ASML reports EUR 2.6 billion sales at 43.0% gross margin in Q2

ASML reports EUR 2.6 billion sales at 43.0% gross margin

in Q2Stronger Logic compensates for Memory

weakness; 2019 total sales view unchanged

VELDHOVEN, the Netherlands, July 17, 2019 - today ASML

Holding N.V. (ASML) publishes its 2019 second-quarter results.

- Q2 net sales of EUR 2.6 billion, net income of EUR 476 million,

gross margin 43.0 percent

- ASML expects Q3 2019 net sales of around EUR 3.0 billion and a

gross margin between 43 percent and 44 percent

|

(Figures in millions of euros unless otherwise

indicated) |

Q1 2019 |

Q2 2019 |

|

Net sales |

2,229 |

2,568 |

|

...of which Installed Base Management sales 1 |

540 |

717 |

|

|

|

|

|

New lithography systems sold (units) |

43 |

41 |

|

Used lithography systems sold (units) |

5 |

7 |

|

|

|

|

|

Net bookings |

1,399 |

2,828 |

|

|

|

|

|

Gross profit |

928 |

1,105 |

|

Gross margin (%) |

41.6 |

|

43.0 |

|

|

|

|

|

|

Net income |

355 |

476 |

|

EPS (basic; in euros) |

0.84 |

1.13 |

|

|

|

|

|

End-quarter cash and cash equivalents and short-term

investments |

3,275 |

2,335 |

(1) Installed Base Management sales equals our net service and

field option sales.

Numbers have been rounded for readers' convenience. A complete

summary of US GAAP Consolidated Statements of Operations is

published on www.asml.com

CEO statement"Our second-quarter sales came in

within guidance and the gross margin came in above guidance, helped

by improved EUV manufacturing results and higher field upgrade

sales, which more than compensates the negative mix effect in

comparison with Q1.

"For the remainder of the year we see further weakness in

Memory, while Logic looks stronger. We expect that the

increased demand in Logic will compensate for the decreased demand

in Memory. The additional growth in Logic is driven by accelerated

investments in 7 nm nodes and beyond.

"We received ten orders for EUV systems during the second

quarter, some of which are slated for use in the production of DRAM

devices.

"Our 2019 total sales view remains unchanged and we continue to

see 2019 as a growth year," said ASML President and Chief Executive

Officer Peter Wennink.

Q2 2019 product and business highlights

- For EUV, on the NXE:3400C, we recently demonstrated >170

wafers per hour at ASML as well as >2,000 wafers per day under

customer memory production conditions.

- ASML and Mitsui Chemicals have agreed that ASML will license

the EUV pellicle assembly technology to Mitsui Chemicals. Mitsui

Chemicals is able to assemble and sell pellicles in high volume to

our lithography customers. In parallel, ASML will continue to

develop next generations of pellicle membranes with its partners,

which is expected to enable improved performance of EUV

pellicles.

OutlookFor the third quarter of 2019, ASML

expects net sales around EUR 3.0 billion, and a gross margin of

between 43 percent and 44 percent. ASML also expects R&D costs

of around EUR 495 million, and SG&A costs of around EUR 125

million. Our estimated annualized effective tax rate is around 9

percent for 2019.

Update share buyback programAs part of ASML’s

financial policy to return excess cash to shareholders through

dividends and regularly timed share buybacks, in January 2018 ASML

announced its intention to purchase up to EUR 2.5 billion of

shares, to be executed within the 2018–2019 time frame. ASML

intends to cancel these shares after repurchase, with the exception

of up to 2.4 million shares, which will be used to cover employee

share plans.

Through June 30, 2019, ASML has acquired 7.5 million shares

under this program for a total consideration of EUR 1.2

billion.

The current program may be suspended, modified or discontinued

at any time. All transactions under this program are published on

ASML’s website (www.asml.com/investors) on a weekly basis.

| Media

Relations contacts |

Investor

Relations contacts |

| Monique Mols +31

6 5284 4418 |

Skip Miller +1

480 235 0934 |

| Lucas van

Grinsven +31 6 1019 9532 |

Marcel Kemp +31

40 268 6494 |

| Brittney Wolff

Zatezalo +1 408 483 3207 |

Craig DeYoung

+852 2295 1168 |

Quarterly video interview and investor and media

conference callWith this press release, ASML has published

a video interview in which CEO Peter Wennink discusses the Q2 2019

results, which can be viewed on www.asml.com.

A conference call for investors and media will be hosted by CEO

Peter Wennink and CFO Roger Dassen on July 17, 2019 at 15:00

Central European Time / 09:00 US Eastern Time. To register for the

call and to receive dial-in information, go to

www.asml.com/qresultscall. Listen-only access is also available via

www.asml.com.

About ASMLASML is one of the world’s leading

manufacturers of chip-making equipment. Our vision is a world in

which semiconductor technology is everywhere and helps to tackle

society’s toughest challenges. We contribute to this goal by

creating products and services that let chipmakers define the

patterns that integrated circuits are made of. We continuously

raise the capabilities of our products, enabling our customers to

increase the value and reduce the cost of chips. By helping to make

chips cheaper and more powerful, we help to make semiconductor

technology more attractive for a larger range of products and

services, which in turn enables progress in fields such as

healthcare, energy, mobility and entertainment. ASML is a

multinational company with offices in more than 60 cities in 16

countries, headquartered in Veldhoven, the Netherlands. We employ

more than 24,200 people on payroll and flexible contracts

(expressed in full time equivalents). ASML is traded on Euronext

Amsterdam and NASDAQ under the symbol ASML. More information about

ASML, our products and technology, and career opportunities is

available on www.asml.com.

US GAAP and IFRS Financial ReportingASML's

primary accounting standard for quarterly earnings releases and

annual reports is US GAAP, the accounting principles generally

accepted in the United States of America. Quarterly US GAAP

consolidated statements of operations, consolidated statements of

cash flows and consolidated balance sheets are available on

www.asml.com.

The consolidated balance sheets of ASML Holding N.V. as of

June 30, 2019, the related consolidated statements of

operations and consolidated statements of cash flows for the

quarter and six-month period ended June 30, 2019 as presented

in this press release are unaudited.

In addition to reporting financial figures in accordance with US

GAAP, ASML also reports financial figures in accordance with

International Financial Reporting Standards as adopted by the

European Union ('IFRS') for statutory purposes. The most

significant differences between US GAAP and IFRS that affect ASML

concern the capitalization of certain product development costs and

the accounting of income taxes.

Today, July 17, 2019, ASML also published the Statutory

Interim Report for the six-month period ended June 30, 2019.

This report is in accordance with the requirements of the EU

Transparency Directive as implemented in theNetherlands, and

includes Consolidated Condensed Interim Financial Statements

prepared in accordance with IAS 34 as adopted by the European Union

'Interim Financial Reporting', an Interim Management Board Report

and a Managing Directors' Statement and is available on

www.asml.com.

Regulated InformationThis press release

contains inside information within the meaning of Article 7(1) of

the EU Market Abuse Regulation.

Forward Looking StatementsThis

document contains statements that are forward-looking, including

statements with respect to expected trends, outlook, bookings,

financial results and effective tax rate, annual revenue

opportunity in 2020 and through 2025 and growth opportunity,

expected trends in end markets, products and segments, including

memory and logic, expected industry and business environment

trends, the expected continuation of Moore’s law and the

expectation that EUV will continue to enable Moore’s law and drive

long term value for ASML, the expected trends in the technologies

ASML uses and is developing and their expected benefits, and the

intention to continue to return excess cash to shareholders through

a combination of share buybacks and growing dividends. You can

generally identify these statements by the use of words like "may",

"will", "could", "should", "project", "believe", "anticipate",

"expect", "plan", "estimate", "forecast", "potential", "intend",

"continue", "target", and variations of these words or comparable

words. These statements are not historical facts, but rather are

based on current expectations, estimates, assumptions and

projections about our business and our future financial results and

readers should not place undue reliance on them. Forward-looking

statements do not guarantee future performance and involve risks

and uncertainties. These risks and uncertainties include, without

limitation, economic conditions; product demand and semiconductor

equipment industry capacity; worldwide demand and manufacturing

capacity utilization for semiconductors; the impact of general

economic conditions on consumer confidence and demand for our

customers’ products; performance of our systems, the success of

technology advances and the pace of new product development and

customer acceptance of and demand for new products; the number and

timing of systems ordered, shipped and recognized in revenue, and

the risk of order cancellation or push out, production capacity for

our systems including delays in system production; our ability to

enforce patents and protect intellectual property rights and the

outcome of intellectual property disputes and litigation;

availability of raw materials, critical manufacturing equipment and

qualified employees; trade environment; changes in exchange and tax

rates; available liquidity, our ability to refinance our

indebtedness, distributable reserves for dividend payments and

share repurchases, results of the share repurchase progress and

other risks indicated in the risk factors included in ASML’s Annual

Report on Form 20-F and other filings with and submissions to the

US Securities and Exchange Commission. These forward-looking

statements are made only as of the date of this document. We do not

undertake to update or revise the forward-looking statements,

whether as a result of new information, future events or

otherwise.

- Link to press release

- Link to consolidated financial statements

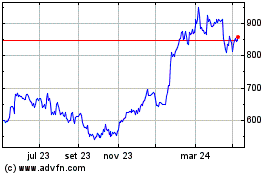

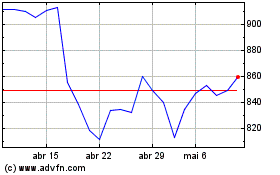

ASML Holding NV (BIT:1ASML)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

ASML Holding NV (BIT:1ASML)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024