InterRent Real Estate Investment Trust (TSX-IIP.UN)

(“

InterRent” or the “

REIT”)

announced today that it has entered into an agreement with a

syndicate of underwriters (the “

Underwriters”) led

by Scotiabank, Desjardins Capital Markets and BMO Capital Markets,

as joint bookrunners, to purchase 12,500,000 trust units (the

“

Units”) of the REIT on a bought deal basis at a

price of $14.00 per Unit (the “

Offering Price”)

for gross proceeds of approximately $175 million (the

“

Offering”).

InterRent has also granted the Underwriters an

over-allotment option, exercisable, in whole or in part, at any

time until and including 30 days following the closing of the

Offering, to purchase up to an additional 1,875,000 Units at

the Offering Price for additional gross proceeds of approximately

$26 million, to cover over-allotments, if any.

Closing of the Offering is anticipated to occur

on or about July 9, 2019 and is subject to the receipt of

applicable regulatory approvals including approval of the Toronto

Stock Exchange. The Units will be offered in all provinces and

territories of Canada by way of a short form prospectus.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or

applicable exemption from the registration requirements. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy nor shall there be any sale of the securities in

any State in which such offer, solicitation or sale would be

unlawful.

The net proceeds from the Offering will be used

to fund acquisitions, repay existing indebtedness, fund previously

announced developments and for working capital purposes.

InterRent has entered into conditional

agreements to acquire four different properties located in the city

of Montreal. Should the REIT elect to waive the conditions and

close on all four properties, it will acquire a total of 716 suites

and approximately 15,000 square feet of commercial space for a

combined purchase price of approximately $166 million. The REIT

intends to enhance the value of these properties through its active

asset repositioning program.

In addition, InterRent recently announced that

it had entered into an unconditional agreement to purchase

Hampstead Towers (Montreal), containing 121 residential suites and

approximately 31,500 square feet of commercial space, for $38

million.

With the addition of the properties under

contract and Hampstead Towers, InterRent’s Montreal portfolio would

consist of 20 properties totaling 2,735 suites, thereby increasing

the REIT’s Montreal exposure to 27.0% of its total suites. The City

of Montreal has continued to experience significant population

growth with an estimated increase of 1.6% from 2017 to 2018,

outpacing the Quebec average of 1.1% and the National average of

1.4%. Montreal also saw a 10-year low in unemployment rates (5.4%)

and approximately 4% nominal growth of disposable income in 2018.

Montreal accounts for over 50% of the population of Quebec and

attracted 85.6% of immigrants to the province last year. Statistics

Canada estimates that 41,314 people immigrated to Montreal between

July 1, 2017 and July 1, 2018, representing 13.6% of Canada’s total

immigration. With 18 post-secondary institutions, the city welcomes

approximately 248,000 students, and according to Ryerson

University’s Centre for Urban Research and Land Development,

Montreal is the sixth-fastest growing metro in North America.

“These acquisitions are all concrete, high-rise

assets well-situated within central Montreal. In addition to

providing significant value creation potential through our

repositioning strategy, these properties will provide operational

synergies given the close proximity to existing properties in our

portfolio. This equity offering allows us to fund these

acquisitions while reducing the REIT’s leverage, better positioning

the balance sheet as we move forward with some of the other

attractive acquisition and development opportunities that we have

before us,” said Mike McGahan, CEO.

Pro forma the Offering and the intended use of

proceeds, InterRent’s debt to gross book value ratio is expected to

be approximately 37.6%.

About InterRent

InterRent REIT is a growth-oriented real estate

investment trust engaged in increasing Unitholder value and

creating a growing and sustainable distribution through the

acquisition and ownership of multi-residential properties.

InterRent's strategy is to expand its portfolio

primarily within markets that have exhibited stable market

vacancies, sufficient suites available to attain the critical mass

necessary to implement an efficient portfolio management structure

and, offer opportunities for accretive acquisitions.

InterRent's primary objectives are to use the

proven industry experience of the Trustees, Management and

Operational Team to: (i) to grow both funds from operations per

Unit and net asset value per Unit through investments in a

diversified portfolio of multi-residential properties; (ii) to

provide Unitholders with sustainable and growing cash

distributions, payable monthly; and (iii) to maintain a

conservative payout ratio and balance sheet.

Forward Looking Statements

This news release contains “forward-looking

statements” within the meaning applicable to Canadian securities

legislation. Generally, these forward-looking statements can be

identified by the use of forward-looking terminology such as

“plans”, “anticipated”, “expects” or “does not expect”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates” or “does not anticipate”, or “believes”,

or variations of such words and phrases or state that certain

actions, events or results “may”, “could”, “would”, “might” or

“will be taken”, “occur” or “be achieved”. InterRent is subject to

significant risks and uncertainties which may cause the actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward looking statements contained in this

release. A full description of these risk factors can be found in

InterRent’s most recently publicly filed information located at

www.sedar.com. InterRent cannot assure investors that actual

results will be consistent with these forward looking statements

and InterRent assumes no obligation to update or revise the forward

looking statements contained in this release to reflect actual

events or new circumstances.

For further information about InterRent please

contact:

| Mike McGahan |

Brad Cutsey, CFA |

Curt Millar, CPA, CA |

| Chief Executive Officer |

President |

Chief Financial Officer |

| Tel: (613) 569-5699 Ext 244 |

Tel: (613) 569-5699 Ext 226 |

Tel: (613) 569-5699 Ext 233 |

| Fax: (613) 569-5698 |

Fax: (613) 569-5698 |

Fax: (613) 569-5698 |

| e-mail:

mmcgahan@interrentreit.com |

e-mail :

bcutsey@interrentreit.com |

e-mail:

cmillar@interrentreit.com |

| web site:

www.interrentreit.com |

|

|

The TSX has not reviewed and does not

accept responsibility for the adequacy or accuracy

of this release.

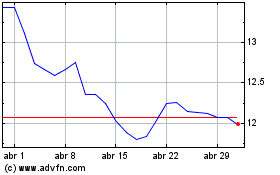

InterRent Real Estate In... (TSX:IIP.UN)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

InterRent Real Estate In... (TSX:IIP.UN)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024