Athabasca Minerals Inc. (“Athabasca” or the “Corporation”)

(TSXV:AMI) announces its financial results for the third quarter

ended September 30, 2020. The Corporation’s financial statements

and management’s discussion and analysis (“MD&A”) are available

on SEDAR at www.sedar.com and on the Athabasca Minerals Inc.

website at www.athabascaminerals.com. The Corporation also

announces the Q3 2020 Results Investor Update to be held on

December 1, 2020.

In the third quarter of 2020, Athabasca reported consolidated

revenue of $0.4 million ($0.1 million in Q3 2019) with a total loss

and comprehensive loss of $1.1 million, compared to income of $0.8

million in Q3 2019.

Robert Beekhuizen stated: “Despite the challenges of COVID-19,

AMI and our group of companies continues to focus on our objectives

and making the right long-term decisions to advance our projects

and strategic initiatives. The non-brokered private placement of

$1.48 million in late October highlights the commitment to our

Duvernay Sand Project, as well as the announcement of our joint

venture partner to develop the sand facility.”

BUSINESS HIGHLIGHTS

Athabasca Minerals reports the following key highlights in

Q3-2020:

- In September 2020, the Corporation announced the advancement of

a strategic Joint Venture (“JV”) initiative with an international

industrial partner to pursue the Duvernay Sand Project. The aim of

the JV initiative is to co-develop and operate one of the greenest

sand facilities in North America. The JV initiative offers a number

of unique synergies including industrial land for construction of

the facility, as well as access to industrial utilities and

transportation infrastructure;

- AMI Aggregates was impacted by lower activity due to COVID-19

as well as the economic downturn. Resumption of normalized

production out of Coffey Lake or AMI’s other corporate pits is not

anticipated until early 2021 without improvement to commodity

prices and lifting of COVID-19 restrictions;

- In the third quarter of 2020, AMI RockChain had increased sales

volumes relative to Q2-2020; however, volumes continue to be

impacted by the economic downturn from COVID-19;

- Subsequent to the third quarter of 2020, on October 26, 2020,

the Corporation announced the closing of a $1.48 million

non-brokered private placement, with the issuance of 9,866,688

common shares at a premium price of $0.15. Proceeds from the

private placement will be used to advance Front-End Engineering

& Development ("FEED") activities for the Duvernay Sand Project

("Duvernay Project") and for general corporate purposes. The

private placement was supported by JMAC Resources Ltd. as an anchor

investor. With the private placement, insider ownership of the

Corporation’s Common Shares increased from 8.1% to 22.5%;

- On October 26, 2020, the Corporation also announced the

addition of Jon McCreary, CEO of JMAC Resources Inc., to the Board

of Directors, effective November 1, 2020; and

- AMI continues to pursue strategic partnering and joint-venture

relationships that will advance its industrial minerals growth

strategies, diversify its revenue generation, and increase options

for access to lower-cost capital funding.

Fiscal Management & Reporting

- The Corporation has undertaken several financial initiatives in

response to the COVID-19 pandemic:

- A $40,000 loan for AMI Silica and a $40,000 loan for AMI

RockChain were secured through the Canadian Emergency Business

Account (“CEBA”) program to support these businesses through the

COVID-19 pandemic. TerraShift also had a $40,000 CEBA loan at the

time of acquisition. These loans are interest free, require no

principal payments until December 2022, and $10,000 is forgivable

if repaid by December 2022. In October 2020, the Government of

Canada announced its intention to increase CEBA loans from $40,000

to $60,000, of which $20,000 will be forgivable if repaid by

December 2022;

- AMI applied for the Canadian Emergency Wage Subsidy (“CEWS”)

program to assist its businesses through the COVID-19 pandemic. The

CEWS program is currently in place until June 2021, and AMI has

received and accrued subsidies totaling $267,574 as at September

30, 2020 from the CEWS program;

- In November 2020, AMI intends to apply for the Canadian

Emergency Rent Subsidy (“CERS”) program to further assist its

businesses by receiving subsidies for rent and other commercial

properties expenses incurred from September 27, 2020 until June

2021;

- Principal repayment of the $1,500,000 bank loan purposed for

Coffey Lake Public Pit and the True North Staging Hub construction

was deferred an additional three months to six months of

interest-only payment terms, which ended in July 2020;

- In an effort to preserve the Corporation’s cash position and

employees during the COVID-19 pandemic and economic downturn, AMI

implemented a 90/10 compensation program whereby 90% of base salary

is paid in cash and 10% of base salary is paid in treasury-issued

shares. For this compensation program, the Corporation has put into

place an Employee Share Purchase Plan (“ESP Plan”) and

participation in the ESP Plan is voluntary. The compensation

program was put into effect June 1, 2020 for employees and

management. For director’s fees, the compensation program was

retroactive to April 1, 2020. The ESP Plan was approved by the

shareholders on September 22, 2020 and by the TSX Venture Exchange

on October 16, 2020.

- AMI’s cash position as at September 30, 2020 was $1.2 million

free cash and $1.1 million restricted cash. The free cash balance

increased subsequent to quarter end as a result of the $1.48

million non-brokered private placement which closed on October 26,

2020. AMI’s cash position as at October 31, 2020 was $2.4 million

free cash and $1.1 million restricted cash.

COVID-19 UPDATE

Athabasca and its subsidiaries will continue to be operational

through the new enhanced public health directives issued by the

Province of Alberta, as per the recommendation of health officials,

most employees will be working from home. AMI continues to develop

both safety and technology features to better allow our customers

and suppliers a safe and efficient method to continue meeting their

aggregate needs. However, all operations could be affected by any

new COVID-19 related issues or new lockdown directives, as it will

be more challenging for our customers to move forward with projects

during a lockdown.

FINANCIAL AND OPERATIONAL HIGHLIGHTS

|

($ thousands of CDN, |

Three Months Ended Sept

30 |

Nine Months Ended

Sept 30 |

| unless

otherwise noted) |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

| |

|

|

|

|

| Aggregate sales revenue |

$326 |

$78 |

$874 |

$1,059 |

|

Management services revenue |

|

100 |

|

0 |

|

557 |

|

434 |

|

Revenue |

|

426 |

|

78 |

|

1,431 |

|

1,493 |

| Operating costs |

|

(601) |

|

(430) |

|

(1,392) |

|

(2,107) |

| |

|

|

|

|

| Gross (loss) profit |

|

(322) |

|

(445) |

|

(312) |

|

(853) |

| |

|

|

|

|

| Total (loss) income and

comprehensive (loss) income |

|

(1,106) |

|

749 |

|

(2,596) |

|

(1,619) |

| |

|

|

|

|

| Cash position |

|

1,176 |

|

3,986 |

|

1,176 |

|

3,986 |

| Net cash (used in) operating

activities |

|

(512) |

|

(760) |

|

(1,471) |

|

(1,868) |

| |

|

|

|

|

|

Loss (income) per share ($ per share) |

|

|

|

|

| Basic |

(.023) |

.017 |

(.055) |

(.038) |

| Fully

diluted |

(.023) |

.016 |

(.055) |

(.038) |

- The quarterly increase in revenue was a result of growth in

aggregate sales revenue from AMI RockChain. In the third quarter of

2020, management services revenue was also generated by TerraShift,

while the comparable quarter had nil revenue with the closure of

Susan Lake operations.

- For the nine months ended September 30, 2020, aggregates sales

revenue was lower due to a decline in AMI’s corporate pit revenue,

offset by increased networked 3rd party sales revenue from AMI

RockChain. Management services revenue in the nine months ended

September 20, 2020 increased versus the comparable period in 2019

due to sales from Coffey Lake in 2020 and the addition of

TerraShift’s revenue stream.

- Gross profit (loss) for the three and nine months ended

September 30, 2020 was a loss of $0.3 million and loss of $0.3

million, respectively, compared to a loss of $0.4 million and $0.9

million for the same periods in 2019. Included in the loss of $0.3

million for the three and nine months ended September 30, 2020 was

an inventory write-down of $0.3 million. The Corporation took the

necessary actions to adjust costs structures where possible, and as

a result, gross losses were significantly reduced in the three and

nine month 2020 periods. It is anticipated that these adjustments

to costs will benefit the Corporation on an ongoing basis.

- The total loss (income) and comprehensive loss (income) for the

three and nine months ended September 30, 2020 was a loss of $1.1

million and $2.6 million, respectively, compared to income of $0.8

million and a loss of $1.6 million for the corresponding periods in

2019.

- Net working capital of $1.0 million as at September 30, 2020

(December 31, 2019: $2.8 million). On October 26, 2020, the

Corporation completed a $1.48 million non-brokered private

placement enhancing AMI’s net working capital. In management’s

opinion the enhanced net working capital from the private placement

positions AMI to fund ongoing operations. The Corporation used less

cash in operations in the three and nine months ended September 30,

2020 compared to the equivalent periods in 2019. The write-down of

inventory also decreased working capital as at September 30, 2020

compared to December 31, 2019.

GRANT OF STOCK OPTIONS AND DEFERRED SHARE

UNITS

- AMI announces that its Board of

Directors have approved the grant of 664,800 stock options

("Options") and 36,000 Deferred Share Units ("DSUs") to officers,

directors, and select management of the Corporation pursuant to the

Corporation's Options and DSU plans as well as the Corporation's

Stock Option Replenishment Program. The Options have an exercise

price of $0.14 per share and have a term of five years.

INVESTOR UPDATE WEBCASTAthabasca will host a

webcast for investors, analysts and stakeholders to provide an

update on the existing operating environment. Registration

is required, so please

pre-register to receive your

password.

| Date: |

Tuesday, December 1, 2020 |

| Time: |

11:30 am MT (1:30 pm ET) |

|

Webcast: |

To avoid delays, please

register in

advancehttps://us02web.zoom.us/webinar/register/WN_cgbGhOPYR7eYR7XFT3G_zg |

| |

Or

https://www.athabascaminerals.com/ |

| Phone: |

1-587-328-1099ID: 883 2911

3771Passcode: 498488 |

A webcast link and related presentation material

will be accessible on the ‘Investors Information’ page of the

Corporation’s website at https://www.athabascaminerals.com/. A

replay of the event will be provided at the same location following

the event.

ABOUT ATHABASCA MINERALS INC.Athabasca is an

integrated group of companies focused on the aggregates, industrial

minerals and resource sectors, including exploration and

development; aggregates marketing and midstream supply-logistics

solutions. Business activities include aggregate production, sales

and royalties from corporate-owned pits, management services of

third-party pits, acquisitions of sand and gravel operations,

integrated supply/delivery solutions of industrial minerals, and

new venture development. The Corporation is strategically focused

on growing its three core business units: the AMI Aggregates

division, the AMI RockChain division, and the AMI Silica division.

Management is continually pursuing opportunities for sustained

growth and diversification in supplying aggregate products and

industrial minerals.

Athabasca’s business is comprised of the following three

reportable segments:

- AMI Aggregates

division produces and sells aggregate out of its corporate pits and

manages the Coffey Lake Public Pit on behalf of the Province of

Alberta for which aggregate management services revenue are

earned.

- AMI Silica division

is positioning to become a leading supplier of premium domestic

silica sand with regional deposits in Alberta and NE British

Columbia. This reporting segment encompasses all silica assets

including Firebag, the Duvernay Project and the Montney In-Basin

Project.

- AMI RockChain

division is a midstream technology-based business using its

proprietary RockChain™ digital platform, associated algorithm and

quality assurance & control services to provide cost-effective

integrated supply / delivery solutions of industrial minerals to

industry, and the construction sector.

- TerraShift Engineering Ltd. is a newly

acquired entity of RockChain. It offers technology-based

applications that support resource exploration and development,

environmental and regulatory planning, resource management,

compliance reporting, and reclamation for a growing customer base

across Western Canada and Ontario.

For further information, please contact:Tanya Finney, Director,

Investor and Stakeholder RelationsTel: 587-391-0548 / Email:

tanya.finney@athabascaminerals.comNeither the TSX Venture

Exchange nor its Regulation Services Provider (as that term is

defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this

release.

FORWARD LOOKING STATEMENTS This document

contains “forward looking statements” and “forward-looking

information” (collectively referred to herein as “forward-looking

statements”) concerning anticipated developments and events that

may occur in the future. Forward looking statements include, but

are not limited to: statements with respect to the estimation of

aggregate and mineral reserves and resources, the realization of

aggregate and mineral reserve estimates, disposition of assets, the

timing and amount of estimated future production, costs of

production, capital expenditures, costs and timing of the

development of new deposits, success of exploration activities,

permitting time lines, requirements for additional capital,

potential joint venture relationships, potential acquisitions,

geographic diversification, government regulation of mining

operations, environmental risks, unanticipated reclamation

expenses, title disputes or claims and limitations on insurance

coverage.

Forward-looking statements are statements that are not

historical facts and are generally, but not always, identified by

the words “expects”, “plans”, “anticipates”, “believes”, “intends”,

“estimates”, “continues”, “future”, “forecasts”, “potential”,

“budget” and similar expressions, or are events or conditions that

“will”, “would”, “may”, “likely”, “could”, “should”, “can”,

“typically”, “traditionally” or “tend to” occur or be achieved.

This MD&A contains forward-looking statements, pertaining to,

among other things, the following: the impact of Athabasca’s

financial resources or liquidity on its future operating, investing

and financing activities; Athabasca’s capital budgets, the

appropriateness of the amount and expectations of how it will be

funded; the Corporation’s capital management strategy and financial

position; Athabasca’s outlook, industrial and construction levels,

and focus on cost management; the expansion of customers and

network of AMI RockChain; the international industrial partner or

joint venture for the Duvernay Project; a potential partner for the

Montney Project; continued development of the Duvernay Project; the

potential completion of a National Instrument 43-101 compliant

technical report for the Montney Project; the reactivation of

certain inactive pits; potential acquisition or divestiture

activities; the demand for aggregates from the Richardson Quarry

Project; and the impact of and the Corporation’s response to the

COVID-19 health pandemic.

Although the Corporation believes that the material factors,

expectations and assumptions expressed in such forward-looking

statements are reasonable based on information available to it on

the date such statements are made, undue reliance should not be

placed on the forward-looking statements because the Corporation

can give no assurances that such statements and information will

prove to be correct and such statements are not guarantees of

future performance. Since forward-looking statements address future

events and conditions, by their very nature they involve inherent

risks and uncertainties. Actual performance and results could

differ materially from those currently anticipated due to a number

of factors and risks. These include, but are not limited to: known

and unknown risks, including those set forth in the Corporation’s

annual information form dated September 3, 2020 (a copy of which

can be found under Athabasca’s website under Annual Documents or on

the Corporation’s profile on SEDAR at www.sedar.com); exploration

and development costs and delays; weather, health, safety, market

and environmental risks; integration of acquisitions, competition,

and uncertainties resulting from potential delays or changes in

plans with respect to acquisitions, development projects or capital

expenditures and changes in legislation including, but not limited

to incentive programs and environmental regulations; stock market

volatility and the inability to access sufficient capital from

external and internal sources; general economic, market or business

conditions; the COVID-19 health pandemic; global economic events;

changes to Athabasca’s financial position and cash flow; the

availability of qualified personnel, management or other key

inputs; potential industry developments; and other unforeseen

conditions which could impact the use of services supplied by the

Corporation. Accordingly, readers should not place undue importance

or reliance on the forward-looking statements. Readers are

cautioned that the list of factors set out herein is not exhaustive

and should refer to “Risk Factors” set out in the Corporation’s

annual information form dated September 3, 2020.

Statements, including forward-looking statements, contained in

this MD&A are made as of the date they are given and the

Corporation disclaims any intention or obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, unless so

required by applicable securities laws. The forward-looking

statements contained in this MD&A are expressly qualified by

this cautionary statement.

Additional information on these and other factors that could

affect the Corporation’s operations and financial results are

included in reports on file with applicable securities regulatory

authorities and may be accessed on Athabasca’s website or under

Athabasca’s profile on SEDAR at www.sedar.com.

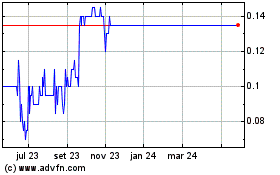

Athabasca Minerals (TSXV:AMI)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Athabasca Minerals (TSXV:AMI)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024