Canadian Natural Resources Limited (“Canadian Natural” or the

“Company”) is providing a corporate update on its capital

flexibility and its continued focus on effective and efficient

operations.

Canadian Natural is well positioned through the

current global COVID-19 challenges, due to our significant long

life low decline asset base that has 27.8 years of reserve life

based on proved reserves and 36.0 years of reserve life based on

proved plus probable reserves. Of the proved reserves, 83% is

derived from long life low decline assets and 77% of budgeted 2020

liquids production is from the same type of long life low decline

assets. Importantly, Canadian Natural’s Oil Sands Mining and

Upgrading assets have a reserve life in excess of 43 years. These

Oil Sands Mining and Upgrading assets have a production capability

in the range of 430,000 - 475,000 bbl/d of Synthetic Crude Oil

("SCO"), with operating costs of approximately US$13/bbl. These

assets currently make up approximately 45% of our liquids

production and continue to generate substantial free cash flow at

current commodity price levels.

Canadian Natural’s asset base has low sustaining

capital and low reservoir risk which allows it to effectively

manage through commodity price cycles, with little impact on our

near term production levels and net asset value, thereby preserving

long term value for our shareholders and creditors. The Company

maintains a flexible and disciplined capital allocation strategy,

with a focus on maintaining a strong financial position throughout

the commodity price cycle.

With the continued volatility in commodity

pricing, the Company has identified and implemented further

opportunities to reduce its 2020 capital spending budget to

approximately $2,960 million, a $1,090 million reduction from its

original 2020 budget. Notwithstanding this spending reduction,

there is no change to our 2020 corporate production guidance

volumes of 1,137,000 - 1,207,000 BOE/d; originally issued on

December 4, 2019. Canadian Natural's long life low decline asset

base and its associated low annual sustaining capital of

approximately $3 billion, coupled with the ramp up of production

volumes at Kirby North, Primrose and Jackfish production, all where

capital for these projects was largely incurred in 2019 and before,

results in similar targeted production levels in 2021 and 2022.

Summary of 2020 capital budget by areas are as

follows:

| ($

million) |

Original 2020Budget |

Current Revised Budget |

|

Conventional/Unconventional |

$ |

1,550 |

|

$ |

990 |

|

| Long Life Low Decline |

$ |

2,500 |

|

$ |

1,970 |

|

|

Total |

$ |

4,050 |

|

$ |

2,960 |

|

Canadian Natural’s ability to maintain our

original 2020 corporate production guidance volumes is a reflection

of the strength of our long life low decline production base, our

low maintenance capital costs and our effective and efficient

operations which drive low operating costs. Further, the ability of

the Company to generate free cash flow is enhanced by our

production mix, where approximately 60% of liquids production is

light oil and SCO, subject to light oil pricing, driving

significant positive netbacks, even in the current price

environment. This is supported by effective and efficient

operations across the entire asset base where the Company continues

to be focused on margin growth and its industry leading operating

and sustaining capital costs.

The revised capital budget, with no change to

our 2020 corporate production guidance volumes, ensures strong

adjusted funds flow in the current challenging environment to cover

the current dividend and maintain balance sheet strength. As

part of this balance sheet strength, the Company has suspended

share purchases under its issuer bid as at March 11, 2020. In

addition, Canadian Natural’s current liquidity is approximately $5

billion consisting of cash, including approximately $1 billion in

estimated cash reserves as at March 31, 2020, and availability

under committed credit facilities, which is more than sufficient to

retire, when due, any current debt retirement obligations.

As part of the continued focus on effective and

efficient operations, the Company has reviewed its compensation

program in light of the current commodity volatility. Effective

April 2020 the President’s annual salary has been reduced 20%,

while other members of the Management Committee will have annual

salaries reduced by 15% and Vice-President positions will have

annual salaries reduced by 12%. Concurrently, the Board of

Directors has also agreed to reduce their annual Board cash

retainer by 10%.

The Company is continuing to monitor the rapidly

changing COVID-19 situation, following provincial and federal

health guidelines to ensure the wellbeing of our employees and is

taking the necessary precautions to ensure the safety of our office

and field operations staff. Canadian Natural is confident

that it can maintain effective operations with our current

procedures and protocols.

Canadian Natural is a senior oil and natural gas

production company, with continuing operations in its core areas

located in Western Canada, the U.K. portion of the North Sea and

Offshore Africa.

|

CANADIAN NATURAL RESOURCES LIMITED |

| 2100, 855

- 2nd Street S.W. Calgary, Alberta, T2P4J8Phone: 403-514-7777

Email: ir@cnrl.comwww.cnrl.com |

|

|

| |

|

STEVE W. LAUTExecutive Vice-Chairman TIM

S. MCKAYPresident MARK A.

STAINTHORPEChief Financial Officer and Senior

Vice-President, Finance Trading Symbol - CNQToronto Stock

ExchangeNew York Stock Exchange |

ADVISORY

Special Note Regarding Forward-Looking

Statements

Certain statements relating to Canadian Natural

Resources Limited (the "Company") in this document or documents

incorporated herein by reference constitute forward-looking

statements or information (collectively referred to herein as

"forward-looking statements") within the meaning of applicable

securities legislation. Forward-looking statements can be

identified by the words "believe", "anticipate", "expect", "plan",

"estimate", "target", "continue", "could", "intend", "may",

"potential", "predict", "should", "will", "objective", "project",

"forecast", "goal", "guidance", "outlook", "effort", "seeks",

"schedule", "proposed", "aspiration" or expressions of a similar

nature suggesting future outcome or statements regarding an

outlook. Disclosure related to expected future commodity pricing,

forecast or anticipated production volumes, royalties, production

expenses, capital expenditures, income tax expenses and other

guidance provided throughout the Company's Management’s Discussion

and Analysis ("MD&A") of the financial condition and results of

operations of the Company, constitute forward-looking statements.

Disclosure of plans relating to and expected results of existing

and future developments, including, without limitation, those in

relation to the Company's assets at Horizon, AOSP, Primrose thermal

projects, the Pelican Lake water and polymer flood project, the

Kirby Thermal Oil Sands Project, the Jackfish Thermal Oil Sands

Project, the timing and future operations of the North West

Redwater bitumen upgrader and refinery, construction by third

parties of new, or expansion of existing, pipeline capacity or

other means of transportation of bitumen, crude oil, natural gas,

natural gas liquids ("NGLs") or synthetic crude oil ("SCO") that

the Company may be reliant upon to transport its products to

market, development and deployment of technology and technological

innovations, the assumption of operations at processing facilities,

and the "Outlook" section of the Company's MD&A, particularly

in reference to the 2020 guidance provided with respect to budgeted

capital expenditures, also constitute forward-looking statements.

These forward-looking statements are based on annual budgets and

multi-year forecasts, and are reviewed and revised throughout the

year as necessary in the context of targeted financial ratios,

project returns, product pricing expectations and balance in

project risk and time horizons. These statements are not guarantees

of future performance and are subject to certain risks. The reader

should not place undue reliance on these forward-looking statements

as there can be no assurances that the plans, initiatives or

expectations upon which they are based will occur.

In addition, statements relating to "reserves"

are deemed to be forward-looking statements as they involve the

implied assessment based on certain estimates and assumptions that

the reserves described can be profitably produced in the future.

There are numerous uncertainties inherent in estimating quantities

of proved and proved plus probable crude oil, natural gas and NGLs

reserves and in projecting future rates of production and the

timing of development expenditures. The total amount or timing of

actual future production may vary significantly from reserves and

production estimates.

The forward-looking statements are based on

current expectations, estimates and projections about the Company

and the industry in which the Company operates, which speak only as

of the earlier of the date such statements were made or as of the

date of the report or document in which they are contained, and are

subject to known and unknown risks and uncertainties that could

cause the actual results, performance or achievements of the

Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements. Such risks and uncertainties include,

among others: general economic and business conditions (including

as a result of demand and supply effects resulting from the

COVID-19 virus pandemic and the actions of OPEC and non-OPEC

countries) which will, among other things, impact demand for and

market prices of the Company’s products; volatility of and

assumptions regarding crude oil, natural gas and NGL prices;

fluctuations in currency and interest rates; assumptions on which

the Company’s current guidance is based; economic conditions in the

countries and regions in which the Company conducts business;

political uncertainty, including actions of or against terrorists,

insurgent groups or other conflict including conflict between

states; industry capacity; ability of the Company to implement its

business strategy, including exploration and development

activities; impact of competition; the Company’s defense of

lawsuits; availability and cost of seismic, drilling and other

equipment; ability of the Company and its subsidiaries to complete

capital programs; the Company’s and its subsidiaries’ ability to

secure adequate transportation for its products; unexpected

disruptions or delays in the mining, extracting or upgrading of the

Company’s bitumen products; potential delays or changes in plans

with respect to exploration or development projects or capital

expenditures; ability of the Company to attract the necessary

labour required to build, maintain and operate its thermal and oil

sands mining projects; operating hazards and other difficulties

inherent in the exploration for and production and sale of crude

oil and natural gas and in mining, extracting or upgrading the

Company’s bitumen products; availability and cost of financing; the

Company’s and its subsidiaries’ success of exploration and

development activities and its ability to replace and expand crude

oil and natural gas reserves; timing and success of integrating the

business and operations of acquired companies and assets;

production levels; imprecision of reserves estimates and estimates

of recoverable quantities of crude oil, natural gas and NGLs not

currently classified as proved; actions by governmental authorities

(including production curtailments mandated by the Government of

Alberta); government regulations and the expenditures required to

comply with them (especially safety and environmental laws and

regulations and the impact of climate change initiatives on capital

expenditures and production expenses); asset retirement

obligations; the adequacy of the Company’s provision for taxes; and

other circumstances affecting revenues and expenses.

The Company’s operations have been, and in the

future may be, affected by political developments and by national,

federal, provincial, state and local laws and regulations such as

restrictions on production, changes in taxes, royalties and other

amounts payable to governments or governmental agencies, price or

gathering rate controls and environmental protection regulations.

Should one or more of these risks or uncertainties materialize, or

should any of the Company’s assumptions prove incorrect, actual

results may vary in material respects from those projected in the

forward-looking statements. The impact of any one factor on a

particular forward-looking statement is not determinable with

certainty as such factors are dependent upon other factors, and the

Company’s course of action would depend upon its assessment of the

future considering all information then available.

Readers are cautioned that the foregoing list of

factors is not exhaustive. Unpredictable or unknown factors not

discussed in the Company's MD&A could also have adverse effects

on forward-looking statements. Although the Company believes that

the expectations conveyed by the forward-looking statements are

reasonable based on information available to it on the date such

forward-looking statements are made, no assurances can be given as

to future results, levels of activity and achievements. All

subsequent forward-looking statements, whether written or oral,

attributable to the Company or persons acting on its behalf are

expressly qualified in their entirety by these cautionary

statements. Except as required by applicable law, the Company

assumes no obligation to update forward-looking statements in the

Company's MD&A, whether as a result of new information, future

events or other factors, or the foregoing factors affecting this

information, should circumstances or the Company's estimates or

opinions change.

Special Note Regarding non-GAAP

Financial Measures

This press release includes references to

financial measures commonly used in the crude oil and natural gas

industry, such as: adjusted net earnings (loss) from operations;

adjusted funds flow (previously referred to as funds flow from

operations) and net capital expenditures. These financial measures

are not defined by International Financial Reporting Standards

("IFRS") and therefore are referred to as non-GAAP measures. The

non-GAAP measures used by the Company may not be comparable to

similar measures presented by other companies. The Company uses

these non-GAAP measures to evaluate its performance. The non-GAAP

measures should not be considered an alternative to or more

meaningful than net earnings (loss), cash flows from operating

activities, and cash flows used in investing activities, as

determined in accordance with IFRS, as an indication of the

Company's performance.

Adjusted net earnings (loss) from operations is

a non-GAAP measure that represents net earnings (loss) as presented

in the Company's consolidated Statements of Earnings (Loss),

adjusted for the after-tax effects of certain items of a non-

operational nature. The Company considers adjusted net earnings

(loss) from operations a key measure in evaluating its performance,

as it demonstrates the Company's ability to generate after-tax

operating earnings from its core business areas. The reconciliation

“Adjusted Net Earnings (Loss) from Operations, as Reconciled to Net

Earnings (Loss)" is presented in the Company’s MD&A.

Adjusted funds flow (previously referred to as

funds flow from operations) is a non-GAAP measure that represents

cash flows from operating activities as presented in the Company's

consolidated Statements of Cash Flows, adjusted for the net change

in non-cash working capital, abandonment expenditures and movements

in other long-term assets, including the unamortized cost of the

share bonus program and prepaid cost of service tolls. The Company

considers adjusted funds flow a key measure as it demonstrates the

Company’s ability to generate the cash flow necessary to fund

future growth through capital investment and to repay debt. The

reconciliation “Adjusted Funds Flow, as Reconciled to Cash Flows

from Operating Activities” is presented in the Company’s

MD&A.

Net capital expenditures is a non-GAAP measure

that represents cash flows used in investing activities as

presented in the Company's consolidated Statements of Cash Flows,

adjusted for the net change in non-cash working capital, investment

in other long-term assets, share consideration in business

acquisitions and abandonment expenditures. The Company considers

net capital expenditures a key measure as it provides an

understanding of the Company’s capital spending activities in

comparison to the Company's annual capital budget. The

reconciliation “Net Capital Expenditures, as Reconciled to Cash

Flows used in Investing Activities” is presented in the Net Capital

Expenditures section of the Company’s MD&A.

Free cash flow is a non-GAAP measure that

represents cash flows from operating activities as presented in the

Company's consolidated Statements of Cash Flows, adjusted for the

net change in non-cash working capital from operating activities,

abandonment, certain movements in other long-term assets, less net

capital expenditures and dividends on common shares. The Company

considers free cash flow a key measure in demonstrating the

Company’s ability to generate cash flow to fund future growth

through capital investment, pay returns to shareholders, and to

repay debt.

Adjusted EBITDA is a non-GAAP measure that

represents net earnings (loss) as presented in the Company's

consolidated Statements of Earnings (Loss), adjusted for interest,

taxes, depletion, depreciation and amortization, stock based

compensation expense (recovery), unrealized risk management

gains (losses), unrealized foreign exchange gains (losses), and

accretion of the Company’s asset retirement obligation. The Company

considers adjusted EBITDA a key measure in evaluating its operating

profitability by excluding non-cash items.

Debt to adjusted EBITDA is a non-GAAP measure

that is derived as the current and long-term portions of long-term

debt, divided by the 12 month trailing Adjusted EBITDA, as defined

above. The Company considers this ratio to be a key measure in

evaluating the Company's ability to pay off its debt.

Debt to book capitalization is a non-GAAP

measure that is derived as net current and long-term debt, divided

by the book value of common shareholders' equity plus net current

and long-term debt. The Company considers this ratio to be a key

measure in evaluating the Company's ability to pay off its

debt.

Available liquidity is a non-GAAP measure that

is derived as cash and cash equivalents, total bank and term credit

facilities, less amounts drawn on the bank and credit facilities

including under the commercial paper program. The Company considers

available liquidity a key measure in evaluating the sustainability

of the Company’s operations and ability to fund future growth. See

note 8 - Long-term Debt in the Company’s consolidated financial

statements.

Special Note Regarding Currency,

Financial Information and Production

This press release should be read in conjunction

with the Company's MD&A and unaudited interim consolidated

financial statements for the three months and year ended December

31, 2019 and the Company's MD&A and the audited consolidated

financial statements of the Company for the year ended December 31,

2018. All dollar amounts are referenced in millions of Canadian

dollars, except where noted otherwise. The Company’s unaudited

interim consolidated financial statements for the three months and

year ended December 31, 2019 and the Company's MD&A have been

prepared in accordance with IFRS as issued by the International

Accounting Standards Board ("IASB"). Changes in the Company's

accounting policies in accordance with IFRS, including the adoption

of IFRS 16 "Leases" on January 1, 2019, are discussed in the

"Changes in Accounting Policies" section of the Company's MD&A.

In accordance with the new IFRS 16 "Leases" standard, comparative

period balances in 2018 reported in the Company's MD&A have not

been restated.

Production volumes and per unit statistics are

presented throughout the Company's MD&A on a "before royalties"

or "company gross" basis, and realized prices are net of blending

and feedstock costs and exclude the effect of risk management

activities. In addition, reference is made to crude oil and natural

gas in common units called barrel of oil equivalent ("BOE"). A BOE

is derived by converting six thousand cubic feet ("Mcf") of natural

gas to one barrel ("bbl") of crude oil (6 Mcf:1 bbl). This

conversion may be misleading, particularly if used in isolation,

since the 6 Mcf:1 bbl ratio is based on an energy equivalency

conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. In comparing the

value ratio using current crude oil prices relative to natural gas

prices, the 6 Mcf:1 bbl conversion ratio may be misleading as an

indication of value. In addition, for the purposes of the Company's

MD&A, crude oil is defined to include the following

commodities: light and medium crude oil, primary heavy crude oil,

Pelican Lake heavy crude oil, bitumen (thermal oil), and SCO.

Production on an "after royalties" or "company net" basis is also

presented in the Company's MD&A for information purposes

only.

Additional information relating to the Company,

including its Annual Information Form for the year ended December

31, 2018, is available on SEDAR at www.sedar.com, and on EDGAR at

www.sec.gov. Detailed guidance on production levels, capital

expenditures and production expenses can be found on the Company's

website at www.cnrl.com. Information on the Company's website,

including such guidance, does not form part of and is not

incorporated by reference in the Company's MD&A.

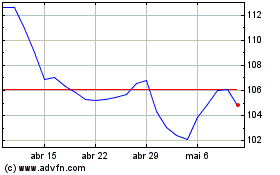

Canadian Natural Resources (TSX:CNQ)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Canadian Natural Resources (TSX:CNQ)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024