NOT FOR DISTRIBUTION IN THE UNITED STATES

Aritzia Inc. ("

Aritzia" or the

"

Company") (TSX: ATZ), a vertically integrated,

innovative design house of exclusive fashion brands, today

announced that certain shareholders, including an investment

vehicle managed by Berkshire Partners LLC, a Boston-based private

equity firm (“

Berkshire Shareholder”) and 8317640

Canada Inc., an entity indirectly controlled by Aldo Bensadoun, a

director of Aritzia (the “

Bensadoun Shareholder”

and together with the Berkshire Shareholder, the “

Selling

Shareholders”), have entered into an agreement with a

syndicate of underwriters led by CIBC Capital Markets, RBC Capital

Markets and TD Securities Inc. (the

“

Underwriters”), pursuant to which the

Underwriters have agreed to purchase on a bought deal basis an

aggregate of 19,505,000 subordinate voting shares of the Company

(“

Shares”) held by the Selling Shareholders at an

offering price of $16.90 per Share (the “

Offering

Price”) for total gross proceeds to the Selling

Shareholders of $329,634,500 (the

“

Offering”). Aritzia will not receive any

proceeds from the Offering.

The Company also announced today that it has

agreed to purchase, directly or indirectly, the equivalent of

6,333,653 Shares for cancellation from the Berkshire Shareholder

(the “Share Repurchase”). The purchase price

to be paid by the Company under the Share Repurchase will be the

same as the Offering Price, for gross proceeds to the Berkshire

Shareholder of $107,038,736 from the Share Repurchase.

Following these transactions, the Berkshire

Shareholder will have no remaining equity interest in Aritzia. The

Offering and the Share Repurchase are expected to close on or about

March 8, 2019.

Brian Hill, Founder, Chief Executive Officer and

Chairman, commented, “These transactions mark a significant

milestone after a successful 14 year-long relationship between

Aritzia and Berkshire Partners. We would like to thank them for

their partnership and collaboration over the years. The repurchase

of shares from Berkshire Partners represents a compelling

opportunity to deploy Aritzia’s capital in a manner that is

accretive to shareholders. Aritzia maintains ample financial

flexibility to continue to invest in and execute on our strategic

growth initiatives.”

Mr. Hill continued, “Aritzia has a successful

track record of consistently delivering strong revenue and earnings

growth and executing on its strategic initiatives. We remain

very well positioned to capitalize on our next phase of growth and

are excited about the opportunities ahead.”

Marni Payne, Managing Director at Berkshire

Partners, added, “It has been a privilege to partner with Aritzia,

one of North America’s most innovative and deeply loved apparel

companies, for the past 14 years. We feel fortunate to have enjoyed

such a close collaboration with Brian and his team, and we look

forward to watching their continued success.”

Details of the Transactions

Pursuant to the Offering, the Berkshire

Shareholder (on its own behalf and certain charitable entities

having received donations by affiliates of the Berkshire

Shareholder) will be selling a total of 19,005,000 Shares and the

Bensadoun Shareholder will be selling a total of 500,000 Shares.

Following completion of the Offering and Share Repurchase, there

will be 83,044,711 subordinate voting shares outstanding and

24,537,349 multiple voting shares outstanding of the Company. The

proceeds from the Bensadoun Shareholder’s participation in the

Offering are expected to support The Bensadoun Family Foundation,

consistent with all prior secondary offerings of the Company.

Entities owned and controlled by Brian Hill (the

“Hill Group”) will not be selling any Shares under

the Share Repurchase or the Offering. As a result of the Offering

(and the Berkshire Shareholder’s equity interest falling below the

sunset provision under the terms of the Company’s multi-voting

shares), the Hill Group’s equity interest will remain at

approximately 21.9%, and its voting interest will increase to

approximately 73.4%, in each case, on a non-diluted basis.

Following completion of the Offering and the Share Repurchase, the

Hill Group’s equity interest will increase to approximately 23.2%,

and its voting interest will increase to approximately 74.8%, in

each case, on a non-diluted basis.

The Shares will be offered by way of a short

form prospectus in all of the provinces and territories of Canada

and may also be offered by way of private placement in the United

States and internationally as permitted. A preliminary short form

prospectus relating to the Offering will be filed by no later than

February 22, 2019 with Canadian securities regulatory authorities

and closing is expected to occur on or about March 8, 2019.

The Underwriters have not been granted an over-allotment

option.

Each of Aritzia’s officers and directors and

reporting insiders (other than the Berkshire Shareholder and its

director nominee Marni Payne) has agreed to enter into a customary

lock-up agreement with the Underwriters for a period of 90 days

after the closing of the Offering.

The purchase price under the Share Repurchase is

expected to be funded through cash on hand. As of February 4, 2019,

the Company had $124.5 million of cash on hand. Aritzia maintains

ample financial flexibility to continue to invest in and execute on

its strategic growth initiatives. As a result of the Share

Repurchase the Company will be suspending further purchases under

its normal course issuer bid, which is set to expire in May 2019.

Aritzia will evaluate renewing its normal course issuer bid in due

course.

The Share Repurchase will result in an

approximately 5.6% reduction in basic shares outstanding and is

expected to be accretive to Adjusted Net Income per share.

Special Committee Review

Process

To review and evaluate the merits of the Share

Repurchase, the Board of Directors of the Company established a

special committee of independent directors (the “Special

Committee”). The Special Committee was chaired by John

Currie and included David Labistour and Marcia Smith. The

Company retained Stikeman Elliott LLP as its legal counsel and the

Special Committee retained Greenhill & Co. Canada Ltd. as its

independent financial advisor and Borden Ladner Gervais LLP as its

independent legal counsel.

The Special Committee undertook a deliberate and

full consideration of the Share Repurchase and various alternatives

and financing options related thereto. Greenhill & Co.

Canada Ltd. has provided a fairness opinion to the Special

Committee and the Board of Directors of the Company that the

consideration to be paid by the Company in connection with the

Share Repurchase is fair, from a financial point of view, to the

Company.

Upon the recommendation of the Special Committee

that, among other things, the Share Repurchase is in the best

interests of the Company, the Board of Directors (other than

interested directors who abstained from voting) unanimously

approved the Share Repurchase.

No securities regulatory authority has either

approved or disapproved of the contents of this news release. The

Shares have not been registered under the United States Securities

Act of 1933, as amended (the “U.S. Securities

Act”) or any state securities laws. Accordingly, the

Shares may not be offered or sold within the United States unless

registered under the U.S. Securities Act and applicable state

securities laws or pursuant to exemptions from the registration

requirements of the U.S. Securities Act and applicable state

securities laws. This news release does not constitute an offer to

sell or a solicitation of an offer to buy any securities of Aritzia

in any jurisdiction in which such offer, solicitation or sale would

be unlawful.

About Aritzia

Aritzia is a vertically integrated, innovative

design house of fashion brands. The Company designs apparel and

accessories for its collection of exclusive brands. The Company's

expansive and diverse range of women's fashion apparel and

accessories addresses a broad range of style preferences and

lifestyle requirements. Aritzia is well known and deeply loved by

its clients in Canada with growing client awareness and affinity in

the United States and outside of North America. Aritzia aims to

delight its clients through an aspirational shopping experience and

exceptional client service that extends across its more than 90

retail boutiques and eCommerce business, aritzia.com.

About Berkshire Partners

Berkshire Partners, a Boston-based investment

firm, has made over 125 investments since its founding in 1986

through nine private equity funds with more than $16 billion in

aggregate capital. Berkshire has developed industry experience in

several areas including consumer and retail, communications,

business services, industrials and healthcare. Berkshire has a long

history of partnering with management teams to build market leading

growth companies. Current and prior investments in the retail

sector include Bare Escentuals, Carter’s, Kendra Scott and Party

City.

Non-IFRS Measures

This press release makes reference to certain

non-IFRS measures including certain retail industry metrics. These

measures are not recognized measures under IFRS, do not have a

standardized meaning prescribed by IFRS, and are therefore unlikely

to be comparable to similar measures presented by other companies.

Rather, these measures are provided as additional information to

complement those IFRS measures by providing further understanding

of our results of operations from management's perspective.

Accordingly, these measures should not be considered in isolation

nor as a substitute for analysis of our financial information

reported under IFRS. We use non-IFRS measures including "Adjusted

Net Income". Non-IFRS measures including retail industry metrics

are used to provide investors with supplemental measures of our

operating performance and thus highlight trends in our core

business that may not otherwise be apparent when relying solely on

IFRS measures. We believe that securities analysts, investors and

other interested parties frequently use non-IFRS measures including

retail industry metrics in the evaluation of issuers. Our

management also uses non-IFRS measures including retail industry

metrics in order to facilitate operating performance comparisons

from period to period, to prepare annual operating budgets and

forecasts and to determine components of management compensation.

Definitions and reconciliations of non-IFRS measures to the

relevant reported measures can be found in our MD&A.

Forward-Looking Information

Certain statements made in this press release

may constitute forward-looking information under applicable

securities laws. These statements may relate to the anticipated

financial impact of the Offering and the Share Repurchase, the

market impact on the trading price of the Shares following the

completion of the Offering and the Share Repurchase and other

statements that are not historical facts. Particularly, information

regarding our expectations of future results, targets, performance

achievements, prospects or opportunities is forward-looking

information. As the context requires, this may include certain

targets as disclosed in the prospectus for our initial public

offering, which are based on the factors and assumptions, and

subject to the risks, as set out therein and herein. Often but not

always, forward-looking statements can be identified by the use of

forward-looking terminology such as "may" "will", "expect",

"believe", "estimate", "plan", "could", "should", "would",

"outlook", "forecast", "anticipate", "foresee", "continue" or the

negative of these terms or variations of them or similar

terminology.

Many factors could cause our actual results,

level of activity, performance or achievements or future events or

developments to differ materially from those expressed or implied

by the forward-looking statements, including, without limitation,

the factors discussed in the "Risk Factors" section of the

Company's annual information form dated May 10, 2018 for the

fiscal year ended February 25, 2018 (the "AIF"). A copy of the AIF

and the Company's other publicly filed documents can be accessed

under the Company's profile on the System for Electronic Document

Analysis and Retrieval ("SEDAR") at www.sedar.com. The Company

cautions that the list of risk factors and uncertainties described

in the AIF is not exhaustive and other factors could also adversely

affect its results. Readers are urged to consider the risks,

uncertainties and assumptions carefully in evaluating the

forward-looking information and are cautioned not to place undue

reliance on such information.

For more information:Jean FontanaICR,

Inc.646-277-1214Jean.Fontana@icrinc.com

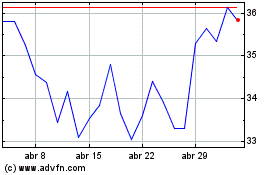

Aritzia (TSX:ATZ)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Aritzia (TSX:ATZ)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025