Goldmoney Inc. (TSX:XAU) (“Goldmoney”)(the "Company”), a precious

metal financial service and technology company, today

announced financial results for the quarter ended December 31,

2017. All amounts are expressed in Canadian dollars unless

otherwise noted.

Financial Highlights

- Consolidated Revenue of $150.4 million, an increase of $23.5

million (+19%) quarter over quarter (“QoQ”) and quarterly record

for the company.

- Cryptocurrency Business Revenue of $22.4 million in just 7

weeks of operation.

- Group Gross Operating Profit of $9.3 million, an increase of

$7.7 million (+481%) QoQ.

- IFRS Net Income of $4.1 million, a quarterly record for the

company.

- Basic and diluted net income per share of $0.06 and $0.05

respectively.

- Non-IFRS Cash Gain1 of $6.1 million, also a record for the

company.

- Raised $28 million net of fees in a private placement to new

institutional investors.

- Tangible Common Equity2 of $109.3 million at December 31, 2017

vs. $61.1 million at September 30, 2017.

- Cryptocurrencies position of $0.64 million at December 31,

2017. The Company, currently only managing inventory for client

dealing, has no meaningful long positions in cryptocurrencies as of

the date of this release.

- Currency loans totaling $19.3 million of balance sheet capital

extended to users against their pledged precious metals earning an

average interest rate of 3.6%.

- Corporate precious metal position of $16 million at December

31, 2017, reflecting the company’s commitment to grow long-term

precious metal ownership per share from surplus returns on

capital.

- Client assets under custody stable at $1.76 billion as of

December 31, 2017.

Operational Highlights

- Signed Letter of Intent with Zhaojin Mining (1818:HK) to form

Goldmoney® China Joint Venture. The venture is advancing and

expected to launch by March 31, 2018.

- Launched crypto asset business within the Goldmoney Holding by

signing on asset managers, crypto miners, and HNWI investors, which

led to $22.4 million of revenue and 0.5 million of operating profit

in less than 8 weeks of operation.

- Formed BlockVault Inc. subsidiary and announced pending launch

of ColdBlocksTM: an insurable, auditable-custodial cold storage

technology for crypto assets.

- Completed Menē 24 karat jewelry private beta launch and “Series

A” Financing, raising up to $33 million ($12 million from unit

subscription and the balance from outstanding warrants that may be

exercised) in marketing and growth capital for an important

Goldmoney “ecosystem” dealing client.

- Announced the spin-off and go-public listing of Menē, which

will likely take place by June 30, 2018.

- Record quarter for FCA-regulated lending associate Lend &

Borrow Trust Company Ltd. The company plans to expand into

cryptocurrency loans in the future using the group’s propriety

insured-custody solution and regulated asset-backed lending

license.

The Company made several key advancements following the close of

the second quarter, including the closing of a $30 million private

placement to new institutional investors.

|

IFRS Consolidated Income Statement Data(expressed

in $000s except loss per share) |

FY 2018 |

FY 2017 |

FY 2016 |

|

|

Q3 |

Q2 |

Q1 |

Q4 |

Q3 |

Q2 |

Q1 |

Q4 |

|

Revenue |

149,819 |

126,274 |

125,211 |

131,851 |

139,149 |

140,391 |

112,409 |

108,705 |

|

Fee Revenue |

584 |

645 |

661 |

713 |

633 |

711 |

655 |

513 |

|

Gross margin |

1,903 |

958 |

1,320 |

1,284 |

1,401 |

1,543 |

1,361 |

1,271 |

|

Gross profit (excludes revaluation of inventories) |

2,487 |

1,602 |

1,981 |

1,997 |

2,034 |

2,254 |

2,016 |

1,785 |

|

Gross profit (includes revaluation of inventories) |

9,340* |

1,630 |

1,273 |

2,075 |

1,458 |

2,323 |

2,858 |

1,890 |

*For Q3 FY 2018 – includes realized Bitcoin gains of $6.9

million

*Refer to “Use of Non-IFRS Financial Measures” and

“Reconciliation of Non-IFRS Financial Measures” in the

MD&A.

Please visit our SEDAR profile to view the

consolidated financial statements and MD&A.

Comments from Management

Roy Sebag, Founder and Chief Executive Officer of

Goldmoney Inc.:

This was a truly fantastic quarter for Goldmoney Inc., which is

the direct result of hard work and the long-term strategic planning

that guides our company. On the operational side, we saw record

Gross Margin for the group at $2.5 million, a near 55% increase

QoQ, and the normalization of our margins on the Holding line of

business. While it has been widely reported that the precious metal

industry has experienced a significant slowdown in sales, revenue

in our precious metal businesses (Holding and coins) continued to

grow QoQ through the second half of CY 2018, a period of some of

the lowest realized-volatility in decades. I believe this can be

attributed to our superior technology and trusted brand, which

enables our company to continue gaining market share globally, even

before the phased-in growth of new sales channels through Menē and

the Goldmoney China JV to be realized in the March 31, 2018 and

June 30, 2018 quarters, respectively.

It is important to note that, due to the IFRS accounting rules,

this quarter’s financial results also include the consolidated

results for Menē. As Menē was only launched in private-beta in

November and there was not yet meaningful revenue during this

quarter, results did not require material adjustments; however, it

is important to recognize that on the operational expenditure side,

nearly $1 million of the $5.6 million of operational expenditures

can be attributed to Menē. Therefore, if we are to net out these

‘investment’ expenditures and also net out non-cash components

totaling $2.2 million, one can see that our core Holding business

is profitable and increasingly-producing recurring cash flow to

group.

What’s more, we are still running our core business at

significantly elevated levels of operational expenditure as we

pursue long-term growth opportunities and build scalable

operational infrastructure and branding. Said in another way: we

could likely eliminate additional costs in our core business,

leading to even more free cash flow. This operational discipline

and capital management strategy allow us to make long-term

decisions in our investment thesis, provide growth capital to new

and exciting Goldmoney-related opportunities such as Menē,

BlockVault, and Lend & Borrow Trust – and on occasion, generate

significant capital gains. This quarter saw us generate nearly $7

million in capital gains within our investment portfolio. In total,

the group has generated more than $15 million of capital and

financing gains over the last 18 months related to our stated

business thesis and capital allocation strategy. This can be

attributed to the ongoing ‘mainstreaming’ of crypto assets we held

prior to our risk-tempered entry into that business; currency and

precious metal hedging; and a loan book which now stands at $19

million. It must be stressed that while these gains are not

necessarily recurring through our ordinary course of business, with

the group now managing nearly $109 million of cash and tangible

equity, there are substantial levers for additional free cash flow

generation through a combination of balance sheet, technology, and

additional client-servicing activities.

I am very proud of the results this quarter, our second

quarterly IFRS profit this fiscal year, and the continued

normalization of our business after nearly two years of

consolidating operating activities. I am also proud of the fact

that our senior management team, the majority of which continues to

accept a $1 cash salary in lieu of deferred equity in the business,

has demonstrated our ability to raise capital, deploy that capital

effectively, build businesses from scratch, and monetize those

businesses. If we look at our crypto asset business, it could very

well continue to grow and eventually reach the size and scale of

our precious metal business – even before we scale institutional

BlockVault services. If the Menē business develops into something

that is even minimally successful, we can expect our 80 million

shares to add additional tangible equity to our balance sheet in

addition to the growth in revenue, dealing, lending and

cross-client leads funded with ‘off-balance sheet’ growth and

spending.

Lastly, I must highlight that the single most important upcoming

event is the launch of Goldmoney® China. We are taking this launch

very seriously, and we believe there is a fantastic opportunity to

expand our brand into the world’s largest gold market and the most

advanced ‘fintech’ market. I look forward to this important launch,

and to continuing to expand the Goldmoney® mission into more

markets globally.

Josh Crumb, Founder and Chief Financial Officer of

Goldmoney Inc.:

This quarter marks 2.5 years since the launch of the original

‘BitGold’ business, and we are extremely pleased by the Company’s

results at this halfway point to a “five-year build”. Importantly,

we also realized some notable validations of our underlying macro

thesis as the digital-asset market reached a mainstream tipping

point. While our core expertise and focus remain on the link and

interoperability between securely-vaulted precious metals and other

market ecosystems – be it fiat or crypto – a link that, in our

view, will become increasingly clear and important. We were well

positioned to capitalize on this crypto-asset tipping point both on

our balance sheet and within our client-dealing infrastructure; in

just half a quarter, we recorded crypto-related revenues and

margins that took us many months to achieve with BitGold.

The quarter also marked our strategic entry into Asia through

Goldmoney China, and the beta launch and ‘Series A’ financing of

Menē, two important steps to set up future value to the business in

both brand and sales infrastructure. While we will continue to take

a tempered and long-term approach to growth spending, these

proactive as well as reactive positions should help demonstrate the

value of what we’re building at Goldmoney, which is no better

demonstrated to stakeholders than through record top and bottom

line results.

Turning specifically to the crypto asset market, it’s important

to note a few subtle points: first, we made the important decision

to finally enter client services in this market in a very

risk-measured way, focusing on our core infrastructure expertise in

custody and minimizing counter-party risk “outside of the banking

system, but inside the regulatory system”. While crypto markets

could be considered the antithesis of precious metals stability,

our clients recognized the need for a qualified custodian in a

crypto-market still riddled with banking system friction and

lacking financial transparency at exchanges and other points of

third-party “safe” keeping.

Further, we remain perplexed that tens of billions of dollars in

assets are held without standard-market transparency, where even

‘industry leaders’ do not provide: sufficient auditing of

segregated client holdings (if even properly legally-segregated),

audits of their own financial statements as counterparty, or

third-party insurance. We also believe that many competitors who

are entering the crypto-custody space have not made the sufficient

investments in licensing and regulation that we have. We spent

nearly three years being thoughtful about regulation before

launching our services, which is why we are excited to launch

ColdBlocks by BlockVault over upcoming quarters, providing

important institutional-quality infrastructure to this now massive

market – one that in our view still lacks a single competitor that

is qualified at the required level for professional market

infrastructure.

Lastly, we’ve transitioned from taking a measured-speculative

position in assets to a measured-position in servicing the market.

In our view, the most substantial ‘Graham’s law’ move has perhaps

passed in Bitcoin on a risk-adjusted basis. While we are not

attempting to speculate on the Bitcoin price, which could again

move either substantially higher or lower without surprise, we feel

we are now well-positioned to provide the metaphorical “shovels to

this digital gold rush” and will keep our gold in physical form

from a balance sheet perspective. Therefore, we have chosen to

minimize our risk exposure only to client-dealing inventory in this

phase. Our macro-thesis remains intact and we believe the market is

sending an important signal about this nascent asset class, so we

are focusing on our core expertise of precious metal

interoperability and minimizing counterparty risk in market

infrastructure for the mainstreaming of digital assets and “Web

3.0”.

James Turk, Lead Director of Goldmoney

Inc.:

It took two years of hard work to bring two companies together

into Goldmoney, and these results for the quarter, and indeed the

past nine months, show that our long-term vision is now starting to

pay off with visible rewards. I have complete confidence in the

management team and the employees throughout the company and look

forward to seeing the results of the new initiatives already

underway.

The selected financial information included in this release is

qualified in its entirety by, and should be read together with, the

Company's unaudited condensed consolidated interim financial

statements for the three months and nine months ended December 31,

2017, prepared in accordance with International Financial Reporting

Standards ("IFRS") and corresponding management's discussion and

analysis, which are available under the Company's profile on SEDAR

at www.sedar.com.

Consolidation with Menē

Inc.

The financial statements are consolidated with Menē Inc.’s

financial statements under IFRS rules. Once Menē completes its

go-public listing, the financials will be unconsolidated. In terms

of direct impact, the Menē consolidation resulted in minimal

revenue impact and about $0.9 million of operational expenses and a

$13 million increase in tangible equity. Netting these figures

would provide the non-consolidated view of the group’s financials.

With that said, it is important to stress that Goldmoney Inc.

currently owns approximately 38% of Menē. Therefore, it would be

correct to ascribe a portion of the tangible equity to Goldmoney

Inc. as well.

Investor Relations Questions As is our

company’s tradition, we only host two conference calls per year.

Our next call will be held on the reporting date for our Annual

Financial Results. Investors with interim questions may send them

to: ir@goldmoney.com.

Non-IFRS Measures

This news release contains non-IFRS financial measures; the

Company believes that these measures provide investors with useful

supplemental information about the financial performance of its

business, enable comparison of financial results between periods

where certain items may vary independent of business performance,

and allow for greater transparency with respect to key metrics used

by management in operating its business. Although management

believes these financial measures are important in evaluating the

Company's performance, they are not intended to be considered in

isolation or as a substitute for, or superior to, financial

information prepared and presented in accordance with IFRS. These

non-IFRS financial measures do not have any standardized meaning

and may not be comparable with similar measures used by other

companies. For certain non-IFRS financial measures, there are no

directly comparable amounts under IFRS. These non-IFRS financial

measures should not be viewed as alternatives to measures of

financial performance determined in accordance with IFRS. Moreover,

presentation of certain of these measures is provided for

year-over-year comparison purposes, and investors should be

cautioned that the effect of the adjustments thereto provided

herein have an actual effect on the Company's operating

results.

Non-IFRS Cash Gain (Loss)1 is a non IFRS financial measure. This

figure excludes from comprehensive loss the impact of non-cash

items, including the amortization of intangible assets or stock

based compensation. Refer to the MD&A for a detailed breakdown

of these items.

Tangible Common Equity2 is a non-IFRS measure. This figure

excludes from total shareholder equity (i) intangibles, and (ii)

goodwill, and is useful to demonstrate the tangible capital

employed by the business.

For a full reconciliation of non-IFRS financial measures used

herein to their nearest IFRS equivalents, please see the section

entitled "Reconciliation of Non-IFRS Financial Measures" in the

Company's MD&A for the year ended March 31, 2017.

About Goldmoney Inc.

Goldmoney Inc., a financial service company traded on the

Toronto Stock Exchange (TSX:XAU), is a global leader in precious

metal investment services and the world's largest precious metals

payment network. Safeguarding $1.8 billion in assets for clients

located in more than 150 countries, Goldmoney is focused on a

singular mission to make precious metals-backed savings accessible

to all. Powered by Goldmoney’s patented technology, the

Goldmoney® Holding is an online account that enables clients

to invest, earn, or spend gold, silver, platinum, palladium and

cryptocurrencies that are securely stored in insured vaults in

seven countries. All bullion assets are fully allocated and

physically redeemable property. Goldmoney Wealth Limited is

regulated by the Jersey Financial Services Commission (JFSC) as a

Money Services Business. Goldmoney Network is a reporting entity to

the Financial Transactions and Reports Analysis Centre of Canada

(FINTRAC), and is registered with the Financial Crimes Enforcement

Network (FinCEN) in the U.S. For more information about Goldmoney,

visit goldmoney.com.

Media and Investor Relations Inquiries:

Renee WeiDirector of Global Communications

Goldmoney Inc. renee.wei@goldmoney.com

Josh Crumb Chief Strategy Officer &

CFO Goldmoney Inc. +1 647-499-6748

Forward-Looking Statements

This news release contains or refers to certain forward-looking

information. Forward-looking information can often be identified by

forward-looking words such as "anticipate", "believe", "expect",

"plan", "intend", "estimate", "may", "potential" and "will" or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions or statements

about future events or performance. All information other than

information regarding historical fact, which addresses activities,

events or developments that the Goldmoney Inc. (the "Company")

believes, expects or anticipates will or may occur in the future,

is forward looking information. Forward-looking information does

not constitute historical fact but reflects the current

expectations the Company regarding future results or events based

on information that is currently available. By their nature,

forward-looking statements involve numerous assumptions, known and

unknown risks and uncertainties, both general and specific, that

contribute to the possibility that the predictions, forecasts,

projections and other forward-looking information will not occur.

Such forward-looking information in this release speak only as of

the date hereof.

Forward-looking information in this release includes, but is not

limited to, statements with respect to: service times for

transactions on the Goldmoney network; growth of the Company's

business, expected results of operations, and the market for the

Company's products and services and competitive conditions. This

forward-looking information is based on reasonable assumptions and

estimates of management of the Company at the time it was made, and

involves known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others:

the Company's limited operating history; history of operating

losses; future capital needs and uncertainty of additional

financing; fluctuations in the market price of the Company's common

shares; the effect of government regulation and compliance on the

Company and the industry; legal and regulatory change and

uncertainty; jurisdictional factors associated with international

operations; foreign restrictions on the Company's operations;

product development and rapid technological change; dependence on

technical infrastructure; protection of intellectual property; use

and storage of personal information and compliance with privacy

laws; network security risks; risk of system failure or inadequacy;

the Company's ability to manage rapid growth; competition;

effectiveness of the Company's risk management and internal

controls; use of the Company's services for improper or illegal

purposes; uninsured and underinsured losses; theft & risk of

physical harm to personnel; precious metal trading risks; and

volatility of precious metals prices & public interest in

precious metals investment; and those risks set out in the

Company's most recently filed annual information form, available

on SEDAR. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. The Company undertakes no

obligation to update or revise any forward-looking information,

except as required by law.

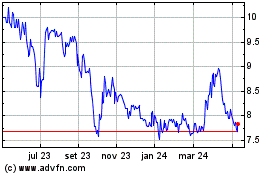

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

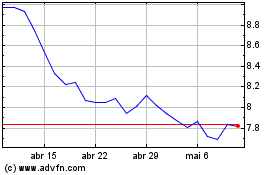

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024