MarketWall, a fintech company specialising in

finance and trading IT solutions, has set up the new investment

firm InvestoPro Sim.

The idea behind the project stems from a plan

conceived by the shareholders of MarketWall – the

Canadian artificial intelligence company AnalytixInsight

(TSX-V:ALY; OTCQB:ATIXF), Intesa Sanpaolo

(MI:ISP) and Marco Roscio Ricon, CEO of

MarketWall and of the new entity – to create a

highly innovative SIM dedicated to private investors intending to

manage their assets independently, characterised by a wide range of

investment tools and offers, the quality of the information flow

and the ability to provide advanced digital solutions.

InvestoPro Sim, which received

authorisation to trade from Consob, is launching

InvestoPro.com, an online and digital trading

platform that includes financial analyses, news, research,

educational formats and other exclusive content created by teams of

experts with the aid of artificial intelligence, high value tools

that help investors familiarise themselves with the operating

logics of the financial markets, receive guidance within a very

wide range of offers and recognise opportunities that best match

their objectives and risk profiles.

To date, thanks to the early launch of a beta

phase in recent months, InvestoPro.com can already

count a community of over 2.5 million visitors per month from all

over the world through its channels: website, social network, smart

TV, mobile app and progressive web app.

Intesa Sanpaolo customers will

soon have the opportunity to access InvestoPro.com

and activate the online trading service with their credentials.

InvestoPro.com is a

multi-device platform characterised by intuitive and fast usability

with a high level of customisation: investors can build their own

customised user experience, combining features and contents

according to their specific needs, thanks to very straightforward

and user-friendly tools.

InvestoPro.com is at the same

time a marketplace for third-party financial content that extends

the range of information services available to users to support

their investment decisions. The platform devotes ample space to

training, providing training courses and a growing range of

webinars that make it possible to make informed decisions and

define investment strategies wisely and independently. The Virtual

Trading feature also enables users to put into practice what they

have learned and gain experience without running risks, by

investing virtual capital.

Marco Roscio Ricon, CEO of MarketWall

and InvestoPro Sim: “Technology pervades our everyday

life: digitalisation, social networks and artificial intelligence

are now essential aspects in the creation of innovative products

and services. With this in mind, we have created InvestoPro, the

first FinTech Sim. A first step as part of a broader disruptive

innovation process that will soon see the offer of payment

services, social trading and much more."

Prakash Hariharan, CEO of

AnalytixInsight: “Investors are independently managing

their assets in record breaking numbers worldwide. InvestoPro

offers its users educational content and information tools which

are unparalleled in the industry by incorporating artificial

intelligence and scalable machine-created content into their

investment decisions.”

Stefano Barrese, Intesa Sanpaolo's Head

of the Banca dei Territori Division: “The partnership with

InvestoPro, the newly created Sim of our fintech subsidiary

MarketWall, allows us to complete our digital offer by providing

customers, especially those who wish to manage a part of their

assets independently, a next-generation trading platform, equipped

with the best information, training and trading tools.”

***

MarketWall is an Italian

fintech company operating in the development of software solutions

for some of the main global groups in the technological and

financial world such as Samsung and Morningstar. Since 2015 it has

partnered with Intesa Sanpaolo, which holds a 33% stake in the

share capital.

InvestoPro SIM is the

investment company wholly owned by MarketWall. The board is

composed of:

Massimo Tessitore (Chair): Head of Digital

Channels - Branch Platform & Digital Business Partner

Commercial Banking, Private and Insurance of Intesa Sanpaolo,Laura

Stoduto: Compliance Officer, Fideuram Asset Management SGR,Giuseppe

Attanà: Board Member of UBI Banca S.p.a., Board Member of Intesa

Sanpaolo Vita S.p.a.,Marco Roscio Ricon: CEO of MarketWall and

InvestoPro,Luca Canevello: COO of InvestoPro,Prakash Hariharan:

Board Chairman and CEO of AnalytixInsight, andChaith Kondragunta:

Board Member of AnalytixInsight.

Media

RelationsMarketWallEmanuela

GuadagninoMarketing

Manageremanuela.guadagnino@marketwall.comFintech.MarketWall.com

***

AnalytixInsight is an

Artificial Intelligence, machine-learning company.

AnalytixInsight’s financial analytics platform CapitalCube.com

algorithmically analyzes market price data and regulatory filings

to create insightful actionable narratives and research on

approximately 50,000 global companies and ETFs, providing

high-quality financial research and content for investors,

information providers, finance portals, and media. AnalytixInsight

holds a 49% interest in MarketWall.

Media

RelationsAnalytixInsightScott UrquhartVP

Corporate

DevelopmentScott.Urquhart@AnalytixInsight.comAnalytixInsight.com

***

Intesa Sanpaolo is the leading

Bank in Italy and one of the soundest and most profitable banks in

Europe. It offers commercial, corporate investment banking, asset

management and insurance services. The Intesa Sanpaolo Group has

approximately 14.7 million customers in Italy who are assisted

through both digital and traditional channels. It also has 7.1

million international customers which it serves through its

commercial banking subsidiaries present in 12 countries in

Central-Eastern Europe, the Middle East and North Africa, and

through an international network dedicated to corporate customers

in 26 countries. Intesa Sanpaolo is considered one of the most

sustainable banks in the world. For the Group, creating value means

being a driver for growth, for the benefit of both society and the

economy. As regards the environment, the Group has set up a

6-billion-euro fund for the circular economy. Intesa Sanpaolo

supports major economic inclusion and poverty reduction projects,

including an impact fund of 1.5 billion euro for loans available to

social groups who struggle to access credit. Intesa Sanpaolo has a

high level of involvement in cultural initiatives, organised by the

Bank or in collaboration with other entities in Italy and further

afield. These include permanent and temporary exhibitions

showcasing the Bank’s impressive artistic heritage at the Gallerie

d’Italia, the Group’s museums located in Milan, Naples, Vicenza and

soon Turin.

Media Relations Intesa

SanpaoloCorporate & Investment Banking and Governance

AreasCarlo

Torresancarlo.torresan@intesasanpaolo.comwww.intesasanpaolo.com/it/news

Website:

group.intesasanpaolo.com | News:

https://group.intesasanpaolo.com/it/sala-stampaTwitter:

@intesasanpaolo | Facebook: @intesasanpaolo

|LinkedIn:

https://www.linkedin.com/company/intesa-sanpaolo |

Instagram: @intesasanpaolo

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE

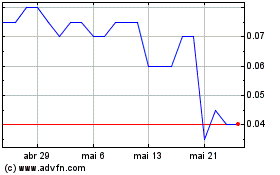

AnalytixInsight (TSXV:ALY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

AnalytixInsight (TSXV:ALY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024