Artificial Intelligence company, AnalytixInsight Inc.

(“AnalytixInsight”, or the “Company”) (

TSX-V: ALY; OTCQB:

ATIXF), reports financial results for the second quarter

ended June 30, 2021.

Key Highlights:

- Completed an overnight marketed

public offering raising gross proceeds of $9.3 million;

- Launched ESG Analytics research

reports under Refinitiv AI-driven research initiative;

- Announced expansion to AI-driven

research distribution agreement with Refinitiv;

- Received European regulatory

approval for InvestoPro as online financial broker;

- Introduced InvestoPro, together with

Intesa Sanpaolo, as their AI-assisted digital trading platform.

InvestoPro has 2.5 million visitors per month through its

multi-channels: website, social, smart TV, mobile app and

progressive web app;

- The Intesa Sanpaolo migration of

stock trading accounts to InvestoPro is expected to begin in the

third quarter of 2021. Intesa Sanpaolo is one of the top banking

groups in Europe with approximately 11.6 million multichannel

customers and approximately 7.1 million customers using the Intesa

Sanpaolo App;

- Announced the addition of payment

processing to the InvestoPro digital trading platform, pending

regulatory approvals, to allow InvestoPro users to make payments,

remittances, and money transfers between accounts;

- Announced the development of a North

American AI-assisted stock trading and research platform which will

include real-time quotes, financial analysis, robo-advisory and

unique order management provisions;

- AnalytixInsight’s revenue for the

three and six month periods ended June 30, 2021, was $773,834 and

$1,727,162 respectively, which represents an increase of 3% and 24%

respectively, when compared to $750,034 and $1,395,380 respectively

in the prior year comparable periods. Net loss for the quarter was

$409,271 which compares to $357,700 for the prior year comparable

period;

- MarketWall’s revenue for the three

and six month periods ended June 30, 2021, was $1,394,911 and

$2,369,552 respectively, which compares to $1,595,427 and

$2,913,694 respectively in the prior year comparable periods.

MarketWall returned to profitability, reporting net income for the

quarter of $90,984 which compares to net income of $407,892 for the

prior year comparable period, and net loss of $259,243 in the first

quarter ended March 31, 2021, which is reflective of the investment

MarketWall has made in the development of InvestoPro during the

current fiscal year. MarketWall is 49%-owned by AnalytixInsight and

thus not consolidated in AnalytixInsight’s financial results;

- As at June 30, 2021, AnalytixInsight

has a cash balance of $10,107,988 and working capital of

$9,549,531.

Business Review

AnalytixInsight is an established AI-driven content supplier

with the ability to offer scalable machine-created research content

on approximately 50,000 worldwide stocks and North American ETFs

through its CapitalCube platform. CapitalCube provides AI-driven

research reports to Refinitiv, an LSEG (London Stock Exchange

Group) business and one of the world’s largest providers of

financial markets data and infrastructure. Under the Refinitiv

initiative, CapitalCube has published more than 13,000 reports on

company earnings, dividend quality, and pre-revenue company

analysis.

During the quarter, the Company launched ESG Analytics research

reports which embed ESG scores and ESG metrics into its proprietary

analysis and narratives. ESG (Environmental, Social, and

Governance) is commonly used as a generic term by investors and

regulators to evaluate corporate behaviors. CapitalCube also

performs robo-analysis of stocks and North American ETFs, allowing

robo-portfolio selection based on broad market metrics, dividend

quality, Efficient Frontier computations, and more.

AnalytixInsight’s 49%-owned FinTech affiliate, MarketWall, has

developed InvestoPro as a European online broker allowing users to

trade stocks, options, and derivatives. In March 2021, Investo

received regulatory approval by CONSOB (Commissione Nazionale per

le Società e la Borsa), the Italian financial markets regulator.

InvestoPro has been enabled as an AI-assisted trading platform

incorporating artificial intelligence and machine-created content

to assist investors in making investment decisions through its

interconnection with CapitalCube.

During the quarter, InvestoPro was jointly introduced by

MarketWall, AnalytixInsight, and Intesa Sanpaolo, whose customers

will be able to activate online trading using their bank

credentials. Intesa Sanpaolo, one of the top banking groups in

Europe with approximately 7.1 million customers using the Intesa

Sanpaolo App, is preparing to introduce InvestoPro to its customers

as its online digital trading platform and migration of stock

trading accounts to InvestoPro is expected to begin in September

2021. Intesa Sanpaolo owns 33% of MarketWall and has a presence in

12 countries in Central-Eastern Europe, the Middle East and North

Africa, and an international network dedicated to corporate

customers in 26 countries. Intesa Sanpaolo is considered one of the

most sustainable banks in the world.

During the quarter, the Company announced that MarketWall

intends to begin the regulatory process steps to add payment

processing capabilities to InvestoPro to enable users to make

payments and transfer funds between accounts. InvestoPro already

draws an audience of over 2.5 million monthly visitors through its

multi-device platform and social media presence. As a Samsung

Electronics partner, the InvestoPro app is also preloaded on

certain Samsung devices in Europe.

MarketWall offers its next-generation trading platform as a

white label B2B product offering to banks and brokers under the

brand GEMINA, allowing a bank or broker to license the online stock

trading solution for deployment under their own brand,

interconnected to their existing trading platform. Worldwide

interest in online brokers has increased significantly over the

past year as a new generation of investors got their start in

investing and opened online accounts in record numbers.

AnalytixInsight is uniquely positioned to provide the tools

investors are now seeking such as AI-assisted financial analysis,

market commentaries, ESG scores, training, education, and more.

During the quarter, AnalytixInsight announced its intention to

develop a stock trading platform for North American users, banks,

and brokers, that will integrate the attributes of CapitalCube,

InvestoPro and GEMINA to offer real-time quotes, financial

analysis, investor education, robo-advisory, stock trading, and

more.

AnalytixInsight’s Workforce Optimization division, Euclides

Technologies Inc., continues to advance its sales initiatives in

the Field Service Management (FSM) industry. As a result of the

pandemic, many North American businesses are now seeking innovative

solutions for field dispatch, job tracking and workflow efficiency.

Data analytics plays an important role in this shift, which is more

easily enabled now that most service technicians use digital-based

solutions. The Company is working collaboratively with industry

leaders to design and build machine learning and deep learning

solutions that are designed to improve Workforce Optimization and

Scheduling in the FSM industry. Euclides is a highly skilled

systems integration team experienced in integrating IFS and

Salesforce field management solutions.

Complete details of the Company’s financial and operating

results are available under the Company’s profile at www.SEDAR.com.

CONTACT INFORMATION:

Scott UrquhartVP Corporate

DevelopmentScott.Urquhart@AnalytixInsight.comTel: (416)

522-3975

ABOUT ANALYTIXINSIGHT INC.

AnalytixInsight Inc. is an Artificial Intelligence,

machine-learning company. AnalytixInsight’s financial analytics

platform CapitalCube.com algorithmically analyzes market price data

and regulatory filings to create insightful actionable narratives

and research on approximately 50,000 global companies and ETFs,

providing high-quality financial research and content for

investors, information providers, finance portals and media.

AnalytixInsight also designs and implements Workforce Optimization

solutions for large global enterprises. AnalytixInsight holds a 49%

interest in MarketWall, a developer of FinTech solutions for

financial institutions. For more information,

visit AnalytixInsight.com.

Regulatory Statements

This press release contains “forward-looking information” within

the meaning of applicable Canadian securities legislation.

Forward-looking information includes, without limitation,

statements regarding the growth of the Company’s business

operations; the impact of COVID-19 on the Company’s operations; the

Company’s financial results; the adoption of AI in various

industries and the anticipated benefits therefrom; the ability of

InvestoPro to provide the tools investors are seeking and to grant

Intesa Sanpaolo’s customers online trading access; the Company’s

expectation that Intesa Sanpaolo will introduce its customers and

migrate stock trading accounts to InvestoPro beginning in September

2021; the ability of MarketWall to license GEMINA to banks and

brokers globally; the use of the Company’s content by various

parties; the impact of the distribution agreement with Refinitiv;

the Company’s ongoing relationship with IFS and the Company’s

ability to enter into commercial transactions with members thereof;

the Company’s ability to expand its content distribution;

MarketWall’s and Intesa Sanpaolo’s future performance; the ability

of the Company to develop a stock trading platform for North

American users including the features described in this release;

and the Company’s future performance. Generally, forward-looking

information can be identified by the use of forward-looking

terminology such as “plans”, “expects” or “does not expect”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates” or “does not anticipate”, or “believes”,

or variations of such words and phrases or statements that certain

actions, events or results “may”, “could”, “would”, “might” or

“will be taken”, “occur” or “be achieved”. Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of

activity, performance or achievements of AnalytixInsight, as the

case may be, to be materially different from those expressed or

implied by such forward-looking information, including but not

limited to: general business, economic, competitive, geopolitical

and social uncertainties; the Company’s technology and revenue

generation; risks associated with operation in the technology

sector; the Company’s ability to successfully integrate new

technologies and employees; foreign operations risks; and other

risks inherent in the technology industry. Although AnalytixInsight

has attempted to identify important factors that could cause actual

results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking information.

AnalytixInsight does not undertake to update any forward-looking

information, except in accordance with applicable securities

laws.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE

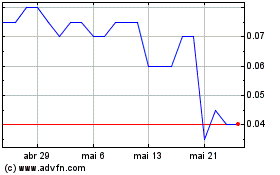

AnalytixInsight (TSXV:ALY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

AnalytixInsight (TSXV:ALY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024