Goldmoney Inc. (TSX:XAU) (“Goldmoney”)(the “Company”), a precious

metal financial service and technology company, today

announced financial results for the fiscal year ended March 31,

2018. All amounts are expressed in Canadian dollars unless

otherwise noted.

Financial Highlights

- First ever IFRS Annual Net Income of $5.7 million in Fiscal

2018.

- First ever Non-IFRS Adjusted Net Profit of $10.1 million in

Fiscal 2018.

- Annual Revenue in CAD of $572.4 million in Fiscal 2018 vs.

$523.8 million in Fiscal 2017, an increase of 9.3% Year over

Year.

- Record Quarterly Revenue in CAD of $171.1 million in March 31,

2018 quarter vs. $149.8 million in December 31, 2017 quarter, an

increase of 14% over sequential quarters.

- Precious Metal Revenue of $140.5 million in Q4 2018 vs. $127.5

million in Q3 2018, highlighting strong organic growth and

consistent outperformance versus industry peers in precious metals

dealing.

- $30.6 million of Cryptocurrency Revenue compared to $22.4

million in prior quarter, an increase of 36.6% over sequential

quarters for an organic business we built and deployed

internally.

- Fully-Reserved Precious Metal Loan Portfolio up to $19.5

million vs. $8.6 million last year, earning the group $1.2 million

of interest vs. $0.3 million in the prior fiscal year.

- $111.5 million in Cash and Tangible Capital ($1.46 per share)

at Year End Fiscal 2018 vs. $58.7 million ($0.87 per share) in

Fiscal 2017, an increase of 90% Year over Year.

- 68% Per-Share Year-over-Year growth in gold-denominated

Tangible Capital per share, highlighting management’s focus on a

positive Return on Metal Weight (“ROMW”) on an annual basis.

| IFRS Consolidated Income Statement

Data |

|

(expressed in $000s) |

FY 2018 |

FY 2017 |

|

|

Q4 |

Q3 |

Q2 |

Q1 |

Q4 |

Q3 |

Q2 |

Q1 |

|

Revenue |

171,102 |

|

|

|

149,819 |

|

|

|

126,274 |

|

|

|

125,211 |

|

|

|

131,851 |

|

|

|

139,149 |

|

|

|

140,391 |

|

|

|

112,409 |

|

|

|

|

Fee Revenue |

580 |

|

|

|

584 |

|

|

|

645 |

|

|

|

661 |

|

|

|

713 |

|

|

|

633 |

|

|

|

711 |

|

|

|

655 |

|

|

|

|

Gross margin |

2,250 |

|

|

|

1,903 |

|

|

|

958 |

|

|

|

1,320 |

|

|

|

1,284 |

|

|

|

1,401 |

|

|

|

1,543 |

|

|

|

1,361 |

|

|

|

|

Gross profit (excluding revaluation of inventories) |

3,663 |

|

|

|

9,692 |

|

|

|

2,042 |

|

|

|

4,408 |

|

|

|

2,046 |

|

|

|

2,138 |

|

|

|

2,400 |

|

|

|

2,060 |

|

|

|

|

Gross profit (including revaluation of inventories) |

2,486 |

|

|

|

9,630 |

|

|

|

2,070 |

|

|

|

3,701 |

|

|

|

2,075 |

|

|

|

1,458 |

|

|

|

2,323 |

|

|

|

2,858 |

|

|

|

Goldmoney Inc. Annual Shareholder Letter

We have prepared an annual shareholder letter, which includes

additional information about the fiscal 2018 financial results and

non-financial progress. Read Goldmoney’s 2018 letter to investors

to be posted on June 22, 2018 which can be found here.

Goldmoney Inc. New Corporate Video

The company is proud to share a new Corporate Video which can be

found here.

Comments from Management

Roy Sebag, Founder and Chief Executive Officer of

Goldmoney Inc.:

Fiscal 2018 was an excellent year for Goldmoney. I have prepared

an extensive letter to investors which I hope our shareholders will

take the time to read for a deeper dive into our results and future

outlook.

James Turk, Lead Director of Goldmoney

Inc.:

I congratulate the entire Goldmoney team for these exceptional

results. While there are many aspects of the report worth noting,

it is particularly gratifying to see the annual increase in

Tangible Capital and the 68% per share yearly ROMW. These two

metrics show that Goldmoney is accumulating real wealth for its

shareholders.

Josh Crumb, Founder and Chief Strategy Officer of

Goldmoney Inc.:

“Goldmoney continues to take a long-term approach to maximizing

shareholder value, recognizing that an annual group profit is the

only sustainable way to realize our growth mission while still

providing clients with the assurance of a sound and conservative

balance sheet. As Roy further details in his annual letter, we are

pleased with the Year over Year financial results and other

qualitative and quantitative assessments of the group’s growing

businesses. While the North American and European retail precious

metals industry continues to face the dual challenge of decade-low

consumer engagement in many products and extremely low realized

volatility in dealing, Goldmoney is thriving. In what appears to be

a challenging market for others, we continue to grow top line

revenue and market share by focusing on delivering our clients

increased platform services, the industry’s most trusted thought

leadership, and continuous improvements in technology-driven

engagement. We continue to invest in the Goldmoney group brands and

position Goldmoney shareholders for increased demand across our

products as the business cycle turns, where we believe clients will

increasingly seek the safety of precious metals and alternative

money outside of the core banking system during the ongoing unwind

of the extraordinary monetary policy experiments and central bank

interest rate-price fixing that has dominated capital markets for

nearly a decade now. Looking ahead to Fiscal 2019, we hope to

deliver another year of strong per-share ROMW gains as we deliver

on our group’s investments in Menē and its spinout on the TSX

Venture and BlockVault and our first corporate clients in

institutional crypto-custody launching this summer.”

Conference Call Information

The company will be hosting its annual conference call at 3:00

p.m. ET on Friday, June 22, to discuss earnings and provide a

general corporate update. The call is open to investors and will be

held by Roy Sebag, CEO of Goldmoney Inc., and Josh Crumb, Chief

Strategy Officer of Goldmoney Inc.

PARTICIPANT ACCESS CODE: 362764

DIAL-IN NUMBERS:

Toronto: +1 647 478 7145 New York: +1 917 962 0650 London: +44

203 769 6819 To view additional local dial-in numbers, please click

here

QUESTIONS: Please note that the conference line will be muted to

all callers. Questions to be answered during the call can be

emailed ahead of time to: ir@goldmoney.com.

Non-IFRS Measures

This news release contains non-IFRS financial measures; the

Company believes that these measures provide investors with useful

supplemental information about the financial performance of its

business, enable comparison of financial results between periods

where certain items may vary independent of business performance,

and allow for greater transparency with respect to key metrics used

by management in operating its business. Although management

believes these financial measures are important in evaluating the

Company's performance, they are not intended to be considered in

isolation or as a substitute for, or superior to, financial

information prepared and presented in accordance with IFRS. These

non-IFRS financial measures do not have any standardized meaning

and may not be comparable with similar measures used by other

companies. For certain non-IFRS financial measures, there are no

directly comparable amounts under IFRS. These non-IFRS financial

measures should not be viewed as alternatives to measures of

financial performance determined in accordance with IFRS. Moreover,

presentation of certain of these measures is provided for

year-over-year comparison purposes, and investors should be

cautioned that the effect of the adjustments thereto provided

herein have an actual effect on the Company's operating

results.

Non-IFRS Adjusted Gain1 is a non IFRS financial measure. This

figure excludes from comprehensive gain (loss) the impact of the

following amounts: (i) any gains or losses on precious metals

inventory, (ii) non-cash items, including the amortization of

intangible assets or stock-based compensation, (iii) the impact of

foreign exchange gains or losses, and (iv) unrealized gains or

losses on investments held for sale. Refer to the MD&A for a

detailed breakdown of these items.

Non-IFRS Cash Gain is a non IFRS financial measure. This figure

excludes from comprehensive gain (loss) the impact of non-cash

items, including the amortization of intangible assets or

stock-based compensation. Refer to the MD&A for a detailed

breakdown of these items.

Tangible Common Equity is a non-IFRS measure. This figure

excludes from total shareholder equity (i) intangibles, and (ii)

goodwill, and is useful to demonstrate the tangible capital

employed by the business.

For a full reconciliation of non-IFRS financial measures used

herein to their nearest IFRS equivalents, please see the section

entitled "Reconciliation of Non-IFRS Financial Measures" in the

Company's MD&A for the year ended March 31, 2018.

About Goldmoney Inc. Goldmoney Inc., a

financial service company traded on the Toronto Stock Exchange

(TSX:XAU), is a global leader in precious metal investment services

and the world’s largest precious metals payment network.

Safeguarding $1.8 billion in assets for clients located in more

than 150 countries, Goldmoney is focused on a singular mission to

make precious metals-backed savings accessible to all. Powered by

Goldmoney’s patented technology, the Goldmoney® Holding is an

online account that enables clients to invest, earn, or spend gold,

silver, platinum, palladium and cryptocurrencies that are securely

stored in insured vaults in seven countries. All bullion assets are

fully allocated and physically redeemable property. Goldmoney

Wealth Limited is regulated by the Jersey Financial Services

Commission (JFSC) as a Money Services Business. Goldmoney Network

is a reporting entity to the Financial Transactions and Reports

Analysis Centre of Canada (FINTRAC), and is registered with the

Financial Crimes Enforcement Network (FinCEN) in the U.S. For more

information about Goldmoney, visit goldmoney.com.

Media and Investor Relations inquiries:

Renee WeiDirector of Global

CommunicationsGoldmoney Inc.renee.wei@goldmoney.com Josh

Crumb Chief Strategy Officer Goldmoney Inc. +1

647-499-6748

Forward-Looking Statements

This news release contains or refers to certain forward-looking

information. Forward-looking information can often be identified by

forward-looking words such as “anticipate”, “believe”, “expect”,

“plan”, “intend”, “estimate”, “may”, “potential” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions or statements

about future events or performance. All information other than

information regarding historical fact, which addresses activities,

events or developments that the Goldmoney Inc. (the “Company”)

believes, expects or anticipates will or may occur in the future,

is forward-looking information. Forward-looking information does

not constitute historical fact but reflects the current

expectations the Company regarding future results or events based

on information that is currently available. By their nature,

forward-looking statements involve numerous assumptions, known and

unknown risks and uncertainties, both general and specific, that

contribute to the possibility that the predictions, forecasts,

projections and other forward-looking information will not occur.

Such forward-looking information in this release speak only as of

the date hereof.

Forward-looking information in this release includes, but is not

limited to, statements with respect to: service times for

transactions on the Goldmoney network; growth of the Company’s

business, expected results of operations, and the market for the

Company’s products and services and competitive conditions. This

forward-looking information is based on reasonable assumptions and

estimates of management of the Company at the time it was made, and

involves known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others:

(i) cash flow from the Company’s operations; (ii) general economic,

financial market, regulatory and political conditions in which the

Company operates; (iii) consumer interest in the Company’s

products; (iv) competition; (v) anticipated and unanticipated

costs; (vi) government regulations applicable to the Company’s

business and operations, and its impacts thereon; (vii) the

Company’s ability to obtain qualified staff, equipment, and

services in a timely and cost-efficient manner; (viii) the

Company’s ability to conduct operations in a safe, efficient and

effective manner; (ix) the Company’s ability to carry out its

marketing plans and their effectiveness; (x) the efficacy of the

Company’s security measures; and (xi) the Company’s product

development plans and timeframes for completion; and those risks

set out in the Company’s most recently filed annual information

form, available on SEDAR. Although the Company has attempted

to identify important factors that could cause actual results to

differ materially, there may be other factors that cause results

not to be as anticipated, estimated or intended. There can be no

assurance that such statements will prove to be accurate as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking information. The Company

undertakes no obligation to update or revise any forward-looking

information, except as required by law.

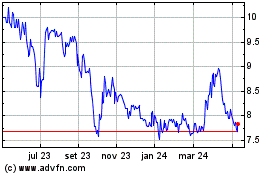

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

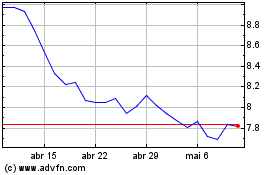

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024