First Quarter Highlights

- For the

three-month period ended March 31, 2024, PHX Energy generated

consolidated revenue of $166.1 million which is slightly higher

than the consolidated revenue generated in the first quarter of

2023 and is the second highest level in the Corporation’s history.

This achievement resulted from strong Canadian results that

outpaced the industry trend and despite the 18 percent decline in

the US rig count impacting the Corporation’s US results.

Consolidated revenue in the 2024-quarter included $8.2 million of

motor rental revenue and $2.8 million of motor equipment and parts

sold (2023 - $10.9 million and $0.7 million, respectively).

- In the first

quarter of 2024, adjusted EBITDA(1) was $35 million, 21 percent of

consolidated revenue(1), as compared to $37 million, 22 percent of

consolidated revenue, in the same 2023-quarter. Included in the

2024-quarter’s adjusted EBITDA is $5.7 million of cash-settled

share-based compensation expense (2023 - $1.4 million). Adjusted

EBITDA excluding cash-settled share-based compensation expense(1)

in the first quarter of 2024 was $40.7 million, 25 percent of

consolidated revenue(1) (2023 - $38.4 million, 23 percent of

consolidated revenue).

- Earnings in the

2024 three-month period were $17.5 million, $0.37 per share, as

compared to $22.4 million, $0.42 per share, in the same

2023-period.

- PHX Energy’s US

division’s revenue in the first quarter of 2024 was $114.2 million,

9 percent lower compared to the $125.7 million in the 2023-quarter

and represented 69 percent of consolidated revenue (2023 – 76

percent of consolidated revenue). During the quarter, the US

industry activity declined which affected the Corporation’s US

division’s results.

- PHX Energy’s

Canadian division reported $52 million of quarterly revenue, 29

percent higher compared to $40.4 million in the 2023-quarter and

the highest level in the last ten years.

- In the 2024

three-month period, the Corporation generated excess cash flow(2)

of $7.4 million, after deducting capital expenditures of $29.6

million offset by proceeds on disposition of drilling and other

equipment of $12.3 million.

- For the

three-month period ended March 31, 2024, PHX Energy paid $9.5

million in dividends which is 24 percent higher than the dividend

amount paid in the same 2023-period. On March 15, 2024, the

Corporation declared a dividend of $0.20 per share or $9.5 million

payable on April 15, 2024. There were no common shares purchased

under the current NCIB in the three-month period ended March 31,

2024 (2023 - nil).

- As at March 31,

2024, the Corporation had working capital(2) of $88.7 million and

net cash(2) of $5.8 million.

Financial Highlights

(Stated in thousands of dollars except per share

amounts, percentages and shares outstanding)

|

|

Three-month periods ended March 31, |

|

|

|

2024 |

|

2023 |

|

% Change |

|

|

Operating Results |

(unaudited) |

|

(unaudited) |

|

|

|

|

Revenue |

166,123 |

|

166,022 |

|

- |

|

|

Earnings |

17,454 |

|

22,417 |

|

(22 |

) |

|

Earnings per share – diluted |

0.37 |

|

0.42 |

|

(12 |

) |

|

Adjusted EBITDA(1) |

35,033 |

|

37,000 |

|

(5 |

) |

|

Adjusted EBITDA per share – diluted(1) |

0.74 |

|

0.69 |

|

7 |

|

|

Adjusted EBITDA as a percentage of revenue(1) |

21% |

|

22% |

|

|

|

|

Cash Flow |

|

|

|

|

|

|

|

Cash flows from operating activities |

11,167 |

|

3,905 |

|

186 |

|

|

Funds from operations(2) |

26,141 |

|

26,737 |

|

(2 |

) |

|

Funds from operations per share – diluted(3) |

0.55 |

|

0.50 |

|

10 |

|

|

Dividends paid per share(3) |

0.20 |

|

0.15 |

|

33 |

|

|

Dividends paid |

9,453 |

|

7,636 |

|

24 |

|

|

Capital expenditures |

29,640 |

|

18,583 |

|

60 |

|

|

Excess cash flow(2) |

7,431 |

|

19,232 |

|

(61 |

) |

|

Financial Position |

Mar 31 ‘24 |

|

Dec 31 ‘23 |

|

|

|

|

Working capital(2) |

88,679 |

|

93,915 |

|

(6 |

) |

|

Net debt (Net cash)(2) |

(5,833 |

) |

(8,869 |

) |

(34 |

) |

|

Shareholders’ equity |

222,310 |

|

209,969 |

|

6 |

|

|

Common shares outstanding |

47,488,005 |

|

47,260,472 |

|

- |

|

Outlook

In the first quarter of 2024, the Corporation

continued to generate strong operating and financial results on the

back of two consecutive record years.

- We believe the

declining US rig count has stabilized and this new level of

activity will be sustained in the upcoming quarters. In the second

quarter our US RSS activity has rebounded from the slower start at

the beginning of the year. We believe that our US operations will

continue to produce strong results and any future increases in the

rig count will create an additional upside.

- During the first

quarter, we made strides in our marketing strategy for our motor

sales and rental division. We have established a separate brand,

Atlas Downhole Technology, with experienced marketing and

operations personnel now in place and dedicated to its growth. We

believe that the steps taken in the first quarter and the large

portion of our 2024 capital expenditures budget dedicated to Atlas

will aid us in expanding this division’s market presence.

- Our Canadian

operations continue to benefit from the addition of new

technologies and the increase in our RSS related activity. Our team

has successfully grown our market share in key Canadian basins and

this is softening the impact of the typical spring break-up, as we

have multiple clients whose operations are more resilient to the

seasonal slowdown. We foresee the second quarter building off the

success of the last two record quarters in Canada and being strong

on a historical basis. We are cautiously optimistic for the third

and fourth quarters in Canada.

- In the first

quarter of 2024, we ordered a large portion of the planned capital

expenditures to ensure we received delivery of items in a timely

manner, which impacted the level of excess cash flow achieved. We

believe in the future quarters the excess cash flow achieved will

increase. We are committed to continue rewarding shareholders

through our dividend and NCIB program as we remain dedicated to

delivering value to our shareholders.

We are proud of our first quarter achievements

and believe they are once again a testament to the strength of

operations and technology.

Michael Buker, PresidentMay 7, 2024

Financial Results

In the 2024 three-month period, PHX Energy

generated consolidated revenue of $166.1 million which is

marginally higher than the $166 million generated in the same

2023-period and is the second highest quarterly level in the

Corporation’s history. This was achieved primarily due to strong

Canadian results and despite the lower US rig count.

For the three-month period ended March 31, 2024,

the Corporation’s US division’s revenue decreased by 9 percent to

$114.2 million as compared to $125.7 million in the same

2023-period. The US industry activity declined 18 percent as

compared to the first quarter of 2023, although the steady decline

that occurred through 2023 did level off with the US rig count

being flat when compared to the fourth quarter of last year. In

line with lower US industry drilling activity, PHX Energy’s US

operating days declined by 14 percent from 4,820 in the first

quarter of 2023 to 4,168 in the 2024-quarter while average revenue

per day(3) for directional drilling services improved by 4 percent

quarter-over-quarter. The Corporation’s US motor rental and sales

divisions generated $7.9 million and $2.8 million of revenue,

respectively in the first quarter of 2024 (2023 - $10.2 million and

$0.7 million, respectively). Revenue from PHX Energy’s US segment

represented 69 percent of consolidated revenue in the 2024

three-month period (2023 - 76 percent).

In the 2024 three-month period, the

Corporation’s Canadian division generated revenue of $52 million,

which is the highest level since the fourth quarter of 2014 and is

29 percent greater than the $40.4 million generated in the same

2023-period. During the 2024-quarter, despite the flat Canadian

industry activity, PHX Energy’s Canadian operating days grew by 23

percent to 3,858 days from the 3,135 operating days in the

comparable 2023-quarter. Average revenue per day realized by the

Canadian segment also improved by 6 percent over the first quarter

of 2023. These results were largely driven by the Canadian

segment’s growing Rotary Steerable System (“RSS”) activity and

further expansion of its client base.

For the three-month period ended March 31, 2024,

earnings were $17.5 million (2023 - $22.4 million), adjusted

EBITDA(1) was $35 million (2023 - $37 million), and adjusted EBITDA

represented 21 percent of consolidated revenue(1) (2023 – 22

percent). Included in the 2024-quarter earnings is a $5.3 million

provision for income taxes (2023 - $3.5 million). Included in the

2024 three-month period adjusted EBITDA is cash-settled share-based

compensation expense of $5.7 million (2023 - $1.4 million). For the

three-month period ended March 31, 2024, adjusted EBITDA excluding

cash-settled share-based compensation expense(1) is $40.7 million,

25 percent of consolidated revenue (2023 - $38.4 million, 23

percent of consolidated revenue).

As at March 31, 2024, the Corporation had

working capital(2) of $88.7 million and net cash(2) of $5.8

million. The Corporation also has CAD $87 million and USD $20

million available to be drawn from its credit facilities.

Dividends and ROCS

On March 15, 2024, the Corporation declared a

dividend of $0.20 per share payable to shareholders of record at

the close of business on March 28, 2024. This is 33 percent higher

than the dividend of $0.15 per share declared in the 2023-quarter.

An aggregate of $9.5 million was paid on April 15, 2024.

The Corporation remains committed to enhancing

shareholder returns through its Return of Capital Strategy (“ROCS”)

that includes multiple options including the dividend program and

the Normal Course Issuer Bid (“NCIB”). In the 2024-quarter, 70

percent of PHX Energy’s excess cash flow(2) was $5.2 million (2023

- $13.5 million) and $9.5 million (2023 - $7.6 million) was paid in

dividends to shareholders. The decrease in excess cash flow was

mainly due to higher capital expenditures spent in the 2024

three-month period. In the 2024-quarter, the remaining

distributable balance under ROCS(2) was negative $4.3 million (2023

- positive $5.8 million). We expect that future cash flow will

compensate for the negative balance in the quarter and anticipate

the remaining distributable balance under ROCS to be positive in

the latter half of the year.

(Stated in thousands of dollars)

|

|

Three-month periods ended March 31, |

|

|

|

2024 |

|

2023 |

|

|

Excess cash flow(2) |

7,431 |

|

19,232 |

|

|

70% of excess cash flow |

5,202 |

|

13,462 |

|

|

|

|

|

|

|

|

Deduct: |

|

|

|

|

|

Dividends paid to shareholders |

(9,453 |

) |

(7,636 |

) |

|

Repurchase of shares under the NCIB |

- |

|

- |

|

|

Remaining Distributable Balance under ROCS(2) |

(4,251 |

) |

5,826 |

|

Normal Course Issuer Bid

During the third quarter of 2023, the TSX

approved the renewal of PHX Energy’s NCIB to purchase for

cancellation, from time-to-time, up to a maximum of 3,552,810

common shares, representing 10 percent of the Corporation’s public

float of Common Shares as at August 2, 2023. The NCIB commenced on

August 16, 2023 and will terminate on August 15, 2024. Purchases of

common shares are to be made on the open market through the

facilities of the TSX and through alternative trading systems. The

price which PHX Energy is to pay for any common shares purchased is

to be at the prevailing market price on the TSX or alternate

trading systems at the time of such purchase.

Pursuant to the current NCIB, no common shares

were purchased by the Corporation and cancelled in the three-month

period ended March 31, 2024 (2023 - nil).

Capital Spending

In the first quarter of 2024, the Corporation

spent $29.6 million in capital expenditures, of which $24.2 million

was spent on growing the Corporation’s fleet of drilling equipment,

$4.1 million was spent to replace retired assets, and $1.3 million

was spent to replace equipment lost downhole during drilling

operations. With proceeds on disposition of drilling and other

equipment of $12.3 million, the Corporation’s net capital

expenditures(2) for the 2024-quarter were $17.3 million. Capital

expenditures in the 2024-quarter were primarily directed towards

Atlas High Performance motors (“Atlas”), Velocity Real-Time systems

(“Velocity”), and RSS. PHX Energy funded capital spending primarily

using proceeds on disposition of drilling equipment, cash flows

from operating activities, and its credit facilities when

required.

(Stated in thousands of dollars)

|

|

Three-month periods ended March 31, |

|

|

|

2024 |

|

2023 |

|

|

Growth capital expenditures(3) |

24,224 |

|

9,955 |

|

|

Maintenance capital expenditures(3) from asset retirements |

4,141 |

|

4,857 |

|

|

Maintenance capital expenditures(3) from downhole equipment

losses |

1,275 |

|

3,771 |

|

|

|

29,640 |

|

18,583 |

|

|

Deduct: |

|

|

|

|

|

Proceeds on disposition of drilling equipment |

(12,301 |

) |

(12,417 |

) |

|

Net capital expenditures(2) |

17,339 |

|

6,166 |

|

As at March 31, 2024, the Corporation had

capital commitments to purchase drilling and other equipment for

$21.8 million, $18.6 million of which is growth capital and

includes $11.3 million for performance drilling motors, $2.4

million for Velocity systems, and $4.9 million for other equipment.

Equipment on order as at March 31, 2024 is expected to be delivered

within the year.

The approved capital expenditure budget for the

2024-year, excluding proceeds on disposition of drilling equipment,

is $75 million, which includes $5 million of carryover from the

2023 budget. Of the total expenditures, $47 million is expected to

be allocated to growth capital and the remaining $28 million is

expected to be allocated towards maintenance of the existing fleet

of drilling and other equipment and replacement of equipment lost

downhole during drilling operations.

The Corporation currently possesses

approximately 768 Atlas motors, comprised of various configurations

including its 5.13", 5.25", 5.76", 6.63", 7.12", 7.25", 8.12",

9.00”, 9.62", and 12.00” Atlas motors, and 118 Velocity systems.

The Corporation also possesses the largest independent RSS fleet in

North America with 64 RSS tools and the only fleet currently

comprised of both the PowerDrive Orbit and iCruise systems.

Non-GAAP and Other Financial

Measures

Throughout this document, PHX Energy uses

certain measures to analyze financial performance, financial

position, and cash flow. These Non-GAAP and Other Specified

Financial Measures do not have standardized meanings prescribed

under Canadian generally accepted accounting principles (“GAAP”)

and include Non-GAAP Financial Measures and Ratios, Capital

Management Measures and Supplementary Financial Measures

(collectively referred to as “Non-GAAP and Other Financial

Measures”). These Non-GAAP and Other Specified Financial Measures

include, but are not limited to, adjusted EBITDA, adjusted EBITDA

per share, adjusted EBITDA excluding cash-settled share-based

compensation expense, adjusted EBITDA as a percentage of revenue,

gross profit as a percentage of revenue excluding depreciation and

amortization, selling, general and administrative (“SG&A”)

costs excluding share-based compensation as a percentage of

revenue, funds from operations, funds from operations per share,

excess cash flow, net capital expenditures, net debt, working

capital, and remaining distributable balance under ROCS. Management

believes that these measures provide supplemental financial

information that is useful in the evaluation of the Corporation’s

operations and are commonly used by other oil and natural gas

service companies. Investors should be cautioned, however, that

these measures should not be construed as alternatives to measures

determined in accordance with GAAP as an indicator of PHX Energy’s

performance. The Corporation’s method of calculating these measures

may differ from that of other organizations, and accordingly, such

measures may not be comparable. Please refer to the “Non-GAAP and

Other Financial Measures” section of this document for applicable

definitions, rationale for use, method of calculation and

reconciliations where applicable.

| Footnotes throughout

this document reference: |

|

|

(1) |

Non-GAAP financial measure or ratio that does not have any

standardized meaning under IFRS and therefore may not be comparable

to similar measures presented by other entities. Refer to Non-GAAP

and Other Financial Measures section of this document. |

| |

(2) |

Capital management measure that does not have any standardized

meaning under IFRS and therefore may not be comparable to similar

measures presented by other entities. Refer to Non-GAAP and Other

Financial Measures section of this document. |

| |

(3) |

Supplementary financial measure that does not have any standardized

meaning under IFRS and therefore may not be comparable to similar

measures presented by other entities. Refer to Non-GAAP and Other

Financial Measures section of this document. |

Revenue

The Corporation generates revenue primarily

through the provision of directional drilling services which

includes providing equipment, personnel, and operational support

for drilling a well. Additionally, the Corporation generates

revenue through the rental and sale of drilling motors and

associated parts, particularly Atlas.

(Stated in thousands of dollars)

|

|

Three-month periods ended March 31, |

|

|

|

2024 |

2023 |

% Change |

|

|

Directional drilling services |

155,058 |

154,473 |

- |

|

|

Motor rental |

8,246 |

10,860 |

(24 |

) |

|

Sale of motor equipment and parts |

2,819 |

689 |

309 |

|

|

Total revenue |

166,123 |

166,022 |

- |

|

For the three-month period ended March 31, 2024,

the Corporation’s consolidated revenue was $166.1 million,

relatively flat as compared to the $166 million in the first

quarter of 2023 and the second highest level of quarterly revenue

on record.

In the first quarter of 2024, the US industry

rig count stabilized, with the average of 610 horizontal and

directional rigs operating per day being virtually identical to the

daily average of 608 horizontal and directional rigs in the fourth

quarter of 2023; however, quarter-over-quarter the daily average

decreased 18 percent from 742 rigs in the first quarter of 2023.

(Source: Baker Hughes, North American Rotary Rig Count, Jan 2000 –

Current, https://rigcount.bakerhughes.com/na-rig-count). In Canada,

industry horizontal and directional drilling activity (as measured

by drilling days) was 17,714 days in the 2024-quarter, only a 1

percent decline from 17,829 days in the same 2023-quarter (Source:

Daily Oil Bulletin, hz-dir days 240331). Despite the US rig count

driving an overall weakening in North American industry activity,

PHX Energy’s activity levels held steady with consolidated

operating days slightly increasing by 1 percent to 8,025 days in

the first quarter of 2024 compared to 7,955 days in the same

2023-quarter. The Corporation’s US activity declined in line with

the industry, whereas PHX Energy’s Canadian drilling activity

outpaced the industry trend as additional market share was captured

in the 2024-period.

Average consolidated revenue per day(3) for

directional drilling services was relatively unchanged from the

first quarter of 2023 at $19,322 in the 2024 three-month period

compared to $19,420. During the 2024-quarter, both the US and

Canadian segments realized improvements in average revenue per

day(3) for directional drilling services. However, as PHX Energy’s

Canadian activity increased as a portion of its consolidated

activity in the 2024-period, a greater percentage of consolidated

activity was at the lower average revenue per day for directional

drilling services in Canada.

In the 2024-quarter, revenue generated by the

Atlas motor rental division declined by 24 percent to $8.2 million

from $10.9 million in the same 2023-period. The decrease was

largely due to the lower US industry rig count. For the three-month

period ended March 31, 2024, revenue of $2.8 million was generated

from the sale of Atlas motors and parts (2023 – 0.7 million).

Operating Costs and

Expenses

(Stated in thousands of dollars except

percentages)

|

|

Three-month periods ended March 31, |

|

|

|

2024 |

|

2023 |

|

% Change |

|

|

Direct costs |

129,044 |

|

131,988 |

|

(2 |

) |

|

Depreciation & amortization drilling and other equipment

(included in direct costs) |

10,319 |

|

9,317 |

|

11 |

|

|

Depreciation & amortization right-of-use asset (included in

direct costs) |

849 |

|

407 |

|

109 |

|

|

Gross profit as a percentage of revenue excluding depreciation

& amortization(1) |

29% |

|

26% |

|

|

|

Direct costs are comprised of field and shop

expenses, costs of motors and parts sold, and include depreciation

and amortization of the Corporation’s equipment and right-of-use

assets.

In line with the consistent level of

consolidated revenue and activity, direct costs in the 2024

three-month period were relatively the same level as the

corresponding 2023-period, decreasing by only 2 percent to $129

million from $132 million in the 2023-period. In the 2024-quarter,

depreciation and amortization expenses on drilling and other

equipment increased by 11 percent mainly due to the volume of fixed

assets acquired as part of PHX Energy’s 2023 and 2024 capital

expenditure program. This increase was offset by lower motor repair

expenses that largely resulted from the decline in Atlas motor

rental activity in the US.

In the 2024 three-month period, gross profit as

a percentage of revenue excluding depreciation and amortization(1)

improved to 29 percent from 26 percent in the corresponding

2023-period. Greater profitability in the period was largely driven

by the increased utilization of the Corporation’s premium

technologies, particularly increased deployment of Velocity as a

result of enhancements developed by PHX Energy’s Research and

Development (“R&D”) department that better integrate Velocity

and newly acquired RSS. Increased profits from the Corporation’s

Atlas sales division also contributed to the improved margins.

(Stated in thousands of dollars except

percentages)

|

|

Three-month periods ended March 31, |

|

|

|

2024 |

|

2023 |

|

% Change |

|

|

Selling, general and administrative (“SG&A”) costs |

21,017 |

|

15,556 |

|

35 |

|

|

Cash-settled share-based compensation (included in SG&A

costs) |

5,710 |

|

1,374 |

|

316 |

|

|

Equity-settled share-based compensation (included in SG&A

costs) |

100 |

|

101 |

|

(1 |

) |

|

SG&A costs excluding share-based compensation as a percentage

of revenue(1) |

9% |

|

8% |

|

|

|

For the three-month period ended March 31, 2024,

SG&A costs were $21 million, an increase of 35 percent as

compared to $15.6 million in the corresponding 2023-period. Higher

SG&A costs in the 2024-period were primarily due to greater

cash-settled share-based compensation and rising personnel-related

costs.

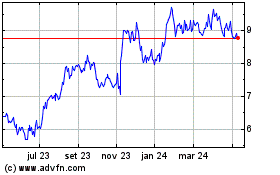

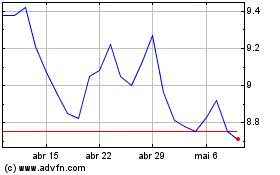

Cash-settled share-based compensation relates to

the Corporation’s retention awards and is measured at fair value.

For the three-month period ended March 31, 2024, the related

compensation expense recognized by PHX Energy was $5.7 million

(2023 - $1.4 million). Changes in cash-settled share-based

compensation expense in the 2024-period were mainly driven by

fluctuations in the Corporation’s share price which increased, and

the number of awards granted in the period. There were 1,527,685

retention awards outstanding as at March 31, 2024 (2023 –

2,083,553). SG&A costs excluding share-based compensation as a

percentage of revenue(1) in the 2024 three-month period was 9

percent as compared to 8 percent in the corresponding

2023-period.

(Stated in thousands of dollars)

|

|

Three-month periods ended March 31, |

|

|

|

2024 |

2023 |

% Change |

|

|

Research and development expense |

1,202 |

1,256 |

(4 |

) |

For the three-month period ended March 31, 2024,

PHX Energy’s R&D expenditures declined slightly by 4 percent to

$1.2 million from $1.3 million in the corresponding 2023-period.

During the 2024-quarter, the Corporation’s R&D department

remained focused on key projects, particularly on developing

supplementary technologies that would create value added

capabilities within PHX Energy’s suite of premium fleet. The

Corporation also remained committed in supporting new and ongoing

initiatives to continuously improve the reliability of equipment

and reduce costs to operations.

(Stated in thousands of dollars)

|

|

Three-month periods ended March 31, |

|

|

|

2024 |

2023 |

% Change |

|

|

Finance expense |

334 |

667 |

(50 |

) |

|

Finance expense lease liabilities |

541 |

576 |

(6 |

) |

Finance expenses mainly relate to interest

charges on the Corporation’s credit facilities. For the three-month

period ended March 31, 2024, finance expenses decreased to $0.3

million (2023 - $0.7 million) mainly due to decreased drawings on

the credit facilities in the period.

Finance expense lease liabilities relate to

interest expense incurred on lease liabilities. For the three-month

period ended March 31, 2024, finance expense lease liabilities

decreased by 6 percent primarily due to expired leases.

(Stated in thousands of dollars)

|

|

Three-month periods ended March 31, |

|

|

2024 |

|

2023 |

|

Net gain on disposition of drilling equipment |

8,886 |

|

9,956 |

|

Foreign exchange gains (losses) |

(129 |

) |

23 |

|

Other income |

8,757 |

|

9,979 |

For the three-month periods ended March 31, 2024

and 2023, the Corporation recognized other income of $8.8 million

and $10 million, respectively. In both periods, other income was

mainly comprised of net gain on disposition of drilling equipment.

The recognized gain is net of losses, which typically result from

asset retirements that were made before the end of the equipment’s

useful life. In the 2024-period, fewer instances of high dollar

valued downhole equipment losses occurred as compared to the

corresponding 2023-period which resulted in lower proceeds and

gains. The Corporation will use capital expenditure funds,

including the proceeds from disposition of drilling equipment, to

replace this equipment and these amounts will be added to the

capital expenditures for the remainder of 2024.

(Stated in thousands of dollars except

percentages)

|

|

Three-month periods ended March 31, |

|

|

|

2024 |

|

2023 |

|

|

Provision for income taxes |

5,288 |

|

3,541 |

|

|

Effective tax rates(3) |

23% |

|

14% |

|

For the three-month period ended March 31, 2024,

the Corporation reported income tax provision of $5.3 million (2023

- $3.5 million). In the 2024-quarter, PHX Energy’s effective tax

rate is 23 percent which is in line with the combined US federal

and state corporate income tax rate of 21 percent and combined

Canadian federal and provincial income tax rate of 23 percent.

Segmented Information

The Corporation reports two operating segments

on a geographical basis throughout the Gulf Coast, Northeast and

Rocky Mountain regions of the US and throughout the Western

Canadian Sedimentary Basin. (refer to the “Changes in Material

Accounting Policies” section of the Corporation’s First Quarter

2024 MD&A filed on Sedar+ for the change in operating

segments).

United States

(Stated in thousands of dollars)

|

|

Three-month periods ended March 31, |

|

|

|

2024 |

2023 |

% Change |

|

|

Directional drilling services |

103,406 |

114,746 |

(10 |

) |

|

Motor rental |

7,925 |

10,231 |

(23 |

) |

|

Sale of motor equipment and parts |

2,819 |

689 |

309 |

|

|

Total US revenue |

114,150 |

125,666 |

(9 |

) |

|

Reportable segment profit before tax |

16,594 |

15,923 |

4 |

|

For the three-month period ended March 31, 2024,

PHX Energy’s US operations generated revenue of $114.2 million, a 9

percent decrease compared to $125.7 million in the 2023-quarter.

The decrease in revenue was largely due to the lower US industry

activity in the 2024-quarter relative to the first quarter of

2023.

In the 2024 three-month period, the US industry

horizontal and directional rig count decreased by 18 percent with

610 active rigs per day as compared to 742 rigs per day in the

first quarter of 2023, but remained flat when compared to the

fourth quarter of 2023. (Source: Baker Hughes, North American

Rotary Rig Count, Jan 2000 – Current,

https://rigcount.bakerhughes.com/na-rig-count). The continued

demand for PHX Energy’s premium technologies remained strong and

created some resilience to the industry’s trajectory. The

Corporation’s US directional drilling activity decreased by only 14

percent to 4,168 operating days in the first quarter of 2024

compared to 4,820 days in the same 2023-quarter and has increased

by 1 percent as compared to the 4,114 days in the fourth quarter of

2023. The US division’s average revenue per day(3) for directional

drilling services marginally improved by 4 percent to $24,812 in

the first quarter of 2024 from $23,806 in the corresponding

2023-quarter.

In the 2024 three-month period, the US segment’s

Atlas motor rental activity was weaker due to the softer market

conditions. In the 2024-quarter, the Corporation generated motor

rental revenue of $7.9 million, a 23 percent decrease from $10.2

million in the same 2023-quarter.

For the three-month period ended March 31, 2024,

the US segment realized reportable segment income before tax of

$16.6 million which is 4 percent higher than $15.9 million in the

corresponding 2023-period. During the 2024-quarter, the technology

enhancements developed to better integrate Velocity with RSS

increased fleet utilization which contributed to reduced costs and

improved profitability. Margins from the sale of Atlas motors and

parts also contributed to the increased profitability in the

2024-period. For the three-month period ended March 31, 2024, PHX

Energy generated $2.8 million of revenue from this line of business

(2023 - $0.7 million).

Canada

(Stated in thousands of dollars)

|

|

Three-month periods ended March 31, |

|

|

|

2024 |

2023 |

% Change |

|

|

Directional drilling services |

51,652 |

39,727 |

30 |

|

|

Motor rental |

321 |

629 |

(49 |

) |

|

Total Canadian revenue |

51,973 |

40,356 |

29 |

|

|

Reportable segment profit before tax |

8,674 |

8,293 |

5 |

|

In the first quarter of 2024, PHX Energy’s

Canadian operations generated revenue of $52 million, its highest

level of quarterly revenue since the fourth quarter of 2014 and a

29 percent increase compared to $40.4 million generated in the 2023

first quarter. Strong quarterly revenue generated in the

2024-period was largely driven by growth in both the Canadian

segment’s client base and its market presence as an RSS

provider.

For the three-month period ended March 31, 2024,

the Canadian division’s average revenue per day(3) for directional

drilling services increased by 6 percent to $13,390 from $12,674 in

the corresponding 2023-period. The Canadian segment’s operating

days in the 2024-quarter grew by 23 percent to 3,858 days as

compared to 3,135 days in the corresponding 2023-quarter. In

comparison, industry horizontal and directional drilling activity

(as measured by drilling days) declined by 1 percent to 17,714 days

in the 2024 three-month period (Source: Daily Oil Bulletin, hz-dir

days 240331). During the 2024-quarter, the Corporation was active

in the Duvernay, Montney, Glauconite, Frobisher, Cardium, Viking,

Bakken, Torquay, Colony, Clearwater, Deadwood, Ellerslie, Charlie

Lake, and Scallion basins.

For the three-month period ended March 31, 2024,

the Corporation’s Canadian division recognized reportable segment

profit before tax of $8.7 million (2023 – $8.3 million). Despite

increased revenue and activity, profitability marginally increased

primarily due to higher equipment rentals associated with greater

RSS activity and an overall increase in equipment repair costs.

Investing Activities

Net cash used in investing activities for the

three-month period ended March 31, 2024 was $4.9 million as

compared to $5 million in the 2023-period. During the first quarter

of 2024, the Corporation spent $24.2 million (2023 - $10 million)

to grow the Corporation’s fleet of drilling equipment, $4.1 million

(2023 - $4.9 million) was used to maintain capacity in the

Corporation’s fleet of drilling and other equipment, and $1.3

million was used to replace equipment lost downhole during drilling

operations (2023 - $3.8 million). With proceeds on disposition of

drilling and other equipment of $12.3 million (2023 - $12.4

million), the Corporation’s net capital expenditures(2) for the

2024-quarter were $17.3 million (2023 - $6.2 million).

(Stated in thousands of dollars)

|

|

Three-month periods ended March 31, |

|

|

|

2024 |

|

2023 |

|

|

Growth capital expenditures(3) |

24,224 |

|

9,955 |

|

| Maintenance capital

expenditures(3) from asset retirements |

4,141 |

|

4,857 |

|

|

Maintenance capital expenditures(3) from downhole equipment

losses |

1,275 |

|

3,771 |

|

|

|

29,640 |

|

18,583 |

|

| Deduct: |

|

|

|

Proceeds on disposition of drilling equipment |

(12,301 |

) |

(12,417 |

) |

|

Net capital expenditures(2) |

17,339 |

|

6,166 |

|

The 2024-period capital expenditures comprised

of:

- $11 million in

downhole performance drilling motors;

- $11.7 million in

RSS;

- $6.5 million in

MWD systems and spare components; and

- $0.4 million in machinery and

equipment and other assets.

The change in non-cash working capital balances

of $12.5 million (source of cash) for the three-month period ended

March 31, 2024, relates to the net change in the Corporation’s

trade payables that are associated with the acquisition of capital

assets. This compares to $1.1 million (source of cash) for the

three-month period ended March 31, 2023.

Financing Activities

For the three-month period ended March 31, 2024,

net cash used in financing activities was $9.6 million as compared

to $1.6 million in the 2023-period. In the 2024-period:

- dividends of

$9.5 million were paid to shareholders;

- $0.1 million net

repayments were made towards the Corporation’s syndicated credit

facility;

- payments of $0.8

million were made towards lease liabilities; and

- 227,533 common

shares were issued from treasury for proceeds of $0.7 million upon

the exercise of share options.

Capital Resources

As of March 31, 2024, the Corporation had CAD

$7.5 million drawn on its Canadian credit facilities, nothing drawn

on its US operating facility, and a cash balance of $13.4 million.

As at March 31, 2024, the Corporation had CAD $87 million and USD

$20 million available from its credit facilities. The credit

facilities are secured by substantially all of the Corporation’s

assets and mature in December 2026.

As at March 31, 2024, the Corporation was in

compliance with all its financial covenants. Under the syndicated

credit agreement, in any given period, the Corporation’s

distributions (as defined therein) cannot exceed its maximum

aggregate amount of distributions limit as defined in the

Corporation’s syndicated credit agreement. Distributions include,

without limitation, dividends declared and paid, cash used for

common shares purchased by the independent trustee in the open

market and held in trust for potential settlement of outstanding

retention awards, as well as cash used for common shares

repurchased and cancelled under the NCIB.

Cash Requirements for Capital

Expenditures

Historically, the Corporation has financed its

capital expenditures and acquisitions through cash flows from

operating activities, proceeds on disposition of drilling

equipment, debt and equity. With $5 million carried over from the

2023 capital expenditure budget and the previously announced

preliminary 2024 capital expenditure program of $70 million, PHX

Energy anticipates spending $75 million of capital expenditures in

2024. Of the total expenditures, $47 million is targeted to be

spent on growth and $28 million is expected to be allocated to

maintain capacity in the existing fleet of drilling and other

equipment and replace equipment lost downhole during drilling

operations. The amount expected to be allocated towards replacing

equipment lost downhole could increase should more downhole

equipment losses occur throughout the year.

These planned expenditures are expected to be

financed from cash flow from operating activities, proceeds on

disposition of drilling equipment, cash and cash equivalents, and

the Corporation’s credit facilities, if necessary. However, if a

sustained period of market uncertainty and financial market

volatility persists in 2024, the Corporation's activity levels,

cash flows and access to credit may be negatively impacted, and the

expenditure level would be reduced accordingly where possible.

Conversely, if future growth opportunities present themselves, the

Corporation would look at expanding this planned capital

expenditure amount.

As at March 31, 2024, the Corporation has

commitments to purchase drilling and other equipment for $21.8

million. Deliveries are expected to occur throughout the rest of

the 2024-year.

About PHX Energy Services

Corp.

PHX Energy is a growth-oriented, public oil and

natural gas services company. The Corporation, through its

directional drilling subsidiary entities provides horizontal and

directional drilling services and technologies to oil and natural

gas exploration and development companies principally in Canada and

the US. In connection with the services it provides, PHX Energy

engineers, develops and manufactures leading-edge technologies. In

recent years, PHX Energy has developed various new technologies

that have positioned the Corporation as a technology leader in the

horizontal and directional drilling services sector.

PHX Energy’s Canadian directional drilling

operations are conducted through Phoenix Technology Services LP.

The Corporation maintains its corporate head office, research and

development, Canadian sales, service and operational centers in

Calgary, Alberta. In addition, PHX Energy has a facility in

Estevan, Saskatchewan. PHX Energy’s US operations, conducted

through the Corporation’s wholly-owned subsidiary, Phoenix

Technology Services USA Inc. is headquartered in Houston, Texas.

Phoenix USA has sales and service facilities in Houston, Texas;

Midland, Texas; Casper, Wyoming; and Oklahoma City, Oklahoma.

Internationally, PHX Energy has sales offices and service

facilities in Albania, and an administrative office in Nicosia,

Cyprus. The Corporation also supplies technology to the Middle East

regions.

The common shares of PHX Energy trade on the

Toronto Stock Exchange under the symbol PHX.

For further information please contact:John

Hooks, CEO; Michael Buker, President; or Cameron Ritchie, Senior

Vice President Finance and CFO

PHX Energy Services Corp.Suite 1600, 215 9th

Avenue SW, Calgary Alberta T2P 1K3Tel: 403-543-4466 Fax:

403-543-4485 www.phxtech.com

Condensed Consolidated Interim

Statements of Financial Position

(Stated in thousands of dollars, unaudited)

|

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

ASSETS |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

13,380 |

|

$ |

16,433 |

|

|

|

Trade and other receivables |

|

125,711 |

|

|

121,334 |

|

|

|

Inventories |

|

63,003 |

|

|

63,173 |

|

|

|

Prepaid expenses |

|

4,598 |

|

|

2,409 |

|

|

|

Current tax assets |

|

1,961 |

|

|

3,691 |

|

|

|

Total current assets |

|

208,653 |

|

|

207,040 |

|

|

Non-current assets: |

|

|

|

|

|

|

|

|

Drilling and other long-term assets |

|

146,789 |

|

|

128,263 |

|

|

|

Right-of-use assets |

|

26,764 |

|

|

27,056 |

|

|

|

Intangible assets |

|

13,771 |

|

|

14,200 |

|

|

|

Investments |

|

3,001 |

|

|

3,001 |

|

|

|

Other long-term assets |

|

1,429 |

|

|

1,284 |

|

|

|

Deferred tax assets |

|

2,993 |

|

|

4,650 |

|

|

|

Total non-current assets |

|

194,747 |

|

|

178,454 |

|

|

Total assets |

$ |

403,400 |

|

$ |

385,494 |

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Trade and other payables |

$ |

107,100 |

|

$ |

100,438 |

|

|

|

Dividends payable |

|

9,498 |

|

|

9,453 |

|

|

|

Lease liability |

|

3,376 |

|

|

3,234 |

|

|

|

Total current liabilities |

|

119,974 |

|

|

113,125 |

|

|

Non-current liabilities: |

|

|

|

|

|

|

|

|

Lease liability |

|

33,622 |

|

|

33,972 |

|

|

|

Loans and borrowings |

|

7,547 |

|

|

7,564 |

|

|

|

Deferred tax liability |

|

18,831 |

|

|

16,822 |

|

|

|

Other |

|

1,116 |

|

|

4,042 |

|

|

|

Total non-current liabilities |

|

61,116 |

|

|

62,400 |

|

|

Equity: |

|

|

|

|

|

|

|

|

Share capital |

|

223,628 |

|

|

222,653 |

|

|

|

Contributed surplus |

|

7,005 |

|

|

7,168 |

|

|

|

Deficit |

|

(37,739 |

) |

|

(45,695 |

) |

|

|

Accumulated other comprehensive income |

|

29,416 |

|

|

25,843 |

|

|

|

Total equity |

|

222,310 |

|

|

209,969 |

|

|

Total liabilities and equity |

$ |

403,400 |

|

$ |

385,494 |

|

Condensed Consolidated Interim

Statements of Comprehensive Earnings

(Stated in thousands of dollars except earnings

per share, unaudited)

|

|

|

Three-month periods ended March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

| Revenue |

$ |

166,123 |

|

$ |

166,022 |

|

| Direct

costs |

|

129,044 |

|

|

131,988 |

|

|

Gross profit |

|

37,079 |

|

|

34,034 |

|

| Expenses: |

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

21,017 |

|

|

15,556 |

|

|

Research and development expenses |

|

1,202 |

|

|

1,256 |

|

|

Finance expense |

|

334 |

|

|

667 |

|

|

Finance expense lease liability |

|

541 |

|

|

576 |

|

|

Other income |

|

(8,757 |

) |

|

(9,979 |

) |

|

|

|

14,337 |

|

|

8,076 |

|

|

Earnings before income taxes |

|

22,742 |

|

|

25,958 |

|

| |

|

|

|

|

|

|

| Provision for income

taxes |

|

|

|

|

|

|

|

Current |

|

1,986 |

|

|

2,724 |

|

|

Deferred |

|

3,302 |

|

|

817 |

|

|

|

|

5,288 |

|

|

3,541 |

|

|

Net earnings |

|

17,454 |

|

|

22,417 |

|

|

|

|

|

|

|

|

|

| Other comprehensive

income |

|

|

|

|

|

|

|

Foreign currency translation, net of tax |

|

3,573 |

|

|

(107 |

) |

|

Total comprehensive earnings |

$ |

21,027 |

|

$ |

22,310 |

|

|

|

|

|

|

|

|

|

| Earnings per share –

basic |

$ |

0.37 |

|

$ |

0.44 |

|

|

Earnings per share – diluted |

$ |

0.37 |

|

$ |

0.42 |

|

Condensed Consolidated Interim

Statements of Cash Flows

(Stated in thousands of dollars, unaudited)

|

|

|

Three-month periods ended March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

| Earnings |

$ |

17,454 |

|

$ |

22,417 |

|

| Adjustments for: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

10,319 |

|

|

9,317 |

|

|

Depreciation and amortization right-of-use asset |

|

849 |

|

|

407 |

|

|

Provision for income taxes |

|

5,288 |

|

|

3,541 |

|

|

Unrealized foreign exchange (gain) loss |

|

148 |

|

|

(26 |

) |

|

Net gain on disposition of drilling equipment |

|

(8,886 |

) |

|

(9,956 |

) |

|

Equity-settled share-based payments |

|

100 |

|

|

101 |

|

|

Finance expense |

|

334 |

|

|

667 |

|

|

Finance expense lease liability |

|

541 |

|

|

576 |

|

|

Provision for inventory obsolescence |

|

535 |

|

|

269 |

|

|

Interest paid on lease liability |

|

(541 |

) |

|

(576 |

) |

|

Interest paid |

|

(204 |

) |

|

(513 |

) |

|

Income taxes paid |

|

(185 |

) |

|

(134 |

) |

|

Change in non-cash working capital |

|

(14,585 |

) |

|

(22,185 |

) |

|

Net cash from operating activities |

|

11,167 |

|

|

3,905 |

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

Proceeds on disposition of drilling equipment |

|

12,301 |

|

|

12,417 |

|

|

Acquisition of drilling and other equipment |

|

(29,640 |

) |

|

(18,583 |

) |

|

Change in non-cash working capital |

|

12,469 |

|

|

1,142 |

|

|

Net cash used in investing activities |

|

(4,870 |

) |

|

(5,024 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

Dividends paid to shareholders |

|

(9,453 |

) |

|

(7,636 |

) |

|

Payments of lease liability |

|

(830 |

) |

|

(762 |

) |

|

Net proceeds from (net repayment of) loans and borrowings |

|

(60 |

) |

|

7,326 |

|

|

Proceeds from exercise of options |

|

712 |

|

|

266 |

|

|

Purchase of shares held in trust |

|

- |

|

|

(808 |

) |

|

Net cash used in financing activities |

|

(9,631 |

) |

|

(1,614 |

) |

| Net decrease in cash and cash

equivalents |

|

(3,334 |

) |

|

(2,733 |

) |

| Cash and cash equivalents,

beginning of period |

|

16,433 |

|

|

18,247 |

|

| Effect

of movements in exchange rates on cash held |

|

281 |

|

|

(12 |

) |

| Cash

and cash equivalents, end of period |

$ |

13,380 |

|

$ |

15,502 |

|

Cautionary Statement Regarding

Forward-Looking Information and Statements

This document contains certain forward-looking

information and statements within the meaning of applicable

securities laws. The use of "expect", "anticipate", "continue",

"estimate", "objective", "ongoing", "may", "will", "project",

"could", "should", "can", "believe", "plans", "intends", "strategy"

and similar expressions are intended to identify forward-looking

information or statements.

The forward-looking information and statements

included in this document are not guarantees of future performance

and should not be unduly relied upon. These statements and

information involve known and unknown risks, uncertainties and

other factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements and information. The Corporation believes the

expectations reflected in such forward-looking statements and

information are reasonable, but no assurance can be given that

these expectations will prove to be correct. Such forward-looking

statements and information included in this document should not be

unduly relied upon. These forward-looking statements and

information speak only as of the date of this document.

In particular, forward-looking information and

statements contained in this document include without limitation,

the expectations related to future cash flows and the impact on the

remaining distributable balance under ROCS, the Corporation’s

intent to preserve balance sheet strength and continue to reward

shareholders, including through its dividend program, the ROCS

program and NCIB, PHX Energy's intentions with respect to the NCIB

and purchases thereunder and the effects of repurchases under the

NCIB, the anticipated industry activity and demand for the

Corporation’s services and technologies in North America, the

projected capital expenditures budget for 2024 ,and how the budget

will be allocated and funded, the timeline for delivery of

equipment on order, and the anticipated continuation of PHX

Energy’s quarterly dividend program and the amounts of

dividends.

The above are stated under the headings:

“Financial Results”, “Dividends and ROCS”, “Capital Spending”, and

“Capital Resources”. In addition, all information contained under

the heading “Outlook” of this document may contain forward-looking

statements.

In addition to other material factors,

expectations and assumptions which may be identified in this

document and other continuous disclosure documents of the

Corporation referenced herein, assumptions have been made in

respect of such forward-looking statements and information

regarding, without limitation, that: the Corporation will continue

to conduct its operations in a manner consistent with past

operations; the general continuance of current industry conditions

and the accuracy of the Corporation’s market outlook expectations

for 2024 and in the future; that future business, regulatory and

industry conditions will be within the parameters expected by the

Corporation; anticipated financial performance, business prospects,

impact of competition, strategies, the general stability of the

economic and political environment in which the Corporation

operates; the potential impact of pandemics, the Russian-Ukrainian

war, Middle-East conflict and other world events on the global

economy, specifically trade, manufacturing, supply chain, inflation

and energy consumption, among other things and the resulting impact

on the Corporation’s operations and future results which remain

uncertain; exchange and interest rates, and inflationary pressures

including the potential for further interest rate hikes by global

central banks and the impact on financing charges and foreign

exchange and the anticipated global economic response to concerted

interest rate hikes; the continuance of existing (and in certain

circumstances, the implementation of proposed) tax, royalty and

regulatory regimes; the sufficiency of budgeted capital

expenditures in carrying out planned activities; the availability

and cost of labour and services and the adequacy of cash flow; debt

and ability to obtain financing on acceptable terms to fund its

planned expenditures, which are subject to change based on

commodity prices; market conditions and future oil and natural gas

prices; and potential timing delays. Although management considers

these material factors, expectations, and assumptions to be

reasonable based on information currently available to it, no

assurance can be given that they will prove to be correct.

Readers are cautioned that the foregoing lists

of factors are not exhaustive. Additional information on these and

other factors that could affect the Corporation’s operations and

financial results are included in reports on file with the Canadian

Securities Regulatory Authorities and may be accessed through the

SEDAR+ website (www.sedarplus.ca) or at the Corporation’s website.

The forward-looking statements and information contained in this

document are expressly qualified by this cautionary statement. The

Corporation does not undertake any obligation to publicly update or

revise any forward-looking statements or information, whether as a

result of new information, future events or otherwise, except as

may be required by applicable securities laws.

Non-GAAP and Other Financial

Measures

Non-GAAP Financial Measures and

Ratios

a) Adjusted

EBITDA

Adjusted EBITDA, defined as earnings before

finance expense, finance expense lease liability, income taxes,

depreciation and amortization, impairment losses on drilling and

other equipment and goodwill and other write-offs, equity-settled

share-based payments, severance payouts relating to the

Corporation’s restructuring cost, and unrealized foreign exchange

gains or losses, does not have a standardized meaning and is not a

financial measure that is recognized under GAAP. However,

Management believes that adjusted EBITDA provides supplemental

information to earnings that is useful in evaluating the results of

the Corporation’s principal business activities before considering

certain charges, how it was financed and how it was taxed in

various countries. Investors should be cautioned, however, that

adjusted EBITDA should not be construed as an alternative measure

to earnings determined in accordance with GAAP. PHX Energy’s method

of calculating adjusted EBITDA may differ from that of other

organizations and, accordingly, its adjusted EBITDA may not be

comparable to that of other companies.

The following is a reconciliation of earnings to

adjusted EBITDA:

(Stated in thousands of dollars)

|

|

Three-month periods ended March 31, |

|

|

|

2024 |

2023 |

|

|

Earnings: |

17,454 |

22,417 |

|

|

Add: |

|

|

|

|

Depreciation and amortization drilling and other equipment |

10,319 |

9,317 |

|

|

Depreciation and amortization right-of-use asset |

849 |

407 |

|

|

Provision for income taxes |

5,288 |

3,541 |

|

|

Finance expense |

334 |

667 |

|

|

Finance expense lease liability |

541 |

576 |

|

|

Equity-settled share-based payments |

100 |

101 |

|

|

Unrealized foreign exchange loss (gain) |

148 |

(26 |

) |

|

Adjusted EBITDA |

35,033 |

37,000 |

|

b) Adjusted EBITDA

Per Share - Diluted

Adjusted EBITDA per share - diluted is

calculated using the treasury stock method whereby deemed proceeds

on the exercise of the share options are used to reacquire common

shares at an average share price. The calculation of adjusted

EBITDA per share - dilutive is based on the adjusted EBITDA as

reported in the table above divided by the diluted number of shares

outstanding at the period end.

c) Adjusted EBITDA

as a Percentage of Revenue

Adjusted EBITDA as a percentage of revenue is

calculated by dividing the adjusted EBITDA as reported in the table

above by revenue as stated on the Condensed Consolidated Interim

Statements of Comprehensive Earnings.

d) Adjusted EBITDA

Excluding Cash-settled Share-based Compensation

Expense

Adjusted EBITDA excluding cash-settled

share-based compensation expense is calculated by adding

cash-settled share-based compensation expense to adjusted EBITDA as

described above. Management believes that this measure provides

supplemental information to earnings that is useful in evaluating

the results of the Corporation’s principal business activities

before considering certain charges, how it was financed, how it was

taxed in various countries, and without the impact of cash-settled

share-based compensation expense that is affected by fluctuations

in the Corporation’s share price.

The following is a reconciliation of earnings to

adjusted EBITDA excluding cash-settled share-based compensation

expense:

(Stated in thousands of dollars)

|

|

Three-month periods ended March 31, |

|

|

|

2024 |

2023 |

|

|

Earnings: |

17,454 |

22,417 |

|

|

Add: |

|

|

|

|

Depreciation and amortization drilling and other equipment |

10,319 |

9,317 |

|

|

Depreciation and amortization right-of-use asset |

849 |

407 |

|

|

Provision for income taxes |

5,288 |

3,541 |

|

|

Finance expense |

334 |

667 |

|

|

Finance expense lease liability |

541 |

576 |

|

|

Equity-settled share-based payments |

100 |

101 |

|

|

Unrealized foreign exchange loss (gain) |

148 |

(26 |

) |

|

Cash-settled share-based compensation expense |

5,710 |

1,374 |

|

|

Adjusted EBITDA excluding cash-settled share-based compensation

expense |

40,743 |

38,374 |

|

e) Adjusted EBITDA

Excluding Cash-settled Share-based Compensation Expense as a

Percentage of Revenue

Adjusted EBITDA excluding cash-settled

share-based compensation expense as a percentage of revenue is

calculated by dividing adjusted EBITDA excluding cash-settled

share-based compensation expense as reported above by revenue as

stated on the Condensed Consolidated Interim Statements of

Comprehensive Earnings.

f) Gross Profit as

a Percentage of Revenue Excluding Depreciation &

Amortization

Gross profit as a percentage of revenue

excluding depreciation & amortization is defined as the

Corporation’s gross profit excluding depreciation and amortization

divided by revenue and is used to assess operational profitability.

This Non-GAAP ratio does not have a standardized meaning and is not

a financial measure recognized under GAAP. PHX Energy’s method of

calculating gross profit as a percentage of revenue may differ from

that of other organizations and, accordingly, it may not be

comparable to that of other companies.

The following is a reconciliation of revenue,

direct costs, depreciation and amortization, and gross profit to

gross profit as a percentage of revenue excluding depreciation and

amortization:

(Stated in thousands of dollars)

|

|

Three-month periods ended March 31, |

|

|

|

2024 |

|

2023 |

|

|

Revenue |

166,123 |

|

166,022 |

|

|

Direct costs |

129,044 |

|

131,988 |

|

|

Gross profit |

37,079 |

|

34,034 |

|

| Depreciation &

amortization drilling and other equipment (included in direct

costs) |

10,319 |

|

9,317 |

|

| Depreciation &

amortization right-of-use asset (included in direct costs) |

849 |

|

407 |

|

|

|

48,247 |

|

43,758 |

|

|

Gross profit as a percentage of revenue excluding depreciation

& amortization |

29% |

|

26% |

|

g) SG&A Costs

Excluding Share-Based Compensation as a Percentage of

Revenue

SG&A costs excluding share-based

compensation as a percentage of revenue is defined as the

Corporation’s SG&A costs excluding share-based compensation

divided by revenue and is used to assess the impact of

administrative costs excluding the effect of share price

volatility. This Non-GAAP ratio does not have a standardized

meaning and is not a financial measure recognized under GAAP. PHX

Energy’s method of calculating SG&A costs excluding share-based

compensation as a percentage of revenue may differ from that of

other organizations and, accordingly, it may not be comparable to

that of other companies.

The following is a reconciliation of SG&A

costs, share-based compensation, and revenue to SG&A costs

excluding share-based compensation as a percentage of revenue:

(Stated in thousands of dollars)

|

|

Three-month periods ended March 31, |

|

|

|

2024 |

|

2023 |

|

|

SG&A Costs |

21,017 |

|

15,556 |

|

|

Deduct: |

|

|

|

|

|

Share-based compensation (included in SG&A) |

5,810 |

|

1,475 |

|

|

|

15,207 |

|

14,081 |

|

|

Revenue |

166,123 |

|

166,022 |

|

|

SG&A costs excluding share-based compensation as a percentage

of revenue |

9% |

|

8% |

|

Capital Management Measures

a) Funds from

Operations

Funds from operations is defined as cash flows

generated from operating activities before changes in non-cash

working capital, interest paid, and income taxes paid. This

financial measure does not have a standardized meaning and is not a

financial measure recognized under GAAP. Management uses funds from

operations as an indication of the Corporation’s ability to

generate funds from its operations before considering changes in

working capital balances and interest and taxes paid. Investors

should be cautioned, however, that this financial measure should

not be construed as an alternative measure to cash flows from

operating activities determined in accordance with GAAP. PHX

Energy’s method of calculating funds from operations may differ

from that of other organizations and, accordingly, it may not be

comparable to that of other companies.

The following is a reconciliation of cash flows

from operating activities to funds from operations:

(Stated in thousands of dollars)

|

|

Three-month periods ended March 31, |

|

|

2024 |

2023 |

|

Cash flows from operating activities |

11,167 |

3,905 |

|

Add (deduct): |

|

|

|

Changes in non-cash working capital |

14,585 |

22,185 |

|

Interest paid |

204 |

513 |

|

Income taxes paid |

185 |

134 |

|

Funds from operations |

26,141 |

26,737 |

b) Excess Cash

Flow

Excess cash flow is defined as funds from

operations (as defined above) less cash payment on leases, growth

capital expenditures, and maintenance capital expenditures from

downhole equipment losses and asset retirements, and increased by

proceeds on disposition of drilling equipment. This financial

measure does not have a standardized meaning and is not a financial

measure recognized under GAAP. Management uses excess cash flow as

an indication of the Corporation’s ability to generate funds from

its operations to support operations and grow and maintain the

Corporation’s drilling and other equipment. This performance

measure is useful to investors for assessing the Corporation’s

operating and financial performance, leverage and liquidity.

Investors should be cautioned, however, that this financial measure

should not be construed as an alternative measure to cash flows

from operating activities determined in accordance with GAAP. PHX

Energy’s method of calculating excess cash flow may differ from

that of other organizations and, accordingly, it may not be

comparable to that of other companies.

The following is a reconciliation of cash flows

from operating activities to excess cash flow:

(Stated in thousands of dollars)

|

|

Three-month periods ended March 31, |

|

|

|

2024 |

|

2023 |

|

|

Cash flows from operating activities |

11,167 |

|

3,905 |

|

|

Add (deduct): |

|

|

|

|

|

Changes in non-cash working capital |

14,585 |

|

22,185 |

|

|

Interest paid |

204 |

|

513 |

|

|

Income taxes paid |

185 |

|

134 |

|

|

Cash payment on leases |

(1,371 |

) |

(1,339 |

) |

|

|

24,770 |

|

25,398 |

|

|

|

|

|

|

|

|

Proceeds on disposition of drilling equipment |

12,301 |

|

12,417 |

|

|

Maintenance capital expenditures to replace downhole equipment

losses and asset retirements |

(5,416 |

) |

(8,628 |

) |

|

Net proceeds |

6,885 |

|

3,789 |

|

|

|

|

|

|

|

|

Growth capital expenditures |

(24,224 |

) |

(9,955 |

) |

|

Excess cash flow |

7,431 |

|

19,232 |

|

c) Working

Capital

Working capital is defined as the Corporation’s

current assets less its current liabilities and is used to assess

the Corporation’s short-term liquidity. This financial measure does

not have a standardized meaning and is not a financial measure

recognized under GAAP. Management uses working capital to provide

insight as to the Corporation’s ability to meet obligations as at

the reporting date. PHX Energy’s method of calculating working

capital may differ from that of other organizations and,

accordingly, it may not be comparable to that of other

companies.The following is a reconciliation of current assets and

current liabilities to working capital:

(Stated in thousands of dollars)

|

|

March 31, 2024 |

|

December 31, 2023 |

|

|

Current assets |

208,653 |

|

207,040 |

|

|

Deduct: |

|

|

|

Current liabilities |

(119,974 |

) |

(113,125 |

) |

|

Working capital |

88,679 |

|

93,915 |

|

d) Net Debt (Net

Cash)

Net debt is defined as the Corporation’s loans

and borrowings less cash and cash equivalents. This financial

measure does not have a standardized meaning and is not a financial

measure recognized under GAAP. Management uses net debt to provide

insight as to the Corporation’s ability to meet obligations as at

the reporting date. PHX Energy’s method of calculating net debt may

differ from that of other organizations and, accordingly, it may

not be comparable to that of other companies.

The following is a reconciliation of loans and

borrowings and cash and cash equivalents to net debt:

(Stated in thousands of dollars)

|

|

March 31, 2024 |

|

December 31, 2023 |

|

|

Loans and borrowings |

7,547 |

|

7,564 |

|

|

Deduct: |

|

|

|

Cash and cash equivalents |

(13,380 |

) |

(16,433 |

) |

|

Net debt (Net cash) |

(5,833 |

) |

(8,869 |

) |

e) Net Capital

Expenditures

Net capital expenditures is comprised of total

additions to drilling and other long-term assets, as determined in

accordance with IFRS, less total proceeds from disposition of

drilling equipment, as determined in accordance with IFRS. This

financial measure does not have a standardized meaning and is not a