AkzoNobel’s Q2 results show progress towards 15 by 20 strategy, with adjusted operating income up 36%, despite continued ex...

24 Julho 2019 - 2:00AM

July 24, 2019

AkzoNobel’s Q2 results show progress towards 15 by 20

strategy, with adjusted operating income up 36%, despite continued

external headwinds

Akzo Nobel N.V. (AKZA; AKZOY) publishes

results for second quarter 2019

• Adjusted operating income1 36% higher at €305 million (2018:

€225 million) • ROS, excluding unallocated costs,2 increased to

13.7% (2018: 12.1%) • Focus on value over volume resulted in

price/mix up 5% and 6% lower volumes • Transformation on track and

delivered €43 million cost savings • Acquisition of Mapaero,

announced July 18, 2019, further strengthens our aerospace coatings

business

Q2 2019: • Revenue was flat and up 1% in

constant currencies, with positive price/mix of 5% and acquisitions

contributing 1%, offset by 6% lower volumes• Adjusted operating

income up 36% at €305 million (2018: €225 million, which included

€20 million of one-off costs) driven by ongoing pricing initiatives

and cost-saving programs; ROS at 12.4% (2018: 9.2%) • Operating

income at €308 million includes €3 million positive impact from

identified items, related to a gain on disposal following asset

network optimization (€57 million) and transformation costs (€54

million); 2018 operating income at €192 million included €33

million negative identified items• Decorative Paints ROS up at

13.5% (2018: 12.2%); Performance Coatings ROS up at 13.6% (2018:

11.8%)• Adjusted EPS from continuing operations up 85% at €0.96

(2018: €0.52); EPS from total operations at €1.07 (2018: €1.06)

AkzoNobel CEO, Thierry Vanlancker,

commented:“We remain fully focused on delivering our

Winning together: 15 by 20 strategy and our Q2 results show we’re

making progress with profit up 36%. Return on sales was 13.7% for

the quarter, moving us another step closer to our 2020 ambition of

15%.

“This was an important quarter for us to demonstrate our

strategy is working. Q2 performance improved largely due to our

ongoing pricing initiatives and cost-saving programs, despite

headwinds in the external business environment. This is a rewarding

step for the organization and encouraging for the work still ahead

of us as we continue our transformation journey.

“In the face of softer market trends, we continue to focus on

delivering our strategy while investing in strategic growth

opportunities, to become recognized as the reference in the paints

and coatings industry.”

|

AkzoNobel in € millions |

Q2 2018 |

Q2 2019 |

Δ% |

Δ% CC3 |

|

Revenue |

2,446 |

2,451 |

-% |

1% |

|

Adjusted operating income1 |

225 |

305 |

36% |

|

|

ROS |

9.2% |

12.4% |

|

|

|

ROS excluding unallocated costs2 |

12.1% |

13.7% |

|

|

|

Operating income |

192 |

308 |

60% |

|

Recent highlights

Operation Night WatchWe recently partnered with

the Rijksmuseum for one of the most innovative projects in the

history of art – the live restoration of Rembrandt’s Night Watch.

In a spectacular fusion of old and new, Operation Night Watch will

use ground-breaking techniques to preserve the painting for future

generations. We’ll also be contributing our color expertise to the

historic project.

New paint range pounces on French market Our

Dulux Valentine decorative paint brand in France has roared onto

the market with a new EasyCare product called Color Resist. The

EasyCare range (also known as EasyClean) has now been introduced in

26 countries worldwide, including brands such as Dulux and

Marshall. The extensive launch in France proved to be a great

success, with a widespread TV campaign due to continue into August.

The French brand – which uses a distinctive black panther on its

packaging – launched the Color Resist range in April.

AkzoNobel rises to challenge of historic Hudson Yards

project in New YorkNew York’s historic Hudson Yards

development – which is changing the city’s iconic skyline – has

reached its latest milestone, and AkzoNobel has made a major

contribution.The largest private real estate development in US

history, the ongoing project recently saw the completion of the two

towers at 10 and 30 Hudson Yards. Taller than the Empire State

Building, the impressive glass and steel structure of 30 Hudson

Yards uses the company’s high performance architectural powder

coatings, while 10 Hudson Yards features AkzoNobel’s industrial

coatings.

Paint the Future goes beyond expectationsOur

pioneering Paint the Future startup challenge proved to be a huge

success, with five business agreements being awarded by AkzoNobel

at the accelerator event held in May. Organized in conjunction with

partner KPMG, the challenge attracted 160 submissions, with the 21

shortlisted startups being given the chance to collaborate with

industry experts and further their solutions. The agreements are

the first to emerge from a new innovation ecosystem which will help

us to further push the boundaries of the paints and coatings

industry and better meet customer needs.

Making powder coatings even more sustainableOur

powder coatings have become even more sustainable following the

introduction of a full range of Interpon Low-E products by our

Powder Coatings business. A complete range of smooth finishes in

Interpon 610 has been added to the coarse texture range launched

last year. Specially engineered for curing at temperatures lower

than the current standard of 180-190°C, the new offering is

polyester TGIC-free, saves energy and helps customers to improve

their efficiency.

AkzoNobel and Airbus advance innovation in aerospace

industry A new chromate-free exterior primer has been

developed by AkzoNobel and Airbus. Newly qualified by Airbus and

now included in the aircraft manufacturer’s specifications, Aerodur

HS 2121 is designed to be applied at the final assembly stage to

virtually all external aircraft surfaces. In addition to being free

from chromates, the new primer provides users with numerous

performance, appearance and application benefits.

|

Outlook: We are delivering towards our Winning

together: 15 by 20 strategy and continue creating a fit-for-purpose

organization for a focused paints and coatings company,

contributing to the achievement of our 2020 guidance. Demand

trends differ per region and segment in an uncertain macro-economic

environment. Raw material inflation is expected to stabilize during

the second half of 2019. Continued pricing initiatives and

cost-saving programs are in place to address the current

challenges. We continue executing our transformation to

deliver the next €200 million cost savings by 2020, incurring

one-off costs in 2019 and 2020. We target a leverage ratio

of between 1.0-2.0 times net debt/EBITDA by the end of 2020 and

commit to retain a strong investment grade credit rating.

|

The report for the second quarter 2019

can be viewed and downloaded

at http://akzo.no/Q22019

1 Adjusted operating income = operating income excluding

identified items (previously called EBIT)2 ROS excluding

unallocated costs is adjusted operating income as a percentage of

revenue excluding unallocated corporate center costs3 Constant

Currencies calculations exclude the impact of changes in foreign

exchange rates

This is a public announcement by Akzo Nobel N.V. pursuant to

section 17 paragraph 1 of the European Market Abuse Regulation

(596/2014).

About AkzoNobel

AkzoNobel has a passion for paint. We’re experts

in the proud craft of making paints and coatings, setting the

standard in color and protection since 1792. Our world class

portfolio of brands – including Dulux, International, Sikkens and

Interpon – is trusted by customers around the globe. Headquartered

in the Netherlands, we are active in over 150 countries and employ

around 34,500 talented people who are passionate about delivering

the high-performance products and services our customers

expect.

Not for publication – for more

information

| Media Relations |

Investor Relations |

| T +31 (0)88 – 969 7833 |

T +31 (0)88 – 969 7856 |

| Contact: Joost

RuempolMedia.relations@akzonobel.com |

Contact: Lloyd

MidwinterInvestor.relations@akzonobel.com |

Safe Harbor StatementThis press

release contains statements which address such key issues such as

AkzoNobel’s growth strategy, future financial results, market

positions, product development, products in the pipeline and

product approvals. Such statements should be carefully considered,

and it should be understood that many factors could cause

forecasted and actual results to differ from these statements.

These factors include, but are not limited to, price fluctuations,

currency fluctuations, developments in raw material and personnel

costs, pensions, physical and environmental risks, legal issues,

and legislative, fiscal, and other regulatory measures, as well as

the sale of Specialty Chemicals. Stated competitive positions are

based on management estimates supported by information provided by

specialized external agencies. For a more comprehensive discussion

of the risk factors affecting our business please see our latest

annual report, a copy of which can be found on our website:

www.akzonobel.com.

- Q2 2019 PDF media release

- Q2 2019 report

- Photo CEO Thierry Vanlancker

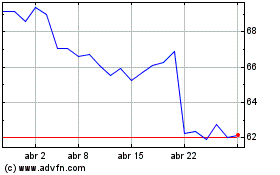

Akzo Nobel NV (EU:AKZA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Akzo Nobel NV (EU:AKZA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024