Fortress Technologies Inc. Announces First Quarter 2019 Financial Results

30 Maio 2019 - 6:00PM

Fortress Technologies Inc. (“

Fortress” or the

“

Company”) (TSXV: FORT), a well-capitalized

company currently evaluating emerging opportunities in technology

sectors, reports its results of operations for the first quarter

and three month period ended March 31, 2019 (“

Q1

2019”). For the full condensed consolidated interim

financial statements and management discussion & analysis for

the three month period ended March 31, 2019, please visit the

Company’s profile on the System for Electronic Document Analysis

and Retrieval (“SEDAR”) at www.sedar.com.

First Quarter Financial

Highlights(All amounts are in Canadian dollars unless

otherwise specified)

- Revenues of $262,980 for the three months ended March 31, 2019.

During Q1 2019, Fortress mined 53.7 Bitcoin over 64 days from

January 1, 2019 to March 5, 2019 (on March 5, 2019, the Company

temporarily deactivated its Flagship Facility and then entered into

a sub-lease at the Flagship Facility on March 27, 2019). The

average Bitcoin mined per day (“Average Mining

Yield”) during Q1 2019 was 0.84 Bitcoin equivalent,

representing a 17% increase over the Q4 2018 Average Mining Yield

of 0.72 Bitcoin equivalent (with 64.8 Bitcoin and 16.4 Bitcoin Cash

produced in Q4 2018 over a total of 92 days)1.

- The 17% yield increase is a result of the technical proficiency

of the Fortress management deriving greater hashing power of up to

20.0 PH/s in the 2MW facility from implementing ASIC Boost

technology, allowing the Company to operate over 1500 S9 miners in

the 2MW facility, along with the benefit of a decrease in Bitcoin

mining Difficulty;

- During Q1 2019, the Company maintained its competitive cost of

mining at US$2,796 per Bitcoin mined (based on quantity of Bitcoin

produced divided by Cash Operating Costs), which is one of the

lowest per Bitcoin costs of production among digital currency

mining companies listed on the TSX Venture Exchange

(“TSX-V”). Cash operating costs for the Flagship

Facility are comprised of electricity costs, mine staff, and

general Flagship Facility operating costs (lease, insurance,

internet and other maintenance costs) but excludes depreciation

(“Cash Operating Cost”). .

- The Company notes that it lead all TSX-V listed digital

currency mining companies for lowest cost of Bitcoin production

(based on quantity of Bitcoin produced divided by Cash Operating

Costs) during the financial year ending December 31, 2018

(“FY2018”). During FY2018, the Company’s per Bitcoin cost for

mining was US$2,271 per Bitcoin. From March 7, 2018 to December 31,

2018, the Company mined a total of 257.4 Bitcoin equivalent

(assuming a 10 Bitcoin Cash to 1 Bitcoin estimated

conversion).

- The Company was renamed to Fortress Technologies Inc to better

reflect its diversified outlook for strategies that provide

accretive growth to shareholders.

- On March 5, 2019, the Company's operating partner and digital

currency custodian and exchange, Goldmoney Inc. (TSX: XAU), exited

the digital currency space. With Goldmoney Inc. no longer

offering services as a trusted digital currency exchange, and due

to the uncertainty of the regulatory landscape with the Canadian

Public Accountability Board (“CPAB”) in early

March 2019, the Company decided to pursue a business model that

would not involve custody or trading of Bitcoin or other digital

currencies.

- On March 27, 2019, the Company and WeHash Technology LLP

(“WeHash”) signed an agreement to sublease the

Flagship Facility for US$25,000 per thirty-day period (the

“Sublease Agreement”). On May 17, 2019, the

Company was pleased to have renegotiated the sub-lease of its

Flagship Facility, allowing the Company to participate in the

upside of rising Bitcoin prices (the “Sublease

Amendment”). Under the Sublease Amendment, the Company

will now be paid the revenue from all digital currency mined at the

Flagship Facility (currently only Bitcoin is being mined). The

Company also replaced the receipt of a flat-fee of US$25,000

monthly rent (the “Rent”) with a 10% fee of

monthly net profit, up to a maximum of US$10,000, payable monthly

to sub-lessee, WeHash (the “Consulting Fee”). As

part of the Consulting Fee, WeHash will be responsible for the

custody and sale of mined digital currency and for transferring the

proceeds of the sale of digital currency to the Company. For more

information regarding the Sublease Amendment, please refer to the

Company’s May 28, 2019 press release.

- Since May 17, 2019, the effective date of the Sublease

Amendment, WeHash has mined over 10 Bitcoin. More importantly,

WeHash has sold 10 Bitcoin to date at an average of US$ 8,687

through their Coinsquare account, for total gross proceeds of

US$86,870 which has been remitted to Fortress.

- The Sublease Amendment will allow the Company to capitalize on

the increase in Bitcoin prices as Management continues to focus on

developing projects where access to growth capital is highly

valued.

- As at March 31, 2019, the Company had $10,427,038 in cash and

$nil in digital currencies (December 31, 2018: $10,564,795 in cash

and $10,408 in digital currencies).

- The share value of the Company's cash and digital currency

holdings, after deducting liabilities, as at March 31, 2019 was

$0.15 per share based on 71,177,984 outstanding Fortress common

shares (the “Net Liquid Asset Value”). This Net

Liquid Asset Value does not include the asset value of the Flagship

Facility or S9 ASIC Miners owned by the Company.

- Corporate overhead (recurring costs relating to the staffing,

operation and maintenance of the Company as a TSX-V listed company

in good standing) were approximately $30,000 per month in Q1 2019

on average, while free cash flow from the mining operation was

$30,000 per month on average.

Cash Position

The Company maintains a strong cash position as

of May 30, 2019 with $10,460,000 in cash and GICs. Additionally,

the Company now enjoys at least 90% of the profit from the Bitcoin

mining activity which provides an estimated monthly net income of

US$115,000 per month (US$195,000 revenue less US$70,000 Monthly

Cash Operating Costs and the US$10,000 Consulting Fee) on a

run-rate basis using current Bitcoin prices and 0.75 BTC mined per

day at current difficulty.

Fortress believes that its digital currency

mining operation, having successfully completed an audit, has

unique value amongst other publicly traded digital currency mining

companies which were not able to successfully complete an audit

under the new CPAB regulations.

Grant of Stock Options

The Company also announces that it has granted

(the “Option Grant”) to certain officers of the

Company an aggregate of 100,000 incentive stock options to purchase

common shares (a “Stock Option”) under the

Company’s stock option plan (the “Plan”). Under

the Option Grant, all Stock Options are exercisable at a price of

C$0.18. The Stock Options will expire three years from the date of

grant, will vest immediately and be subject to the terms and

conditions of the Plan.

About Fortress Technologies

Fortress Technologies Inc. (TSX-V: FORT) is a

well-capitalized company currently evaluating emerging

opportunities in technology sectors. Fortress is focused on

developing projects where access to growth capital is highly

valued.

Neither the TSX Venture Exchange nor its

Regulation Service Provider (as that term is defined

in the policies of the TSX Venture Exchange)

accepts responsibility for the adequacy or accuracy

of this press release.

Forward Looking Statements:This

news release contains certain “forward-looking information” within

the meaning of applicable Canadian securities laws that are based

on expectations, estimates and projections as at the date of this

news release. The information in this release about future plans

and objectives of the Company, are forward-looking information.

Other forward-looking information includes but is not limited to

information concerning: the intentions, plans and future actions of

the Company, the status and impact of new electrical power rates

and the status of deliberations by the Grant County Public Utility

District, as well as the Company’s ability to successfully mine

digital currency, revenue increasing as currently anticipated,

volatility in digital currency prices and the resulting significant

negative impact on the Company’s operations, the construction and

operation of expanded blockchain infrastructure, and the regulatory

environment of cryptocurrency in the United States and other

jurisdictions where the Company may operate.

Any statements that involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, assumptions, future events or performance (often but

not always using phrases such as “expects”, or “does not expect”,

“is expected”, “anticipates” or “does not anticipate”, “plans”,

“budget”, “scheduled”, “forecasts”, “estimates”, “believes” or

“intends” or variations of such words and phrases or stating that

certain actions, events or results “may” or “could”, “would”,

“might” or “will” be taken to occur or be achieved) are not

statements of historical fact and may be forward-looking

information and are intended to identify forward-looking

information.

This forward-looking information is based on

reasonable assumptions and estimates of management of the Company

at the time it was made, and involves known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking information. Such

factors include, among others: the status and impact of new

electrical power rates and the status of deliberations by the Grant

County Public Utility District, risks relating to the global

economic climate; dilution; the Company’s limited operating

history; future capital needs and uncertainty of additional

financing; the competitive nature of the industry; currency

exchange risks; the need for the Company to manage its planned

growth and expansion; the effects of product development and need

for continued technology change; protection of proprietary rights;

the effect of government regulation and compliance on the Company

and the industry; network security risks; the ability of the

Company to maintain properly working systems; reliance on key

personnel; global economic and financial market deterioration

impeding access to capital or increasing the cost of capital; and

volatile securities markets impacting security pricing unrelated to

operating performance. In addition, particular factors which

could impact future results of the business of the Company include

but are not limited to: the impact of new electrical power rates

which could impair profitability and operating performance;

deliberations by the Grant County Public Utility District which

could limit the ability of the Company to carry on business on a

profitable basis or at all; the construction and operation of

blockchain infrastructure may not occur as currently planned, or at

all; expansion may not materialize as currently anticipated, or at

all; the digital currency market; the ability to successfully mine

digital currency; revenue may not increase as currently

anticipated, or at all; it may not be possible to profitably

liquidate the current digital currency inventory, or at all; a

decline in digital currency prices may have a significant negative

impact on operations; the volatility of digital currency prices;

the anticipated growth and sustainability of hydroelectricity for

the purposes of cryptocurrency mining in the Grant Count of the

State of Washington, the ability to complete current and future

financings, any regulations or laws that will prevent the Company

from operating its business; historical prices of digital

currencies and the ability to mine digital currencies that will be

consistent with historical prices; and there will be no regulation

or law that will prevent the Company from operating its business.

The Company has also assumed that no significant events occur

outside of the Company’s normal course of business. Although

the Company has attempted to identify important factors that could

cause actual results to differ materially, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

information. The Company undertakes no obligation to revise or

update any forward-looking information other than as required by

law.

1 The Company calculates Average Mining

Yield by using a 10 Bitcoin Cash to one Bitcoin estimated

conversion.

For further information, please contact:

Aydin Kilic

Chief Executive Officer

604 477 9997

a@fortressblockchain.io

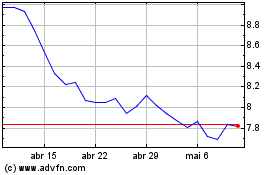

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

GoldMoney (TSX:XAU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024