Kering: 2020 Annual Results

|

PRESS RELEASE2020 annual results |

|

February 17, 2021 |

SOLID PERFORMANCES

KERING READY TO LEVERAGE THE

REBOUND

Consolidated revenue: €13,100.2

milliondown 17.5% reported and 16.4%

comparable

Recurring operating income: €3,135.2

millionRecurring operating margin: 23.9%Net income

attributable to the Group: €2,150.4 millionRecurring net

income attributable to the Group1: €1,972.2 million

Recommended ordinary dividend stable at €8.00 per

share

Kering Press release - Full year results 2020_17 02 2021

« In a year of disruption, Kering demonstrated

remarkable resilience and agility. We achieved a solid top-line

recovery in the second half, we protected our margins while

continuing to invest in our Houses and growth platforms, our cash

flow generation remained elevated, and we further strengthened the

Group’s financial structure. This year, safeguarding the health and

safety of our employees and customers was our first priority. I am

grateful for the resourcefulness and commitment of all Kering

people. I am proud of the solidarity our Group has shown in this

unprecedented environment. More than ever, I am convinced that our

strategy and business model are perfectly in sync with the current

and future trends of the Luxury universe. We are emerging from the

crisis stronger and better positioned to leverage the rebound. We

invest in all our brands to maximize their potential, and to resume

our profitable growth journey. »

François-Henri Pinault, Chairman and

Chief Executive Officer

- 2020 consolidated revenue: €13,100.2 million, down 17.5% as

reported and 16.4% on a comparable basis.

- Sales generated by the retail network down 15.9% on a

comparable basis in 2020 owing to store closures and the halt in

tourism; sharp rebound in the second half led by North America and

Asia-Pacific.

- Further sharp acceleration in online sales, up 67.5% over the

year. Online sales accounted for 13% of total sales generated by

the retail network.

- Sales generated through the wholesale network down 17.4% on a

comparable basis.

- Resilient profitability, with recurring operating income of

€3,135.2 million, yielding a solid recurring operating margin of

23.9%. Further investment in the Houses and growth platforms.

Key financial indicators

|

(in € millions) |

|

2020 |

2019 |

Change |

|

|

|

|

|

|

|

Revenue |

|

13,100.2 |

15,883.5 |

-17.5% |

|

Comparable change |

|

|

|

-16.4% |

|

Recurring operating

income |

|

3,135.2 |

4,778.3 |

-34.4% |

|

as a % of revenue |

|

23.9% |

30.1% |

-6.2 pts |

|

EBITDA |

|

4,574.2 |

6,023.6 |

-24.1% |

|

as a % of revenue |

|

34.9% |

37.9% |

-3.0 pts |

|

|

|

|

|

|

|

Net income attributable to the Group |

|

2,150.4 |

2,308.6 |

-6.9% |

|

|

|

|

|

|

|

Recurring net income attributable to the

Group(1) |

|

1,972.2 |

3,211.5 |

-38.6% |

(1) Recurring net income

attributable to the Group: net income from continuing operations

attributable to the Group, excluding non‑current items.

Operating performance

|

Revenue(in € millions) |

|

2020 |

2019 |

Reported

change |

Comparable change(1) |

|

|

|

|

|

|

|

|

Total Luxury Houses |

|

12,676.6 |

15,382.6 |

-17.6% |

-16.5% |

|

Gucci |

|

7,440.6 |

9,628.4 |

-22.7% |

-21.5% |

|

Yves Saint Laurent |

|

1,744.4 |

2,049.1 |

-14.9% |

-13.8% |

|

Bottega Veneta |

|

1,210.3 |

1,167.6 |

+3.7% |

+4.8% |

|

Other Houses |

|

2,281.3 |

2,537.5 |

-10.1% |

-9.4% |

|

|

|

|

|

|

|

|

Corporate and other |

|

423.6 |

500.9 |

-15.4% |

-14.6% |

|

|

|

|

|

|

|

|

KERING |

|

13,100.2 |

15,883.5 |

-17.5% |

-16.4% |

(1) Comparable Group structure

and exchange rate basis.

|

Recurring operating income(in € millions) |

|

2020 |

2019 |

Change(in €m) |

Change(%) |

|

|

|

|

|

|

|

|

Total Luxury Houses |

|

3,367.1 |

5,042.0 |

(1,674.9) |

-33.2% |

|

Gucci |

|

2,614.5 |

3,946.9 |

(1,332.4) |

-33.8% |

|

Yves Saint Laurent |

|

400.0 |

562.2 |

(162.2) |

-28.9% |

|

Bottega Veneta |

|

172.0 |

215.2 |

(43.2) |

-20.1% |

|

Other Houses |

|

180.6 |

317.7 |

(137.1) |

-43.2% |

|

|

|

|

|

|

|

|

Corporate and other |

|

(231.9) |

(263.7) |

31.8 |

+12.1% |

|

|

|

|

|

|

|

|

KERING |

|

3,135.2 |

4,778.3 |

(1,643.1) |

-34.4% |

Total revenue generated by Kering’s

Houses in 2020 amounted to €12,676.6 million, down

17.6% as reported and 16.5% on a comparable basis. While the health

crisis and lockdown measures took a heavy toll on the Houses’

first-half sales (down 30.2%), the situation improved significantly

in the second half (down 3.3%), despite new restrictions towards

the end of the year in certain regions.In the retail network,

comparable sales declined 15.9% over the year and were nearly

stable in the second half (down 1.5%). E-commerce sales further

accelerated (up 67.5%), accounting for 13% of total sales generated

by the retail network in the year.Wholesale revenue was down 17.4%

on a comparable basis, in line with the Group’s strategy to

streamline and make this channel more exclusive.

In the fourth quarter, total

revenue generated by the Houses contracted 4.8% on a comparable

basis, including a 2.9% decrease for the retail network.

Recurring operating income for

the Houses totaled €3,367.1 million in 2020, resulting in a

recurring operating margin of 26.6%.

Gucci: solid performances and

fundamentals

Gucci posted revenue of

€7,440.6 million in 2020, down 22.7% as reported

and 21.5% on a comparable basis. Sales generated in directly

operated stores fell 19.5% on a comparable basis, with a

significant improvement in the second half (down 5.9%). Despite the

store closures resulting from the pandemic, Gucci recovered a

robust and encouraging sales momentum with local customers,

especially in Mainland China, which benefited from repatriation of

demand. Online sales continued to enjoy fast-paced growth, up

nearly 70% for the year. Wholesale revenue dropped 33.4% based on a

comparable basis, reflecting Gucci’s strategy of continuing to

enhance its distribution network’s exclusivity.

In the fourth quarter, revenue

was down 10.3% on a comparable basis, including a 7.5% decrease for

the retail network.

Gucci’s recurring operating

income in 2020 totaled €2,614.5 million. Recurring

operating margin was extremely resilient, at 35.1% for the

year, reaching 38.6% in the second half, while the House pursued

its investments.

Yves Saint Laurent: resilience and

return to growth in the second half

Yves Saint Laurent posted

revenue of €1,744.4 million in

2020, down 14.9% as reported and 13.8% on a

comparable basis. After a sharp contraction in the first half, the

House’s revenue returned to growth in the second half, growing by

2.1% on a comparable basis. In the full year, revenue from directly

operated stores retreated 13.4% on a comparable basis, while online

sales surged, up nearly 80%, and wholesale revenue dropped 13.7% on

a comparable basis.

Yves Saint Laurent put in a solid performance in

the fourth quarter (up 0.5% on a comparable

basis), with favorable sales momentum in Asia-Pacific, North

America and Japan.

Recurring operating income

totaled €400.0 million in the year, yielding a recurring

operating margin of 22.9%.

Bottega Veneta: a remarkable year fueled by an

exceptional creative drive

Bottega Veneta posted revenue

of €1,210.3 million in 2020, up 3.7% as reported

and 4.8% on a comparable basis. After a mixed first-half

performance, sales in the second half were strong, up 18.0% on a

comparable basis. Comparable revenue in directly operated stores

contracted 5.3% in the full year but rose 7.2% in the second half,

buoyed by robust sales momentum in the Asia-Pacific region as well

as by e-commerce. Wholesale grew sharply (up 48.5%), thanks to the

successful collections of the House which remains very exclusive in

its selection of wholesale partners.

Trends were positive in all distribution

channels in the fourth quarter, with revenue up

15.7% on high bases of comparison.

Bottega Veneta posted recurring

operating income of €172.0 million for 2020 for a

recurring operating margin of 14.2%. The House delivered recurring

operating income growth of 15.4% in the second half of the

year.

Other Houses: excellent momentum in the Couture &

Leather Goods Division

Revenue of the Other Houses

totaled €2,281.3 million in 2020, down 10.1% as

reported and 9.4% on a comparable basis. Balenciaga and Alexander

McQueen delivered highly satisfactory performances, posting

year‑on-year revenue growth. The Jewelry Houses, penalized by their

exposure to Western Europe, reported strong sales growth in Asia.

Sales at Qeelin were up sharply over the year, buoyed by the strong

recovery in Mainland China. Boucheron also delivered a solid

performance in the Asia-Pacific region. In the full year, revenue

for the Other Houses from the retail network was 4.9% lower, while

wholesale revenue shrank 13.0%.

Sales in the fourth

quarter posted solid growth (up 1.7% on a comparable

basis), buoyed by double‑digit growth in the Couture & Leather

Goods Division.

Recurring operating income for

the Other Houses totaled €180.6 million in the year, yielding a

recurring operating margin of 7.9%.

Corporate and other

The Corporate and other segment delivered €423.6

million in sales, including €398.6 million for Kering Eyewear after

eliminating intra-group sales and royalties paid to the Houses.

Kering Eyewear had total sales

of €487.1 million in 2020, down 17.6% on a

comparable basis. After being hard hit by store closures in the

first half, particularly in travel retail, revenue recovered in the

second half, with a decline of 8.6%.

Net expenses of the Corporate and other segment

totaled €231.9 million in 2020, an improvement of €31.8 million

year on year, thanks mainly to Kering Eyewear, which delivered

positive and higher recurring operating income in the year.

Financial performance

In 2020, other non-recurring operating

income and expenses represented net income of

€163.0 million, including on the one hand the capital gain on

the sale of the Group’s 5.83% stake in PUMA in October 2020,

and on the other hand asset impairment charges.

Net finance costs amounted to

€341.7 million. This total includes the cost of net debt, which

amounted to €43.3 million, 17.2% lower than in the same period of

2019.

Kering’s effective tax rate in

2020 was 25.7%, while its effective tax rate on recurring income

remained stable year on year, at 28.1%.

Cash flows and financial position

The Group’s free cash flow from operations rose

38.4% in 2020, to €2,104.6 million.

As of December 31, 2020, Kering has a very

robust financial structure, with net debt down 23.6%:

|

(in € millions) |

|

Dec. 31, 2020 |

Dec. 31, 2019 |

Change |

|

Capital employed |

|

14,183.7 |

13,250.8 |

+7.0% |

|

o/w Total equity |

|

12,035.0 |

10,438.6 |

+15.3% |

|

o/w Net debt |

|

2,148.7 |

2,812.2 |

-23.6% |

|

|

|

2020 |

2019 |

|

Gearing (net debt/equity) |

|

17.8% |

26.9% |

Dividend

At its February 16, 2021 meeting, the Board of

Directors decided to ask shareholders to approve a €8.00 per-share

cash dividend for 2020 at the Annual General Meeting to be held to

approve the financial statements for the year ended December 31,

2020.An interim cash dividend of €2.50 per share was paid on

January 21, 2021 pursuant to a decision made by the Board on

December 10, 2020.The balance of the dividend for 2020

will be submitted for shareholder approval at the forthcoming

Annual General Meeting to be held on April 22, 2021.

Outlook

Positioned in structurally fast-growing markets,

Kering enjoys very solid fundamentals and a balanced portfolio of

complementary, high-potential brands with clearly focused

priorities. The Group’s strategy is focused on achieving same-store

revenue growth while ensuring the targeted and selective expansion

of the store network in order to sustainably grow its Houses,

strengthen the exclusivity of their distribution and consolidate

their profitability profiles. The Group is also proactively

investing to develop cross-business growth platforms in the areas

of e-commerce, omni-channel distribution, logistics and

technological infrastructure, expertise, and innovative digital

tools.

The health and subsequent economic crises caused

by the COVID-19 pandemic in 2020 have had major consequences on

consumption trends, tourism flows and global economic growth. Along

with the luxury sector, the Group was deeply impacted by the

effects of the pandemic on its customers and its business

operations, primarily in the first six months of the year. More

favorable trends emerged in the second half, although these remain

closely linked to developments in the health situation and

associated restrictions across countries and regions.

Against this backdrop, Kering has taken all

necessary measures to adapt its cost base, limit the decline in its

profitability and preserve its cash flow generation, while

maintaining the expenditure and investments required to protect its

Houses’ market positions and ensure their potential to bounce back.

Kering also continues to resolutely pursue its strategy and will

continue to manage and allocate its resources in order to support

its operating performance, maintain high cash flow generation and

optimize return on capital employed.

Thanks to its strong business model and

structure, along with its robust financial position, Kering remains

confident in its growth potential for the medium and long term.

While the current environment remains subject to a number of

uncertainties, the crisis has not called into question the

structural growth drivers of the worldwide luxury market, fully

validating the pertinence of Kering’s strategy and enabling the

Group to emerge stronger from the crisis.

***

At its meeting on February 16, 2021, the Board

of Directors, under the chairmanship

of

François-Henri Pinault, approved the consolidated financial

statements for 2020. The consolidated financial statements have

been audited and the certification is in progress.

AUDIOCAST

An

audiocast for analysts and investors will be held

at 8.30am (CET) on Wednesday,

February 17, 2021. It may be accessed

here.

The slides (PDF) will

be available ahead of the audiocast at www.kering.com.

A replay of the

audiocast will also be available at www.kering.com.

The 2020 financial document will be available at

www.kering.com.

About Kering

A global Luxury group, Kering manages the

development of a series of renowned Houses in Fashion, Leather

Goods, Jewelry and Watches: Gucci, Saint Laurent, Bottega Veneta,

Balenciaga, Alexander McQueen, Brioni, Boucheron, Pomellato, DoDo,

Qeelin, Ulysse Nardin, Girard-Perregaux, as well as Kering Eyewear.

By placing creativity at the heart of its strategy, Kering enables

its Houses to set new limits in terms of their creative expression

while crafting tomorrow’s Luxury in a sustainable and responsible

way. We capture these beliefs in our signature: “Empowering

Imagination”. In 2020, Kering had over 38,000 employees and revenue

of €13.1 billion.

Contacts

PressEmilie

Gargatte

+33 (0)1 45 64 61

20

emilie.gargatte@kering.comMarie de Montreynaud

+33 (0)1 45 64 62 53

marie.demontreynaud@kering.com

Analysts/investorsClaire Roblet

+33 (0)1 45 64 61

49

claire.roblet@kering.comLaura Levy

+33 (0)1 45 64 60

45

laura.levy@kering.com

|

APPENDICES EXTRACT

FROM THE CONSOLIDATED FINANCIAL STATEMENTS AND ADDITIONAL

INFORMATION FOR THE YEAR ENDED DECEMBER 31, 2020

AUDITED FINANCIAL STATEMENTS, CERTIFICATION IN

PROGRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contents |

|

page |

|

|

|

|

|

|

|

|

|

Highlights and announcements since January 1,

2020 |

9 |

|

|

|

Consolidated income statement |

12 |

|

|

|

Consolidated balance sheet |

13 |

|

|

|

Consolidated cash flow statement |

14 |

|

|

|

Breakdown of revenue |

15 |

|

|

|

Main definitions |

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HIGHLIGHTS AND ANNOUNCEMENTS SINCE

JANUARY 1, 2020

Finance and governance

highlights

Revised dividend per share for

2019

April 21, 2020 – In light of the Covid-19

pandemic and its impact on economic activity, the Board of

Directors decided to revise the amount allocated to the 2019

dividend payment and to recommend to shareholders at Kering SA’s

Annual General Meeting on June 16, 2020 that the total dividend

payout should amount to €1,010 million, corresponding to €8

per share. This is €442 million lower than the amount announced

when the Group released its 2019 results on February 12, 2020

(€1,452 million, or €11.50 per share).

Reduction in remuneration for 2020 for

Kering’s executive corporate officers

April 21, 2020 – In light of the Covid-19

pandemic and its impact on business activity, François-Henri

Pinault, Chairman and CEO of Kering, decided to reduce the fixed

portion of his salary from April 1, until the end of 2020. In

addition, François-Henri Pinault and Jean-François Palus, Group

Managing Director, decided to waive the entirety of the variable

portions of their annual remuneration for 2020. These decisions

were approved by Kering’s Board of Directors on April 21, 2020. The

Board therefore submitted a revised 2020 remuneration policy

to the vote of the shareholders at the Annual General Meeting held

on June 16, 2020.

Pro-active management of the Group’s

liquidity – a new bond issue and extension of syndicated loan

facilities

May 5, 2020 – Kering carried out a €1.2 billion

dual-tranche bond issue comprising (i) a €600 million tranche with

a three-year maturity and a 0.25% coupon, and (ii) a €600 million

tranche with an eight-year maturity and a 0.75% coupon. In line

with the Group’s pro-active liquidity management approach, this

issue enables Kering to diversify its sources of financing and

enhance its funding flexibility through refinancing of existing

debt and extending the maturity of its financing facilities.

Investors’ high take-up rate of the issue confirmed the market’s

confidence in the Group’s creditworthiness. Kering’s long-term debt

is rated “A-” with a stable outlook by Standard & Poor’s. The

Group also extended its credit facilities from its banks in an

aggregate amount of €1,330 million, giving it €4,635 million in

total confirmed credit lines as of December 31, 2020, versus €3,035

million as of December 31, 2019

Jean Liu, Tidjane Thiam and Emma Watson

join the Board of Kering as Directors

June 16, 2020 – Kering’s shareholders approved

the appointment of Jean Liu, Tidjane Thiam and Emma Watson as

Directors during their Annual General Meeting, as proposed by the

Board of Directors at its meeting of March 12, 2020. Emma Watson

was also appointed Chair of the Sustainability Committee of the

Board of Directors, while Tidjane Thiam was appointed Chair of the

Audit Committee.

Kering successfully completes the sale

of 5.83% of its PUMA shares

October 6, 2020 – The Group further reduced its

investment in PUMA by selling a 5.83% stake on

October 8, 2020 through an accelerated bookbuilding

process with qualified investors at a price of €74.50 per share,

corresponding to a total amount of €656 million. Kering has

retained a 9.87% interest in PUMA.

Other highlights

Kering contributes to the worldwide

fight against COVID-19 since January 28:

In China: -

Kering and its Houses announced a donation to the Hubei Red Cross

Foundation to help fight the spread of the virus.In Italy:

- Kering and its Houses made donations to four major foundation

hospitals in Lombardy, Veneto, Tuscany and Lazio.

- Gucci responded to the appeal launched to the fashion industry

by the Tuscany regional authorities, manufacturing 1.1 million

surgical masks and 55,000 medical overalls for health workers.

In France:

- Kering imported 3 million surgical masks from China.

- Kering made a financial donation to Institut Pasteur to support

its research into COVID-19.

- Kering financed the purchase of 60 3D printers for Paris’

Cochin public hospital, so that it can rapidly produce large

quantities of medical components and address the unprecedented

demand for equipment during the COVID-19 epidemic.

- The French workshops of the Balenciaga and Yves Saint Laurent

Houses manufactured officially approved surgical face masks.

In the United

States:- Kering and its Houses

announced a joint donation of USD 1 million to the CDC Foundation,

to support healthcare workers in the Americas. This donation helped

support front-line health workers in the United States – and

particularly the hardest hit States such as New York, New Jersey,

California and Florida – as well as in Brazil.In the United

Kingdom:- Kering donated face

masks to the National Health Service (NHS).

Progress report on the Group’s 2025

sustainability targets

January 30, 2020 – Three years after announcing

its next-generation sustainability strategy, “Crafting Tomorrow’s

Luxury”, Kering published its Sustainability Progress Report. The

Group has made serious progress and is on track to meet its 2025

targets, while setting the foundation to align with a 1.5°C

pathway. Kering has reduced its overall environmental impacts by

14% in terms of EP&L intensity (between 2015 and 2018) and is

on a positive trajectory to reach its 40% reduction target by 2025.

GHG emissions have fallen 77% in intensity in Kering’s own

operations (between 2015 and 2018), with renewable energy use

reaching 100% in seven countries, 78% in Europe and 67% covered

overall, Group-wide. Kering has also reached its target of

purchasing 100% responsible gold for its Jewelry and Watches

Divisions, and is on track to reach 100% sustainable sourcing for

other key raw materials by 2025. In addition, the Group has

attained 88% traceability for its key raw materials.

Kering and its brands stand in

solidarity against racism

June 2, 2020 – Kering and all its brands stand

in solidarity against racism. On behalf of all its brands, Kering

made a donation to the NAACP (National Association for the

Advancement of Colored People), which fights to eliminate

race-based discrimination in the United States, and Campaign Zero,

an organization that aims to reduce police violence in the United

States. The Group and its brands also committed to continue to

develop initiatives and internal programs to foster respect,

equality and fairness, recognizing that it is a journey and we are

committed to continuously doing the work.

Biodiversity strategy

June 30, 2020 – For the first time, Kering

published a dedicated biodiversity strategy with a series of new

targets to achieve a “net positive” impact on biodiversity by 2025,

which included launching a fund to support the fashion industry’s

transition to regenerative agriculture.

Kerby Jean-Raymond and Kering launch

“Your Friends in New York”

September 10, 2020 – Kerby Jean-Raymond and

Kering announced the creation of “Your Friends in New York”, a

groundbreaking new platform designed to empower the next generation

of innovators. “Your Friends in New York” will merge music, art,

philanthropy and wellness to form an ecosystem of creativity that

reimagines how consumers discover and interact with brands,

including Jean-Raymond’s own brand, Pyer Moss. Aiming to

participate in this powerful community for new talents and

innovation, Kering will support the project as a partner.

Progress report one year after the

launch of the Fashion Pact October 12, 2020 – One year

after its creation, the Fashion Pact published its first progress

report. The Fashion Pact is a global coalition of companies in the

fashion and textile industry that was created following a mission

given to Kering Chairman and CEO, François-Henri Pinault by French

President, Emmanuel Macron. Today it has 60 members, all

committed to a common core of ambitious key environmental goals in

three areas: mitigating climate change, restoring biodiversity and

protecting the oceans. With the support of some of the best

technical experts, the Fashion Pact’s signatories have identified

seven tangible strategic targets, particularly in areas where

collaborative action is needed to scale solutions and thus achieve

critical impact on a global scale. The coalition has made its first

strides, including implementing an operational structure,

developing a dashboard of KPIs to measure the impact of its joint

efforts, and initiating collaborative work on biodiversity drawing

on the technical skills of industry experts.

Kering and Conservation International

launch the Regenerative Fund for NatureJanuary 28, 2021 –

Kering and Conservation International launched the Regenerative

Fund for Nature to transform one million hectares of farms and

landscapes producing raw materials in fashion’s supply chains to

regenerative agriculture over the next five years. As an important

step in achieving Kering’s commitment to have a net positive impact

on biodiversity by 2025, the one million hectares under the new

Fund is on top of Kering’s goal to protect an additional one

million hectares of critical, “irreplaceable” habitat outside of

its direct supply chain, entailing the transformation of two

million hectares in total.

CONSOLIDATED INCOME STATEMENT

|

(in € millions) |

2020 |

2019 |

|

Continuing operations |

|

|

|

Revenue |

13,100.2 |

15,883.5 |

|

Cost of sales |

(3,590.6) |

(4,108.5) |

|

Gross margin |

9,509.6 |

11,775.0 |

|

Personnel expenses |

(2,070.0) |

(2,290.8) |

|

Other recurring operating income and expenses |

(4,304.4) |

(4,705.9) |

|

Recurring operating income |

3,135.2 |

4,778.3 |

|

Other non-recurring operating income and expenses |

163.0 |

(168.5) |

|

Operating income |

3,298.2 |

4,609.8 |

|

Financial result |

(341.7) |

(309.5) |

|

Income before tax |

2,956.5 |

4,300.3 |

|

Income tax expense |

(759.2) |

(2,133.7) |

|

Share in earnings (losses) of equity-accounted companies |

(7.6) |

41.8 |

|

Net income from continuing operations |

2,189.7 |

2,208.4 |

|

o/w attributable to the Group |

2,160.2 |

2,166.9 |

|

o/w attributable to minority interests |

29.5 |

41.5 |

|

Discontinued operations |

|

|

|

Net income from discontinued operations |

(9.8) |

125.4 |

|

o/w attributable to the Group |

(9.8) |

141.7 |

|

o/w attributable to minority interests |

- |

(16.3) |

|

Total Group |

|

|

|

Net income of consolidated companies |

2,179.9 |

2,333.8 |

|

o/w attributable to the Group |

2,150.4 |

2,308.6 |

|

o/w attributable to minority interests |

29.5 |

25.2 |

|

|

|

|

|

(in € millions) |

2020 |

2019 |

|

Net income attributable to the Group |

2,150.4 |

2,308.6 |

|

Basic earnings per share (in €) |

17.20 |

18.40 |

|

Diluted earnings per share (in €) |

17.20 |

18.40 |

|

Net income from continuing operations attributable

to the Group |

2,160.2 |

2,166.9 |

|

Basic earnings per share (in €) |

17.28 |

17.27 |

|

Diluted earnings per share (in €) |

17.28 |

17.27 |

|

Net income from continuing operations (excluding

non-recurring items) attributable

to the Group |

1,972.2 |

3,211.5 |

|

Basic earnings per share (in €) |

15.78 |

25.59 |

|

Diluted earnings per share (in €) |

15.78 |

25.59 |

CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

Assets

|

(in € millions) |

Dec. 31, 2020 |

Dec. 31, 2019 |

|

Goodwill |

2,452.2 |

2,525.9 |

|

Brands and other intangible assets |

6,985.8 |

7,260.5 |

|

Lease right-of-use assets |

3,956.8 |

4,246.7 |

|

Property, plant and equipment |

2,670.2 |

2,619.3 |

|

Investments in equity-accounted companies |

36.2 |

1,105.3 |

|

Non-current financial assets |

1,688.6 |

458.4 |

|

Deferred tax assets |

1,177.4 |

1,367.6 |

|

Other non-current assets |

17.4 |

18.8 |

|

Non-current assets |

18,984.6 |

19,602.5 |

|

Inventories |

2,845.5 |

2,959.2 |

|

Trade receivables |

824.2 |

996.0 |

|

Current tax receivables |

600.5 |

280.7 |

|

Current financial assets |

158.0 |

38.4 |

|

Other current assets |

1,149.1 |

979.4 |

|

Cash and cash equivalents |

3,442.8 |

2,285.9 |

|

Current assets |

9,020.1 |

7,539.6 |

|

Assets held for sale |

0.7 |

6.1 |

|

Total Assets |

28,005.4 |

27,148.2 |

Equity and liabilities

|

(in € millions) |

Dec. 31, 2020 |

Dec. 31, 2019 |

|

Equity attributable to the Group |

11,820.9 |

10,278.1 |

|

Equity attributable to minority interests |

214.1 |

160.5 |

|

Equity |

12,035.0 |

10,438.6 |

|

Non-current borrowings |

3,815.3 |

3,122.2 |

|

Non-current lease liabilities |

3,545.8 |

3,598.6 |

|

Non-current financial liabilities |

80.0 |

47.9 |

|

Non-current provisions for pensions and other post-employment

benefits |

107.5 |

106.5 |

|

Non-current provisions |

18.4 |

15.1 |

|

Deferred tax liabilities |

1,485.1 |

1,530.4 |

|

Other non-current liabilities |

183.6 |

141.4 |

|

Non-current liabilities |

9,235.7 |

8,562.1 |

|

Current borrowings |

1,776.2 |

1,975.9 |

|

Current lease liabilities |

538.0 |

720.0 |

|

Current financial liabilities |

338.1 |

503.2 |

|

Trade payables |

666.0 |

808.7 |

|

Current provisions for pensions and other post-employment

benefits |

12.2 |

8.9 |

|

Current provisions |

212.4 |

216.0 |

|

Current tax liabilities |

901.3 |

1,361.5 |

|

Other current liabilities |

2,290.4 |

2,552.5 |

|

Current liabilities |

6,734.6 |

8,146.7 |

|

Liabilities associated with assets held for

sale |

0.1 |

0.8 |

|

Total Equity and Liabilities |

28,005.4 |

27,148.2 |

CONSOLIDATED STATEMENT OF CASH FLOWS

|

(in € millions) |

2020 |

2019 |

|

Net income from continuing operations |

2,189.7 |

2,208.4 |

|

Net recurring charges to depreciation, amortization

and provisions on non-current operating assets |

1,439.0 |

1,245.3 |

|

Other non-cash (income) expenses |

(282.8) |

(392.4) |

|

Cash flow received from operating activities |

3,345.9 |

3,061.3 |

|

Interest paid (received) |

277.4 |

277.1 |

|

Dividends received |

- |

- |

|

Current tax expense |

657.0 |

2,597.9 |

|

Cash flow received from operating activities before tax,

dividends and interest |

4,280.3 |

5,936.3 |

|

Change in working capital requirement |

44.4 |

(557.5) |

|

Income tax paid |

(1,436.1) |

(2,903.5) |

|

Net cash received from operating activities |

2,888.6 |

2,475.3 |

|

Acquisitions of property, plant and equipment

and intangible assets |

(786.9) |

(955.8) |

|

Disposals of property, plant and equipment and intangible

assets |

2.9 |

1.2 |

|

Acquisitions of subsidiaries and associates,

net of cash acquired |

6.2 |

(42.4) |

|

Disposals of subsidiaries and associates, net of cash

transferred |

656.3 |

0.8 |

|

Acquisitions of other financial assets |

(267.9) |

(285.6) |

|

Disposals of other financial assets |

186.0 |

76.6 |

|

Interest and dividends received |

6.9 |

19.1 |

|

Net cash received from (used in) investing

activities |

(196.5) |

(1,186.1) |

|

Dividends paid to shareholders of Kering SA |

(1,000.1) |

(1,320.1) |

|

Dividends paid to minority interests in consolidated

subsidiaries |

(9.3) |

(21.9) |

|

Transactions with minority interests |

(27.5) |

(19.2) |

|

(Acquisitions) disposals of Kering treasury shares |

(54.1) |

(402.1) |

|

Issuance of bonds and bank debt |

1,443.1 |

644.6 |

|

Redemption of bonds and bank debt |

(642.3) |

(287.6) |

|

Issuance (redemption) of other borrowings |

(258.6) |

798.8 |

|

Repayment of lease liabilities |

(787.3) |

(639.6) |

|

Interest paid and equivalent |

(287.0) |

(289.9) |

|

Net cash received from (used in) financing

activities |

(1,623.1) |

(1,537.0) |

|

Net cash received from (used in) discontinued

operations |

(4.3) |

132.7 |

|

Impact of exchange rates on cash

and cash equivalents |

97.8 |

116.4 |

|

Net increase (decrease) in cash and cash

equivalents |

1,162.5 |

1.3 |

|

Cash and cash equivalents at opening |

1,837.6 |

1,836.3 |

|

Cash and cash equivalents at closing |

3,000.1 |

1,837.6 |

REVENUE FOR THE FIRST, SECOND, THIRD AND FOURTH QUARTERS

OF 2020

| (in

€ millions) |

|

Q4 2020 |

Q4 2019(1) |

Reported change |

Comparable change(1) |

Q3 2020 |

Q3 2019(1) |

Reported change |

Comparable change(1) |

Q2 2020 |

Q2 2019(1) |

Reported change |

Comparable change(1) |

Q1 2020 |

Q1 2019(1) |

Reported change |

Comparable change(1) |

|

Total Luxury Houses |

|

3,901.0 |

4,240.4 |

-8.0% |

-4.8% |

3,600.1 |

3,777.8 |

-4.7% |

-1.6% |

2,109.8 |

3,716.3 |

-43.2% |

-43.4% |

3,065.7 |

3,648.1 |

-16.0% |

-16.9% |

|

Gucci |

|

2,280.6 |

2,636.6 |

-13.5% |

-10.3% |

2,087.8 |

2,374.7 |

-12.1% |

-8.9% |

1,268.1 |

2,291.5 |

-44.7% |

-44.7% |

1,804.1 |

2,325.6 |

-22.4% |

-23.2% |

|

Yves Saint Laurent |

|

552.6 |

569.6 |

-3.0% |

+0.5% |

510.7 |

506.5 |

+0.8% |

+3.9% |

246.5 |

475.5 |

-48.2% |

-48.4% |

434.6 |

497.5 |

-12.6% |

-13.8% |

|

Bottega Veneta |

|

374.7 |

334.3 |

+12.1% |

+15.7% |

332.5 |

284.3 |

+17.0% |

+20.7% |

229.4 |

300.9 |

-23.8% |

-24.4% |

273.7 |

248.1 |

+10.3% |

+8.5% |

|

Other Houses |

|

693.1 |

699.9 |

-1.0% |

+1.7% |

669.1 |

612.3 |

+9.3% |

+11.7% |

365.8 |

648.4 |

-43.6% |

-44.0% |

553.3 |

576.9 |

-4.1% |

-5.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate and other |

|

103.2 |

120.1 |

-14.1% |

-11.0% |

117.6 |

106.8 |

+10.1% |

+13.8% |

65.3 |

136.8 |

-52.3% |

-52.5% |

137.5 |

137.2 |

+0.2% |

-1.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KERING |

|

4,004.2 |

4,360.5 |

-8.2% |

-5.0% |

3,717.7 |

3,884.6 |

-4.3% |

-1.2% |

2,175.1 |

3,853.1 |

-43.5% |

-43.7% |

3,203.2 |

3,785.3 |

-15.4% |

-16.4% |

(1) On a comparable Group structure and exchange rate

basis.

MAIN DEFINITIONS

“Reported” and “comparable”

revenueThe Group’s “reported” revenue corresponds to

published revenue. The Group also uses “comparable” data to measure

organic growth. “Comparable” revenue refers to 2019 revenue

adjusted as follows

by:-

neutralizing the portion of revenue corresponding to entities

divested in

2019;-

including the portion of revenue corresponding to entities acquired

in

2020;-

remeasuring 2019 revenue at 2020 exchange rates.These adjustments

give rise to comparative data at constant scope and exchange rates,

which serve to measure organic growth.

Recurring operating incomeThe

Group’s operating income includes all revenues and expenses

directly related to its activities, whether these revenues and

expenses are recurring or arise from non-recurring decisions or

transactions.Other non-recurring operating income and expenses

consist of items that, by their nature, amount or frequency, could

distort the assessment of the Group’s operating performance as

reflected in its recurring operating income. They include changes

in Group structure, the impairment of goodwill and brands and,

where material, of property, plant and equipment and intangible

assets, capital gains and losses on disposals of non-current

assets, restructuring costs and disputes.“Recurring operating

income” is therefore a major indicator for the Group, defined as

the difference between operating income and other non-recurring

operating income and expenses. This intermediate line item is

intended to facilitate the understanding of the operating

performance of the Group and its Houses and can therefore be used

as a way to estimate recurring performance. This indicator is

presented in a manner that is consistent and stable over the long

term in order to ensure the continuity and relevance of financial

information.

EBITDAThe Group uses EBITDA to

monitor its operating performance. This financial indicator

corresponds to recurring operating income plus net charges to

depreciation, amortization and provisions on non-current operating

assets recognized in recurring operating income.

Free cash from operations, available

cash flow from operations and available cash flowThe Group

uses an intermediate line item, “Free cash flow from operations”,

to monitor its financial performance. This financial indicator

measures net operating cash flow less net operating investments

(defined as acquisitions and disposals of property, plant and

equipment and intangible assets).The Group has also defined a new

indicator, “Available cash flow from operations”, in order to take

into account capitalized fixed lease payments (repayments of

principal and interest) pursuant to IFRS 16, and thereby reflect

all of its operating cash flows.“Available cash flow” therefore

corresponds to available cash flow from operations plus interest

and dividends received, less interest paid and equivalent

(excluding leases).

Net debtNet debt is one of the

Group’s main financial indicators, and is defined as borrowings

less cash and cash equivalents. Consequently, the cost of net debt

corresponds to all financial income and expenses associated with

these items, including the impact of derivative instruments used to

hedge the fair value of borrowings.

Effective tax rate on recurring

incomeThe effective tax rate on recurring income

corresponds to the effective tax rate excluding tax effects

relating to other non‑recurring operating income and expenses.

IAS 17-adjusted financial

indicatorsCertain key indicators such as recurring

operating income and EBITDA may be presented on an adjusted IAS 17

basis, i.e., as if IAS 17 had been applied instead of IFRS 16. In

such cases, the indicator will be followed by the phrase “adjusted

for IAS 17” in brackets.

1 Recurring net income attributable to the Group: net income

from continuing operations attributable to the Group, excluding

non‑recurring items.

- Kering Press release - Full year results 2020_17 02 2021

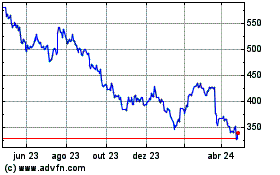

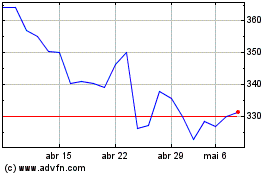

Kering (EU:KER)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Kering (EU:KER)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024