AnalytixInsight Launches ESG Analytics, Expands Refinitiv AI-driven Research Initiative

17 Março 2021 - 8:30AM

Artificial Intelligence company, AnalytixInsight Inc.

(“AnalytixInsight”, or the “Company”) (

TSX-V: ALY; OTCQB:

ATIXF), announces that it has expanded its AI-driven

research solution with Refinitiv to include ESG analytics. Under

the Refinitiv initiative, the Company has already published more

than 13,000 reports on company earnings, dividend quality, and

pre-revenue company analysis, and will now embed ESG scores

and ESG metrics into its proprietary analysis and narratives,

through its financial analytics platform, CapitalCube. Refinitiv,

an LSEG (London Stock Exchange Group) business, is one of the

world’s largest providers of financial markets data and

infrastructure.

ESG (Environmental, Social, and Governance) is

commonly used as a generic term by investors and regulators to

evaluate corporate behaviors. ESG factors are rapidly increasing in

importance by investment professionals when making investment

decisions. For example, a recent study by the European Fund and

Asset Management Association reports that asset managers in Europe

manage almost EUR 11 trillion in assets that take some form of ESG

considerations into account.

CapitalCube now provides ESG performance

analysis and ESG scoring summaries on the approximately 9,000

global companies who report their ESG measures. An ESG narrative

commentary and peer comparison chart is now embedded within

CapitalCube’s earnings report. Over the past six months CapitalCube

has published more than 3,000 earnings reports under the Refinitiv

initiative.

The Company will also add CapitalCube ESG

analysis and scoring metrics for stocks listed on InvestoPro, the

European online financial broker platform of its FinTech affiliate,

MarketWall. InvestoPro has been developed as a stock trading

platform with a focus on fundamental analysis, research, and

education, and will be offered to European users, following

regulatory approvals.

The Company believes that CapitalCube’s

proprietary AI-based quality scoring metrics which measure a

company’s financial health, dividend quality, and ESG performance,

will become increasingly more important to new retail investors who

are learning to invest on their own, and are traits desired by

regulators.

CapitalCube is the Company’s financial analytics

platform which delivers scalable, machine-created content. Its

powerful analytics engine is capable of more than 100 billion daily

computations and provides fundamental financial analysis on

approximately 50,000 worldwide stocks and North American ETFs.

The Company has also retained Red Cloud

Securities Inc. (“RCSI”) to provide market stabilization and

liquidity of the Company’s shares listed on the TSX Venture

Exchange. RCSI will receive $5,000 per month for their services

which may be terminated with thirty-day notice. There are no

additional performance factors, shares, or options offered as

compensation. RCSI is arm’s length and independent of the

Company.

CONTACT INFORMATION:

Scott

Urquhart VP

Corporate

DevelopmentAnalytixInsightScott.Urquhart@AnalytixInsight.com

Sophic Capital All@SophicCapital.com(647) 670

1991sophiccapital.com/investment-ideas/AnalytixInsight

ABOUT ANALYTIXINSIGHT INC.

AnalytixInsight Inc. is an Artificial

Intelligence, machine-learning company. AnalytixInsight’s financial

analytics platform CapitalCube.com algorithmically analyzes market

price data and regulatory filings to create insightful actionable

narratives and research on approximately 50,000 global companies

and ETFs, providing high-quality financial research and content for

investors, information providers, finance portals and media.

AnalytixInsight also designs and implements Workforce Optimization

solutions for large global enterprises. AnalytixInsight holds a 49%

interest in MarketWall, a developer of FinTech solutions for

financial institutions. AnalytixInsight.com

Regulatory Statements

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Forward-looking information includes, without

limitation, statements regarding the growth of the Company’s

business operations; the impact of ESG analysis on the Company’s

business, the features and capabilities of ESG analysis, the

ability for MarketWall or InvestoPro to obtain regulatory approvals

to become an online broker; the impact of RCSI’s services; and the

Company’s future performance. Generally, forward-looking

information can be identified by the use of forward-looking

terminology such as “plans”, “expects” or “does not expect”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates” or “does not anticipate”, or “believes”,

or variations of such words and phrases or state that certain

actions, events or results “may”, “could”, “would”, “might” or

“will be taken”, “occur” or “be achieved”. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of

activity, performance or achievements of AnalytixInsight Inc., as

the case may be, to be materially different from those expressed or

implied by such forward-looking information, including but not

limited to: general business, economic, competitive, geopolitical

and social uncertainties; the Company’s technology and revenue

generation; risks associated with operation in the technology

sector; ability to successfully integrate new technology and

employees; foreign operations risks; and other risks inherent in

the technology industry. Although AnalytixInsight has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated or intended. There can be no assurance

that such information will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. AnalytixInsight does not

undertake to update any forward-looking information, except in

accordance with applicable securities laws.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE

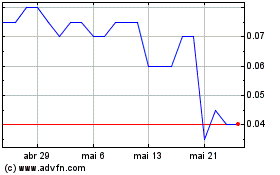

AnalytixInsight (TSXV:ALY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

AnalytixInsight (TSXV:ALY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024