Banca IFIS, profit of 26 million Euro despite the Covid-19 effect

Mestre (Venice), 12 May 2020 –

The Board of Directors of Banca Ifis met today, chaired by Deputy

Chairman Ernesto Fürstenberg Fassio, and approved the results for

the first quarter of 2020.

“We are facing a complex time, an unforeseen

global crisis, to which we have responded swiftly and efficiently.

Banca Ifis promptly implemented incisive measures to protect the

health and safety of its employees and customers, while also

ensuring full operations: in around ten days, 93% of our people

began to work remotely, and the Company continued its business in

accordance with all regulations,” explained Luciano

Colombini, Chief Executive Officer of Banca Ifis.

“The financial impacts of the Covid-19 pandemic

are clearly characterised by a high level of uncertainty, but the

Group's financial performance and financial position are

solid and enable the Bank to face the current financial

crisis with confidence: at 31 March we had increased our

CET1 ratio to 11,12% (+0,16% on 31 December 2019)

and available liquidity amounted to approximately 1,4

billion Euro.

The results for the first quarter were affected

by Covid-19, although the first

two months of the year were in line with the targets set in

the Business Plan. Several transactions were completed

during the period, such as the closing of the sale of the property

on Corso Venezia in Milan, which generated a capital gain of 24

million Euro, and the successful placement of a senior bond of 400

million Euro as part of the strategy of diversifying funding

sources. The corporate and organisational restructuring of the NPL

business and the work to build an IT platform in support of small

and medium enterprises were launched on schedule.

In March, when the spread of the pandemic

resulted in the closure of many businesses and severely limited the

movement of individuals, we used every means at our disposal to

rise to this challenge and manage the new situation as well as

possible. We stepped up our digital transformation processes and in

just a few weeks made a great technological leap forwards, testing

out new working methods that allowed us to achieve important

objectives, confirming the agility and dynamism of the Bank's

model.

We contacted over 5.000 customers and acquired

approximately 300 of them, developing new products and services

like loans for industrial conversions or expansion of production

lines in response to the emergency. In addition, some sectors

particularly affected by Covid-19 began to be closely monitored and

covered. In just a few weeks we prepared a digital platform to

streamline the process of granting new loans guaranteed by the

government under the “Cure Italy” Decree.

We continued to invest in the non-performing

loans market, taking an active part in unsecured NPL sales

processes, and we enhanced our telephone recovery activity

following the temporary suspension of operations by the agents

network. In the future, we are confident that our ten years of

experience in the sector will allow us to continue to make sound

purchases. In addition, we foresee that the impact of the court

closures will be temporary and will primarily be tied to longer

payment times rather than to reduced payments. Banca Ifis offers

its debtors sustainable long-term repayment plans with an average

time to recovery of the portfolio of five to seven years.

In view of the exceptional nature of this

situation, and given the uncertain course of the emergency and its

impact in the coming months, on 1 April the Bank's Board of

Directors decided, in accordance with the prudence principle, to

take the responsible course of action of following the supervisory

authority's recommendation and thus to propose that the

distribution of the 2019 dividend be postponed until at least 1

October 2020, and thus to proceed with payment of the dividend

after that date, provided that no regulations or recommendations

from the supervisory authorities to the contrary are issued before

that date. Banca Ifis has also decided to suspend the financial

performance and position targets set in the 2020-2022 Business

Plan, which will be revised and updated as soon as the

macroeconomic situation stabilises.

The Board of Directors, supervisory bodies and

the Company's management continue constantly to monitor the course

of the emergency caused by the spread of Covid-19 and to take the

decisions and measures necessary to respond to it,” Luciano

Colombini concluded.

Highlights

RECLASSIFIED DATA 1

In order to fully implement the Group’s business

model, as envisaged by the 2020-2022 Business Plan, changes have

been made to the operating segments as they were previously

structured: the Enterprises Segment, now renamed Commercial

& Corporate Banking, groups together the commercial

activities intended for enterprises and excludes the portfolios of

loans disbursed by Interbanca before the acquisition and set to run

off (previously merged into the Enterprises Segment); the

NPL Segment has been kept in line with the past,

while the last segment, now called Governance &

Services and Non-Core, has been integrated into the

Non-Core section, which includes the portfolios excluded from

Commercial & Corporate Banking.

In addition, segment reporting relating to

income statement components has been expanded to include a view of

results at the level of net profit.

The comparative information in this document has

been restated in line with the new segment reporting.

Highlights from the Banca Ifis Group's income

statement for the first quarter of 2020 are provided below.

Net banking

income1

Consolidated net banking income amounted to 106

million Euro, down by 18,6% on the same period of 2019, almost

exclusively as a result of the economic and health emergency that

swept through Italy in March, resulting in the lockdown. The

closure of all production activities and, specifically, the courts,

effectively prevented any legal action from being taken to obtain

writs, attachments of property and garnishment orders, typically

more profitable for the industry as a whole. All this mainly

affected the net banking income of the NPL Segment, which totalled

43,2 million Euro, compared with 61,8 million Euro in the first

quarter of 2019 (-30,0%).

The net banking income of the Commercial &

Corporate Banking Segment amounted to 53,8 million Euro, down 8,0%

on 31 March 2019. The decline in the Factoring Area was moderate

(-3,4%) compared to that in the Leasing Area (-11,1%) and the

Corporate Banking & Lending Area, which recorded a decrease of

32,0%, mainly due to the lesser contribution of the “PPA reversal”3

compared with the same period in 2019.

Net impairment

losses1

During the quarter net credit risk losses

totalled 18,5 million Euro, compared to 13,1 million Euro during

the period ended 31 March 2019. These impairment losses mainly

refer to the greater provisions in the Governance & Services

and Non-Core Segment, in which individual impairment losses were

calculated on a single significant position, relating to a customer

operating in the retail sector, which further deteriorated due to

the shutdown of commercial businesses as a result of Covid-19.

Operating

costs

Operating costs declined by 1,2% to 73,5 million

Euro in the first quarter of 2020 (74,4 million Euro in the period

ended 31 March 2019). The effect of the decrease in revenues due to

Covid-19 affected the cost-income ratio (the ratio of operating

costs to net banking income), which stood at 69,4% compared with

57,2% at 31 March 2019.

Personnel expenses amounted to

32,0 million Euro and were essentially in line with the same period

in the previous year (31,4 million Euro for the period ended 31

March 2019).

Other administrative expenses

declined by 6,5% to 40,5 million Euro, compared with 43,3 million

Euro for the period ended 31 March 2019, due to the reduction in

the costs of purchasing goods and services and direct and indirect

taxes, which more than offset the increase in the costs of

professional services.

Other net operating income

totalled 8,0 million Euro (7,0 million Euro for the period ended 31

March 2019) and referred mainly to revenue from the recovery of

expenses charged to third parties. The relevant cost item is

included in other administrative expenses, namely under legal

expenses and indirect taxes, as well as recoveries of expenses

associated with leasing operations, in line with the same period in

the previous year.

Pre-tax profit from continuing

operations amounted to 38,1 million Euro (-10,7% compared

to 31 March 2019). Despite the positive effect of the sale of the

Milan property of 24,2 million Euro, this result was adversely

affected by the situation relating to the Covid-19 pandemic,

including: the 9,4 million Euro of impacts on the operations of the

NPL Segment of the court closures, in addition to 6,9 million Euro

of impairment losses on UCI provisions primarily related to the

non-performing loans of the former Interbanca and 7,6 million Euro

of provisions for credit and endorsement risk on a single

individually significant position.

Group net profit for the

period

The Group net profit for the period ended 31

March 2020 totalled 26,4 million Euro, compared with 29,9 million

Euro for the period ended 31 March 2019, a decrease of 11,7%.

Focus on individual

segments

Highlights of the contributions of the various

segments to the operating and financial results for the period

ended 31 March 2020 are provided below:

In the Commercial & Corporate

Banking Segment, the net profit for the period, which

accounted for 41,2% of the total, amounted to 10,9 million Euro,

compared with 16,5 million Euro for the period ended 31 March 2019

(-33,9%). Despite the increase in the net profit of the Factoring

Area to 8,5 million Euro, the result was affected by the decline in

net profit in both the Leasing Area and the Corporate Banking &

Lending Area.

·In particular, the net banking income of the

Factoring Area decreased by 3,4% on the same

period in the previous year. This result was driven by the positive

contribution of net interest income, up by 0,8 million Euro, offset

by a decline in net commission income (2,1 million Euro), affected

by the decline in volumes managed due to the adverse scenario

arising from Covid-19, as well as by competitive pressure on the

economic conditions applied to customers. Net credit risk losses

decreased to 4,8 million Euro (compared with 6,9 million Euro in

the first quarter of 2019), owing to the greater reversals, mainly

due to collections on previously impaired or written off positions.

Operating expenses were essentially in line with the corresponding

period of the previous year. The combined effect of these factors

enabled a net profit for the period of 8,5 million Euro, down

slightly, by 7,3%, on the period ended 31 March 2019. The Area's

total loans to customers amounted to 2.973,9 million Euro (-7,9% on

the end of 2019).

·In the first quarter of 2020, the

Leasing Area presented net banking income of 11,8

million Euro, down by 11,1% on the period ended 31 March 2019, due

to the greater cost attributable to a decrease in net commission

income of approximately 0,5 million Euro. Net impairment losses on

receivables amounted to 4,3 million Euro, up 2,8 million Euro

compared to the first quarter of 2019. This increase was tied to

the migration of previously performing positions to more uncertain

risk statuses. Operating expenses decreased by 10,4%, after

reflecting non-recurring costs such as uncapitalised software

development and consultancy and non-routine maintenance on the

Mondovì office in 2019. The net profit for the period thus totalled

2,4 million Euro, compared with 5,5 million Euro in the first three

months of 2019. Receivables due from customers amounted to 1.403,5

million Euro (-3,1% on 31 December 2019), due to the decline in

volumes disbursed during the quarter (down by 37% on the same

period in the previous year).

·The net banking income of the Corporate

Banking & Lending Area decreased by 32,0% on the

period ended 31 March 2019, mainly due to the decrease in the fair

value of the UCI funds in portfolio. This effect is due to the

worsening of risk factors (liquidity and credit) during the

quarter, negatively impacted by the instability of markets in the

current context. Net impairment losses on receivables amounted to

1,9 million Euro, up 1,6 million Euro compared to the corresponding

period of 2019, due above all to the increase in loans. Operating

expenses also increased by approximately 0,9 million Euro, driven

by personnel costs in support of the growth planned for the Area’s

loans.In view of the foregoing, the net loss for the period was 71

thousand Euro, compared with a net profit of 3,0 million Euro

during the period ended 31 March 2019.At 31 March 2020 total

receivables due from customers amounted to 879,1 million Euro, up

by 17,6% on the previous year: both loans relating to structured

finance and new lending to SMEs increased, in line with the

development strategy.

The net banking income of the NPL

Segment1 amounted to 43,2 million Euro, (-30,0%) compared

with 61,8 million Euro for the period ended 31 March 2019, and may

be broken down as follows.

"Interest income from amortised cost", referring

to the interest accruing at the original effective interest rate,

was up 12,4% from 30,7 million Euro to 34,5 million Euro, largely

thanks to the increase in receivables measured at amortised cost,

the greater contribution by which is related for 17,2 million Euro

to writs, attachments of property, and garnishment orders, and for

6,7 million Euro to settlement plans.

By contrast, there was a decline in “Other

components of net interest income”, which includes the effect on

the income statement of changes in expected cash flows as a

function of the greater or lesser collections reported or expected

compared with previous forecasts, which were down from 34,8 million

Euro to 15,1 million Euro. The item was affected by the closure of

the courts in March, which significantly reduced the writs,

attachments of property, and garnishment orders obtained compared

with the same period in the previous year. In the first quarter of

2019 the income statement also included the non-recurring positive

effects of the initial consolidation of the former FBS Group.

Net commission income is essentially in line

with the same quarter of the previous year and is almost entirely

attributable to the contribution made by commission income from

servicing on third party portfolios.

Operating costs decreased by 15,7% to 33,5

million Euro from 39,7 million Euro in the first quarter of 2019.

The reduction is mainly due to the variable costs connected with

debt collection and, in particular, those relating to legal

collection. As for revenues, the court closure due to the Covid-19

emergency resulted in the halt of a series of costly lawsuits used

by the Segment to increase its chance of collection.

The net profit for the period of 6,8 million

Euro was down by approximately 8,7 million Euro, mainly due, as

specified above, to external negative factors affecting the entire

national economy.

The net banking income of the Governance

& Services and Non-Core Segment was

9,0 million Euro, down by approximately 0,9 million Euro on the

period ended 31 March 2019. The change was tied to a decrease in

net interest income, primarily due to the gradual reduction in the

contribution of the “PPA reversal”3, only partially offset by the

lower impairment losses on assets at fair value and a positive

effect attributable to trading activity.

In terms of the cost of credit, net adjustments

increased to 7,5 million Euro from 4,4 million Euro in the first

quarter of 2019. The main contribution to the adjustments is

attributable to the analytical impairment calculated on a single

relevant position allocated to the run-off portfolio of the former

Interbanca, already restructured in the past. Operating costs also

increased, driven by greater provisions for risks and charges.

The result for the segment also includes the

capital gain, net of the related selling costs, of 24 million Euro

on the sale of the property located on Corso Venezia in Milan. The

sale of this property, already classified as a non-current asset

held for sale with a value of 25,6 million Euro at 31 December

2019, following the signing of a binding offer for the sale of the

property, was closed and the full consideration collected in March

2020.

The net profit for the period totalled 8,8

million Euro, compared to a net loss of 2,0 million Euro for the

period ended 31 March 2019.

At 31 March 2020, total net receivables for the

Segment amounted to 1.073,4 million Euro, up 13,5% on the figure at

31 December 2019 (945,6 million Euro). The increase is

substantively linked to the Proprietary Finance business

(approximately 160 million Euro), which, mainly through the

purchase of government securities, more than offset the

physiological reduction of run-off portfolios.

The breakdown of the main statement of

financial position items of the Banca Ifis Group at 31 March 2020

is shown below.

Receivables due from

customers measured at amortised cost

Total receivables due from customers

measured at amortised cost amounted to 7.600,7 million

Euro, essentially in line with 31 December 2019 (-0,7%). The

Commercial & Corporate Banking Segment was down by -3,1% on the

figure at 31 December 2019, the NPL Segment was in line with the

figure at 31 December 2019 (-0,7%) and, finally, the Governance

& Services and Non-Core Segment was up (+13,5% on the figure at

31 December 2019).

The Commercial & Corporate Banking

Segment's net non-performing exposures totalled 252,1

million Euro at 31 March 2020, up 25,7 million Euro from 31

December 2019 (226,4 million Euro), and may be broken down as

follows:

- Net bad loans stood at 42,9 million Euro and were essentially

stable, with the ratio of bad loans to total loans also holding

stable (0,8%).

- The balance of net unlikely to pay positions was 87,1 million

Euro, down by 1,6% from 88,6 million Euro at 31 December 2019,

despite the increase in the average coverage ratio.

- Net non-performing past due exposures amounted to 122,1 million

Euro compared to 95,0 million Euro at 31 December 2019 (+27,1%)

with a coverage ratio of 7,6% compared to 8,4% at 31 December 2019;

the increase in non-performing past due exposures is mainly

attributable to the Factoring Area. The gross and net ratio at 31

March 2020 were up on the end of 2019 at 2,4% and 2,3%,

respectively.

Overall, the gross NPE ratio of the Commercial

& Corporate Banking Segment was up on 31 December 2019 at 9,3%,

whereas the net NPE ratio was 4,8% (4,2% at 31 December 2019).

Funding

During the first quarter of 2020, the Group

continued its strategy of consolidating wholesale funding in order

to ensure a better balance with respect to retail funding. In line

with this strategy, no transactions were undertaken on the debt

market with institutional investors during the period. At 31 March

2020 total funding was 8.468,5 million Euro, in line with the

figure at the end of 2019, and the funding structure was as

follows:

- 57,8% customers;

- 17,4% debt securities;

- 12,8% ABSs;

- 9,3% TLTROs;

- 2,7% other.

Payables due to customers at 31

March 2020 amounted to 4.894,3 million Euro (-7,4% compared to 31

December 2019), due to the decrease in retail funding (Rendimax and

Contomax) from 4.790,9 million Euro at 31 December 2019 to 4.528,6

million Euro at 31 March 2020.

Payables due to banks amounted

to 1.014,4 million Euro (+5,7% compared to 31 December 2019). This

item mainly refers to the TLTRO tranche totalling 791,5 million

Euro subscribed respectively in 2017 and at end 2019, deposits with

other banks of 166,7 million Euro and 56,2 million Euro related to

other accounts and loans.

Securities issued amounted to

2.559,8 million Euro, including 1.085,4 million Euro (1.150 million

Euro at 31 December 2019) in securities issued by the special

purpose vehicles as part of the securitisation of trade receivables

launched at the end of 2016. The item also comprised 1.006,9

million Euro (including interest) in senior bonds issued by Banca

Ifis, as well as the 406,3 million Euro (including interest) Tier 2

bond. The rest of debt securities issued at 31 March 2020 included

60,7 million Euro in a bond loan issued at the time by the merged

entity Interbanca.

Equity and

ratios

The Group's consolidated equity was

strengthened to 1.542,4 million Euro at 31 March 2020,

compared with 1.539,0 million Euro at 31 December 2019.

At 31 March 2020 the ratios for the Banca Ifis

Group only, without considering the effects of consolidation within

the parent company, La Scogliera, amounted to a CET1

ratio of 14,59% (compared with 14,28% at 31 December

20194), a TIER1 ratio of 14,59% (14,28% at 31

December 20194) and a Total Capital ratio of

19,07% (compared with 18,64% at 31 December 20194).

With prudential consolidation within La

Scogliera, capital ratios at 31 March 2020 amounted to a

CET1 ratio of 11,12% (compared with 10,96% at 31

December 20194), a TIER1 ratio of 11,72% (11,56%

at 31 December 20194) and a Total Capital ratio of

14,80% (compared with 14,58% at 31 December 20194).

Common Equity Tier 1, Tier 1 Capital, and total

Own Funds do not include the profits generated by the Banking Group

at 31 March 2020, inasmuch as they have not been certified by the

auditor. However, these items do include the profits generated by

the Banking Group during the year ended at 31 December 2019, net of

the dividend approved and suspended.

In addition, please note that the Bank of Italy

has instructed the Banca Ifis Group to adopt the following

consolidated capital requirements in 2020, in continuity with 2019,

including a 2,5% capital conservation buffer:

- Common equity tier 1 (CET1) capital ratio of 8,12%, with a

required minimum of 5,62%;

- Tier 1 capital ratio of 10,0%, with a required minimum of

7,5%;

- Total Capital ratio of 12,5%, with a required minimum of

10,0%.

At 31 March 2020, the Banca Ifis Group met the

above prudential requirements.

Significant events occurred in the

period

The Banca Ifis Group transparently and promptly

discloses information to the market, constantly publishing

information on significant events through press releases. Please

visit the Investor Relations and Media Press sections of the

institutional website www.bancaifis.it to view all press

releases.

Here below is a summary of the most significant

events in the period.

2020-2022 Business Plan

presented

The Board of Directors of Banca Ifis approved

the 2020-2022 Business Plan on 13 January 2020. The Plan was

presented to the financial community on 14 January.

Banca Ifis: successful placement of the

400 million Euro Senior Preferred bond maturing on 25 June

2024

On 18 February 2020, Banca Ifis (Fitch rating

BB+ with stable outlook) successfully concluded placement of a

Senior Preferred bond issue intended for professional investors,

for an amount of 400 million Euro. The bond, issued under the scope

of the EMTN Programme, comes as part of the funding strategy

envisaged by the 2020-2022 Business Plan, which looks to better

diversify the sources of finance. The transaction was strongly in

demand with final orders, more than 60% of which came from foreign

investors, more than three times the allocated amount. The reoffer

price was 99,692, for a return at maturity of 1,82% and a coupon

that is payable annually in the amount of 1,75%.

Resignation from the Board of Director

Alessandro Csillaghy De Pacser

On 31 March 2020, Alessandro Csillaghy De Pacser

tendered his resignation from the position of member of the Parent

Company's Board of Directors, in order to devote himself fully to

the international development of the Group's business and his roles

at its foreign subsidiaries. At the date of his resignation, the

director did not hold any shares of the Company, and his

termination from the position did not entail the payment of

indemnities or other benefits, in accordance with the remuneration

policy adopted by the Banca Ifis Group.

Significant subsequent

events

Communication on the FY 2019 Dividend

Distribution Policy

At its extraordinary session held on 1 April

2020, in accordance with the Bank of Italy’s recommendation of 27

March 2020 on dividend policy during the Covid-19 pandemic, the

Board of Directors of Banca Ifis decided to act responsibly by

following the guidance provided by the Supervisory Authorities, and

therefore to propose that the distribution of dividends for

financial year 2019 be postponed until at least 1 October 2020, and

thus to proceed with payment after that date, provided that no

regulations or recommendations from supervisory authorities to the

contrary are issued before that date. In accordance with applicable

provisions, and without prejudice to the fundamental focus on the

Group's financial solidity, Banca Ifis is confident that it will be

able to distribute a dividend as soon as conditions so permit after

1 October 2020.

The Shareholders' Meeting approves the

2019 financial statements

The Ordinary Shareholders' Meeting of Banca Ifis

S.p.A., held on 23 April 2020, approved the financial statements

relative to FY 2019 and the deferral of the distribution of the

dividend of Euro 1,10 per share for FY 2019 at least until 1

October 2020, after which, if conditions allow, it will be paid;

this is in line with the proposal made by the Bank’s Board of

Directors. The following were also approved: the Banca Ifis Group

Remuneration Policy as per the “Report on the Remuneration Policy

and Fees Paid” for FY 2020, the update of the shareholders’ meeting

regulation and the proposal made by the shareholder La Scogliera to

appoint Riccardo Preve as new director, in lieu of the resigning

director, Alessandro Csillaghy De Pacser.

Exclusive negotiations for 70,77% of the

share capital of Farbanca S.p.A.

On 10 April 2020 Banca Ifis made a binding offer

for the acquisition of 70,77% of the share capital of Farbanca

S.p.A. (owned by Banca Popolare di Vicenza), the remaining 29,23%

interest in which is held by 450 small shareholders, mainly

pharmacists. The offer, valid for 90 days, is contingent on the

necessary authorisations. On 11 May 2020 the Bank then announced

that it had entered into exclusive negotiations, set to conclude on

29 May.

Declaration of the Corporate Accounting

Reporting Officer

Pursuant to article 154 bis, paragraph 2 of the

Consolidated Law on Finance, the Corporate Accounting Reporting

Officer, Mariacristina Taormina, declares that the financial

information contained in this press release corresponds to the

related books and accounting records.

Disclaimer

The financial impacts of the Covid-19 pandemic

on the various Group companies are currently characterised by

severe uncertainty. The Group's financial performance and financial

position are solid and enable the Bank to face the current

financial crisis.

However, given the uncertain future course of

the Covid-19 emergency, and in accordance with the prudence

principle, the Board of Directors has decided to suspend the

financial performance and position targets set in the 2020-2022

Business Plan, which will be revised and updated as soon as the

macroeconomic scenario stabilises.

The results for the first quarter of 2020

include the impacts of Covid-19 as reasonably foreseeable at 31

March 2020. The adverse effects of Covid-19 may persist beyond the

first quarter of 2020, extending into the following quarters,

although the timing and amount of such effects currently cannot be

foreseen.

In accordance with the Bank of Italy’s

recommendation of 27 March 2020 on dividend policy during the

Covid-19 pandemic, the Board of Directors of Banca IFIS decided to

act responsibly by following the guidance provided by the

Supervisory Authorities, and therefore propose that the

distribution of dividends for the 2019 financial year be postponed

until at least 1 October 2020 and, therefore, to proceed to the

payment after this date if no regulatory provisions or

recommendations from the Supervisory Authorities will be issued

against this.

Barring further deterioration of the scenario,

which in view of its exceptional nature and uncertainty cannot be

excluded, the Group’s solid financial position and ability to

reorganise, as also shown during the Covid-19 emergency, will

nonetheless allow Banca Ifis to continue, as in the past, to

provide sustainable remuneration to its shareholders.

The Board of Directors, supervisory bodies and

the Company's management continue constantly to monitor the course

of the emergency caused by the spread of Covid-19 and to take the

decisions and measures necessary to respond to it.

Reclassified Financial

Statements

Net impairment losses on receivables of the NPL

Segment were reclassified to Interest receivable and similar income

to present more fairly this particular business, for which net

impairment losses represent an integral part of the return on the

investment.

Reclassified Consolidated Statement

of Financial Position

|

ASSETS (in thousands of Euro) |

31.03.2020 |

31.12.2019 |

|

Cash and cash equivalents |

60 |

56 |

|

Financial assets held for trading through profit or loss |

31.162 |

24.313 |

|

Financial assets mandatorily measured at fair value through profit

or loss |

103.743 |

112.785 |

|

Financial assets measured at fair value through other comprehensive

income |

1.215.355 |

1.173.808 |

|

Receivables due from banks measured at amortised cost |

628.756 |

626.890 |

|

Receivables due from customers measured at amortised cost |

7.600.742 |

7.651.226 |

|

Equity investments |

6 |

6 |

|

Property, plant and equipment |

109.632 |

106.301 |

|

Intangible assets |

61.893 |

60.919 |

|

of which: |

|

|

|

- goodwill |

39.500 |

39.542 |

|

Tax assets: |

389.964 |

391.185 |

|

a) current |

56.185 |

56.869 |

|

b) deferred |

333.779 |

334.316 |

|

Non-current assets and disposal groups |

- |

25.560 |

|

Other assets |

351.303 |

352.975 |

|

Total assets |

10.492.616 |

10.526.024 |

|

LIABILITIES AND EQUITY (in thousands of Euro) |

31.03.2020 |

31.12.2019 |

|

Payables due to banks |

1.014.365 |

959.477 |

|

Payables due to customers |

4.894.280 |

5.286.239 |

|

Debt securities issued |

2.559.834 |

2.217.529 |

|

Financial liabilities held for trading |

27.128 |

21.844 |

|

Tax liabilities: |

68.066 |

69.018 |

|

a) current |

33.023 |

28.248 |

|

b) deferred |

35.043 |

40.770 |

|

Other liabilities |

340.134 |

390.022 |

|

Post-employment benefits |

9.708 |

9.977 |

|

Provisions for risks and charges |

36.671 |

32.965 |

|

Valuation reserves |

(24.339) |

(3.037) |

|

Reserves |

1.381.676 |

1.260.238 |

|

Share premiums |

102.285 |

102.285 |

|

Share capital |

53.811 |

53.811 |

|

Treasury shares (-) |

(3.012) |

(3.012) |

|

Equity attributable to non-controlling interests (+/-) |

5.583 |

5.571 |

|

Profit (loss) for the period (+/-) |

26.426 |

123.097 |

|

Total liabilities and equity |

10.492.616 |

10.526.024 |

Reclassified Consolidated Income

Statement

|

ITEMS (in thousands of Euro) |

31.03.2020 |

31.03.2019 |

|

Net interest income |

91.416 |

115.264 |

|

Net commission income |

21.097 |

23.828 |

|

Other components of net banking income |

(6.561) |

(8.983) |

|

Net banking income |

105.952 |

130.109 |

|

Net credit risk losses/reversals |

(18.512) |

(13.088) |

|

Net profit (loss) from financial activities |

87.440 |

117.021 |

|

Administrative expenses: |

(72.549) |

(74.768) |

|

a) personnel expenses |

(32.029) |

(31.447) |

|

b) other administrative expenses |

(40.520) |

(43.321) |

|

Net allocations to provisions for risks and charges |

(4.889) |

(2.512) |

|

Net impairment losses/reversals on property, plant and equipment

and intangible assets |

(4.039) |

(4.062) |

|

Other operating income/expenses |

7.978 |

6.978 |

|

Operating costs |

(73.499) |

(74.364) |

|

Gains (Losses) on disposal of investments |

24.161 |

- |

|

Pre-tax profit (loss) from continuing

operations |

38.102 |

42.657 |

|

Income taxes for the period relating to continuing operations |

(11.660) |

(12.716) |

|

Profit (loss) for the period |

26.442 |

29.941 |

|

Profit (Loss) for the period attributable to non-controlling

interests |

16 |

21 |

|

Profit (loss) for the period attributable to the Parent

company |

26.426 |

29.920 |

Capital indicators

|

OWN FUNDS AND CAPITAL ADEQUACY RATIOS (in

thousands of Euro) |

31.03.2020 |

31.12.2019 |

|

Common equity Tier 1 Capital (CET1) |

994.910 |

1.008.865 |

|

Tier 1 capital (T1) |

1.048.554 |

1.064.524 |

|

Total own funds |

1.323.900 |

1.342.069 |

|

Total RWA |

8.947.456 |

9.206.155 |

|

Common Equity Tier 1 Ratio |

11,12% |

10,96% |

|

Tier 1 Capital Ratio |

11,72% |

11,56% |

|

Ratio - Total Own Funds |

14,80% |

14,58% |

Common Equity Tier 1, Tier 1 Capital, and total

Own Funds at 31 March 2020 do not include the profits generated by

the Banking Group in that same period since they have not been

certified by the auditor.

|

OWN FUNDS AND CAPITAL ADEQUACY RATIOS:

BANCA IFIS BANKING GROUP SCOPE (in

thousands of Euro) |

31.03.2020 |

31.12.2019 |

|

Common equity Tier 1 Capital (CET1) |

1.303.361 |

1.312.821 |

|

Tier 1 capital (T1) |

1.303.361 |

1.312.821 |

|

Total own funds |

1.703.825 |

1.713.198 |

|

Total RWA |

8.933.879 |

9.190.900 |

|

Common Equity Tier 1 Ratio |

14,59% |

14,28% |

|

Tier 1 Capital Ratio |

14,59% |

14,28% |

|

Ratio - Total Own Funds |

19,07% |

18,64% |

Common Equity Tier 1, Tier 1 Capital, and total

Own Funds at 31 March 2020 do not include the profits generated by

the Banking Group in that same period since they have not been

certified by the auditor.

- 20200512_Profit of 26 million Euro despite the Covid-19

effect_ENG

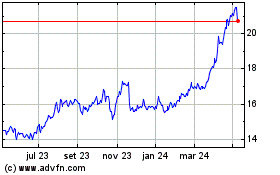

Banca IFIS (BIT:IF)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

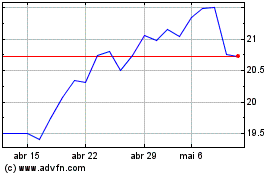

Banca IFIS (BIT:IF)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025