Helios Fairfax Partners Corporation: First Quarter Financial Results

29 Abril 2021 - 6:15PM

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR

FOR DISSEMINATION IN THE UNITED STATES

(Note:

All dollar amounts in this news release are expressed in

U.S. dollars except as otherwise noted. The financial results are

prepared using the recognition and measurement requirements of

International Financial Reporting Standards, except as otherwise

noted, and are unaudited.)

Helios Fairfax Partners Corporation (TSX:

HFPC.U) announces a net loss of $11.1 million in the first quarter

of 2021 ($0.10 net loss per diluted share), compared to a net loss

of $121.8 million in the first quarter of 2020 ($2.05 net loss per

diluted share), principally reflecting net change in unrealized

gains of $1.2 million in the first quarter of 2021 compared to net

change in unrealized losses of $68.6 million in the first quarter

of 2020 and decreased foreign exchange losses of $1.0 million in

the first quarter of 2021 compared to $52.5 million in the first

quarter of 2020.

Highlights in the first quarter of 2021 included

the following:

- Net change in unrealized gains on

investments of $1.2 million were principally comprised of increases

in the market price of the company's investments in Other Public

African Investments ($4.8 million), the Atlas Mara Facility

Guarantee ($2.0 million) and the CIG Loan ($1.2 million), partially

offset by decreases in the market price of the company's indirect

equity interest in AGH ($4.7 million), the Atlas Mara Facility

($1.5 million) and Philafrica common shares ($0.6 million).

- The company recorded a loss on

uncollectible accounts receivable of $5.7 million comprised of

losses recorded on amounts due from Atlas Mara and refundable

Harmonized Sales Tax .

- In accordance with the Investment

Advisory Agreement, a performance fee of $1.9 million was accrued

to the benefit of the Class D unitholder of TopCo LP for the period

from January 1, 2021 to March 31, 2021. The performance fee, if

any, will only be crystallized on December 31, 2023 at the end of

the three year measurement period.

- The company reported net foreign

exchange losses ($1.0 million).

- On March 31, 2021, the company

completed the previously announced arrangement with Fairfax

Financial Holdings Limited ("Fairfax"), pursuant to which Fairfax

through its affiliates invested $100.0 million in 3.0% unsecured

debentures of HFP (the "HFP 3.0% Debentures") and 3 million

warrants (the "HFP Warrants"). The HFP Warrants are exercisable for

one subordinate voting share of HFP, have an exercise price of

$4.90 and are exercisable at any time prior to March 31, 2026. The

net proceeds from the HFP 3.0% Debentures will be used primarily to

invest in African Investments. The HFP 3.0% Debentures mature on

March 31, 2024 or, at the option of Fairfax, on either of the first

two anniversary dates. At maturity or on redemption by Fairfax, the

principal amount to be repaid will be adjusted for the amount, if

any, by which the aggregate fair value of the company's investments

in AGH (indirect via Joseph Holdings), Philafrica common shares,

the Philafrica Facility, and the PGR2 Loan is lower than $102.6

million. At March 31, 2021 as a result of this transaction, the

company recorded a net benefit of $18.1 million in equity.

- On March 31, 2021 the company

committed to invest $50.0 million in Helios Investors IV, L.P.

("Helios Fund IV") and funded its first capital call for $13.1

million. On April 23, 2021 the company funded an additional $9.3

million in Helios Fund IV.

- At March 31, 2021 common

shareholders' equity was $611.8 million, or book value per share of

$5.61 with 109,118,253 shares outstanding, compared to $599.7

million, or book value per share of $5.50 with 109,118,253 shares

outstanding, at December 31, 2020, an increase of 2.0%.

There were 109.1 million and 59.4 million

weighted average shares outstanding during the first quarters of

2021 and 2020 respectively. At March 31, 2021 there were

53,665,388 subordinate voting shares and 55,452,865 multiple voting

shares outstanding.

HFP's detailed first quarter report can be

accessed at its website www.heliosfairfax.com.

In presenting the company's results in this news

release, management has included book value per basic share. Book

value per basic share is calculated by the company as common

shareholders' equity divided by the number of common shares

outstanding.

Helios Fairfax Partners Corporation is an

investment holding company whose investment objective is to achieve

long term capital appreciation, while preserving capital, by

investing in public and private equity securities and debt

instruments in Africa and African businesses or other businesses

with customers, suppliers or business primarily conducted in, or

dependent on, Africa.

| For further

information, contact: |

Keir Hunt,

General Counsel & Corporate Secretary |

| |

(416) 646-4180 |

This press release may contain forward-looking

statements within the meaning of applicable securities legislation.

Forward-looking statements may relate to the company's or an

African Investment's future outlook and anticipated events or

results and may include statements regarding the financial

position, business strategy, growth strategy, budgets, operations,

financial results, taxes, dividends, plans and objectives of the

company. Particularly, statements regarding future results,

performance, achievements, prospects or opportunities of the

company, an African Investment, or the African market are

forward-looking statements. In some cases, forward-looking

statements can be identified by the use of forward-looking

terminology such as "plans", "expects" or "does not expect", "is

expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates" or "does not anticipate" or "believes", or

variations of such words and phrases or state that certain actions,

events or results "may", "could", "would", "might", "will" or "will

be taken", "occur" or "be achieved".

Forward-looking statements are based on our

opinions and estimates as of the date of this press release and

they are subject to known and unknown risks, uncertainties,

assumptions and other factors that may cause the actual results,

level of activity, performance or achievements to be materially

different from those expressed or implied by such forward-looking

statements, including but not limited to the following factors: the

COVID-19 pandemic; geographic concentration of investments;

financial market fluctuations; pace of completing investments;

minority investments; reliance on key personnel and risks

associated with the Investment Advisory Agreement; operating and

financial risks of African investments; valuation methodologies

involve subjective judgments; lawsuits; use of leverage; foreign

currency fluctuation; investments may be made in foreign private

businesses where information is unreliable or unavailable;

significant ownership by Fairfax and Principal Holdco may adversely

affect the market price of the subordinate voting shares; emerging

markets; South African black economic empowerment; economic risk;

weather risk; taxation risks; MLI; and trading price of subordinate

voting shares relative to book value per share. Additional risks

and uncertainties are described in the company's annual information

form dated March 5, 2021 which is available on SEDAR at

www.sedar.com and on the company's website at

www.heliosfairfax.com. These factors and assumptions are not

intended to represent a complete list of the factors and

assumptions that could affect the company. These factors and

assumptions, however, should be considered carefully.

Although the company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking statements,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. The company does not

undertake to update any forward-looking statements contained

herein, except as required by applicable securities laws.

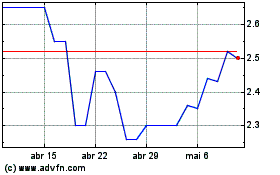

Helios Fairfax Partners (TSX:HFPC.U)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Helios Fairfax Partners (TSX:HFPC.U)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024