PHX Energy Receives TSX Approval for Renewal of Normal Course Issuer Bid

11 Agosto 2021 - 8:30AM

PHX Energy Services Corp. ("

PHX Energy" or the

"

Corporation") (TSX: PHX) today announced

that the Toronto Stock Exchange ("

TSX") has

accepted PHX Energy's notice of intention to renew its normal

course issuer bid for a further one-year term (the

"

NCIB"). The previous NCIB expired on August 13,

2021. Pursuant to the Corporation's previous NCIB, the Corporation

purchased in the open market through the facilities of the TSX and

through other alternative Canadian trading platforms and cancelled

an aggregate of 3,131,388 common shares ("

Common

Shares") of the Corporation at an average price paid of

$1.58 per Common Share, which represents all the approved

securities available for repurchase under the previous NCIB.

Under the renewed NCIB, PHX Energy may purchase

for cancellation, from time to time, as PHX Energy considers

advisable, up to a maximum of 3,679,797 Common Shares, which

represents 10% of the Corporation's public float of 36,797,979

Common Shares as at August 6, 2021. Purchases of Common Shares may

be made on the open market through the facilities of the TSX and

through other alternative Canadian trading platforms at the

prevailing market price at the time of such transaction. The actual

number of Common Shares that may be purchased for cancellation and

the timing of any such purchases will be determined by PHX Energy,

subject to a maximum daily purchase limitation of 23,467 Common

Shares which equates to 25% of PHX Energy's average daily

trading volume of 93,868 Common Shares for the six months ended

July 31, 2021. PHX Energy may make one block purchase per calendar

week which exceeds the daily repurchase restrictions. Any Common

Shares that are purchased by PHX Energy under the NCIB will be

cancelled.

The NCIB will commence on August 16, 2021 and

will terminate on August 15, 2022 or such earlier time as the NCIB

is completed or terminated at the option of PHX Energy. PHX Energy

may enter into an automatic securities purchase plan in connection

with the NCIB which would permit the Corporation to repurchase its

Common Shares during periods of blackout or other periods in which

the Corporation would not ordinarily be permitted to repurchase its

Common Shares. Such automatic securities purchase plan would be

subject to certain parameters set by the Corporation from time to

time which would govern the automatic purchase of Common

Shares.

PHX Energy believes that within a continued

volatile market environment, at times, the prevailing market price

does not reflect the underlying value of its Common Shares and the

repurchase of its Common Shares for cancellation represents an

attractive opportunity to enhance PHX Energy's per share metrics

and thereby increase the underlying value to its shareholders. PHX

Energy intends to use the NCIB as another tool to enhance total

long-term shareholder returns in conjunction with management’s

disciplined capital allocation strategy.

About PHX Energy Services

Corp.

The Corporation, through its directional

drilling subsidiary entities, provides horizontal and directional

drilling technology and services to oil and natural gas producing

companies in Canada, the US and the Middle East through a

partnership with National Energy Services Reunited Corp.

The common shares of PHX Energy are traded on

the Toronto Stock Exchange under the symbol "PHX".

For further information please contact:

John Hooks, CEO; Michael Buker, President; or

Cameron Ritchie, Senior Vice President Finance and CFO

PHX Energy Services Corp. Suite 1400, 250 2nd

Street SW Calgary, Alberta T2P 0C1 Tel: 403-543-4466 Fax:

403-543-4485 www.phxtech.com

Caution Regarding Forward-Looking

Statements

This news release contains certain statements

that may constitute forward-looking information within the meaning

of applicable securities laws. This information includes, but is

not limited to PHX Energy's intentions with respect to the NCIB and

purchases thereunder and the effects of repurchases under the NCIB.

Although PHX Energy believes that the expectations and assumptions

on which the forward-looking statements are based are reasonable,

undue reliance should not be placed on the forward-looking

statements because PHX Energy can give no assurance that they will

prove to be correct. Since forward-looking statements address

future events and conditions by their very nature they involve

inherent risks and uncertainties. Actual results could defer

materially from those currently anticipated due to a number of

factors and risks. Certain of these risks are set out in more

detail in PHX Energy's Annual Information Form which has been filed

on SEDAR and can be accessed at www.sedar.com.

The forward-looking statements contained in this

press release are made as of the date hereof and PHX Energy

undertakes no obligation to update publically or revise any

forward-looking statements or information, whether as a result of

new information, future events or otherwise, unless so required by

applicable securities laws.

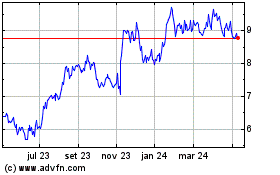

PHX Energy Services (TSX:PHX)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

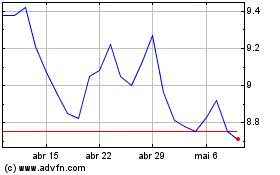

PHX Energy Services (TSX:PHX)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025