Painted Pony Energy Ltd. ("

Painted Pony" or the

"

Corporation") (

TSX: PONY)

announces that it has entered into a definitive arrangement

agreement (the “

Arrangement Agreement”) with

Canadian Natural Resources Limited (the

“

Purchaser”) (

TSX, NYSE: CNQ)

pursuant to which the Purchaser has agreed to acquire all of the

issued and outstanding common shares of Painted Pony

(“

Painted Pony Shares”) for cash consideration of

$0.69 per Painted Pony Share (the “

Purchase

Price”). The Purchase Price represents approximately a 30%

premium over the twenty-day volume weighted average trading price

of the Painted Pony Shares on the Toronto Stock Exchange (the

“

TSX”). The proposed transaction (the

“

Transaction”) is to be completed by way of a plan

of arrangement under the Business Corporations

Act (Alberta).

STRATEGIC RATIONALEWeak prices

for natural gas over the past three years and a recent decline in

natural gas liquids (“NGL”) prices have resulted

in lower than expected adjusted funds flow. This sustained period

of low adjusted funds flow, as well as Painted Pony’s limited

ability to access external markets on an accretive basis, has

deprived Painted Pony’s asset base of the capital necessary to fund

meaningful development. Given the challenges facing Painted Pony,

including potential near-term liquidity considerations, the

Corporation’s Board of Directors (the “Board”)

initiated a confidential process, supervised by a special committee

of independent members of the Board (the “Independent

Committee”) to explore opportunities to enhance

shareholder value (the “Process”).

After reviewing Painted Pony’s current

circumstances and the proposals received in connection with the

Process, the Board determined that the Transaction represented the

best alternative for Painted Pony’s shareholders given current

industry, economic and capital markets conditions. The Purchase

Price is all cash and not subject to any financing conditions,

which provides Painted Pony shareholders with an immediate

opportunity to realize full liquidity and certainty of value in

cash for their investment in the Corporation.

THE ARRANGEMENT AGREEMENT AND

APPROVALSUnder the Transaction, the Purchaser will acquire

all of the issued and outstanding Painted Pony Shares in exchange

for the payment to shareholders of the Purchase Price for each

Painted Pony Share held.

Painted Pony will seek approval of the

Transaction by its shareholders and holders of options (together,

the "Securityholders") at a special meeting

expected to be held in September 2020 (the

"Meeting"). The Transaction is subject to approval

by Securityholders at the Meeting, including the approval of at

least: (a) two-thirds of the votes cast by the shareholders in

person or represented by proxy at the Meeting; (b) two-thirds of

the votes cast by the Securityholders in person or represented by

proxy at the Meeting, voting together as a single class; and (c) if

required, a majority of the votes cast by shareholders in person or

represented by proxy at the Meeting, after excluding the votes cast

by those shareholders whose votes are required to be excluded in

accordance with Multilateral Instrument 61-101 – Protection of

Minority Security Holders in Special Transactions.

The Transaction is subject to various closing

conditions, including receipt of court approval, the required

Painted Pony Securityholder approval at the Meeting and certain

regulatory approvals, including approval under the Competition Act

(Canada). Upon closing of the Transaction, the Painted Pony Shares

will be de-listed from the TSX.

The Arrangement Agreement contains customary

representations and warranties of each party and interim

operational covenants by Painted Pony. The Arrangement Agreement

also provides for, among other things, customary support and

non-solicitation covenants by Painted Pony, subject to a “fiduciary

out” for unsolicited “superior proposals” in favour of Painted Pony

and a provision for the right to match any superior proposals in

favour of the Purchaser.

The Arrangement Agreement provides for a

non-completion fee of $20 million, payable in the event that the

Transaction is not completed or is terminated in certain

circumstances, including if Painted Pony enters into an agreement

with respect to a superior proposal or if the Board withdraws or

modifies its recommendation with respect to the Transaction.

All of the directors and executive officers of

Painted Pony, together with Painted Pony’s two largest

shareholders, have entered into support agreements and have agreed

to support the Transaction and vote an aggregate of approximately

25% of the outstanding Painted Pony Shares in favour of the

Transaction, subject to the provisions of such support

agreements.

Further details with respect to the Transaction

will be included in the information circular to be mailed to the

Securityholders in connection with the Meeting. The Meeting is

expected to be held in September 2020 with closing of the

Transaction to occur soon thereafter upon satisfaction of all

conditions precedent. A copy of the Arrangement Agreement and the

information circular will be filed on Painted Pony’s SEDAR profile

and will be available for viewing at www.sedar.com.

RECOMMENDATION OF THE

BOARDBased on the Fairness Opinion (as defined below) and

the recommendation of the Independent Committee, and after

consulting with its financial and legal advisors, among other

considerations, the Board has unanimously: (i) determined that the

Arrangement is fair, from a financial point of view, to Painted

Pony’s shareholders; (ii) resolved to recommend that the

Securityholders vote in favour of the Transaction; and (iii)

determined that the Arrangement and the entry into the Arrangement

Agreement are in the best interests of Painted Pony.

ADVISORSTD Securities Inc.

(“TD”) and RBC Capital Markets are acting as

Co-Lead Financial Advisors, and Raymond James Ltd. is also acting

as a Financial Advisor, in connection with the Transaction. TD

provided a verbal fairness opinion (the “Fairness

Opinion”) that, subject to review of the final form of

documents affecting the Transaction, as at the date of the

Arrangement Agreement, the consideration to be received by Painted

Pony shareholders pursuant to the Transaction is fair, from a

financial point of view, to Painted Pony shareholders.

Blake, Cassels & Graydon LLP is acting as

legal counsel to Painted Pony.

Bennett Jones LLP is acting as legal counsel to

the Purchaser.

Gryphon Advisors Inc. is acting as proxy

solicitor for Painted Pony.

DEFINITIONS AND ADVISORIES

Currency: All amounts referred to in this press

release are stated in Canadian dollars unless otherwise

specified.

Forward-Looking Information:

This press release contains certain forward-looking information

within the meaning of Canadian securities laws. Forward-looking

information relates to future events or future performance and is

based upon the Corporation's current internal expectations,

estimates, projections, assumptions and beliefs. All information

other than historical fact is forward-looking information. Words

such as "plan", "expect", "intend", "believe", "anticipate",

"estimate", "may", "will", "potential", "proposed" and other

similar words that indicate events or conditions may occur are

intended to identify forward-looking information. More particularly

and without limitation, this press release contains forward looking

information relating to the anticipated benefits of the Transaction

to Painted Pony and its shareholders; the timing and anticipated

receipt of required Securityholder, court, regulatory, stock

exchange and other third party approvals for the Transaction; the

ability of Painted Pony and the Purchaser to satisfy the other

conditions to, and to complete, the Transaction; and the

anticipated timing of the holding of the Meeting and the closing of

the Transaction.

In respect of the forward-looking statements

concerning the anticipated benefits and completion of the

Transaction, the timing and anticipated receipt of required third

party approvals and the anticipated timing for completion of the

Transaction, the Purchaser and Painted Pony have provided such in

reliance on certain assumptions that they believe are reasonable at

this time, including assumptions as to the time required to prepare

and mail special meeting materials, including the information

circular; the ability of the parties to receive, in a timely

manner, the necessary Securityholder, court, regulatory, stock

exchange and other third party approvals, including but not limited

to the receipt of applicable competition approvals; and the ability

of the parties to satisfy, in a timely manner, the other conditions

to the closing of the Arrangement Agreement.

By their nature, forward-looking statements are

subject to numerous risks and uncertainties, some of which are

beyond Painted Pony’s control. Completion of the Transaction is

subject to a number of conditions which are typical for

transactions of this nature. Failure to satisfy any of these

conditions, the emergence of a superior proposal or the failure to

obtain approval of Securityholders may result in the termination of

the Arrangement Agreement. The foregoing list is not

exhaustive. Additional information on these and other risks

that could affect completion of the Transaction will be set forth

in the information circular, which will be available on SEDAR at

www.sedar.com. Readers are cautioned that the assumptions

used in the preparation of such information, although considered

reasonable at the time of preparation, may prove to be imprecise

and, as such, undue reliance should not be placed on

forward-looking statements. The actual results, performance

or achievement of Painted Pony could differ materially from those

expressed in, or implied by, these forward-looking statements and,

accordingly, no assurance can be given that any of the events

anticipated by the forward-looking statements will transpire or

occur, or if any of them do so, what benefits that Painted Pony

will derive therefrom.

The forward-looking statements in this press

release should not be interpreted as providing a full assessment or

reflection of the unprecedented impacts of the recent COVID-19

pandemic and the resulting indirect global and regional economic

impacts.

Painted Pony disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new Information, future events or otherwise,

except as required by applicable securities laws.

ABOUT PAINTED PONYPainted Pony

is a publicly traded natural gas company based in Western Canada.

The Corporation is primarily focused on the development of natural

gas and natural gas liquids from the Montney formation in northeast

British Columbia. Painted Pony’s common shares trade on the TSX

under the symbol “PONY”.

Contact Information:Patrick R.

WardPresident and Chief Executive Officer

Stuart W. JaggardChief Financial Officer

Jason W. FleuryDirector, Investor Relations(403)

776-3261

(403) 475-04401-866-975-0440 toll

freeir@paintedpony.cawww.paintedpony.ca

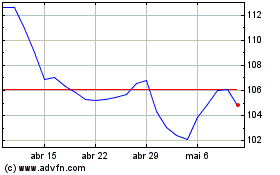

Canadian Natural Resources (TSX:CNQ)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Canadian Natural Resources (TSX:CNQ)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024