positions at agencies WPP, Ogilvy & Mather, and Fallon

Worldwide. Her breakthrough agency planning work resulted in a

myriad awards including Cannes, Effie, Clio One Show (Gold) and

D&AD. Most recently, Shireen served as Chief Brand Experience

Officer where she re-activated the long-dormant fashion brand by

drawing a new generation of loyal fans.

Shireen enjoys ongoing pro-bono work for the

YMCA and Free Arts for Abused Children and teaches progressive

brand building at Columbia Business School and The University of

Washington Foster School of Business.

Tommaso Chiabra – Director

Tommaso Chiabra is a member of the Board of

Directors of Menē Inc.

After earning a degree in Communication from

IULM University of Milan (Italy), Mr. Chiabra went on to found a

series of successful ventures in the event marketing, maritime, and

luxury goods sectors.

In 2010 he founded World Wide Events where he

produced luxury events for companies such as Persol, Luxottica, and

Formula One.

In 2015 he founded Royal Yacht Brokers, which

has become one of the leading luxury yacht-rental services in the

world brokering nearly 2,000 mega yachts for charter worldwide. In

2016 Mr. Chiabra became a principal investor in Berenford Eyewear

which has rapidly become one of the leading independent luxury

eyewear companies.

He joined Menē in 2017 as both an early investor

and consultant, with responsibility for strategic messaging,

communications, and brand positioning. He is also an Advisory Board

Member of the United Nations Children’s Fund (UNICEF) and is an

active philanthropic supporter of The Foundation for AIDS Research

(amfAR).

Josh D. Crumb – Director

Mr. Crumb is the co-founder of Goldmoney Inc.

and has served as its Chief Strategy Officer and Director since

2014, and its Chief Financial Officer since 2017. Mr. Crumb was

previously an Executive Director at Goldman Sachs - the Senior

Metals Strategist in the Global Economics, Commodities and Strategy

Research Division in London; a co-founder and Chief Financial

Officer of Coffee Flour, and a Director of Corporate Development at

the Lundin Group of Companies. Mr. Crumb holds a Master of Science

in Mineral Economics, a Graduate Certificate in International

Political Economy, and a Bachelor of Science degree in Engineering

from the Colorado School of Mines.

Long-term Strategy for Goldmoney Inc.

Shares in the Publicly Traded Menē Inc.

The Menē Inc. board has advised Goldmoney that

it may conduct a share consolidation following the completion of

the transaction and initiation of trading. Goldmoney Inc. currently

intends to distribute at least 50% of the Class B tradeable shares

of Menē Inc. to Goldmoney shareholders in separate tranches over

time, though no such distribution will occur until an official

notice is made, and there is no present commitment that Goldmoney

will proceed with such plan. Based on the present capital structure

plans of Menē, it is the intention of Goldmoney to eventually

distribute one share of Menē for every one share of Goldmoney Inc.

owned by investors as of Monday, December 25, 2017.

Menē Inc. Proposed

Stock Symbol and Investor Presentation

The Company is pleased to report that it has

reserved the stock symbol: “MENE” with the TSX Exchange. An

Investor Presentation for Menē is available at the following link:

https://mene.com/corporate/investor-relations

“We are pleased with the progress of Menē and

look forward to the proposed Transaction and subsequent financing

possibilities, which should ultimately benefit Goldmoney both

through our equity investment as well as the potential for new

revenue and new markets as Menē becomes an important Goldmoney

customer.” said James Turk, Lead Director of Goldmoney. “On behalf

of the board and management of Goldmoney, we wish Diana and Roy the

best of luck as they continue to build-out this disruptive idea,

and I am confident that both Roy and Josh will capably represent

the interests of Goldmoney shareholders on the Menē Board.”

“While Roy and Diana were very passionate and

had a clear vision with Menē, the Goldmoney board has maintained

that the manufacturing and marketing of jewelry falls outside of

the capital mandate of an early stage financial technology company.

Therefore, we believe the proposed Transaction achieves the proper

risk/reward from the perspective of Goldmoney shareholders, as we

seed-funded a potentially important customer to the Goldmoney

ecosystem and now own over a third of what could become a valuable

stake post-transaction. We have also secured an additional source

of revenue to Goldmoney with no additional capital, marketing, or

customer service costs.,” said Josh Crumb, CFO of Goldmoney.

“As with the original BitGold journey, going

public in Canada should prove to be an important step for the

promising venture of Menē,” said Roy Sebag, CEO of Goldmoney. “At

this stage of my career, I have come to value the operational

discipline, reporting, and transparency which are incumbent upon

running a publicly traded company. It is my sincere belief that

those requisites enhance the potential for success when a business

model requires establishing customer trust and relies upon sizeable

capital investment. While it’s obviously early, I feel good about

how far we have come in terms of de-risking the business concept

and demonstrating the global opportunity. I believe the economic

potential for Menē is significant but in order to succeed, we will

need to scale swiftly. This will require further capital investment

in manufacturing, marketing, and a network of global stores.

I look forward to continuing creating value for Goldmoney and Menē

shareholders as we embark on a very exciting journey to build the

world’s first global investment jewelry brand.”

About Goldmoney Inc.

Goldmoney Inc., a financial service company

traded on the Toronto Stock Exchange (TSX:XAU), is a global leader

in precious metal investment services and the world’s largest

precious metals payment network. Safeguarding nearly $2 billion in

assets for clients located in more than 150 countries, Goldmoney is

focused on a singular mission to make precious metals-backed

savings accessible to all. Powered by Goldmoney’s patented

technology, the Goldmoney® Holding is an online account that

enables clients to invest, earn, or spend gold, silver, platinum,

palladium and cryptocurrencies that are securely stored in insured

vaults in seven countries. All bullion assets are fully allocated

and physically redeemable property. Goldmoney Wealth Limited is

regulated by the Jersey Financial Services Commission (JFSC) as a

Money Services Business. Goldmoney Network is a reporting entity to

the Financial Transactions and Reports Analysis Centre of Canada

(FINTRAC), and is registered with the Financial Crimes Enforcement

Network (FinCEN) in the U.S. For more information about Goldmoney,

visit goldmoney.com.

About Menē

Inc.

Menē designs, manufactures, and markets pure 24

karat gold and platinum investment jewelry™ that is sold

direct-to-consumer in 80 countries. Through mene.com, customers can

buy, sell, and exchange Menē jewelry by gram weight at the

prevailing market prices for gold and platinum plus a transparently

disclosed design and manufacturing fee. Menē was

founded by Roy Sebag and Diana W. Picasso with a mission to restore

the ancient tradition of jewelry as a store of enduring value by

combining innovative technology with timeless design.

Learn more at www.mene.com

Media and Investor Relations

inquiries:

Jacquelyn Humphrey Director of Global

Communications Goldmoney Inc. jac@goldmoney.com

Josh Crumb Chief Strategy Officer

Goldmoney Inc. +1 647 499 6748

Forward Looking

Information

Completion of the Business Combination is

subject to a number of conditions, including but not limited to,

receipt of all required approvals by shareholders of Amador

and Menē, respectively, and final acceptance of the Business

Combination by the TSX Venture Exchange. The Business

Combination cannot close until the required shareholder approvals

are obtained. There can be no guarantee that the Business

Combination will be completed as proposed or at all.

Investors are cautioned that, except as

disclosed in the Filing Statement prepared in connection with the

Business Combination, any information released or received with

respect to the transaction may not be accurate or complete and

should not be relied upon. Trading in the securities of the

Resulting Issuer should be considered highly speculative.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of the release.

Except for statements of historical fact

relating to Menē, the information contained herein constitutes

forward-looking statements. Forward-looking statements are

based on the opinions and estimates of management at the date the

statements are made, and are subject to a variety of risks and

uncertainties and other factors that could cause actual events or

results to differ materially from those projected in the

forward-looking statements. Except as required by applicable

securities requirements, Menē undertakes no obligation to update

forward-looking statements if circumstances or management's

estimates or opinions should change. The reader is cautioned

not to place undue reliance on forward-looking statements.

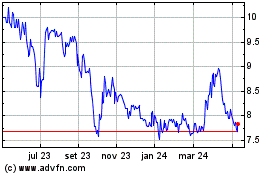

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

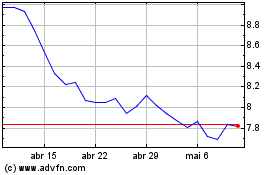

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024