January 18, 2021

AkzoNobel proposes to acquire Tikkurila for €31.25 per

share, to create superior and sustainable value for all

stakeholders

Akzo Nobel N.V. (AKZA; AKZOY) has today made a comprehensive

non-binding proposal to acquire Tikkurila. The proposed combination

of AkzoNobel and Tikkurila would create a strong platform for

future growth, better able to serve customers with more innovative

and sustainable solutions, building on a shared European

heritage.

The proposal includes an all-cash public offer for all issued

and outstanding shares of Tikkurila at an offer price of €31.25 per

share (“potential offer”) and total equity value of around €1.4

billion. This represents a premium of 113% to Tikkurila’s volume

weighted average share price for the undisturbed three-month period

ending December 17, 2020 and is 13% higher than the current offer

made on January 5, 2021.

Thierry Vanlancker, AkzoNobel CEO, commented: “The natural

combination of AkzoNobel and Tikkurila would build on centuries of

industry experience and a shared European heritage to create

significant value for customers, employees, shareholders and other

stakeholders. Bringing together our premium brands and leading

portfolios would provide customers with a wider range of innovative

products and services, including the most sustainable paints and

coatings solutions.”

To obtain merger clearance and ensure deal certainty for

Tikkurila and its shareholders, AkzoNobel has agreed with Hempel

key terms for the sale of assets, including the decorative paints

business of AkzoNobel in the Nordics and the Baltics, to be

completed after closing of AkzoNobel's proposed public offer for

Tikkurila.

The Nordic culture and strong presence of Tikkurila in Finland

would be reflected in the future organization. The main offices and

production facilities of Tikkurila in Finland would become the

vital hub for the combined business in the Baltic Sea region and

substantial investment would be made in production facilities to

supply future growth. Employees and management would benefit from

new and exciting career and professional development opportunities,

in Finland and the wider organization.

AkzoNobel and Tikkurila have a common approach to sustainability

– it’s embedded in the way we operate – and AkzoNobel is widely

recognized as the leader in the paints and coatings industry.

Joining forces would build on the sustainable purpose of Tikkurila

and continue to make a difference for all stakeholders, including

local communities.

Thierry Vanlancker continued: “Our complementary geographic

profiles would create superior value compared to any other

combination, including growth opportunities for the company and its

employees. Our collective procurement capabilities, expanded

production, and combined sales and distribution channels would

deliver substantial value creation. AkzoNobel and Tikkurila would

have an exciting and sustainable future together, continuing the

recent positive momentum and performance improvement, as a global

frontrunner in the industry.”

The transaction is expected to be EPS accretive in 2022, is

aligned with the capital allocation priorities of AkzoNobel, and

will be financed using existing cash and credit lines. AkzoNobel

will continue its current €300 million share buyback program and

maintains a target leverage ratio of 1-2x net debt/EBITDA.

AkzoNobel invites the Board of Directors of Tikkurila to enter

into negotiations with a view to reaching agreement on a

recommended voluntary public cash tender offer.

Implied premia of the potential offer:

- 108% premium compared to the closing price of Tikkurila share

on December 17, 2020, the last trading day prior to Tikkurila

announcement regarding the tender offer

- 113% premium compared to the volume-weighted average trading

price of Tikkurila share during the three-month period prior to

December 17, 2020

- 122% premium compared to the volume-weighted average trading

price of Tikkurila share during the 12-month period prior to

December 17, 2020

Conference calls

On January 18, 2021, AkzoNobel will host a conference call for

media at 09:00 CET and for investors and analysts at 10:00 CET.

Participant dial-in numbers:Finland: +358 981710310 Sweden: +46

856642651 United Kingdom: +44 3333000804 United States: +1

6319131422 Netherlands: +31 207095189

Media (9:00 CET) PIN: 22805884#

Investors and analysts (10:00 CET) PIN: 12011347#

Please register or join the call 5-10 minutes prior to the start

of the event. By registering for the event or joining the call

participants agree to the collection of information, such as

participant name and company name. The conference call will be

recorded.

Advisors

AkzoNobel is being advised by HSBC and J.P. Morgan as financial

advisers and De Brauw Blackstone Westbroek and Roschier, Attorneys

Ltd. as legal advisers.

Key terms for launch and completion of the potential

offer

The final decision to make the potential offer to Tikkurila

shareholders is subject to certain conditions, including: 1) the

Board of Directors of Tikkurila entering into negotiations with

AkzoNobel, 2) customary due diligence on Tikkurila, 3) entering

into a combination agreement between AkzoNobel and Tikkurila, 4)

the Board of Directors of Tikkurila recommending to the

shareholders of Tikkurila that they accept the tender offer of

AkzoNobel, 5) obtaining an irrevocable undertaking from Oras Invest

Oy to accept the potential offer and 6) final approval by the

Supervisory Board of AkzoNobel.

The potential offer would be made pursuant to an offer document

to be approved by the Finnish Financial Supervisory Authority (the

“offer document”). The offer document would include all terms and

conditions of the potential offer. The potential offer would only

be accepted on the basis of the offer document.

The announcement of the potential offer, if any, depends on the

time taken for the Board of Directors of Tikkurila to respond to

this proposal and for negotiations to be concluded in relation to

this transaction. If negotiations advance quickly, a potential

offer could be announced in February and the transaction completed

as soon as possible in 2021.

The completion of the potential offer, if announced, would be

subject to customary conditions substantially similar to those

included in the current tender offer document, dated January 14,

2021, such as reaching a 90% acceptance level and obtaining

required regulatory approvals, and would not be conditional on

financing. AkzoNobel would reserve the right, at its sole

discretion, to waive any of the conditions for completion of the

potential offer.

Shareholders are advised there can be no certainty that this

proposal will eventually lead to any agreement between AkzoNobel

and Tikkurila, the making of an offer to Tikkurila shareholders, or

the timing and terms of any such agreement or offer. The terms of

the potential offer, if announced, may differ from the terms set

out in the proposal and this announcement.

AkzoNobel is aware, based on public information, that the

combination agreement amended on January 5, 2021, includes

procedures allowing the offeror to negotiate should the Board of

Directors of Tikkurila contemplate effecting a change of its

recommendation.

AkzoNobel reserves the right to acquire shares of Tikkurila

prior to announcing a potential offer in public trading or

otherwise. At the date of this announcement, AkzoNobel does not

hold any shares of Tikkurila.

Important Information

THIS IS A PUBLIC ANNOUNCEMENT BY AKZO

NOBEL N.V. (“AKZONOBEL”) PURSUANT TO SECTION 17 PARAGRAPH 1 OF THE

EUROPEAN MARKET ABUSE REGULATION (596/2014). THIS PUBLIC

ANNOUNCEMENT DOES NOT CONSTITUTE AN OFFER, OR ANY SOLICITATION OF

ANY OFFER, TO BUY OR SUBSCRIBE FOR ANY SECURITIES.

THIS RELEASE MAY NOT BE RELEASED OR

OTHERWISE DISTRIBUTED, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY,

IN OR INTO, AUSTRALIA, CANADA, HONG KONG, JAPAN, NEW ZEALAND OR

SOUTH AFRICA OR IN ANY OTHER JURISDICTION IN WHICH AN ANNOUNCEMENT

ON THE INTENTION TO LAUNCH A TENDER OFFER OR THE POTENTIAL TENDER

OFFER WOULD BE PROHIBITED BY APPLICABLE LAW.

THIS RELEASE IS NOT A TENDER OFFER

ANNOUNCEMENT AND AS SUCH DOES NOT CONSTITUTE AN OFFER OR INVITATION

TO MAKE A SALES OFFER, BUT MERELY ANNOUNCES AN INTENTION TO

POTENTIALLY MAKE A TENDER OFFER. IN PARTICULAR, THIS RELEASE IS NOT

AN OFFER TO BUY OR THE SOLICITATION OF AN OFFER TO SELL ANY

SECURITIES DESCRIBED HEREIN, AND IS NOT AN EXTENSION OF A TENDER

OFFER, IN, AUSTRALIA, CANADA, HONG KONG, JAPAN, NEW ZEALAND OR

SOUTH AFRICA. IF A TENDER OFFER IS ANNOUNCED, INVESTORS SHALL

ACCEPT SUCH TENDER OFFER FOR THE SHARES ONLY ON THE BASIS OF THE

INFORMATION PROVIDED IN A TENDER OFFER DOCUMENT. THE POTENTIAL

TENDER OFFER WILL NOT BE MADE, AND THE SHARES WILL NOT BE ACCEPTED

FOR PURCHASE FROM OR ON BEHALF OF PERSONS, DIRECTLY OR INDIRECTLY

IN ANY JURISDICTION WHERE EITHER AN OFFER OR ACCEPTANCE THEREOF IS

PROHIBITED BY APPLICABLE LAW OR WHERE ANY TENDER OFFER DOCUMENT OR

REGISTRATION OR OTHER REQUIREMENTS WOULD APPLY IN ADDITION TO THOSE

THAT WILL BE UNDERTAKEN IN FINLAND.

THIS RELEASE HAS BEEN PREPARED IN

COMPLIANCE WITH THE LAWS OF THE NETHERLANDS AS WELL AS, TO THE

EXTENT APPLICABLE IN ACCORDANCE WITH FINNISH LAW, THE RULES OF

NASDAQ HELSINKI AND THE HELSINKI TAKEOVER CODE AND THE INFORMATION

DISCLOSED MAY NOT BE THE SAME AS THAT WHICH WOULD HAVE BEEN

DISCLOSED IF THIS ANNOUNCEMENT HAD BEEN PREPARED IN ACCORDANCE WITH

THE LAWS OF JURISDICTIONS OUTSIDE OF FINLAND OR THE

NETHERLANDS.

Information for Tikkurila shareholders

in the United States

The potential offer is expected to be made for

the issued and outstanding shares of Tikkurila, which is domiciled

in Finland, and is subject to Finnish disclosure and procedural

requirements. It is anticipated that the potential offer would be

made in the United States pursuant to Section 14(e) and Regulation

14E under the U.S. Securities Exchange Act of 1934, as amended (the

“Exchange Act”), subject to exemptions provided by Rule 14d-1(d)

under the Exchange Act for a “Tier II” tender offer, and otherwise

in accordance with the disclosure and procedural requirements of

Finnish law, including with respect to the timetable of the

potential offer, settlement procedures, withdrawal, waiver of

conditions and timing of payments, which are different from those

of the United States. The potential offer, if any, is to be made to

Tikkurila’s shareholders resident in the United States on the same

terms and conditions as those made to all other shareholders of

Tikkurila to whom an offer may be made.

To the extent permissible under applicable law

or regulations, AkzoNobel and its affiliates or its brokers and its

brokers’ affiliates (acting as agents for AkzoNobel or its

affiliates, as applicable) may from time to time after the date of

this public announcement and during the pendency of the potential

offer, and other than pursuant to potential offer, directly or

indirectly, purchase or arrange to purchase shares of Tikkurila or

any securities that are convertible into, exchangeable for or

exercisable for shares of Tikkurila. These purchases may occur

either in the open market at prevailing prices or in private

transactions at negotiated prices. To the extent information about

such purchases or arrangements to purchase is made public in

Finland, such information will be disclosed by means of a stock

exchange release or public announcement or by other means

reasonably calculated to inform U.S. shareholders of such

information. No purchases will be made outside the potential offer

in the United States by, or on behalf of, AkzoNobel. In addition,

the financial advisers to AkzoNobel may also engage in ordinary

course trading activities in securities of Tikkurila, which may

include purchases or arrangements to purchase such securities. To

the extent required in Finland, any information about such

purchases will be made public in Finland in the manner required by

Finnish law.

Neither the U.S. Securities & Exchange

Commission nor any U.S. state securities commission has approved or

disapproved of the potential offer, passed upon the merits or

fairness of the potential offer, or passed any comment upon the

adequacy, accuracy or completeness of the disclosure in this public

announcement. Any representation to the contrary is a criminal

offence in the United States.

Safe Harbor Statement

This report contains statements which address

such key issues as AkzoNobel’s growth strategy, future financial

results, market positions, product development, products in the

pipeline and product approvals. Such statements should be carefully

considered, and it should be under-stood that many factors could

cause forecast and actual results to differ from these statements.

These factors include, but are not limited to, price fluctuations,

currency fluctuations, developments in raw material and personnel

costs, pensions, physical and environmental risks, legal issues,

and legislative, fiscal, and other regulatory measures, as well as

significant market disruptions such as the impact of pandemics.

Stated competitive positions are based on management estimates

supported by information provided by specialized external agencies.

For a more comprehensive discussion of the risk factors affecting

our business, please see our latest annual report.

About AkzoNobel

AkzoNobel has a passion for paint. We’re experts

in the proud craft of making paints and coatings, setting the

standard in color and protection since 1792. Our world class

portfolio of brands – including Dulux, International, Sikkens and

Interpon – is trusted by customers around the globe. Headquartered

in the Netherlands, we are active in over 150 countries and employ

around 32,000 talented people who are passionate about delivering

the high-performance products and services our customers

expect.

Not for publication – for more

information

| Media Relations |

Investor Relations |

| T +31 (0)88 – 969 7833 |

T +31 (0)88 – 969 7856 |

| Contact: Diana

AbrahamsMedia.relations@akzonobel.com |

Contact: Lloyd

MidwinterInvestor.relations@akzonobel.com |

- 20210118 PDF Media Release AkzoNobel proposes to acquire

Tikkurila for €31.25 per share, to create superior and sustainable

value for all stakeholders

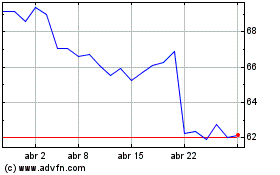

Akzo Nobel NV (EU:AKZA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Akzo Nobel NV (EU:AKZA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024