A&W Revenue Royalties Income Fund and A&W Food Services of Canada Inc. Announce Secondary Bought Deal Offering of Units

15 Maio 2019 - 5:30PM

A&W Revenue Royalties Income Fund (the “Fund”) (TSX: AW.UN) and

A&W Food Services of Canada Inc. ("Food Services") announced

today that the Fund and Food Services have entered into an

agreement with a syndicate of underwriters led by CIBC Capital

Markets (collectively the “Underwriters”) to complete a secondary

offering of 1,125,000 trust units (the “Units”) of the Fund on

a bought deal basis at a price of $44.55 per Unit (the “Offering

Price”), for gross proceeds to Food Services of $50,118,750

(the “Offering”).

The Fund will not receive any proceeds from the

Offering. Food Services will distribute the net proceeds of the

Offering to its long standing shareholders.

The Underwriters have also been granted an

over-allotment option (the “Over-Allotment Option”) by Food

Services to purchase up to an additional 168,750 Units from

Food Services at the Offering Price for additional gross proceeds

of approximately $7.5 million if the Over-Allotment Option is

exercised in full. The Over-Allotment Option can be exercised at

any time, in whole or in part, for a period of 30 days from the

closing date of the Offering.

Food Services currently owns securities

exchangeable for 4,997,603 units of the Fund, representing

approximately a 28.6% indirect interest in the Fund on a

fully-diluted basis. Following the exchange of these securities for

Units and the sale of the Units, assuming no exercise of the

Over-Allotment Option, Food Services will own securities

exchangeable for 3,872,603 Units of the Fund, or approximately

a 22.1% indirect interest in the Fund on a fully-diluted

basis. If the Over-Allotment Option is exercised in full, Food

Services will own securities exchangeable for 3,703,853 Units

of the fund, or approximately a 21.2% indirect interest in the

Fund.

The Offering will be made pursuant to a short

form prospectus to be filed with securities regulators in each of

the provinces of Canada (other than Quebec). The Offering is

expected to close on or about June 5, 2019. Closing is subject to a

number of customary conditions, including receipt of all necessary

regulatory approvals.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy, which may be made

only by means of the prospectus, nor shall there be any sale of the

Units in any state, province or other jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any state, province

or jurisdiction. The Units have not been, and will not be

registered under the U.S. Securities Act of 1933, as amended, and

may not be offered or sold in the United States absent registration

or compliance with an applicable exemption from the registration

requirement under U.S. securities laws.

About the Fund

The Fund is a limited purpose trust established

to invest in A&W Trade Marks Inc. (“Trade Marks”), which

through its interest in A&W Trade Marks Limited Partnership

(the “Partnership”), owns the A&W trade-marks used in the

A&W quick service restaurant business in Canada. The

A&W trade-marks comprise some of the best-known brand names in

the Canadian foodservice industry. In return for licensing

A&W Food Services to use its trade-marks, Trade Marks (through

the Partnership) receives royalties equal to 3% of the sales of

A&W restaurants in the Royalty Pool. A&W is the

second largest quick-service hamburger restaurant chain in Canada.

Operating coast-to-coast, A&W restaurants feature famous

trade-marked menu items such as The Burger Family, Chubby Chicken

and A&W Root Beer.

The Royalty Pool is adjusted annually to reflect

sales from new A&W restaurants, net of the sales of any A&W

restaurants that have permanently closed. Additional limited

partnership units (“LP units”) are issued to A&W Food Services

to reflect the annual adjustment. A&W Food Services'

additional LP units are exchanged for additional shares of Trade

Marks which are exchangeable for units of the Fund. The 17th

annual adjustment to the Royalty Pool took place on January 5, 2019

at which time the number of restaurants in the Royalty Pool

increased from 896 to 934.

A&W Food Services owns 28.6% of the common

shares of Trade Marks, and therefore owns the equivalent of 28.6%

of the units of the Fund on a fully-diluted basis.

Trade Marks' dividends to A&W Food Services

and the Fund, and the Fund's distributions to unitholders are based

on top-line revenues of the A&W restaurants in the Royalty

Pool, less interest, general and administrative expenses and

current income taxes of Trade Marks, and are thereby isolated from

many of the factors that impact an operating business.

Follow A&W on Facebook

(www.facebook.com/AWCanada) and Twitter @AWCanada or visit

www.awincomefund.ca.

Forward Looking Information

Certain statements in this news release may

contain forward-looking information within the meaning of

applicable securities laws in Canada (forward-looking information).

The words "anticipates", "believes", "budgets", "could",

"estimates", "expects", "forecasts", "intends", "may", "might",

"plans", "projects", "schedule", "should", "will", "would" and

similar expressions are often intended to identify forward-looking

information, although not all forward-looking information contains

these identifying words. Specific forward-looking information

in this news release includes statements related to: the expected

use of proceeds of the offering; the expected closing date for the

Offering and the expected indirect interest of Food Services in the

Fund following the completion of the Offering. The forward-looking

information is based on assumptions that management considered

reasonable at the time it was prepared, including the assumption

that the Offering will be completed at the time and on the terms

contemplated herein and that all necessary regulatory approvals

required for the Offering will be obtained. The

forward-looking information is subject to risks, uncertainties and

other factors that could cause actual results to differ materially

from the results anticipated by the forward-looking

information. The factors which could cause results to differ

from current expectations include, without limitation, those

factors described in the Fund's most recent Management Discussion

and Analysis under the heading "Risks and Uncertainties" and the

Fund's Annual Information Form under the heading "Risk Factors",

available on SEDAR at www.sedar.com. The forward-looking

information contained in this news release represent The Fund’s and

Food Services’ expectations as of the date of this news release,

and are subject to change after this date. The Fund and Food

Services each assume no obligation to update or revise any

forward-looking information, except as required by applicable

law.

SOURCE A&W Revenue Royalties Income Fund

For further information: Don Leslie, Chief

Financial Officer: (604) 988-2141 or investorrelations@aw.ca

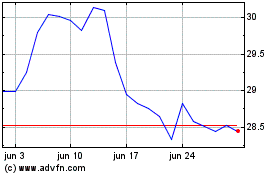

A and W Revenue Royaltie... (TSX:AW.UN)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

A and W Revenue Royaltie... (TSX:AW.UN)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024