IHT FIRST QUARTER PROFIT; UNIGEN CLEAN ENERGY DIVERSIFICATION PROGRESS

28 Junho 2021 - 6:45PM

InnSuites Hospitality Trust (NYSE

American: IHT)

reported Fiscal First Quarter profit of $157,161 which is an

increase of over $500,000 from the same prior year period of

($352,857). Revenues were approximately $1.4 million for the 2022

Fiscal First Quarter Ended April 30, 2021, remaining relatively

flat from revenues of approximately $1.4 million for the same prior

year period. Basic earnings per share for the Fiscal First Quarter

ended April 30, 2021, increased approximately three cents per

share, to ($0.01), compared with ($0.04) for the same Fiscal

Quarter ended April 30, 2020. This increase was largely

attributable to the solid start the Trust’s operations are off to

in the current Fiscal Year 2022 (February 1, 2021-January 31,

2022), along with the decreased impact of Covid-19. These solid

results have accelerated in Fiscal Q2 of the current year. These

are all positive signs, and indicative that things are heading in

the right direction as the Travel Industry, the Economy as a whole,

and InnSuites Hospitality Trust (IHT) specifically, continue to

rebound and recover. Economic conditions continued to improve for

the Trust for the second consecutive Quarter. Q1 of Fiscal Year

2022 and Q4 of Fiscal Year 2021 have both shown increased signs of

strength, growth, and improvement, especially when compared to Q2

and Q3 of Fiscal Year 2021 (May 1, 2021-October 31, 2021).

Several areas of our hotel operations continue

to perform well and maintain their solid start in the current 2022

Fiscal Year, ending January 31, 2022. Consolidated Net Income has

increased more than $500,000 in Fiscal First Quarter 2022 compared

to Fiscal First Quarter 2021, more than $425,000 over Fiscal First

Quarter 2020, and approximately $450,000 greater than Fiscal First

Quarter 2019, (the latter two both pre-Covid).

InnSuites Hospitality Trust (IHT) previously

made an initial $1 million diversification investment in privately

held UniGen Power, Inc. (UniGen), a company developing a patented,

high profit potential, efficient clean energy generation

innovation. The UniGen profit potential is promising, as evidenced

by UniGen’s current pursuit of three additional valuable patents.

In addition to the initial investment, which could be converted

into 1 million UniGen shares, IHT also holds warrants that, if

fully exercised, would provide IHT 2 million additional UniGen

shares, and could potentially result in IHT holding up to an

approximate 25% ownership stake in UniGen. IHT is informed that

UniGen has made progress to date on development of this innovation,

with the first two Prototypes scheduled to be operational later

this year, despite delays related to China supplier travel

restrictions.

IHT has confidence in the UniGen technical team

based in Detroit and in the progress to date. UniGen’s future

profit potential is encouraging for IHT investors, especially

considering 18 months of successful design and development work is

now complete.

Said James Wirth President, CEO, and IHT Board

Chairman:

“IHT continues to execute our strategic plan of

selling existing hotel real estate at market prices significantly

above our low carrying (book) values, and moving toward IHT’s high

potential diversification investment in the efficient, clean-energy

power generation UniGen innovation, a positive move that is

increasingly recognized by investors.”

“Management has long believed, as indicated in

past IHT SEC Filings, that the investor community continues to

value IHT well below its full potential and true underlying value.

Even with the recent increased trading volume and share valuation,

Management is of the opinion that IHT continues to trade well below

its true potential, especially once the UniGen innovation is fully

completed; which is not a certainty, but after investing for 18

months, Management believes is a likelihood.”

Fiscal Year 2021 extended IHT’s uninterrupted,

continuous annual dividends to over 50 years. It is expected the

IHT Board will again approve semi-annual dividends for July 2021,

and January 2022, continuing this impressive record.

For more information, visit

www.innsuitestrust.com and www.innsuites.com.

Forward-Looking Statements

With the exception of historical information,

matters discussed in this news release may include “forward-looking

statements” within the meaning of the federal securities laws. All

statements regarding IHT’s review and exploration of potential

strategic, operational and structural alternatives and expected

associated costs and benefits are forward-looking. Actual

developments and business decisions may differ materially from

those expressed or implied by such forward-looking statements.

Important factors, among others, that could cause IHT’s actual

results and future actions to differ materially from those

described in forward-looking statements include the uncertain

outcome, impact, effects and results of IHT’s review of strategic,

operational and structural alternatives, IHT’s success in finding

potential qualified purchasers for its hospitality real estate, or

a reverse merger partner, the success of and timing of the UniGen

clean energy innovation, the continuation of semi-annual dividends

in the year ahead, and other risks discussed in IHT’s SEC filings.

IHT expressly disclaims any obligation to update any

forward-looking statement contained in this news release to reflect

events or circumstances that may arise after the date hereof, all

of which are expressly qualified by the foregoing, other than as

required by applicable law.

FOR FURTHER INFORMATION:

Marc Berg, Executive Vice President 602-944-1500

email: mberg@innsuites.com

INNSUITES HOTEL CENTRE1730 E. NORTHERN AVENUE,

#122Phoenix, Arizona 85020Phone: 602-944-1500

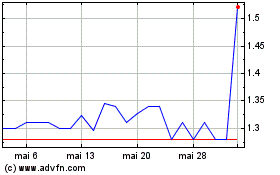

Innsuites Hospitality (AMEX:IHT)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Innsuites Hospitality (AMEX:IHT)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025