Dream Unlimited Corp. Announces Preliminary Results of Its Successful $117.5 Million Substantial Issuer Bid

23 Janeiro 2020 - 9:50AM

DREAM UNLIMITED CORP. (DRM-TSX) (“Dream”, the “Company” or

“we”) announced today the preliminary results of its

substantial issuer bid to purchase for cancellation up to

10,000,000 of its outstanding Class A subordinate voting shares

(“

Shares”) at a price of $11.75 per Share (the

“

Purchase Price”), for an aggregate purchase price

not to exceed $117,500,000 (the “

Offer”). The

Offer expired at 5:00 p.m. Eastern time on January 22, 2020.

In accordance with the terms and conditions of

the Offer and based on the preliminary count by Computershare Trust

Company of Canada, the depositary for the Offer (the

“Depositary”), the Company has taken up and will

purchase for cancellation 10,000,000 Shares at the Purchase Price.

After giving effect to the Offer, 92,205,257 Shares will remain

outstanding.

Based on the preliminary count by the Depositary

for the Offer, approximately 12,335,414 Shares were properly

tendered to the Offer and not withdrawn. As the Offer was

oversubscribed, the Company will purchase the successfully tendered

Shares on a pro rata basis following determination of the final

results of the Offer, except that “odd lot” tenders (of holders

beneficially owning fewer than 100 Shares) will not be subject to

pro ration. The count of Shares tendered under the Offer is

preliminary and is subject to verification. The Company and the

Depositary expect that the final determination of the pro ration

factor will be made on or before January 24, 2020.

The Company will make payment for the Shares

tendered and accepted for purchase by tendering the aggregate

purchase price to the Depositary on or before January 27, 2020 in

accordance with the Offer and applicable laws and the Depositary

will make payment to shareholders promptly thereafter. Payment for

Shares will be made in cash, without interest. Any Shares invalidly

tendered or tendered and not purchased will be returned to the

tendering shareholder promptly by the Depositary.

The full terms and conditions of the Offer are

described in detail in the offer to purchase and issuer bid

circular of the Company dated December 17, 2019, as well as the

related letter of transmittal and notice of guaranteed delivery,

which are available under the Company’s SEDAR profile at

www.sedar.com.

About Dream Unlimited Corp.

Dream is one of Canada’s leading real estate

companies with approximately $9 billion of assets under management.

Dream is an owner and developer of exceptional office and

residential assets in Toronto which we hold for the long term. We

also develop land and residential assets in Western Canada for

immediate sale and own and manage stabilized income generating

assets in both Canada and the U.S. In addition, we have a

successful asset management business, inclusive of three TSX listed

trusts and institutional partnerships. Dream has an established

track record for being innovative and for our ability to source,

structure and execute on compelling investment opportunities. For

more information please visit: www.dream.ca.

For further information, please contact:

|

Pauline Alimchandani EVP & Chief Financial Officer(416)

365-5992palimchandani@dream.ca |

Kim Lefever Director, Investor Relations(416)

365-6339klefever@dream.ca |

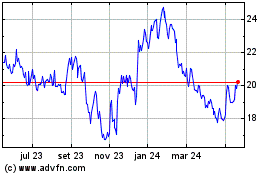

DREAM Unlimited (TSX:DRM)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

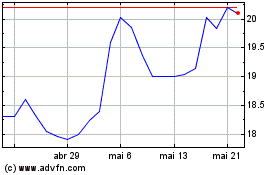

DREAM Unlimited (TSX:DRM)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025