Dream Unlimited Corp. (TSX: DRM and DRM.PR.A) (“Dream”,

“the Company” or “we”) today announced its financial

results for the three months ended March 31, 2019. Basic earnings

per share (“EPS”) for the three months ended March 31, 2019 was

$0.17, down slightly from $0.22 in the comparative quarter on a

standalone basis, which excludes operational income generated from

Dream Hard Asset Alternatives Trust (TSX: DRA.UN) (“Dream

Alternatives”). At March 31, 2019, Dream’s total equity, on a

standalone basis, increased to $9.47 per share, up 8% from $8.75

per share one year ago(1).

"Our underlying operational results were solid

for a quarter which is typically our quietest” said Michael Cooper,

President & Chief Responsible Officer of Dream. “As a

significant portion of our development pipeline is in the planning

or pre-development stages, the financial results for 2019 will not

easily reflect the progress we are making towards creating and

owning best in class assets. Nonetheless, we are extremely pleased

with the advancements we are making. Dream is the largest

unitholder of both Dream Office REIT and Dream Alternatives, both

of which are focused on owning and developing core assets

predominately in Toronto. With the execution of a new shared

services agreement with Dream Office REIT, we are now developing

properties on behalf of Dream Office REIT and Dream Alternatives,

which further adds to the exceptional asset pipeline in Toronto.

”

A summary of our results for the three months

ended March 31, 2019 is included in the table below.

| |

|

| |

Three months ended March

31, |

|

(in thousands of Canadian dollars, except per share amounts) |

|

2019 |

|

|

2018 |

| Consolidated Dream

(including Dream Alternatives): |

|

|

|

|

|

| Revenue |

$ |

56,957 |

|

$ |

59,821 |

| Net margin |

$ |

18,968 |

|

$ |

15,789 |

| Net margin %(2) |

|

33.3% |

|

|

26.4% |

| Earnings (loss) before income

taxes |

$ |

(36,591) |

|

$ |

151,397 |

| Earnings (loss) for the

period |

$ |

(33,524) |

|

$ |

147,058 |

| |

|

|

|

|

|

| Basic earnings (loss) per

share(4) |

$ |

(0.31) |

|

$ |

1.35 |

| Diluted earnings (loss) per

share |

$ |

(0.31) |

|

$ |

1.30 |

| |

|

|

|

|

|

| Dream

Standalone(5): |

|

|

|

|

|

| Revenue |

$ |

45,850 |

|

$ |

49,635 |

| Net margin |

$ |

14,204 |

|

$ |

11,327 |

| Net margin %(2) |

|

31.0% |

|

|

22.8% |

| Earnings before income

taxes |

$ |

23,690 |

|

$ |

29,485 |

| Earnings for the period |

$ |

18,466 |

|

$ |

24,028 |

| EBITDA(3) |

$ |

32,900 |

|

$ |

37,127 |

| Adjusted EBITDA(3) |

$ |

21,427 |

|

$ |

14,957 |

| |

|

|

|

|

|

| Basic earnings per

share(4) |

$ |

0.17 |

|

$ |

0.22 |

| Diluted earnings per

share |

$ |

0.17 |

|

$ |

0.22 |

| |

|

|

|

|

|

|

Dream

Standalone(5): |

|

March 31, 2019 |

|

|

December 31, 2018 |

| Total assets |

$ |

2,103,258 |

|

$ |

2,056,028 |

| Total liabilities |

$ |

1,041,950 |

|

$ |

1,010,776 |

| Total equity (excluding

non-controlling interest)(1) |

$ |

1,014,411 |

|

$ |

1,001,317 |

| Total

equity per share(1) |

$ |

9.47 |

|

$ |

9.33 |

|

(1) |

Total equity (excluding non-controlling interests) and total equity

per share excludes $46.9 million of non-controlling interest as at

March 31, 2019 ($43.9 million as at December 31, 2018) and includes

the Company’s investment in Dream Alternatives as at March 31, 2019

and December 31, 2018 of $77.2 million and $72.7 million,

respectively. For further details refer to pages 23 and 24 in our

management’s discussion and analysis (“MD&A”) for the three

months ended March 31, 2019. |

|

(2) |

Net margin % (see the “Non-IFRS Measures” section of our MD&A

for the three months ended March 31, 2019) represents net margin as

a percentage of revenue. |

|

(3) |

EBITDA and adjusted EBITDA (see the “Non-IFRS Measures” section of

our MD&A for the three months ended March 31, 2019) is

calculated as earnings before interest, taxes, depreciation,

amortization, fair value changes in investment properties and

financial instruments, and share of equity accounted earnings from

Dream Office REIT offset by distributions received from the Dream

Publicly Listed Funds. |

|

(4) |

Basic EPS is computed by dividing Dream’s earnings attributable to

owners of the parent by the weighted average number of Class A

Subordinate Voting Shares and Class B common shares outstanding

during the period. Refer to Management’s discussion below on

consolidated results for the three months ended March 31,

2019. |

|

(5) |

Dream standalone represents the standalone results of Dream,

excluding the impact of Dream Alternatives’ consolidated results.

Refer to the “Non-IFRS Measures” section of our MD&A for

further details. Total assets as at March 31, 2019 and December 31,

2018 includes approximately $77.2 million and $72.7 million,

respectively, relating to the Company’s investment in Dream

Alternatives. |

In the three months ended March 31, 2019, on a

consolidated basis the Company recognized a loss of $33.5 million,

down from income of $147.1 million in the comparative prior year

period. Results in the comparative period included a one-time net

gain on acquisition of Dream Alternatives of $130.0 million.

Current period results included fair value losses on the Dream

Alternatives trust units of $61.9 million which are fair valued

each period under IFRS and were generated as a result of an

increase in the Trust’s unit price of 15% since December 31, 2018.

Excluding these non-cash items, results were more comparable

year-over-year.

In the three months ended March 31, 2019,

the Company recognized earnings before income taxes on a standalone

basis of $23.7 million, a decrease of $5.8 million from the prior

year due to increased interest expense of $1.5 million and a

one-time net gain on acquisition of Dream Alternatives in the

comparative period of $12.6 million. This was partially offset by

fair value gains on financial instruments as a result of an

increase in the unit price of Dream Global REIT relative to the

prior year.

Adjusted EBITDA is calculated on a standalone

basis using earnings for the period adjusted for interest and

income tax expense, depreciation and amortization, fair value

changes and the net distribution component of income from the

Company’s investment in Dream Office REIT. It is an important

measure for the Company as it eliminates the impact of significant

non-cash items from earnings. Adjusted EBITDA for the three months

ended March 31, 2019 was $21.4 million, an increase of $6.5 million

relative to the prior year primarily due to increased contribution

from our asset management segment, improved net operating income

from Arapahoe Basin, our ski area in Colorado, and growth in

distributions from the Dream Publicly Listed Funds due to

additional units acquired since the comparative period.

Effective this quarter we have redefined our

segment information to better reflect how we view and manage our

business. Our operating results have been defined as follows:

- Asset management and investments in

the Dream publicly listed funds ("asset management") includes

managing the publicly listed funds and various development

partnerships, in addition to equity interests in Dream Office REIT

and Dream Global REIT.

- Stabilized income generating assets

includes a ski area in Colorado, income producing assets in Western

Canada and Toronto, and the ownership of a renewable power

portfolio.

- Urban development - Toronto &

Ottawa includes condominium, purpose-built rental and mixed-use

development in the Greater Toronto Area (“GTA”) and Ottawa/Gatineau

regions.

- Western Canada community

development includes land, housing and

retail/commercial/multi-family development in Saskatchewan and

Alberta.

- Dream Alternatives includes the

operating activity of Dream Alternatives' portfolio of real estate

development opportunities and alternative assets.

Asset Management and Investments in

Dream Publicly Listed Funds

- In the three months ended March 31,

2019, the asset management division generated net margin of $8.7

million, compared to $7.1 million in the comparative period. The

increase in net margin year-over-year was driven by growth in

fee-earning assets under management and transactional activity in

the period. Our asset management segment is a key source of

recurring income for our business. For further details, please see

the “Sources of Recurring Income” section of our

MD&A.

- As at March 31, 2019, fee-earning

assets under management across the Dream Publicly Listed Funds

(Dream Global REIT, Dream Industrial REIT and Dream Alternatives)

were approximately $7.0 billion, up from $6.7 billion as at

December 31, 2018. The increase was primarily driven by acquisition

activity in the period by Dream Industrial REIT. Fee-earning assets

under management across private institutional partnerships,

development partnerships and/or funds were $1.6 billion, relatively

consistent with the prior year. Total fee-earning assets under

management were approximately $8.6 billion at March 31, 2019.

- In the three months ended March 31,

2019, Dream’s share of equity income from its 23% investment in

Dream Office REIT was $5.2 million, compared to $6.0 million in the

comparative period. Dream Office REIT’s net income was generated

from net rental income and Dream Office REIT's share of income from

the investment in Dream Industrial REIT, which was offset by

interest expense, fair value adjustments to financial instruments,

and general and administrative expenses. For the three months ended

March 31, 2019, comparative properties net operating income (“NOI”)

increased by 7.6% over the prior year, mainly driven by higher

occupancy and rental rates in downtown Toronto, partially offset by

lower occupancy and rental rates in other markets. In the current

period, the Company’s investment in Dream Office REIT generated

cash distributions of $3.6 million.

- Subsequent to the quarter, Dream

and Dream Office REIT entered into a shared services agreement (the

“new shared services agreement”) pursuant to which Dream will act

as the development manager for Dream Office REIT's future

development projects for market fees and Dream Office REIT will act

as the property manager for Dream’s current and future income

properties in Canada. In order to continue to take advantage

of economies of scale, the new shared services agreement maintains

certain resource sharing arrangements between Dream and Dream

Office REIT such as information technology and human resources at

cost. Concurrent with the execution of the shared services

agreement, Dream and Dream Office REIT terminated the existing

Management Services Agreement and administrative services

agreement. Under the new shared services agreement, in connection

with each future development project, Dream will earn a market

development fee equal to 3.75% of the total net revenues of the

development or, for rental properties, 3.75% of the IFRS value upon

completion, without any promote or other incentive fees. In

connection with the property management services provided by Dream

Office REIT, Dream will pay a market fee equal to 3.5% of gross

revenue of the portfolio. Property management and development

management services have a term of five years, with subsequent

five-year renewal periods. Dream Office REIT has been an owner

manager of its investment properties for over 15 years and has an

experienced management team with a track record of delivering

quality services to tenants of all sizes in commercial buildings.

- As at March 31, 2019, the total

fair value of units held in the Dream Publicly Listed Funds

(comprising Dream Global REIT, Dream Alternatives and Dream Office

REIT) was $521.9 million, representing 60% of the Company’s total

market capitalization. Within this total, Dream had $359.0 million

at fair value invested in Dream Office REIT (a 23% interest or 25%

interest inclusive of units held through Dream’s Chief Responsible

Officer ("CRO")) and $93.2 million at fair value invested in Dream

Alternatives.

- During and subsequent to the three

months ended March 31, 2019, Dream acquired 2.2 million units in

Dream Alternatives for $15.0 million on the open market for a

current ownership of 20% as at May 13, 2019. Subject to market

conditions and our investment strategy, the Company intends to

further invest in Dream Alternatives and Dream Office REIT on an

opportunistic basis as both vehicles refine their portfolios and

focus on core Toronto assets, which is aligned with Dream’s

expanding real estate and development footprint across downtown

Toronto and the GTA.

- As announced in February 2019,

Dream Alternatives committed to a strategic plan to enhance

unitholder value. On April 23, 2019, the Trust announced further

details with respect to the plan which includes an update on their

unit buyback program and maintaining the current distribution

policy at $0.40 per unit on an annual basis. In addition, Dream and

Dream Alternatives have agreed to satisfy the management fees

payable to Dream Asset Management (“DAM”) in units of the Trust,

valued at $8.74 per unit until December 2020, which will provide

the Trust support for the existing cash distribution policy. Dream

Alternatives is currently pursuing the potential sale of its

renewable power segment and certain non-core assets. Proceeds

raised from the Trust’s disposition program are expected to fund

the unit buyback program.

Key Results Highlights: Stabilized

Income Generating Assets

- Our stabilized income generating

assets include: Arapahoe Basin, income producing assets (including

the Distillery District) in Toronto and Western Canada, and a 20%

investment in Firelight Infrastructure, a renewable power

portfolio. Assets in this segment are expected to grow as we

develop and hold investment properties in our core markets upon

stabilization.

- In the three months ended March 31,

2019, our stabilized income generating assets contributed $11.6

million of net operating income, up slightly from $10.5 million in

the comparative period, driven by a $1.2 million increase in NOI

from the recently expanded Arapahoe Basin. This was partially

offset by the impact of the expropriation of a 73-acre property in

Toronto, Ontario in the third quarter of 2018.

- In the three months ended March 31,

2019, Dream, along with Dream Alternatives, invested cash of $2.9

million for an increased interest in its 100 Steeles Ave. West

development ("100 Steeles"). 100 Steeles is currently a 62,000

square foot income producing retail property that is 89% leased,

located north of Toronto, steps away from the proposed Yonge-North

subway extension. Dream and Dream Alternatives have a 50% ownership

in the project, split on a 25%/75% basis, respectively. 100 Steeles

is planned for much higher density beyond current zoning that would

include over 1 million square feet (“sf”) of residential and

mixed-use development.

Key Results Highlights: Urban

Development – Toronto & Ottawa

- As at March 31, 2019, Dream had

approximately 12,000 residential units and 3.7 million

retail/commercial sf in various stages of planning, pre-development

and construction. This included 1,600 residential units and 0.3

million retail/commercial sf which were in inventory, with the

remainder included in our development pipeline. Of our condominium

projects in inventory which have achieved market launches to date,

approximately 99% of these units have been pre-sold, including

Riverside Square and Canary Block Commons, which are expected to

commence occupancy in 2019. Our pipeline includes: future phases of

the West Don Lands, Zibi, the Distillery District, Canary District

– Block 13, Port Credit, IVY, Frank Gehry and Lakeshore East. For

further details on our project pipeline, refer to the “Urban

Development Inventory and Pipeline” section of our

MD&A.

- In the three months ended March 31,

2019, Zibi, our 34-acre waterfront development along the Ottawa

River in Gatineau, Quebec and Ottawa, Ontario continued to progress

with land servicing on both Ontario and Quebec lands. In addition,

construction is underway on the project’s next residential

building, Kanaal, comprising 71 units, which are currently 90%

pre-sold as well as the project's first commercial spaces

comprising over 93,000 sf of office and retail gross floor area

(“GFA”). Our 8-storey, multi-purpose sales centre and event space,

“Zibi House”, opened to the public on May 1, 2019 and provides

birds-eye views of our development, Chaudière Falls and Parliament

Hill.

- Construction for Phase 1 of

Riverside Square is nearing completion, with first occupancies

expected to commence by mid-2019. Riverside Square is a 5-acre,

two-phase, mixed-use development located in Toronto’s downtown east

side on the south side of Queen Street East and immediately east of

the Don Valley Parkway. Dream has a 32.5% interest in the project

alongside its partners. The first phase of the project consists of

688 residential condominium units, a state-of-the-art multi-level

auto-plex and approximately 20,000 sf of retail GFA. The second

phase is planned to consist of approximately 36,000 sf of

multi-tenant commercial space with a proposed grocery-anchored

component together with 224 condominium units.

Key Results Highlights: Western

Canada Development

- In the three months ended March 31,

2019, our land and housing division generated a combined $7.2

million of revenue and incurred negative net margin of $2.1

million, with an expected low volume of 32 lot sales and 14 housing

occupancies (March 31, 2018 – $14.4 million of revenue and negative

net margin of $2.9 million, with 40 lot sales and 41 housing

occupancies). The decrease in revenue relative to the comparative

period was driven by lower volumes achieved in 2019, consistent

with management’s expectations. We have been proactive to address

economic slowdowns in Western Canada and have right-sized our

operating platform accordingly and expect lower overhead commencing

in the second quarter of 2019. As of today, assuming no material

change in market conditions, we currently expect our margin from

the land and housing division to decrease relative to 2018 and

increase again as we commence earning income from land sales in

Providence, our most valuable land position in Western Canada. For

further details on this segment refer to the "Western Canada

Development" section of our MD&A.

- In the three months ended March 31,

2019, Dream achieved first tenant occupancies at Hampton Heights,

our 27,500 square foot retail development in Saskatoon,

Saskatchewan. As a result, the Company transferred the carrying

value of the property of $5.9 million to investment properties and

recognized a non-cash gain of $2.5 million within fair value

changes in investment properties upon transfer. Hampton Heights is

67% leased as at May 13, 2019, including committed leases, with

stabilization expected in early 2020.We are currently developing

and planning 486,100 sf of retail and commercial space and 120

purpose-built rental units across our Western Canada

communities.

Strong Liquidity Position, NCIB Activity

& Return to Shareholders

- As at March 31, 2019, we had up to

$155.9 million of undrawn credit availability on Dream’s operating

line and margin facility, compared to $179.1 million as at December

31, 2018. The Company is focused on maintaining a conservative debt

position and has ample excess liquidity even before considering

unencumbered or under-levered assets. As at March 31, 2019, our

debt to total asset ratio on a Dream standalone basis was 35.4%,

comparable to December 31, 2018.

- In the three months ended March 31,

2019, the Company purchased for cancellation 0.2 million

Subordinate Voting Shares for $1.5 million under its normal course

issuer bid. Dividends of $2.7 million were declared and paid on its

Subordinate Voting Shares and Class B Shares in the period.

Select financial operating metrics for Dream’s

segments for the three months ended March 31, 2019 are summarized

in the table below.

| |

|

| |

Three months ended March 31, 2019 |

|

(in thousands of dollars) |

Assetmanagement |

Stabilized income generating assets |

Urbandevelopment |

Western Canadacommunitydevelopment |

Corporate and other |

Total Dreamstandalone |

|

Revenue(1) |

$ |

12,935 |

$ |

24,138 |

$ |

1,269 |

$ |

7,508 |

$ |

— |

$ |

45,850 |

| % of total revenue(1) |

|

28.2% |

|

52.6% |

|

2.8% |

|

16.4% |

|

—% |

|

100.0% |

| Net margin(1) |

$ |

8,742 |

$ |

9,778 |

$ |

(1,659) |

$ |

(2,657) |

$ |

— |

$ |

14,204 |

| Net margin (%)(2) |

|

67.6% |

|

40.5% |

|

n/a |

|

n/a |

|

n/a |

|

31.0% |

| % of net margin(1) |

|

61.5% |

|

68.8% |

|

(11.7%) |

|

(18.6%) |

|

—% |

|

100.0% |

| EBITDA(2) |

$ |

28,163 |

$ |

8,777 |

$ |

(875) |

$ |

405 |

$ |

(3,570) |

$ |

32,900 |

|

Adjusted EBITDA(2) |

$ |

16,774 |

$ |

11,234 |

$ |

(837) |

$ |

(2,114) |

$ |

(3,630) |

$ |

21,427 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As at March 31, 2019 |

| Segment assets(1) |

$ |

574,346 |

$ |

341,594 |

$ |

376,011 |

$ |

790,633 |

$ |

20,674 |

$ |

2,103,258 |

| Segment liabilities(1) |

$ |

112,661 |

$ |

133,313 |

$ |

208,071 |

$ |

186,422 |

$ |

401,483 |

$ |

1,041,950 |

| Segment shareholders’

equity(1) |

$ |

461,685 |

$ |

208,281 |

$ |

121,043 |

$ |

604,211 |

$ |

(380,809) |

$ |

1,014,411 |

|

Book equity per share(2) |

$ |

4.31 |

$ |

1.94 |

$ |

1.13 |

$ |

5.64 |

$ |

(3.55) |

$ |

9.47 |

| |

Three months ended March 31, 2018 |

|

(in thousands of dollars) |

Assetmanagement |

Stabilized income generating assets |

Urbandevelopment |

Western Canadacommunitydevelopment |

Corporateand other |

Total Dreamstandalone |

|

Revenue(1) |

$ |

10,050 |

$ |

22,670 |

$ |

2,380 |

$ |

14,535 |

$ |

— |

$ |

49,635 |

| % of total revenue(1) |

|

20.2% |

|

45.7% |

|

4.8% |

|

29.3% |

|

—% |

|

100.0% |

| Net margin(1) |

$ |

7,116 |

$ |

8,831 |

$ |

(933) |

$ |

(3,687) |

$ |

— |

$ |

11,327 |

| Net margin (%)(2) |

|

70.8% |

|

39.0% |

|

n/a |

|

n/a |

|

n/a |

|

22.8% |

| % of net margin(1) |

|

62.8% |

|

78.0% |

|

(8.2%) |

|

(32.6%) |

|

—% |

|

100.0% |

| EBITDA(2) |

$ |

35,040 |

$ |

9,224 |

$ |

(559) |

$ |

(2,998) |

$ |

(3,580) |

$ |

37,127 |

|

Adjusted EBITDA(2) |

$ |

12,334 |

$ |

8,975 |

$ |

(261) |

$ |

(3,080) |

$ |

(3,011) |

$ |

14,957 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

This metric is calculated on a Dream standalone basis. Refer to the

“Non-IFRS Measures” section of our MD&A for further

details. |

|

(2) |

Net margin (%), EBITDA and adjusted EBITDA are non-IFRS measures.

Refer to the "Non-IFRS Measures" section of our MD&A for

further details, including a reconciliation of EBITDA and adjusted

EBITDA to net segment earnings. |

|

|

|

Other InformationInformation

appearing in this press release is a select summary of results. The

financial statements and MD&A for the Company are available at

www.dream.ca and on www.sedar.com.

Annual Meeting of

ShareholdersSenior management will host its Annual Meeting

of Shareholders on May 16, 2019 at 9 a.m. (ET), located at the

Hockey Hall of Fame, TSN Theatre (concourse level), Brookfield

Place, 30 Yonge Street, Toronto, Ontario. For further details,

please visit Dream’s website at www.dream.ca and click on the link

for News and Events, then click on Calendar of Events.

About Dream Unlimited Corp.

Dream is one of Canada’s leading real estate

companies with over $15 billion of assets under management in North

America and Europe. The scope of the business includes asset

management and management services for four Toronto Stock Exchange

("TSX") listed trusts and institutional partnerships, condominium

and mixed-use development, investments in and management of a

renewable power portfolio, commercial property ownership,

residential land development, and housing and multi-family

development. Dream has an established track record for being

innovative and for its ability to source, structure and execute on

compelling investment opportunities. For further information,

please contact:

Dream Unlimited Corp.

|

Pauline Alimchandani |

Kim Lefever |

| EVP & Chief Financial

Officer |

Director, Investor Relations |

| (416) 365-5992 |

(416) 365-6339 |

| palimchandani@dream.ca |

klefever@dream.ca |

Non-IFRS Measures

Dream’s consolidated financial statements are

prepared in accordance with International Financial Reporting

Standards (“IFRS”). In this press release, as a complement to

results provided in accordance with IFRS, Dream discloses and

discusses certain non-IFRS financial measures, including: Dream

standalone, net margin %, assets under management, fee-earning

assets under management, net operating income and debt to total

assets ratio, as well as other measures discussed elsewhere in this

release. These non-IFRS measures are not defined by IFRS, do not

have a standardized meaning and may not be comparable with similar

measures presented by other issuers. Dream has presented such

non-IFRS measures as Management believes they are relevant measures

of our underlying operating performance and debt management.

Non-IFRS measures should not be considered as alternatives to

comparable metrics determined in accordance with IFRS as indicators

of Dream’s performance, liquidity, cash flow and profitability. For

a full description of these measures and, where applicable, a

reconciliation to the most directly comparable measure calculated

in accordance with IFRS, please refer to the “Non-IFRS Measures”

section in Dream’s MD&A for the three months ended March 31,

2019.

Forward-Looking Information

This press release may contain forward-looking

information within the meaning of applicable securities

legislation, including, but not limited to, statements regarding

our objectives and strategies to achieve those objectives; our

beliefs, plans, estimates, projections and intentions, and similar

statements concerning anticipated future events, future growth,

results of operations, performance, business prospects and

opportunities, acquisitions or divestitures, tenant base, future

maintenance and development plans and costs, capital investments,

financing, the availability of financing sources, income taxes,

vacancy and leasing assumptions, litigation and the real estate

industry in general; as well as specific statements in respect of

our development plans and proposals for future retail and

condominium and mixed-use projects and future stages of current

retail and condominium and mixed-use projects, including projected

sizes, density, uses and tenants; development timelines and

anticipated returns or yields on current and future retail and

condominium and mixed-use projects, including timing of

construction, marketing, leasing, completion, occupancies and

closings; anticipated current and future unit sales and occupancies

of our condominium and mixed-use projects; our pipeline of retail,

commercial, condominium and mixed-use developments projects;

development plans and timelines of current and future land and

housing projects, including projected sizes, density and uses;

anticipated current and future lot and acre sales and housing unit

occupancies in our land and housing divisions and the timing of

margin contributions from such sales; projected population and

density in our housing developments; our ability to increase

development on our owned lands and the anticipated returns

therefrom; our anticipated ownership levels of proposed

investments, including investments in units of Dream Office REIT

and Dream Alternatives and other Dream Publicly Listed Funds; the

development plans and proposals for Dream Alternatives’ current and

future projects, including projected sizes, timelines, density,

uses and tenants; anticipated levels of development, asset

management and other management fees in future periods; and our

overall financial performance, profitability and liquidity for

future periods and years. Forward-looking information is based on a

number of assumptions and is subject to a number of risks and

uncertainties, many of which are beyond Dream’s control, which

could cause actual results to differ materially from those that are

disclosed in or implied by such forward-looking information. These

assumptions include, but are not limited to: the nature of

development lands held and the development potential of such lands,

our ability to bring new developments to market, anticipated

positive general economic and business conditions, including low

unemployment and interest rates, positive net migration, oil and

gas commodity prices, our business strategy, including geographic

focus, anticipated sales volumes, performance of our underlying

business segments and conditions in the Western Canada land and

housing markets. Risks and uncertainties include, but are not

limited to, general and local economic and business conditions,

employment levels, regulatory risks, mortgage rates and

regulations, environmental risks, consumer confidence, seasonality,

adverse weather conditions, reliance on key clients and personnel

and competition. All forward-looking information in this press

release speaks as of May 14, 2019. Dream does not undertake to

update any such forward-looking information whether as a result of

new information, future events or otherwise, except as required by

law. Additional information about these assumptions and risks and

uncertainties is disclosed in filings with securities regulators

filed on SEDAR (www.sedar.com).

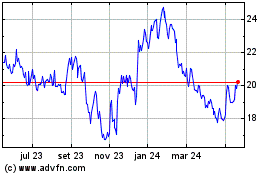

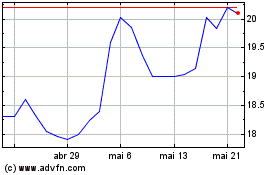

DREAM Unlimited (TSX:DRM)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

DREAM Unlimited (TSX:DRM)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025