Chorus Aviation announces exercise in full and closing of over-allotment option in connection with bought deal offering of 5....

11 Dezembro 2019 - 10:18AM

Chorus Aviation Inc. ('Chorus') (TSX: CHR) is pleased to announce

that the underwriters of its offering of 5.75% senior unsecured

debentures (the ‘Debentures’) exercised in full their

over-allotment option resulting in the issue of an additional

$11,250,000 aggregate principal amount of Debentures, bringing the

total offering to $86,250,000 aggregate principal amount of

Debentures.

The net proceeds of the offering will be used to

fund the growth of Chorus Aviation Capital (Chorus’ aircraft

leasing business), including the acquisition of aircraft intended

for or currently on lease to third parties, as well as for working

capital requirements and other general corporate purposes.

The Debentures bear interest at a rate of 5.75%

per annum, payable semi-annually in arrears on June 30 and December

31 of each year, commencing June 30, 2020, and will mature on

December 31, 2024. The Debentures are listed for trading on the

Toronto Stock Exchange under the symbol ‘CHR.DB.A’.

Subject to any required regulatory approval and

provided no event of default has occurred and is continuing under

the terms of the indenture governing the Debentures, Chorus will

have the option to satisfy its obligation to pay the principal

amount of the Debentures due at redemption or maturity (together

with any applicable premium) by delivering freely tradeable Class B

Voting Shares (‘Class B Shares’) to holders of the Debentures

(‘Debentureholders’) who are Canadians (as defined in the Canada

Transportation Act (‘Qualified Canadians’) or Class A Variable

Voting Shares (‘Class A Shares’ and, together with the Class B

Shares, the ‘Voting Shares’) to Debentureholders who are not

Qualified Canadians.

The Debentures are not convertible into Voting

Shares by Debentureholders at any time.

A syndicate co-led by CIBC Capital Markets and

RBC Capital Markets, and including Scotiabank, National Bank

Financial Inc., TD Securities Inc., BMO Capital Markets, Canaccord

Genuity Corp., Cormark Securities Inc. and Paradigm Capital Inc.

acted as underwriters for the offering.

The Debentures have not been and will not be

registered under the U.S. Securities Act of 1933, as amended, and

may not be offered or sold in the United States absent registration

or an applicable exemption from the registration requirements of

such Act. This news release shall not constitute an offer to sell

or the solicitation of an offer to buy nor shall there be any sale

of the securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

About Chorus

Chorus Aviation is a global provider of

integrated regional aviation solutions. Chorus’ vision is to

deliver regional aviation to the world. Headquartered in Halifax,

Nova Scotia, Chorus comprises Chorus Aviation Capital, a leading,

global lessor of regional aircraft, and Jazz Aviation and Voyageur

Aviation, companies that have long histories of safe operations

with excellent customer service. Chorus provides a full suite

of regional aviation support services that encompasses every stage

of an aircraft’s lifecycle, including: aircraft acquisitions and

leasing; aircraft refurbishment, engineering, modification,

repurposing and preparation; contract flying; aircraft and

component maintenance, disassembly, and parts provisioning.

Chorus Class A Variable Voting Shares and Class

B Voting Shares trade on the Toronto Stock Exchange under the

trading symbol ‘CHR’.

Forward-Looking Information

This news release contains 'forward-looking

information'. Forward-looking information is identified by the use

of terms and phrases such as "anticipate", "believe", "could",

"estimate", "expect", "intend", "may", "plan", "predict",

"potential", "pending", "project", "will", "would", and similar

terms and phrases. In particular, this news release includes

forward-looking information relating to the anticipated use of the

net proceeds of the offering. Forward-looking information involves

known and unknown risks, uncertainties and other factors that may

cause actual results, performance or achievements to differ

materially from those indicated in the forward-looking information.

These risks include, but are not limited to, the potential

reallocation by Chorus of all or a portion of the net proceeds of

the offering for business reasons, including among others, due to

the results of operations or as a result of other business

opportunities that may become available, as well the risk factors

identified in Chorus' Annual Information Form dated February

21, 2019, in Chorus' public disclosure record available

at www.sedar.com and in the short form prospectus filed in

connection with the offering. Statements containing forward-looking

information in this news release represent Chorus' expectations as

of the date of this news release (or as of the date they are

otherwise stated to be made) and are subject to change after such

date. Chorus disclaims any intention or obligation to update or

revise such statements to reflect new information, subsequent

events or otherwise, unless required by applicable securities

laws.

Chorus Media Contacts

Manon Stuart, Halifax, Nova Scotia (902)

873-5054 manon.stuart@chorusaviation.com Debra

Williams, Toronto, Ontario (905)

671-7769 debra.williams@chorusaviation.com

Analyst Contact

Nathalie Megann, Halifax, Nova Scotia, (902) 873-5094

nathalie.megann@chorusaviation.com

Chorus Aviation (TSX:CHR)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

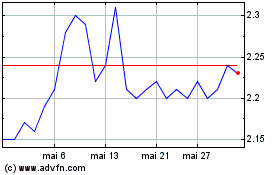

Chorus Aviation (TSX:CHR)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025