Athabasca Minerals Inc. (TSXV: AMI), together with its subsidiaries

(collectively, “

Athabasca” or the

“

Corporation”) announces today that it has closed

the previously announced transaction (the

“

Transaction”) contemplated by the subscription

agreement (the “

Agreement”) between the

Corporation and Badger Mining Corporation

(“

Badger” or the

“

Purchaser”) providing for the acquisition of the

Corporation by the Purchaser. The Transaction follows the

Corporation's filing of the Notice of Intention under the

provisions of Part III, Division 1 of the Bankruptcy and Insolvency

Act (Canada) (“

BIA”) and its previously announced

sales and investment solicitation process

(“

SISP”). The Transaction was approved by the

Alberta Court of King’s Bench (the “

Court”) on

Friday, April 19, 2024.

With the closing of the Transaction, in

accordance with the terms of the Agreement and the order of the

Court, all previously issued and outstanding common shares of the

Corporation (“Common Shares”) have been exchanged

on a 1:1 basis for common shares in the newly incorporated entity,

2585929 Alberta Ltd. (“ResidualCo”). Badger is now

the sole shareholder of the Corporation, which has emerged from BIA

proceedings.

The purchase price pursuant to the Transaction

is approximately CAD $29.2 million, which amount has been

transferred to ResidualCo in accordance with the terms and

conditions of the Agreement and the order of the Court. The gross

proceeds of the Transaction will be used by ResidualCo, under the

direction of KSV Restructuring Inc., in its capacity as proposal

trustee of ResidualCo, to satisfy the Corporation's obligations and

liabilities to its secured and unsecured creditors (whose claims

and encumbrances have been transferred to and assumed by

ResidualCo). Following the satisfaction and discharge of all such

transferred obligations and liabilities, and the final payment of

professional fees associated with the Transaction, any residual

value will be distributed to the shareholders of ResidualCo (being

the former shareholders of the Corporation) and the ResidualCo

shares will thereafter be cancelled. The timing of any potential

disbursement to shareholders of ResidualCo cannot be confirmed but

is anticipated to take several months.

This milestone marks a significant achievement

for all stakeholders involved and marks a new chapter in the

Corporation’s journey. At a sales value of $29.2 million, the

results of the SISP allow for the full restitution of all of the

Corporation’s creditors with any residual value being distributed

to the shareholders of ResidualCo (formerly the shareholders of the

Corporation).

The Common Shares have been suspended from

trading on the TSXV. As a result of the Transaction (including the

Corporation’s application to cease to be a reporting issuer), the

TSXV has delisted the Common Shares effective at the close of

trading on April 24, 2024. The Common Shares were also quoted on

the OTC Pink Market, and the Common Shares have been concurrently

delisted from the OTC Pink Market effective at the close of trading

on April 24, 2024. The Corporation is applying to the applicable

Canadian securities regulatory authorities to cease to be a

reporting issuer in each Canadian jurisdiction in which it is a

reporting issuer.

About Athabasca Minerals

Inc.

Athabasca is an integrated industrial minerals

company focused on the production and delivery of frac sand to

Canada and the United States. Athabasca also operates aggregate

operations in Western Canada and maintains the largest platform for

buying, selling, and transporting of aggregates through its 100%

owned technology platform, AMI RockChain.

For further information, please contact:Cheryl

Grue, Director, Corporate Affairs Tel: 587-392-5862 / Email:

cheryl.grue@athabascaminerals.com

Former shareholders of Athabasca, who are now

the shareholders of ResidualCo, may contact Andrew Basi at KSV

Restructuring Inc. with any questions at 587-287-2670.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENTS

This news release contains certain statements or

disclosures relating to Athabasca that are based on the

expectations of its management as well as assumptions made by and

information currently available to Athabasca which may constitute

forward-looking statements or information (“forward-looking

statements”) under applicable securities laws. All such

statements and disclosures, other than those of historical fact,

which address activities, events, outcomes, results, or

developments that Athabasca anticipates or expects may, or will

occur in the future (in whole or in part) should be considered

forward-looking statements. In some cases, forward-looking

statements can be identified by the use of the words “may”, “will”,

and similar expressions. In particular, but without limiting the

foregoing, this news release contains forward-looking statements

pertaining to the following: the anticipated benefits of the

Transaction to Athabasca and its stakeholders; the potential

residual value to ResidualCo shareholders; restitution of the

Corporation’s creditors; the timing thereof; and the anticipated

approval of the application by Athabasca to cease to be a reporting

in each Canadian jurisdiction in which it is a reporting

issuer.

The forward-looking statements contained in this

news release reflect several material factors and expectations and

assumptions of Athabasca including, without limitation: that

Athabasca’s application to cease to be a reporting issuer in each

Canadian jurisdiction in which it is a reporting issuer will be

approved; costs, expenses, and inflationary pressures faced by

Athabasca will not continue; availability of debt and/or equity

sources to fund Athabasca's capital and operating requirements as

needed; certain cost assumptions; Athabasca will continue to

conduct its operations in a manner consistent with past operations;

that Athabasca's capital resources will be sufficient to meet its

forecasted and budgeted expenses and that such expenses will not

exceed the level of capital resources available; the ability of

Athabasca to obtain and retain qualified staff, equipment, and

services in a timely and cost efficient manner; continuity in the

management of Athabasca; and the general continuance of current or,

where applicable, assumed industry conditions.

Athabasca believes the material factors,

expectations, and assumptions reflected in the forward-looking

statements are reasonable at this time, but no assurance can be

given that these factors, expectations, and assumptions will prove

to be correct. The forward-looking statements included in this news

release are not guarantees of future performance and should not be

unduly relied upon. Such forward-looking statements involve known

and unknown risks, uncertainties, and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements including, without

limitation: the general economic, market, and business conditions;

that Athabasca’s application to cease to be a reporting issuer may

not be approved; Athabasca may be unable to resolve mechanical or

operational issues in the timelines anticipated, in the manner

anticipated, or at all; increased costs and expenses; reliance on

industry partners; that Athabasca will have sufficient working

capital to meet its existing contractual obligations, including

without limitation certain production commitments that may limit

Athabasca's ability to ensure operations are profitable and

operational requirements; future co-operation of the creditors of

Athabasca and the ongoing willingness of its lenders to provide

funds to Athabasca; the ability to maintain relationships with

suppliers, customers, employees, shareholders, and other third

parties in light of Athabasca's current liquidity situation; and

certain other risks detailed from time to time in Athabasca's

public disclosure documents including, without limitation, those

risks identified in this news release and in Athabasca's annual

information form dated April 28, 2022, copies of which are

available on Athabasca's SEDAR+ profile at www.sedarplus.ca.

Readers are cautioned that the foregoing list of factors is not

exhaustive and are cautioned not to place undue reliance on these

forward-looking statements.

The forward-looking statements contained in this

news release are made as of the date hereof and Athabasca

undertakes no obligations to update publicly or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise, unless so required by applicable

securities laws.

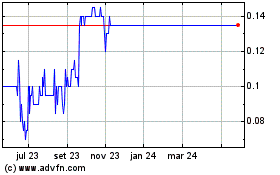

Athabasca Minerals (TSXV:AMI)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Athabasca Minerals (TSXV:AMI)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024