AkzoNobel’s Q4 and full-year 2019 results show transformation on track, with further step up in profitability, despite soft...

12 Fevereiro 2020 - 3:00AM

February 12, 2020

AkzoNobel’s Q4 and full-year 2019 results show

transformation on track, with further step up in profitability,

despite softer end market demand

Akzo Nobel N.V. (AKZA; AKZOY) publishes

results for fourth quarter and full-year 2019

Highlights Q4 2019:

- Adjusted operating income1 up 23% at

€223 million (2018: €181 million), despite softer end market

demand

- ROS, excluding unallocated

costs2, increased to 11.0% (2018:

9.0%)

- Operating income at €173 million (2018: €68 million);

OPI margin improved to 7.7% (2018: 2.9%)

- Progress towards delivering cost savings; delivered €10

million cost savings in this quarter

- Revenue 3% lower and 4% lower in constant currencies3, with

positive price/mix of 1% more than offset by 4% lower volumes

- Adjusted operating income up 23% at €223 million (2018: €181

million) driven by ongoing pricing initiatives, margin management

and cost-saving programs; ROS increased to 9.9% (2018:

7.8%)

- Operating income at €173 million includes €50 million negative

impact from identified items, related to transformation costs and

non-cash impairments (2018: €68 million including €113 million

negative identified items); OPI margin improved to 7.7% (2018:

2.9%)

Full-year 2019:

- Revenue was flat, with positive price/mix of 4% and

acquisitions contributing 1%, offset by 5% lower volumes due to our

value over volume strategy

- Adjusted operating income up 24% at €991 million (2018: €798

million) driven by pricing initiatives and cost savings; ROS up at

10.7% (2018: 8.6%); ROS excluding unallocated costs up at 12.0%

(2018:10.6%)

- Operating income up 39% at €841 million, including €150 million

negative impact from identified items, mainly related to

transformation costs and non-cash impairments, partly offset by a

gain on disposal following asset network optimization (2018: €605

million including €193 million negative impact from identified

items, mainly related to €130 million transformation costs and €57

million one-off non-cash pension costs); OPI margin improved at

9.1% (2018: 6.5%)

- Net income from total operations at €539 million, including €22

million discontinued operations (2018: €6,674 million, including

€6,264 million from discontinued operations)

- Final dividend proposed of €1.49 per share

AkzoNobel CEO, Thierry Vanlancker,

commented:

“Our 2019 results show we are on track with our transformation.

We made good progress, despite higher raw material costs and softer

end market demand. Our performance improvement accelerated during

the second half of 2019, resulting in business return on sales up

by almost 200 basis points to 12.5%.

“We delivered on our commitment and returned €6.5 billion to

shareholders, following the sale of Specialty Chemicals. At the

same time, we continued to invest in our future. We kickstarted a

€50 million investment in our US wood coatings business, completed

the acquisition of Mapaero to strengthen our global position in

aerospace coatings and expanded our Paint the Future innovation

ecosystem.

“The real driving force behind AkzoNobel’s achievements has been

our dedicated and diverse colleagues around the world. Together, we

remain fully focused on delivering our Winning together: 15 by 20

strategy during the year ahead.”

|

AkzoNobel in € millions |

Q4 2018 |

Q4 2019 |

Δ% |

Δ% CC3 |

|

Revenue |

2,308 |

2,242 |

(3%) |

(4%) |

|

Adjusted operating income1 |

181 |

223 |

23% |

|

|

ROS |

7.8% |

9.9% |

|

|

|

ROS, excluding unallocated costs2 |

9.0% |

11.0% |

|

|

|

Operating income |

68 |

173 |

154% |

|

Recent highlights Powder coatings take

landmark building to another levelEurope will soon have a

new tallest building – and it’s being protected from the ravages of

the Warsaw weather by a high class powder coatings system supplied

by AkzoNobel. Standing 310 meters tall, the Varso Tower – developed

by international workspace provider HB Reavis – will dominate the

skyline of the Polish capital. It features a sleek black exterior

which has been created by using the company’s Interpon D2525

super-durable topcoat on the cladding and profiles in a striking

Noir Sablé shade. Meanwhile, Interpon’s Redox Plus primer provides

a super tough core.

Dulux Ambiance range launched in India Dulux

has introduced six special effects paints onto the Indian market.

Part of the Ambiance range, the new Marble, Metallic, Linen, Silk,

ColourMotion and Desert paints enable consumers to createentirely

new designs and patterns. In addition, Dulux has also launched

Dulux Ambiance Velvet Touch Elastoglo. Powered by cutting-edge

elastomeric properties, the product provides a three-fold increase

in the elasticity of the paint film, when compared with other

premium interior paints. It means it can cover hairline cracks and

protect walls, as well as providing a beautiful finish.

Yacht market primed for revolutionary spray

fillerSuperyacht builders and applicators can now benefit

from revolutionary spray filler technology which is all set to make

waves in the industry. Part of our Awlgrip range, Awlfair SF is a

high-performance filler which can be applied by pressurized airless

spray, rather than by hand. The breakthrough innovation not only

allows for wet-on-wet application, it also means up to two coats

per day can be applied, without the need for sanding

in-between.

Investing in people earns AkzoNobel five

“Top Employer” titlesThe Top Employers Institute has

recognized AkzoNobel’s excellence in creating the best conditions

for employees. China received certification in December 2019,

followed by certificates in the other key markets of Brazil, the

UK, the Netherlands and the US. Building on a strong track record

of people-driven initiatives, the company adds its first “Top

Employer” certifications in the Netherlands and the US to the

certifications already held in the UK for eight consecutive years,

seven in China and four in Brazil.

|

Outlook:We are delivering towards our Winning

together: 15 by 20 strategy and continue creating a fit-for-purpose

organization for a focused paints and coatings company,

contributing to the achievement of our 2020 ambition. Demand trends

differ per region and segment in an uncertain macro-economic

environment. Raw material costs are expected to have a moderately

favorable impact for the first half of 2020. Continued margin

management and cost-saving programs are in place to address the

current challenges. We continue executing our transformation,

incurring one-off costs, to deliver the previously announced €200

million cost savings. We target a leverage ratio of 1.0-2.0 times

net debt/EBITDA by the end of 2020 and commit to retain a strong

investment grade credit rating. |

The report for the full-year and fourth quarter

2019 can be viewed and downloaded

at http://akzo.no/Q42019

1 Adjusted operating income = operating income excluding

identified items (previously called EBIT)2 ROS excluding

unallocated costs is adjusted operating income as a percentage of

revenue excluding unallocated corporate center costs3 Constant

Currencies calculations exclude the impact of changes in foreign

exchange rates

This is a public announcement by Akzo Nobel N.V. pursuant to

section 17 paragraph 1 of the European Market Abuse Regulation

(596/2014).

About AkzoNobel

AkzoNobel has a passion for paint. We’re experts

in the proud craft of making paints and coatings, setting the

standard in color and protection since 1792. Our world class

portfolio of brands – including Dulux, International, Sikkens and

Interpon – is trusted by customers around the globe. Headquartered

in the Netherlands, we are active in over 150 countries and employ

around 34,000 talented people who are passionate about delivering

the high-performance products and services our customers

expect.

Not for publication – for more

information

| Media Relations |

Investor Relations |

| T +31 (0)88 – 969 7833 |

T +31 (0)88 – 969 7856 |

| Contact: Joost

RuempolMedia.relations@akzonobel.com |

Contact: Lloyd

MidwinterInvestor.relations@akzonobel.com |

Safe Harbor StatementThis press

release contains statements which address such key issues such as

AkzoNobel’s growth strategy, future financial results, market

positions, product development, products in the pipeline and

product approvals. Such statements should be carefully considered,

and it should be understood that many factors could cause

forecasted and actual results to differ from these statements.

These factors include, but are not limited to, price fluctuations,

currency fluctuations, developments in raw material and personnel

costs, pensions, physical and environmental risks, legal issues,

and legislative, fiscal, and other regulatory measures. Stated

competitive positions are based on management estimates supported

by information provided by specialized external agencies. For a

more comprehensive discussion of the risk factors affecting our

business please see our latest annual report, a copy of which can

be found on our website: www.akzonobel.com.

- 20200212 PDF Media release Q4FY 2019

- AkzoNobel CEO Thierry Vanlancker

- AkzoNobel Q4 and Full Year 2019 Report

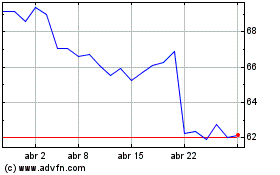

Akzo Nobel NV (EU:AKZA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Akzo Nobel NV (EU:AKZA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024