DREAM UNLIMITED CORP. (DRM-TSX)

(“

Dream”, the “

Company” or

“

we”) today announced its intention to commence a

substantial issuer bid (the “

Offer”) pursuant to

which the Company will offer to purchase up to 10,000,000 of its

outstanding Class A subordinate voting shares

(“

Shares”) at a purchase price of $11.75 per Share

in cash (the “

Purchase Price”).

Substantial Issuer Bid

On November 12, 2019, coincident with the

release of its financial results for the third quarter of 2019, the

Company announced that, conditional upon completion of the sale of

Dream Global Real Estate Investment Trust (“Dream

Global”) to affiliates of real estate funds managed by The

Blackstone Group Inc. (collectively, “Blackstone”)

in December 2019, the Company intended to make an offer to

shareholders in accordance with applicable securities laws to

acquire approximately 10.0 million Shares at an offer price of

$11.00 per Share for a total purchase price of approximately $110.0

million. As previously announced by Dream Global on November 27,

2019, the sale of Dream Global is expected to close on December 10,

2019.

The closing price of the Shares on the Toronto

Stock Exchange (the “TSX”) on November 12, 2019, the last full

trading day prior to the Company’s announcement of its intention to

launch a substantial issuer bid, was $10.31. Since November 12,

2019, the price of the Shares on the TSX has increased to $11.32 as

of market close on December 9, 2019. Given the increase in the

price of the Shares and the anticipated closing of the Dream Global

transaction, the Board of Directors has authorized the commencement

of the Offer at an offer price of $11.75 per Share. The Board of

Directors believes the Offer is a prudent use of our financial

resources given our business profile and assets, the current market

price of the Shares and our cash requirements. The Offer provides

Dream with the opportunity to return up to $117.5 million of

capital to shareholders who elect to tender while at the same time

increasing the proportionate Share ownership of shareholders who

elect not to tender. The Offer is also intended to reduce

shareholdings of less than 100 Shares in order to reduce our

ongoing costs.

The Purchase Price represents a 14% premium over

the closing price of the Shares on the TSX on November 12, 2019,

the last full trading day prior to the Company’s announcement of

its intention to launch a substantial issuer bid and a 3.8% premium

over the closing price of the Shares on the TSX on December 9,

2019, the last full trading day prior to the Company’s announcement

of its intention to make the Offer.

Details of the Offer, including instructions for

tendering Shares to the Offer and the factors considered by the

Board of Directors in making its decision to approve the Offer,

will be included in the formal offer to purchase and issuer bid

circular and other related documents (the “Offer

Documents”), which are expected to be mailed to

shareholders, filed with applicable Canadian Securities

Administrators and made available free of charge on or about

December 17, 2019 on SEDAR at www.sedar.com and on the Company’s

website at www.dream.ca. Shareholders should carefully read the

Offer Documents prior to making a decision with respect to the

Offer. The Offer will not be conditional on any minimum number of

Shares being tendered, but will be subject to various other

conditions that are typical for a transaction of this

nature.

The Offer will expire at 5 p.m. Eastern time on

the 36th day after the mailing of the Offer Documents, unless

terminated or extended by the Company. If more than 10,000,000

Shares are properly tendered to the Offer, the Company will take-up

and pay for the tendered Shares on a pro-rata basis according to

the number of Shares tendered, except that “odd lot” tenders (of

holders beneficially owning fewer than 100 Shares) will not be

subject to pro-ration. Assuming that 10,000,000 Shares are

purchased pursuant to the Offer, the aggregate purchase price

pursuant to the Offer will be $117,500,000. The Company intends to

fund the Offer with the proceeds received from the Dream Global

transaction.

Our Board of Directors has obtained an opinion

from Industrial Alliance Securities Inc. to the effect that, based

on and subject to the assumptions and limitations stated in such

opinion, as of December 9, 2019 (i) a liquid market for the Shares

exists, and (ii) it is reasonable to conclude that, following the

completion of the Offer, there will be a market for holders of the

Shares who do not tender to the Offer that is not materially less

liquid than the market that existed at the time of the making of

the Offer. A copy of the opinion of Industrial Alliance Securities

Inc. will be included in the Offer Documents.

Our Board of Directors has authorized the making

of the Offer. However, our Board of Directors is not making any

recommendation to any Dream shareholder as to whether to tender or

refrain from tendering their Shares under the Offer. Shareholders

are strongly urged to consult their own financial, tax and legal

advisors and to make their own decisions whether to tender or to

refrain from tendering their Shares to the Offer and, if so, how

many Shares to tender.

The Company was authorized by the TSX to

purchase up to 6,604,023 Shares pursuant to a normal course issuer

bid (the “NCIB”) that commenced on September 20,

2019 and expires on September 19, 2020. Since September 20, 2019,

the Company has purchased 322,954 Shares through the NCIB. There

will be no further purchases of Shares under the NCIB until after

the expiry of the Offer or date of termination of the Offer.

Any questions or requests for information may be

directed to Computershare Trust Company of Canada, as the

depositary for the Offer, at 1-800-564-6253 (Toll Free).

About Dream Unlimited Corp.

Dream is one of Canada’s leading real estate

companies with over $16 billion of assets under management in North

America and Europe. The scope of the business includes asset

management and management services for four TSX-listed trusts and

institutional partnerships, condominium and mixed-use development,

investments in and management of a renewable power portfolio,

commercial property ownership, residential land development, and

housing and multi-family development. Dream has an established

track record for being innovative and for its ability to source,

structure and execute on compelling investment opportunities. For

more information please visit: www.dream.ca.

Forward looking information

This press release may contain forward-looking

information within the meaning of applicable securities

legislation, including statements regarding our intention to

undertake the Offer and the terms thereof, including the maximum

number of Shares we may purchase under the Offer, the expected

expiration time of the Offer, the sources and availability of

funding for the Offer, the market for the Shares after completion

of the Offer not being materially less liquid than the market that

exists at the time of the making of the Offer, our expectations for

future purchases of additional Shares following the expiry of the

Offer, the terms of the Dream Global transaction with Blackstone

and the expected date of completion of the transaction, whether the

Dream Global transaction with Blackstone will be completed or that

it will be completed on the terms and conditions contemplated in

this news release, and the amount of proceeds expected to be

received by the Company in connection with the Dream Global

transaction with Blackstone and the proposed uses of such proceeds.

Forward-looking information is based on a number of assumptions and

is subject to a number of risks and uncertainties, many of which

are beyond the Dream’s control, which could cause actual results to

differ materially from those that are disclosed in or implied by

such forward-looking information. These risks and uncertainties

include, but are not limited to, general and local economic and

business conditions, employment levels, regulatory risks, mortgage

rates and regulations, interest rates, foreign exchange rates,

environmental risks, consumer confidence, seasonality, adverse

weather conditions, reliance on key clients and personnel,

inflation and competition. Our objectives and forward-looking

statements are based on certain assumptions, including the nature

of development lands held and the development potential of such

lands, our ability to bring new developments to market, anticipated

positive general economic and business conditions, including low

unemployment and interest rates, positive net migration, oil and

gas commodity prices, our business strategy, including geographic

focus, anticipated sales volumes, performance of our underlying

business segments and conditions in the Western Canada land and

housing markets, and that competition for acquisitions remains

consistent with the current climate. All forward-looking

information in this press release speaks as of the date of this

press release. Dream does not undertake to update any such

forward-looking information whether as a result of new information,

future events or otherwise except as required by law. Additional

information about these assumptions and risks and uncertainties is

contained in the Dream’s filings with securities regulators at

www.sedar.com, including its latest annual information form and

management’s discussion and analysis. These filings are also

available at Dream’s website at www.dream.ca.

For further information, please contact:

DREAM UNLIMITED CORP.

| Pauline

Alimchandani

EVP & Chief Financial Officer

(416)

365-5992

palimchandani@dream.ca |

Kim

LefeverDirector, Investor Relations(416)

365-6339klefever@dream.ca |

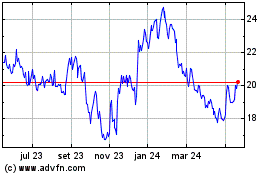

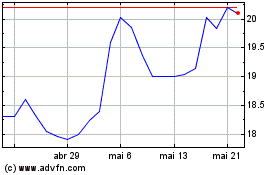

DREAM Unlimited (TSX:DRM)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

DREAM Unlimited (TSX:DRM)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025