Innergex Renewable Energy Inc. (TSX: INE) (“Innergex” or the

“Corporation”) and HQI US Holding LLC, a subsidiary of Hydro-Québec

(“Hydro-Québec”) have entered into a Membership Interest Purchase

Agreement with Atlantic Power to acquire Curtis Palmer, a

60 MW run-of-river hydroelectric portfolio located in Corinth,

New York, consisting of the 12 MW Curtis Mills and 48 MW Palmer

Falls facilities (“Curtis Palmer” or the “Facilities”) for upfront

cash consideration of US$310.0 million ($387.5 million) and an

earn-out provision subject to the evolution of NYISO market

pricing. This joint acquisition is the first under the Strategic

Alliance formed by Innergex and Hydro-Québec in 2020. Upon closing,

Innergex will own indirectly a 50% interest in the Facilities with

Hydro-Québec indirectly owning the remaining 50% interest.

Innergex is also announcing a $175.0 million bought deal equity

financing of common shares and $43.5 million concurrent private

placement of common shares to Hydro-Québec.

“We are thrilled to announce this first joint

acquisition with Hydro-Québec under the Strategic Alliance. The

acquisition of Curtis Palmer represents an opportunity for Innergex

to apply its 30 years of expertise in managing small run-of-river

hydroelectric facilities, while leveraging Hydro-Québec’s

experience in New York to get a foothold in a new market,” said

Michel Letellier, President and Chief Executive Officer of

Innergex. “We are also announcing today an equity financing that

will be used to fund the purchase price of this acquisition and

further our expansion and diversification efforts. We are very

pleased with this support for Innergex and look forward to further

grow in our Strategic Alliance with Hydro-Québec.”

“After having been commercial partners with the

State of New York for more than 100 years, we are now entering a

new phase by investing directly in the State’s hydropower

generation infrastructure alongside Innergex, to which we will both

bring our extensive expertise. This investment clearly demonstrates

our commitment to developing the share of renewables in the energy

mix of North America,” commented Sophie Brochu, President and CEO

of Hydro-Québec.

“The Curtis Palmer facility is one of the

highest quality assets in the Atlantic Power portfolio and an

important hydro facility in the New York market,” said James J.

Moore, Jr., Chief Executive Officer of Atlantic Power. “We are

honored to have been stewards of it and now see it transferred to

experienced operators like Innergex and Hydro-Québec.”

Financial Contribution to

InnergexThe Facilities have a power purchase agreement

(“PPA”) for energy, RECs and capacity with Niagara Mohawk Power

Corporation (A3 / BBB+) that expires upon the earlier of either

December 31, 2027 or the delivery of cumulative 10,000 GWh

(which is expected in 2026). Following the expiry of the PPA, it is

expected that the Facilities will sell energy, RECs and capacity in

the NYISO market. The New York renewable energy market benefits

from state programs that support existing renewables and can offer

additional upside potential to the Facilities, including the recent

Tier 2 REC program, and the introduction of the social cost of

carbon into energy markets.

The Facilities have an attractive cash flow

profile and are expected to generate average annual Adjusted

EBITDA2 of US$42.5 million ($53.1 million) and average annual Free

Cash Flow of US$39.5 million ($49.4 million) through the end

of the PPA, without debt financing on a 100% basis. The purchase

price implies a multiple of average annual Adjusted EBITDA of 7.3x

and an average annual Free Cash Flow yield of 13% through year

2025. The additional 60 MW of capacity from Curtis Palmer will

increase Innergex’s hydro portfolio to 1,259 MW and total portfolio

to 3,801 MW of gross capacity.

During its first full year of ownership, Curtis

Palmer is expected to contribute to Innergex’s financial results by

providing double-digit accretion to Free Cash Flow per Share,

reducing the Payout Ratio by more than 10%, and reducing overall

corporate leverage by 0.4x. Innergex expects the Facilities’

contribution to Free Cash Flow per Share and Payout Ratio to be

sustained throughout the term of the PPA. With Free Cash Flow

representing a return on capital in excess of 50% during the term

of the PPA without debt financing, Innergex expects the Facilities

to continue to generate an attractive return on investment for its

shareholders in the long run.

The acquisition is expected to close in Q4 2021

and is subject to regulatory approvals including FERC and HSR, as

well as customary closing conditions.

Leveraging the Strategic Alliance

between Hydro-Québec and Innergex In February 2020,

Hydro-Québec and Innergex announced the creation of a Strategic

Alliance that would allow both corporations to accelerate their

respective growth strategies and mutually benefit from their

complementary skills and knowledge. The acquisition of Curtis

Palmer will be the first co-investment with Hydro-Québec through

the Strategic Alliance and the second opportunity for Hydro-Québec

to subscribe for additional common shares of Innergex, following

the acquisition of the remaining 50% interest in Energía Llaima SpA

in July 2021. This acquisition under the Strategic Alliance will

benefit from Hydro-Québec’s decades of experience in the New York

market coupled with Innergex’s experience operating run-of-river

hydroelectric assets.

Concurrent Equity Offering and Private

Placement in InnergexInnergex has entered into an

agreement with a syndicate of underwriters led by CIBC Capital

Markets, National Bank Financial Inc., BMO Capital Markets and TD

Securities Inc. (collectively the “Underwriters”), pursuant to

which the Underwriters have agreed to purchase on a bought deal

basis, an aggregate of 9,021,000 common shares at an offering

price of $19.40 per share (the “Offering Price”) for aggregate

gross proceeds to the Corporation of approximately $175.0 million

(the “Offering”). In connection with the Offering, Innergex has

granted the Underwriters an over-allotment option, exercisable in

whole or in part, at any time for a period of 30 days following the

closing of the Offering, to purchase up to an aggregate of an

additional 1,353,150 common shares at the Offering Price.

Innergex has also entered into a subscription

agreement with a wholly-owned subsidiary of Hydro-Québec to

purchase 2,242,000 common shares at the Offering Price, for

gross proceeds to the Corporation of $43.5 million through a

private placement (the “Private Placement”) as part of

Hydro-Québec's rights contained in the Investor Rights Agreement

between Innergex and Hydro-Québec, dated February 6, 2020. As part

of the Private Placement, Hydro-Québec owns the option, exercisable

following the exercise of the over-allotment option by the

Underwriters and prior to the expiry of the Underwriters’

over-allotment option, to purchase additional common shares under

the Private Placement at the Offering Price as to allow

Hydro-Québec to maintain a 19.9% ownership of the common shares

following the exercise of the Underwriters’ over-allotment option.

The common shares offered in the Private Placement are being sold

directly to Hydro-Québec without an underwriter or placement

agent.

The net proceeds of the Offering and Private

Placement will be used to fund the purchase price of the

acquisition of Curtis Palmer, with the remainder of the net

proceeds, or should the acquisition of Curtis Palmer not

successfully close, the net proceeds of the Offering and Private

Placement will be used for general corporate purposes including

future growth initiatives.

In connection with the Offering, Innergex will

file via SEDAR (www.sedar.com) a preliminary short form prospectus

in all provinces of Canada by August 23, 2021. The Offering and

Private Placement are subject to all standard regulatory approvals,

including that of the Toronto Stock Exchange, and are expected to

close on or about September 3, 2021.

The securities referred to herein have not been

and will not be registered under the United States Securities Act

of 1933, as amended, and may not be offered or sold in the United

States absent registration or an applicable exemption from

registration requirements. This news release does not constitute an

offer to sell or the solicitation of any offer to buy, nor will

there be any sale of these securities, in any province, state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such province, state or jurisdiction.

_______________1 Free Cash Flow, Free Cash Flow

per Share and Payout Ratio are non-IFRS measures. See “Cautionary

Statement Regarding Non-IFRS Measures”.2 Adjusted EBITDA is

non-IFRS measures. See “Cautionary Statement Regarding Non-IFRS

Measures”.

Conference Call and

PresentationInnergex will make available an audio

conference and support material relative to this announcement on

its website at www.innergex.com/investors/.

About Innergex Renewable Energy

Inc.For over 30 years, Innergex has believed in a world

where abundant renewable energy promotes healthier communities

and creates shared prosperity. As an independent renewable power

producer which develops, acquires, owns and operates hydroelectric

facilities, wind farms, solar farms and energy storage facilities,

Innergex is convinced that generating power from renewable sources

will lead the way to a better world. Innergex conducts operations

in Canada, the United States, France and Chile and manages a large

portfolio of high-quality assets currently consisting of interests

in 77 operating facilities with an aggregate net installed capacity

of 3,071 MW (gross 3,741 MW) and an energy storage capacity of 150

MWh, including 38 hydroelectric facilities, 32 wind farms and 7

solar farms. Innergex also holds interests in 8 projects under

development, 2 of which are under construction, with a net

installed capacity of 168 MW (gross 205 MW) and an energy storage

capacity of 329 MWh, as well as prospective projects at different

stages of development with an aggregate gross capacity totaling

6,931 MW. Its approach to building shareholder value is to generate

sustainable cash flows, provide an attractive risk-adjusted return

on invested capital and to distribute a stable dividend.

About Hydro-QuébecHydro-Québec

generates, transmits and distributes electricity. It is Canada’s

largest electricity producer and ranks among the world’s largest

hydropower producers. Its sole shareholder is the Québec

government. As a recognized leader in hydropower and large

transmission systems, Hydro-Québec exports clean, renewable power

and commercializes its expertise and innovations on world markets.

Its research institute, IREQ, conducts R&D in energy

efficiency, energy storage and other energy-related fields.

Hydro-Québec invests $100 million in research every year.

Cautionary Statement Regarding

Forward-Looking InformationTo inform readers of the

Corporation's future prospects, this press release contains

forward-looking information within the meaning of applicable

securities laws (“Forward-Looking Information”), including

anticipated completion of the Curtis Palmer acquisition, the

Offering and the Private Placement and timing for such completion,

the Corporation’s projected financial performance, sources and

impact of funding, project acquisitions, and financial benefits and

accretion expected to result from such acquisitions, business

strategy, future development and growth prospects (including

expected growth opportunities under the Strategic Alliance with

Hydro-Québec), business integration, and other statements that are

not historical facts.

Forward-Looking Information can generally be

identified by the use of words such as “approximately”, “may”,

“will”, "could”, “believes”, “expects”, “intends”, "should”,

"would”, “plans”, “potential”, "project”, “anticipates”,

“estimates”, “scheduled” or “forecasts”, or other comparable terms

that state that certain events will or will not occur. It

represents the projections and expectations of the Corporation

relating to future events or results as of the date of this press

release.

Forward-Looking Information includes

future-oriented financial information or financial outlook within

the meaning of securities laws, including information regarding the

Corporation's expected production, projected Adjusted EBITDA,

projected Free Cash Flow, projected Free Cash Flow per Share and

intention to pay dividend quarterly, and other statements that are

not historical facts. Such information is intended to inform

readers of the potential financial impact of expected results, of

the potential financial impact of completed and future

acquisitions, and of the Corporation's ability to sustain current

dividends and to fund its growth. Such information may not be

appropriate for other purposes.

Forward-looking Information is based on certain

key assumptions made by Innergex, including, without restrictions,

assumptions concerning project performance, economic, financial and

financial market conditions, expectations and assumptions

concerning availability of capital resources and timely performance

by third-parties of contractual obligations, receipt of regulatory

approvals and expected closing of the Curtis Palmer

acquisition and of the Offering and the Private Placement. Although

Innergex believes that the expectations and assumptions on which

such forward-looking information is based are reasonable, under the

current circumstances, readers are cautioned not to rely unduly on

this forward-looking information as no assurance can be given that

they will prove to be correct. The forward-looking information

contained in this press release is made as of the date hereof and

Innergex does not undertake any obligation to update or revise any

forward-looking information, whether as a result of events or

circumstances occurring after the date hereof, unless so required

by law.

For more information on the risks and

uncertainties that may cause actual results or performance to be

materially different from those expressed, implied or presented by

the forward-looking information or on the principal assumptions

used to derive this information, please refer to the "Forward

Looking Information" section of the Management's Discussion and

Analysis for the three- and six-month periods ended June 30,

2021.

Cautionary Statement Regarding Non-IFRS

measuresThe unaudited condensed interim consolidated

financial statements for the three- and six-month periods ended

June 30, 2021, have been prepared in accordance with International

Financial Reporting Standards (“IFRS”). However, some measures

referred to in this press release are not recognized measures under

IFRS and therefore may not be comparable to those presented by

other issuers. Innergex believes that these indicators are

important, as they provide management and the reader with

additional information about the Corporation's production and cash

generation capabilities, its ability to sustain current dividends

and dividend increases and its ability to fund its growth. These

indicators also facilitate the comparison of results over different

periods Adjusted EBITDA, Free Cash Flow, Adjusted Free Cash Flow

and Payout Ratio are not measures recognized by IFRS and have no

standardized meaning prescribed by IFRS. Please refer to the

"Non-IFRS Measures" section of the Management's Discussion and

Analysis for the three- and six-month periods ended June 30,

2021.

For information

|

INNERGEX |

|

|

|

Jean-François NeaultChief Financial Officer450 928-2550, ext.

1207investorrelations@innergex.comwww.innergex.com |

|

Karine VachonSenior Director – Communications450 928-2550, ext.

1222kvachon@innergex.com |

|

|

|

|

|

HYDRO-QUÉBECCaroline

Desrosiers514 289-5005desrosiers.caroline@hydroquebec.comwww.hydroquebec.com |

|

|

|

|

|

|

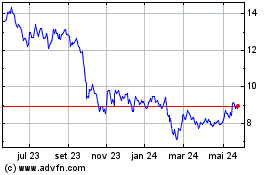

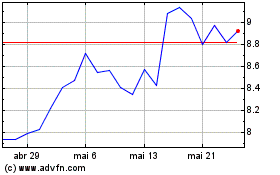

Innergex Renewable Energy (TSX:INE)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Innergex Renewable Energy (TSX:INE)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025