AbraPlata Pursues Strategic Partner following Positive PEA in Argentina

20 Março 2018 - 12:27PM

AbraPlata Resource Corp. (TSX-V:ABRA) (OTC:ABBRF) (Frankfurt:1AH)

has tabled a positive preliminary economic assessment (PEA) on its

80 sq. km Diablillos silver-gold project in Argentina’s Salta

Province, 150 km southwest from the city of Salta.

The PEA features strong economics, with an

after-tax net present value (NPV) of US$197 million at a 7.5%

discount rate, an after-tax internal rate of return of 30.2%, and a

3-year pay-back. The project could produce 9.8 million oz. of

silver equivalent each year at an all-in sustaining cost of US$7.52

per oz. silver equivalent.

AbraPlata bought the project in 2016 from SSR

Mining (TSX:SSRM), and AbraPlata President and CEO Willem Fuchter

says the acquisition was “fortuitous because we were able to get it

when market valuations were low.”

He says SSR had done “considerable work” on the

property already, spending over US$30

million on engineering, metallurgical testing and

geotechnical work. It provided AbraPlata with a solid technical

foundation on which to build its recent PEA.

As of an August 2017 resource estimate,

Diablillos contains 27.1 million indicated tonnes grading 93.1

grams silver per tonne and 0.84 gram gold for 80.9 million oz.

silver and 732,000 oz. gold (or 139 million oz.

silver-equivalent). The deposit’s epithermal mineralization

is mostly found in the centre of the system at the Oculto deposit.

The company says 95% of its resource comes from Oculto, however it

still has several satellite deposits it’s in the process of

drilling.

One such deposit is Fantasma, which lies 800

metres west of Oculto. It remains open for expansion to the east,

and AbraPlata believes, based on its current understanding of the

geology, that Fantasma may extend into Oculto.

AbraPlata says satellite deposits might expand

the resource by 10%, while in-pit drilling could add another

20-30%. However, the company says the most exciting expansion

potential lies in the high grade zone below its current pit

shell.

Abra Plata devised its mine plan to optimize the

project’s NPV and the plan only accounts for 60% of the resources

outlined at Oculto. If the company can expand its in-pit

resources, additional resources located beneath the pit shell could

become economic.

“Some of our drill holes have intercepted grades

of up to 17 grams per tonne over 10 metres down there,” explains

Fuchter. He describes Oculto as containing feeder zones below the

pit shell that have the potential for narrower but higher grade

gold mineralization that AbraPlata could exploit later in the pit’s

eight year life through underground mining.

Abra Plata intends to deliver a fully permitted

project with a feasibility study by the end of 2019. To get there,

it aims to first finish a pre-feasibility study (PFS) by the

end of 2018. The PFS will require AbraPlata to do more drilling,

continue the environmental studies started by SSR, and begin the

permitting process. The company is finalizing a 7,500 metre drill

program for the rest of the year.

The company completed a small financing in

January and raised $2 million. Fuchter says that to complete a

pre-feasibility study will require another $7 million.

“What we’re looking for given the size of the

project is a strategic investor to come in and work with us,”

Fuchter says. “If we did it on our own we could become a mid-tier

producer, but that’s going to take a lot of capital.

The type of strategic investor we’d be looking for is someone who

has a track record of building mines in Latin America and has

operational experience within Latin America.”

AbraPlata also has three early-stage copper

porphyry exploration properties in Argentina. It’s looking to form

joint-venture agreements to continue developing them. Shares of

AbraPlata are currently valued at 18¢ with a 52-week range of 17¢

to 63¢. The company has a market capitalization of $14 million.

“When you look around Latin America, you’ve got

a couple of big silver projects, but most other things that are

development stage are much smaller than this,” Fuchter says.

“They’re typically underground operations, and often in

jurisdictions that take a long time to permit. So to have 10

million oz. of annual production potential that we think we can

permit fairly quickly and have this level of production — I think

that’s very hard to find.”

— The preceding Joint Venture Article is

promoted content sponsored by AbraPlata Resource Corp. and written

in conjunction with The Northern Miner. Visit www.abraplata.com to

learn more.

Willem FuchterPresident & Chief Executive

OfficerAbraPlata Resource Corp.Tel:

+54.11.5258.0920E-mail: willem@abraplata.comRob

BruggemanInvestor Relations AbraPlata Resource Corp.Tel:

+1.416.884.3556Email: rob@abraplata.com

A photo accompanying this announcement is available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/d8b414f1-d53f-4548-8c65-bfcff5671bfe

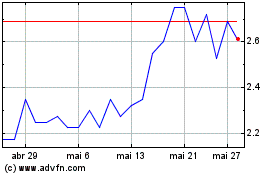

Abra Silver Resource (TSXV:ABRA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Abra Silver Resource (TSXV:ABRA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024